The Accounts Payable (AP) department manages financial documents related to a company’s recurring or short-term debts. It involves maintaining thorough records and generating reports, particularly during tax periods. Knowing the key data to extract from the AP dashboard is essential for running accurate reports, and providing valuable insights into business operations.

In this guide, we’ll explain what accounts payable reports are, highlight commonly used AP reports, discuss best practices for their maintenance, and explore the benefits of automation in this process.

What are Accounts Payable Reports?

Accounts payable reports are financial documents that provide a detailed summary of a company’s outstanding debts to its vendors or suppliers. These reports are an integral part of a business’s overall accounting and financial management system. The primary purpose of Accounts Payable reports is to track and manage the money a company owes to its creditors.

Why should AP Teams Track Accounts Payable Reports?

Accounts payable teams should track Accounts Payable reports to maintain a clear and up-to-date picture of the company’s outstanding financial obligations to suppliers and vendors. These reports provide a consolidated overview of unpaid invoices, helping in the effective management of cash flow and ensuring that payments are made on time. By regularly monitoring AP reports, teams can identify overdue payments, avoid late fees, and nurture positive relationships with suppliers. Additionally, having a comprehensive understanding of payables enables informed decision-making related to budgeting and cost control. Moreover, tracking AP reports is crucial for financial transparency, regulatory compliance, and maintaining the overall financial health of the organization.

Top 10 Commonly Used Accounts Payable Reports

The accounts payable team utilizes a range of essential accounts payable reports to obtain a thorough understanding of their financial standing. Among the frequently utilized reports are the accounts payable aging report, voucher activity reports, reconciliation of accounts reports, history of payments report, open invoice report, and more. These reports are crucial in analyzing the accounts payable process and maintaining financial records. Let’s delve into the details of each report:

Accounts Payable Aging Report

The accounts payable aging report is a crucial tool for effective financial management. By listing vendors and categorizing outstanding payments into periods like “1-30 days” or “31-60 days,” this report helps identify overdue vendor payments. It serves as the general ledger for accounts payable, providing a comprehensive overview of total expenditures and payment terms. Running this report regularly enables AP teams to stay on top of their financial commitments and prioritize actions to maintain healthy vendor relationships.

Voucher Activity Reports

Voucher activity reports offer insights into payment vouchers made during a specific period. This report is useful for tracking spending within a department, group, or specific project. By detailing transaction dates and creditor names, AP teams can track where where, and how the budget is allocated. Approval of vouchers is typically required for generating payments. This report aids in budgeting and ensures transparency in expenditure, facilitating effective financial control.

Reconciliation of Accounts Reports

The reconciliation of accounts report showcases accounting activity related to payment vouchers over a given period. Focused on liability accounts, it helps verify outstanding liabilities against the general ledger. This report ensures accurate payments to vendors and identifies discrepancies or errors in the reconciliation process. By preventing delinquent liability accounts, AP teams can maintain financial accuracy and uphold trust with creditors.

History of Payments Report

The history of payments report is vital for effective bookkeeping, providing a comprehensive list of business expenditures within a specific timeframe. Covering various liabilities such as utility payments, private loans, and raw material purchases, this report aids in monitoring total expenses. Critical for adhering to annual operating budgets, it helps control spending and prevents exceeding financial limits. Regularly reviewing this report is essential to meet financial obligations and nurture positive relationships with vendors.

Open Invoice Report

The open invoice report allows AP teams to assess all open invoices, due dates, and amounts for accuracy. It aids in determining weekly cash requirements and reconciling the GL accounts payable summary account. Additionally, it helps identify open credit memos against invoices. The report ensures proper visibility into pending invoices and supports reconciliation efforts, contributing to effective financial management.

AP Trial Balance Reports

AP trial balance reports provide a summary of all accounts payable transactions within a specific period. Detailing outstanding balances owed to suppliers, accrued expenses, and other liabilities, this report facilitates reconciliation with the general ledger. It ensures the accuracy and completeness of financial statements, offering businesses a comprehensive view of their accounts payable status for informed decision-making.

Top Vendor Report

The top vendor report is a crucial tool for vendor management, categorizing and ranking vendors based on transaction volume and value. This report is instrumental in facilitating negotiations with key suppliers to help AP teams secure favorable terms. It serves as a valuable resource for identifying potential cost-saving opportunities and fostering strategic partnerships with dependable vendors. The insights derived from this report enable businesses to optimize their vendor relationships and enhance overall operational efficiency.

Credit Memo Report

The credit memo report is essential for tracking adjustments in accounts payable balances resulting from discrepancies or returned goods. This report provides transparency into the reasons behind changes in payables, aiding in the identification of patterns and resolution of recurring issues. Analyzing the credit memo report is instrumental in maintaining accurate financial records, ensuring financial integrity, and facilitating proactive management of discrepancies in accounts payable.

Discount Report

The discount report brings attention to discounts obtained by the company through early payments. Through a thorough analysis of this report, businesses can evaluate the success of their cost-saving strategies, assess the effectiveness of discount agreements, and enhance their cash flow by strategically leveraging available discounts. This report serves as a valuable tool for AP teams seeking to optimize their financial practices and capitalize on opportunities for cost efficiency.

Recurring Invoice Report

The recurring invoice report is essential for AP teams with consistent and recurring expenditures, offering valuable insights into scheduled payments to guarantee timely processing. This report plays a crucial role in cash flow forecasting, aiding in the efficient management of budgets and preventing the imposition of late payment penalties. By providing visibility into recurrent financial obligations, the Recurring Invoice Report assists businesses in maintaining financial discipline and ensuring the timely fulfillment of scheduled payments.

