Every business owner knows the challenge: balancing essential expenses with the “extras” that could push your company forward. While payroll, rent, and utilities keep the lights on, it is the discretionary spending—on marketing campaigns, employee perks, or cutting-edge tools—that often sparks real growth. But here is the catch: if you do not manage these costs wisely, they can quickly derail your cash flow.

So, where do you draw the line? By understanding discretionary spending examples and how to prioritize them, you can turn optional costs into strategic investments. Whether you are in finance, SaaS, or e-commerce, knowing how to navigate these decisions can give your business a sharper edge and help you stay in control of your bottom line.

What is a Discretionary Expense?

A discretionary expense is any cost that is not essential for running your business. It is something you choose to spend on, not something you have to. These expenses often help companies to grow, improve operations, or boost employee satisfaction, but they are not necessary to keep the doors open.

Here is an example. Suppose you run a small online store. Paying for your website hosting is essential because your store will not work without it. But spending on custom packaging to create a better unboxing experience? That is a discretionary expense. It is not required, but it might impress customers and encourage them to order again.

These kinds of expenses can be valuable when planned carefully. The goal is to spend where it counts without stretching your budget too thin. Knowing what is essential and what is optional helps you make better decisions for your business.

Discretionary Expenses vs. Essential Expenses vs. Fixed Expenses

Managing money for your business means understanding three key types of expenses. Let us break them down in simple terms.

- Discretionary Spending: Extra Costs You Can Choose

Discretionary spending examples are things your business can live without. These are “nice-to-have” expenses that make your business better but will not stop it from running.

It covers:

- Gifts for customers

- Sponsoring local events

- Team fun activities

- Extra marketing efforts

Ask yourself: “Is this expense helping my business grow?” If not, you can cut it when money is tight.

- Essential Expenses: Must-Have Costs

Essential expenses are the must-pay costs. Without these, your business stops working.

Essential Expense Must-Knows:

- Needed to keep your business going

- Can not be skipped

- Always come first in your budget

Examples include:

- Buying supplies

- Paying for electricity

- Paying your workers

- Basic computer tools

- Fixed Expenses: Steady Costs That Do Not Change

Fixed expenses are bills that stay the same every month, no matter how much money you make.

Fixed Expense Basics:

- Same cost every month

- Often tied to long-term agreements

- Predictable payments

Common fixed expense examples:

- Office rent

- Business Insurance

- Equipment payments

- Regular software subscriptions

Why Should You Monitor Discretionary Spending?

Managing discretionary expenses is about spending smartly. These optional costs can impact your cash flow, profits, and growth. Here is why controlling them is so important.

- Keeps cash flow steady

Tracking expenses like travel or office perks helps you see where to save. Cutting back on these costs frees up money for important activities, like marketing or upgrading products. A steady cash flow means your business can handle tough times more easily.

- Increases profits

Reducing unnecessary spending puts more money back into your business. For example, switching from costly in-person events to online ones can save thousands. These savings can help you offer better prices or improve efficiency, boosting profits over time.

- Lowers financial risks

If discretionary spending gets out of control, your business might struggle to pay bills. Managing these costs ensures you have enough for important things, like paying vendors or covering payroll. Savings can also go into a reserve fund to help during slow periods or market downturns.

- Supports business growth

Smart spending lets you invest in areas that help your business grow. For example, instead of spending on fancy office decor, you can invest in marketing or staff training. These decisions bring more value and help your business stay competitive.

- Prepares you for the future

Businesses that control spending can adapt quickly to changes. Cutting back on unneeded subscriptions or perks gives you the flexibility to invest in new opportunities. This makes it easier to stay ahead in a fast-changing market.

By understanding discretionary spending examples and managing them carefully, businesses can improve cash flow, reduce risks, and focus on growth. Smart spending leads to a stronger, more adaptable business.

