Many small-to-medium sized businesses are still trapped in the old way of doing finance tasks manually, from tracking invoices to creating financial statements. Not only do manual processes take longer to complete, but they’re also prone to costly mistakes.

Thankfully, with the help of process automation tools, you can speed up financial workflows and improve business productivity. In this article, you’ll learn the different types of process automation your finance team can benefit from.

What Does It Mean to Automate a Process?

Process automation is a method of accelerating repetitive business workflows using software. This will help you reduce operational costs, eliminate bottlenecks, prevent data silos, and boost team productivity.

For instance, in manual data collection and entry, accountants need to gather the files from each department and input each information to spreadsheets. This process can take forever, and you might need to hire more people.

In contrast, process automation enables each department to input their data directly on the software. This way, the finance team can focus on other important tasks, such as managing cash flow and getting paid faster.

What Are Good Processes to Automate?

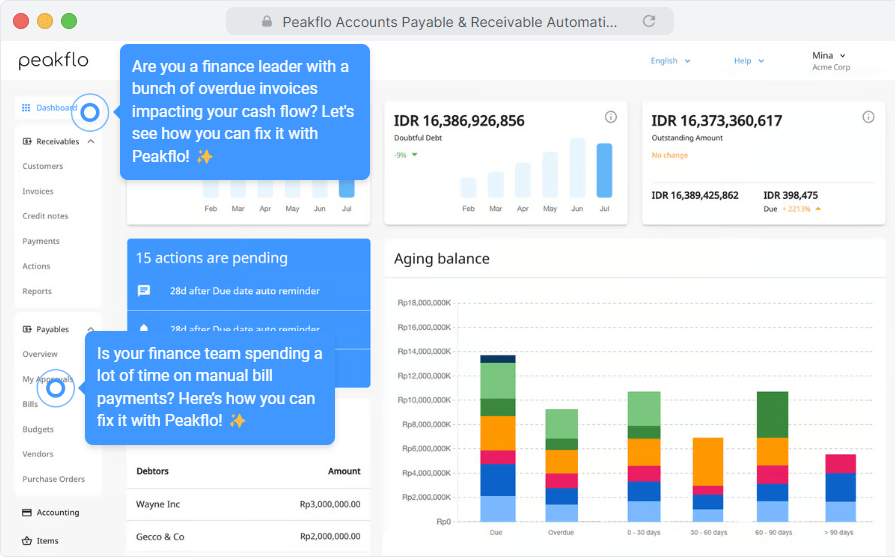

Now that you understand process automation, let’s see how to implement it on your financial workflows. In this section, we’ll discuss process automation examples for both accounts payable and receivable.

Accounts Payable Tasks

From creating POs and matching them with bills to streamlining approvals and paying off vendors, here are several accounts payable tasks to automate.

1. Data Entry

Say no more to manual data entry for POs and bills. You can generate any types of purchase quotes and bills with your professional branding with process automation tools, and at a faster rate.

Peakflo, for example, offers an intuitive dashboard where you can create a new PO and bill. Some of the fields are auto-filled, so you’ll only to fill the rest of the data that is necessary. For bills, you can even add custom fields to categorize their budgeting, identify the requesting department, and any use cases you need to streamline data tracking.

We also offer OCR for automatic PO and bill scanning. Our OCR has an accuracy rate of 98%, saving you time and eliminating human errors altogether.