Best Practices for Accounts Payable Reporting

Establish Strong Internal Controls

Accurate accounts payable reporting begins with robust internal controls. These controls are critical for minimizing errors, reducing the risk of fraud, and ensuring the correct entry and processing of transactions. Proper internal controls directly impact the accuracy of financial reports, making them a foundational element in accounts payable management.

Optimize Payment Cycle

Strategic management of the payment cycle is essential for effective accounts payable reporting. While early payment discounts from vendors may be enticing, it’s crucial to weigh these against the impact on cash flow. Balancing payment timing is key to optimizing cash flow and positively influencing accounts payable reporting.

Regularly Review AP Accounts

Regular reviews of accounts payable accounts are a fundamental best practice for accurate reporting. Automated AP software help spot unusual activity, detect potential fraud, or identify expenses posted to incorrect GL accounts. Regular reviews act as a preventative measure, addressing small issues before they escalate.

Embrace AP Automation for Accuracy

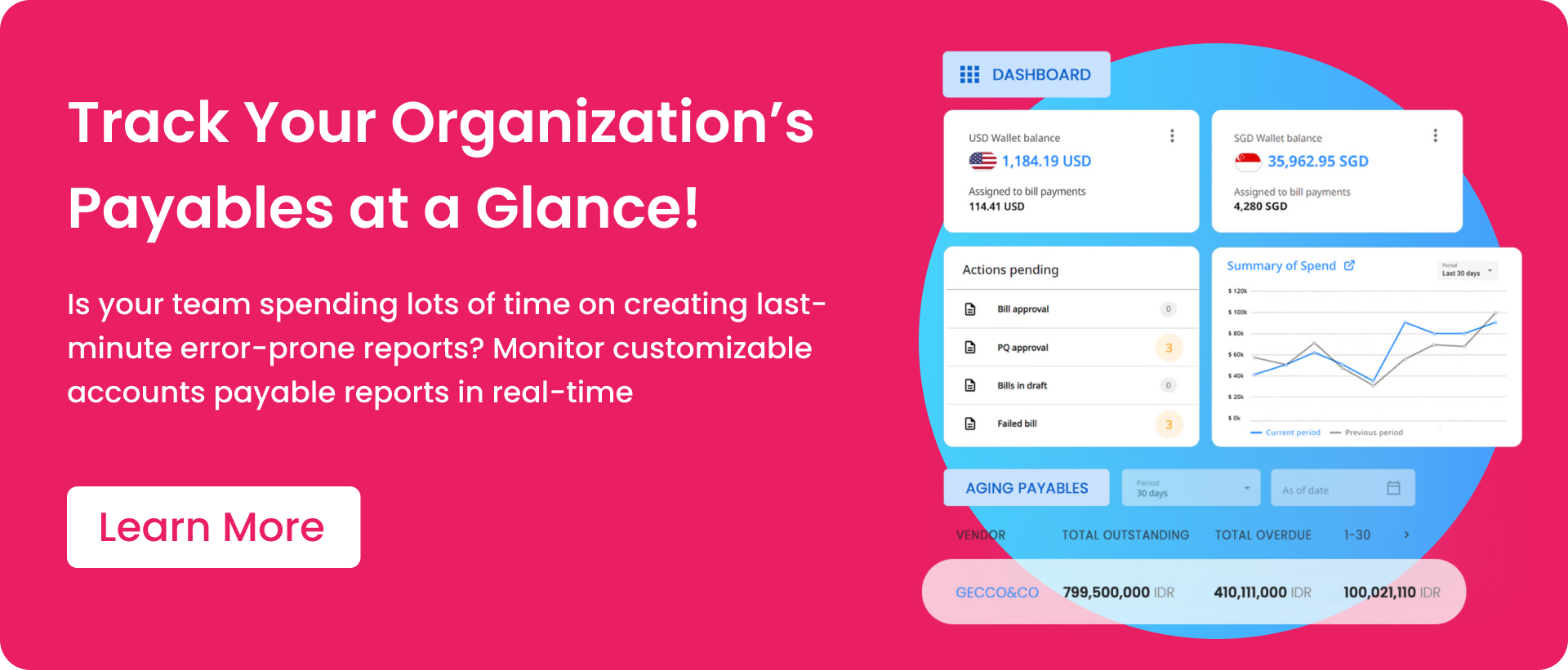

Transitioning from manual processing to AP automation is a transformative best practice. Automation reduces bottlenecks and processing time and significantly minimizes human error. It allows for the reports customization in real-time, ensuring the accuracy of various reports, from open invoices to monthly accruals. Adopting AP automation enhances overall precision in accounts payable reporting.

How Can Automation Help?

Accounts payable automation simplifies and enhances the accuracy of accounts payable reporting and the financial closing process by eliminating manual tasks. Manual processes can introduce errors and hinder the reliability of accounts payable reports, especially during the crucial month-end closing.

Automated accounts payable solutions, such as Peakflo, streamline tasks like matching invoices with purchase orders and reduce time-consuming data entry. This ensures an accurate month-end process and provides real-time visibility into reports.

With Peakflo’s Budget Management and AI-powered reports, AP teams can stay on top of budgets and payables reports in real time. Instead of using spreadsheets to manage budgets or create reports, AP teams can focus their attention on high-value tasks.