Petty cash refers to a small amount of money, including bills and coins, kept on hand for employees to make small purchases that don’t require a company credit card or check. These purchases typically involve minor expenses such as office supplies, snacks, flowers, catered lunches, and small reimbursements. Due to the involvement of actual cash, it is crucial for businesses to carefully oversee the utilization of these funds.

Petty cash reconciliation is the method through which a business confirms that its cash funds are used in line with internal rules and policies. It ensures that all transactions are appropriately documented with a receipt or invoice.

In this blog, we will explore petty cash reconciliation, learn the steps to perform it, and some best practices to implement when reconciling petty cash.

What is Petty Cash Reconciliation?

Petty cash reconciliation is the process of making sure that a business’s small cash fund is used following internal rules and policies. It involves verifying that all transactions made with petty cash are properly documented with receipts or invoices. It is a way for a business to check and confirm that the money in its petty cash fund is being spent appropriately and that there is accurate record-keeping for every transaction.

In other words, petty cash reconciliation is the process of checking if the remaining cash aligns with records of expenses over a period. It involves comparing the actual cash balance with documented transactions and the initially allocated amount. The aim is to ensure that petty cash is used for valid business expenses, preventing fraud and maintaining audit readiness. Since petty cash transactions are irregular, reconciliation can be challenging. Despite being seen as a disposable fund, it holds significance for financial accuracy. Regular reconciliation is a proactive step to uphold transparency and financial integrity in your company’s management.

When Is Petty Cash Reconciliation Used?

Aside from handling larger purchases, your teams also require access to cash for minor expenses like birthday cards or small office supplies between bulk orders. Although the amount set aside for these needs is relatively small, these transactions are important and require regular reconciliation and verification.

Because petty cash involves physical currency kept in a lockbox or drawer, it is susceptible to fraud, waste, and misuse. Petty cash reconciliation serves as a crucial internal control to prevent such issues. Regular reconciliation is vital for identifying and rectifying discrepancies, and ensuring the proper use of the petty cash fund.

Typically conducted when funds are running low and additional funds are requested by the custodian, petty cash reconciliation aims to confirm that the remaining balance matches the initial balance minus all transactions since the last reconciliation, as evidenced by receipts and invoices. Any disparities in the balances must be explained and corrected.

Important Petty Cash Terms

Understanding key petty cash terms is crucial for maintaining transparency and effective control over minor business expenses. Here are some important terms to familiarize yourself with:

Petty Cash Fund: A small amount of physical currency set aside for minor, day-to-day business expenses.

Voucher: A written record, such as a receipt or invoice, serving as evidence for a petty cash transaction.

Float: The initial amount of cash placed in the petty cash fund to cover anticipated expenses.

Imrestock: The act of replenishing the petty cash fund by adding more cash to maintain its original balance.

Disbursement: The payment or distribution of petty cash for approved business expenses.

Overage: The situation where the remaining petty cash balance exceeds the documented transactions, indicating a surplus.

Shortage: The situation where the documented transactions exceed the remaining petty cash balance, indicating a deficit.

Custodian: The person responsible for managing and safeguarding the petty cash fund, including disbursements and record-keeping.

Cash Box: Petty cash is typically contained in a locked box or cash box. This secures the money and stores all receipts and invoices that pertain to the expenses.

Audit Trail: A comprehensive record of all petty cash transactions, providing a clear history for auditing and financial accountability.

How to Reconcile Petty Cash?

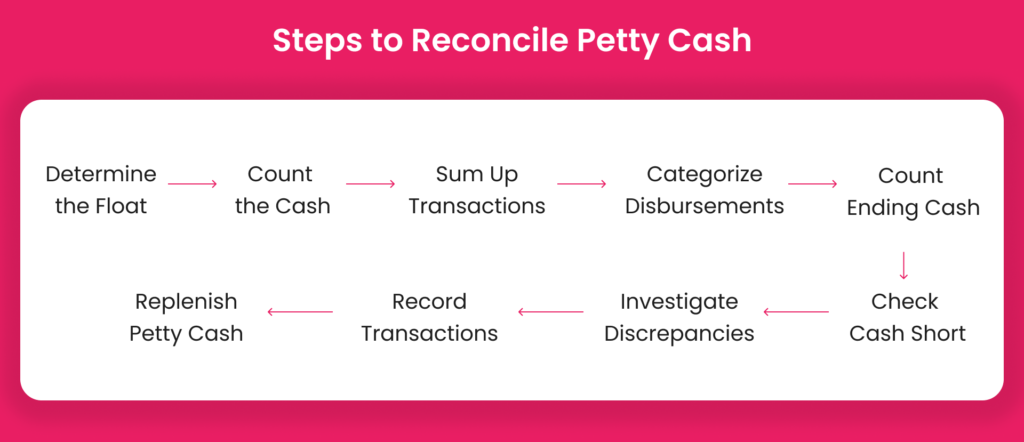

To reconcile petty cash effectively, follow these steps:

- Determine the Float: Identify the initial amount of petty cash designated for business expenses.

- Count the Cash: Periodically assess the remaining cash in the petty cash box, ensuring it is less than the established float.

- Sum Up Transactions: Utilize the receipts, invoices, vouchers, and transaction logs to calculate the total disbursements. Verify that the float minus these transactions equals the remaining cash.