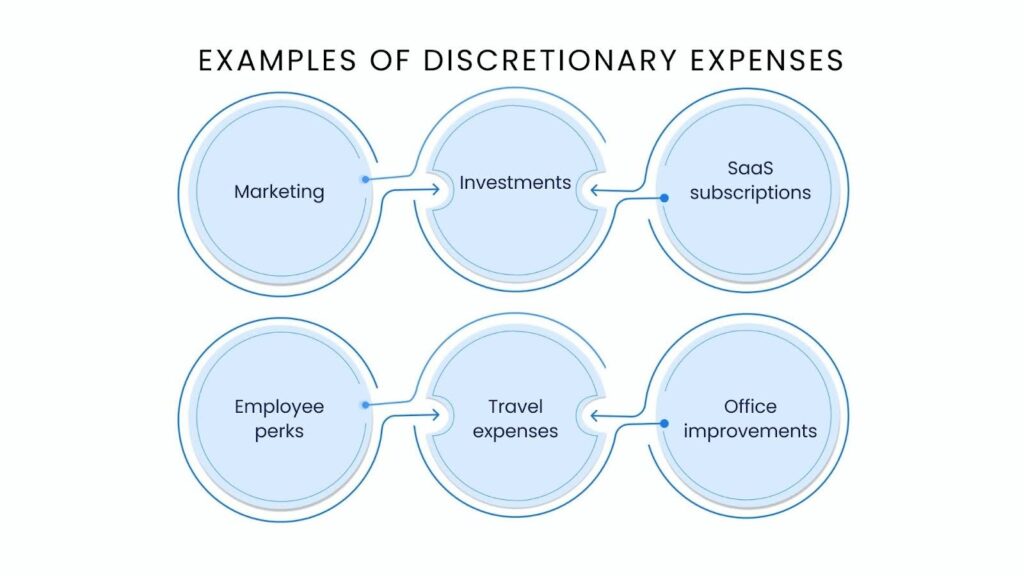

Examples of Discretionary Expenses

Discretionary expenses vary from business to business, but some costs frequently fall into this category. These include marketing, investments, SaaS subscriptions, employee perks, travel expenses, and office improvements.

Explore these discretionary spending examples in more detail and understand why they are considered optional yet valuable.

- Marketing

Marketing helps businesses grow, but how much you spend is up to you. You might invest in ads or focus on creating valuable content. These choices depend on your budget and strategy.

Some examples of marketing-related discretionary expenses include:

- Running paid ads on social media or search engines

- Creating videos, blogs, or podcasts

- Updating your website or branding

- Launching public relations campaigns

Marketing is important, but it is flexible. You can adjust spending based on your goals.

- Investments

Investments can help businesses grow in the long run. They might include purchasing assets or funding projects to improve operations. However, these costs are not critical for day-to-day activities.

Examples of investment-related discretionary expenses are:

- Buying or merging with another company

- Purchasing intellectual property, like patents

- Funding research and development

- Investing in real estate for future growth

These investments are strategic but optional, depending on the company’s priorities.

- SaaS subscriptions

Businesses rely on software to simplify tasks and save time. Tools for accounting, invoicing, or productivity are common examples. However, the type of software you choose and how much you spend are discretionary decisions.

For instance, you might choose an advanced tool with premium features or a basic plan that fits your needs. This flexibility makes SaaS subscriptions a common discretionary spending example.

- Employee perks

Perks can improve employee satisfaction and attract talent, but they are optional. How much you invest in perks depends on your company’s culture and goals.

Some examples of employee perks include:

- Gym memberships or fitness programs

- Team-building activities

- Snacks or meals at the office

- Holiday parties or celebrations

- Home office allowances

These perks can make employees happy, but businesses have full control over how much to spend.

- Travel expenses

Travel is often necessary for businesses, especially for sales teams or conferences. However, it is a discretionary cost because you can set limits and policies to control spending.

For example, you might cover flights and accommodation but set a cap on meal allowances. Businesses can adjust these expenses based on their size and budget.

- Office improvements

Improving office spaces or supporting remote work are also discretionary costs. These upgrades are not essential for running a business but can boost productivity and morale.

Examples include:

- Renovating office spaces

- Providing remote employees with equipment allowances

- Upgrading office furniture

While these expenses can enhance the workplace, they are optional and can be adjusted.

Mastering Discretionary Spending: A Strategic Guide for Financial Success

Managing discretionary spending well is important for keeping your business financially healthy. Without proper tracking and planning, these expenses can grow quickly. This can shrink your profit margins and leave you without extra funds for emergencies. Here are six practical strategies to keep your discretionary spending under control:

- Evaluate the Value of Your Spending

Spending on things that do not bring enough value is a common mistake. This often happens because businesses do not track ongoing expenses or ask for feedback. For example, you might buy a software tool to improve productivity. But if your employees don’t use it because they prefer another method, it becomes wasted money.