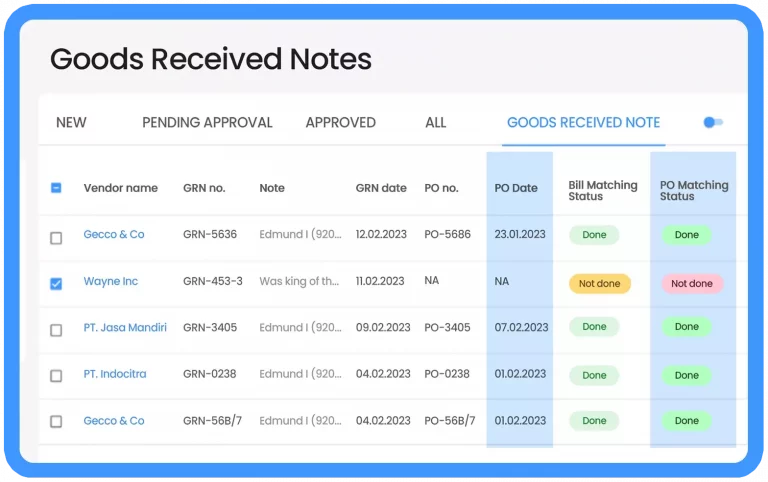

3. Three-Way Matching

Matching hundreds of purchase orders with vendor invoices and GRNs can take a while in any sizes of businesses.

Thankfully, with our software, easily manage, match all the details of your purchase orders, GRN and bills in one place. Peakflo will automatically validate quantity and unit cost for a better inventory management.