- Categorize Disbursements: Assign each disbursement to the relevant expense category such as office supplies, food & beverages, travel, etc. for accurate record-keeping.

- Count Ending Cash: Physically count the remaining cash at the end of the financial period to establish the ending balance.

- Check Cash Short or Cash Over: If the ending cash does not match the recorder transaction mark it as cash short. On the other hand, if the initial amount is lower than the ending cash mark it as cash over.

- Investigate Discrepancies: While matching the recorder transaction and ending cash if discrepancies arise, find the exact reasoning behind variances between the float and actual transactions.

- Record Transactions: Document all transactions in the general ledger during the financial close process.

- Replenish Petty Cash: Ensure continuous availability of funds by replenishing the petty cash float for the upcoming period.

Challenges of Petty Cash Reconciliation

Manually handling reconciliations can be quite time-consuming and challenging for accounting teams. The extensive data and matching requirements can divert their attention from more valuable tasks.

One major issue faced during petty cash reconciliations is the lack of clarity regarding the reasons for disbursements. In the worst-case scenario, cash may be missing without a clear understanding of why or where it went.

Typically, employees responsible for disbursements might not fully grasp the significance of petty cash to accounting teams and expense accounts. Consequently, they may omit crucial information or even forget to document the disbursement, leading to unexplained missing funds or, in some cases, indicating potential fraud.

How to Overcome Petty Cash Reconciliation Problems?

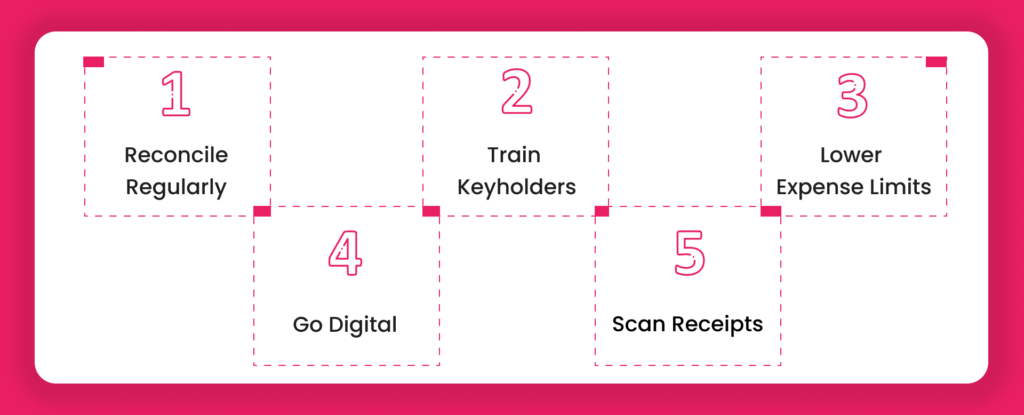

To overcome petty cash reconciliation problems, consider implementing the following strategies:

Reconcile Regularly: Adopt a regular reconciliation schedule, ideally every month, to maintain constant visibility and control over your cash funds.

Train Keyholders: Entrust the petty cash box keys to a trustworthy and responsible individual, preferably from the finance team. Aligning their incentives with responsibility ensures a vigilant approach to the reconciliation process.

Scan Receipts: Embrace technology by scanning receipts to streamline data entry, minimize human errors, and facilitate easy tracking of spending.

Go Digital: Transition from manual reconciliation to a digital system that automates the logging, processing, and balancing of petty cash. This significantly reduces the time and effort required for reconciliation, while also minimizing the risk of errors.

Lower Expense Limits: Consider reducing the maximum cash available in petty cash funds. While this doesn’t eliminate reconciliation challenges, it can help mitigate the frequency and complexity of issues that may arise.

Closing Thoughts

The declining use of cash has led to a shift in the way businesses handle petty cash for small expenses. The traditional methods of using and reconciling petty cash are increasingly being replaced and digitized. This transformation is primarily attributed to advanced software, such as Peakflo, which streamlines and automates the entire reconciliation process.

With Peakflo’s Automated Reconciliations, the finance team no longer needs to dedicate extensive time to month-end closing activities. The software efficiently handles reconciliations and seamlessly syncs the data with your accounting software. This not only saves time but also significantly reduces the challenges and errors associated with manual reconciliation processes.

FAQ

How often should petty cash be reconciled?

Petty cash should ideally be reconciled monthly to ensure accurate tracking and control of funds.

What is petty cash procedure?

Petty cash procedures involve establishing guidelines for the controlled use, tracking, and reconciliation of small amounts of cash for minor business expenses, ensuring accountability and transparency.

How do you fix petty cash?

To fix petty cash issues, conduct regular reconciliations, implement digital tracking systems, and ensure responsible management to address discrepancies promptly.

What is the journal entry for petty cash?

To establish a petty cash fund, the initial journal entry involves debiting “Petty Cash” and crediting the corresponding bank account. Subsequent entries are made for disbursements, debiting various expense accounts, and crediting “Petty Cash.”

What is an example of petty cash?

An example of petty cash expenses includes small, routine purchases such as office supplies, postage, or minor refreshments. For instance, buying pens, stamps, or snacks for the office using a small amount of cash from the petty cash fund would be considered typical petty cash expenses.

Who issues petty cash?

Petty cash is typically issued by a designated individual or department within a company, often referred to as the petty cash custodian. This person is responsible for managing and disbursing the petty cash funds for small, everyday expenses.