To avoid this, track all your expenses and note their impact. Categorize what each expense does for your business and ask if it is worth the cost.

Remember, not every expense has a clear financial return. For example, a new HR software might not show immediate results. But if it saves time onboarding employees, it could still be a smart choice.

- Track Spending Patterns

Keeping an eye on your spending trends can help you make better decisions. Reviewing your expense patterns provides benefits like:

- Showing how your business needs are changing.

- Spotting areas where manual work could be replaced by tools or automation.

- Predicting future costs based on past spending.

- Highlight seasonal trends so you can plan ahead.

Breaking your spending into categories also makes it easier to see where your money is going. For example, you can group expenses into areas like marketing, operations, or technology. This helps you focus on specific parts of your budget and make smarter choices. Tracking discretionary spending examples in your business can lead to better efficiency and control.

- Use the 50-30-20 Rule

If budgeting feels overwhelming, try using the 50-30-20 rule as a starting point. This personal finance rule can be adapted for businesses.

Here is how it works:

- 50% of your budget goes to expenses like rent or salaries.

- 30% of your budget is for discretionary spending, like tools, travel, or events.

- 20% of your budget is saved for future needs, like growth or emergencies.

While this rule may not fit every business perfectly, it is a simple way to begin organizing your spending.

- Keep a Cash Safety Net

Unexpected events can throw off your budget. Businesses without a safety net often cut costs too quickly, which can lower employee morale and hurt vendor relationships.

A cash reserve, or safety net, gives you time to gradually adjust. This way, you can review spending trends and decide where cuts are needed without rushing.

Most companies aim for a reserve that covers six months of expenses. However, your ideal safety net will depend on your business’s unique needs. Take the time to figure out what works best for you.

- Review Expenses Regularly

Set aside time every few months to review your discretionary spending. Work with your finance team and key employees to identify problem areas. For instance, if travel costs for your sales team have gone up, meet with your sales leader to understand why.

Regular reviews keep you updated on what your business needs. You might also discover that some discretionary expenses have become essential. For example, increased travel costs may be critical if your business is expanding or working with new clients.

By reviewing expenses at regular intervals, you can stay ahead of potential issues and improve your overall financial performance.

- Create and Enforce Expense Policies

Having clear rules for spending is one of the best ways to manage your budget. Many businesses struggle with this because they do not enforce their policies well.

You can solve this problem by automating your expense approval process. Automation speeds up approvals and gives employees more time to focus on meaningful work, like reviewing discretionary spending examples or analyzing trends.

A good policy sets limits for spending by department or category. These limits help you predict worst-case scenarios and protect your profit margins. Be sure to involve department leaders when setting limits so the rules are practical and realistic.