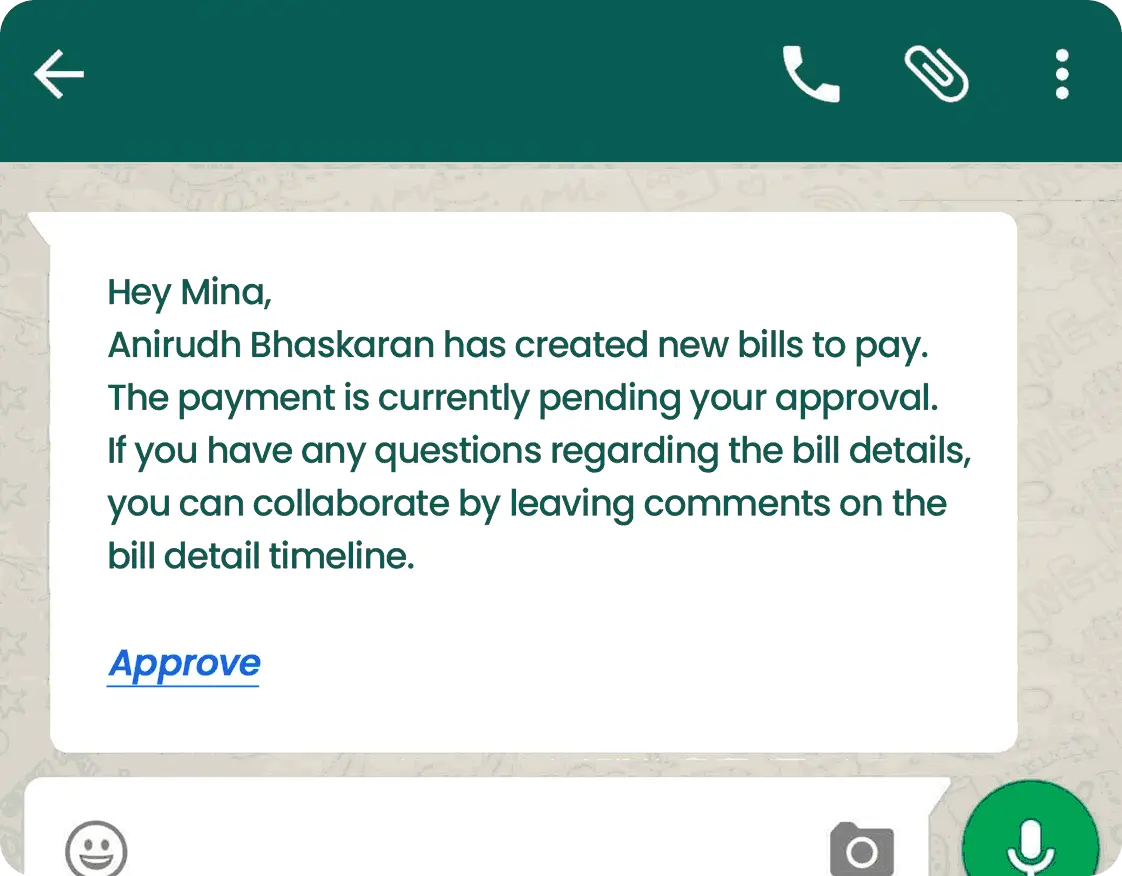

2. PO and Bill Payment Approvals

After creating a PO or a bill, the next problem bill makers face is getting the approval from the higher-ups. This usually ends up in a prolonged series of back-and-forth email threads, which are inefficient.

With Peakflo, you can create custom approval workflows for PO, bill, and transactions. Simply tag the right stakeholders, and they can approve directly in our dashboard via any devices.

We also have auto-approvals for POs and bills which are applied when the maker or sender of the bill is in the first-level of the approval flows.

Once the PO is approved, Peakflo will immediately send it to the vendor. For bills, Peakflo will schedule them for payment based on the due date.

4. Vendor Payments

Paying off vendors and suppliers might seem like a straightforward task, until you deal with dozens of different bank accounts.

To avoid the hassle, we offer a secure digital wallet that enables you to complete local and international payments. You can also schedule payments or pay off bills in bulk.

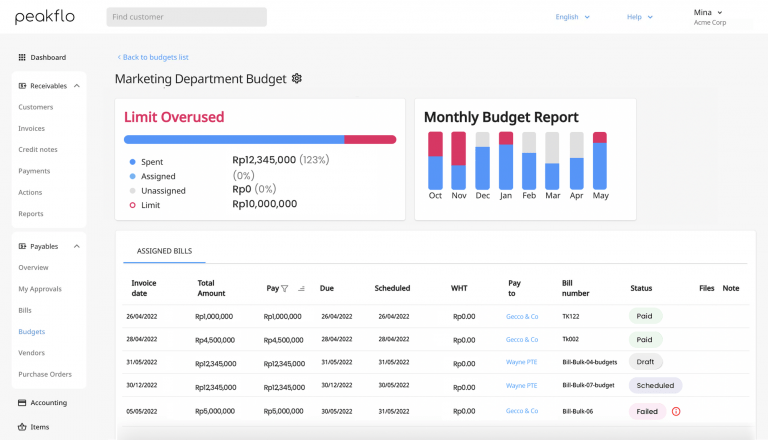

5. Tracking Budget

Another essential task to automate is budget tracking. When done correctly, this can help you gain more visibility over your business expenses for more strategic decision-making.

In Peakflo, budget management is made easy. You can set up budget reports in a few clicks and monitor expenses across departments in real-time. Keep track of spending and get notifications when you’re about to exceed the limit.

Accounts Receivable Tasks

Most companies have troubles getting paid in time, which hampers with their operating capital. Usually, ineffective accounts receivable processes are to blame for such an issue. To get paid faster, automate the following tasks:

1. Invoice Management

For accounts receivable teams, the ability to create invoices quickly is important. This can make the difference between getting paid on time and dealing with late payments.

This is the area where Peakflo can help – you can:

- Create invoices with customizable line items, discounts, and tax rates in seconds.

- Track customers’ invoice status in real-time and get insightful AI predictions on customers’ payment behavior.