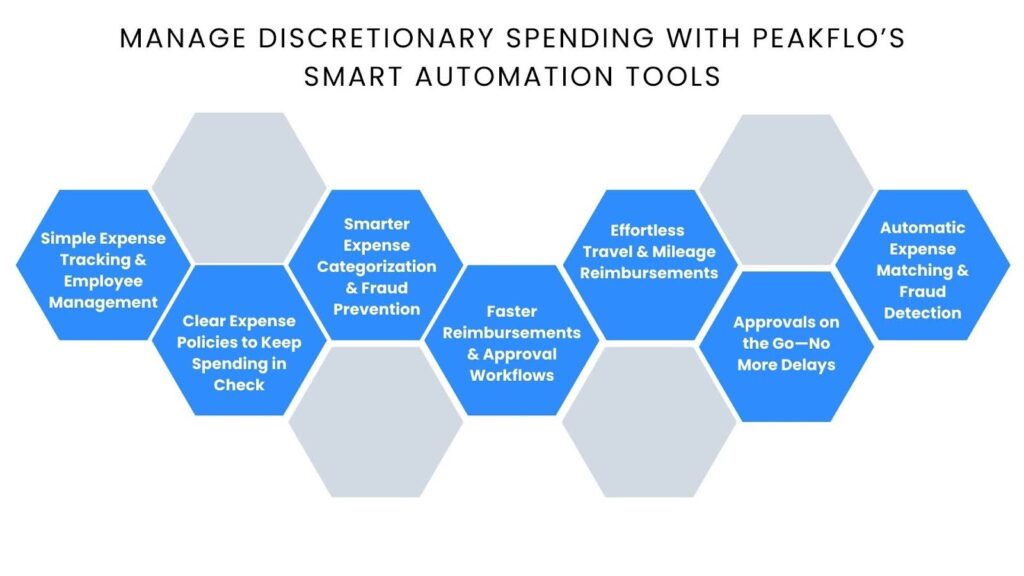

Manage Discretionary Spending With Peakflo’s Smart Automation Tools

Keeping track of discretionary spending—things like travel, meals, office supplies, and employee reimbursements—can get messy fast. Without a clear process, businesses can overspend, delay approvals, and struggle with compliance issues.

That is where Peakflo comes in. It helps companies track, approve, and manage expenses with ease while cutting costs and reducing time spent on manual work.

Here is how Peakflo’s T&E automation can help.

- Simple Expense Tracking & Employee Management

Managing business expenses shouldn’t feel like a full-time job. Peakflo makes it easy to:

- Add employees in bulk and set permissions based on roles.

- Assign managers to approve expenses quickly and efficiently.

- Sync expense categories with your accounting system to keep everything organized.

Why it matters: Everyone knows what they can and can’t spend on, and approvals don’t get stuck in limbo.

- Clear Expense Policies to Keep Spending in Check

Without clear policies, expense management turns into a guessing game. Peakflo lets you:

- Define spending limits and approval rules for different types of expenses.

- Set up admin controls so finance teams can adjust policies as needed.

- Restrict currency conversion surcharges to avoid unnecessary extra costs.

Why it matters: No more surprises. Everyone knows the rules, and businesses can stay on top of spending.

- Smarter Expense Categorization & Fraud Prevention

Managing receipts and keeping track of every dollar spent doesn’t have to be a hassle. With Peakflo, businesses can:

- Automatically categorize expenses like travel, meals, and office supplies.

- Use AI-powered receipt scanning to catch duplicates and flag mismatches before they cause issues.

Why it matters: You’ll never pay the same expense twice, and everything stays organized for tax time.

- Faster Reimbursements & Approval Workflows

Waiting weeks to get reimbursed for a work expense is frustrating. Peakflo speeds things up by:

- Routing approvals automatically to the right person.

- Allowing multi-level approvals for bigger expenses.

- Redirecting approvals if a manager is out so nothing gets stuck.

Why it matters: Employees get paid back 50% faster, and finance teams don’t waste time chasing approvals.

- Effortless Travel & Mileage Reimbursements

For businesses with employees on the road, Peakflo makes mileage and travel expenses easier to manage:

- Set custom fuel reimbursement rates based on location.

- Define per diem limits for different cities and countries.

- Upload receipts via mobile or email, and Peakflo automatically matches them to expenses.

Why it matters: No more missing receipts or miscalculated reimbursements—just fair, accurate payments.

- Approvals on the Go—No More Delays

Waiting for a manager to check their inbox to approve an expense? That’s outdated. Peakflo makes approvals easy:

- Managers get notifications via email, Slack, or WhatsApp—so they can approve in one click.

- Daily expense summaries keep finance teams updated without extra emails.

Why it matters: Approvals happen in minutes, not days, keeping everything moving smoothly.

- Automatic Expense Matching & Fraud Detection

No one has time to manually cross-check receipts. Peakflo does it for you:

- Matches expenses with receipts automatically—no more lost paperwork.

- Flags duplicate invoices or suspicious claims before they get approved.

- OCR-powered receipt scanning pulls in details instantly, so employees don’t have to type them in.

Why it matters: Fewer mistakes, no unnecessary payments, and less manual work for everyone.

Conclusion

Managing discretionary spending wisely is key to a healthy bottom line. By understanding where your money goes and implementing controls, you can ensure these expenses support your business goals. Peakflo empowers businesses with tools to track spending, automate processes, and make informed decisions.

Schedule a free demo tour today to see how Peakflo can help you gain control over your discretionary spending.