![]()

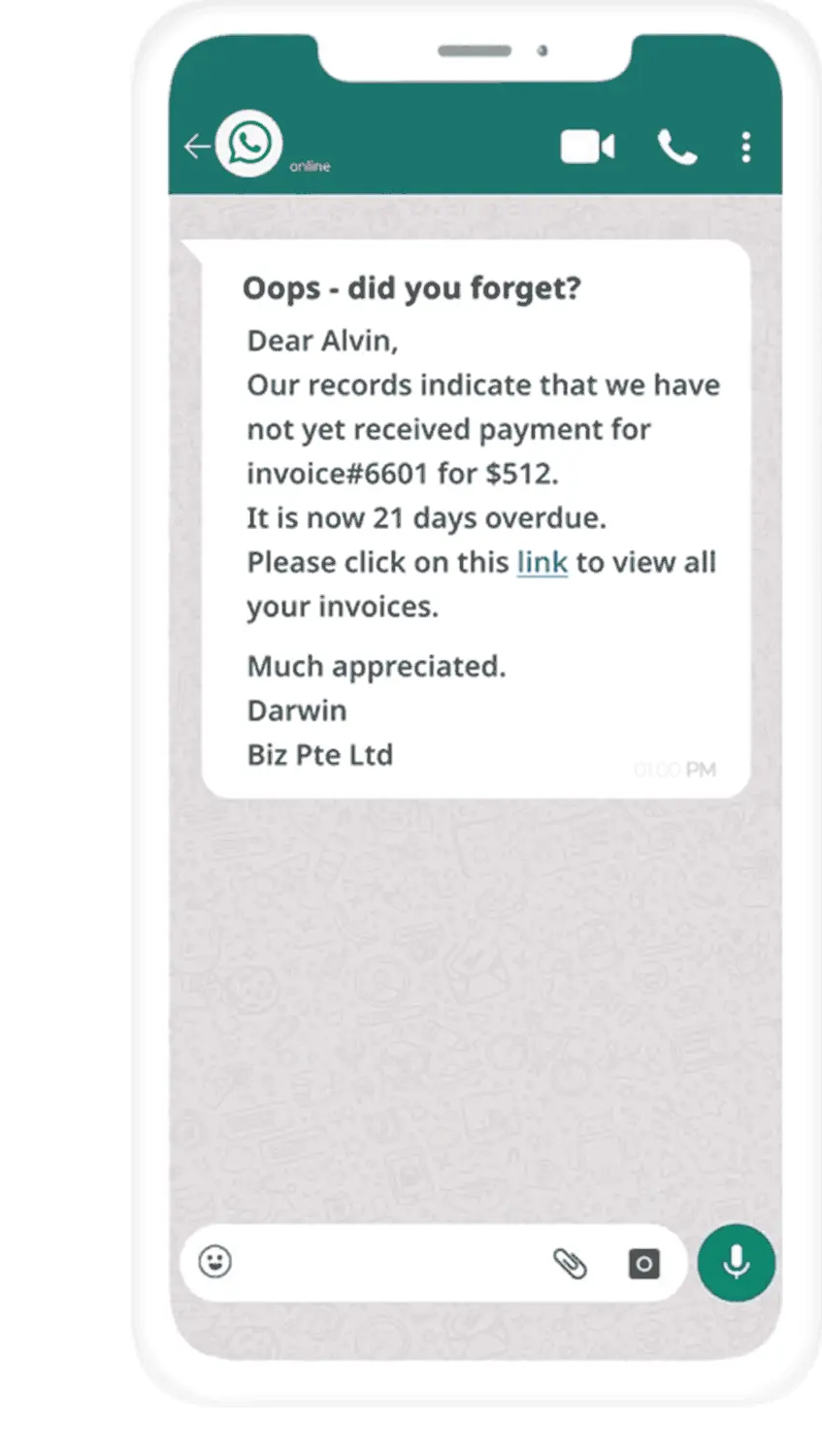

2. Payment Reminder Workflow

It’s no secret that some customers are more likely to pay late than others.

To help you deal with late-paying clients, Peakflo provides smart workflows with automated reminders based on an escalation matrix – you can send customizable messages via email, SMS, or WhatsApp.

If the customers are not paying after back-to-back reminders, decide the next steps in Peakflo, such as legal escalation or account freeze. Tracking your customers’ credit limit is also easier with our real-time credit control reports.

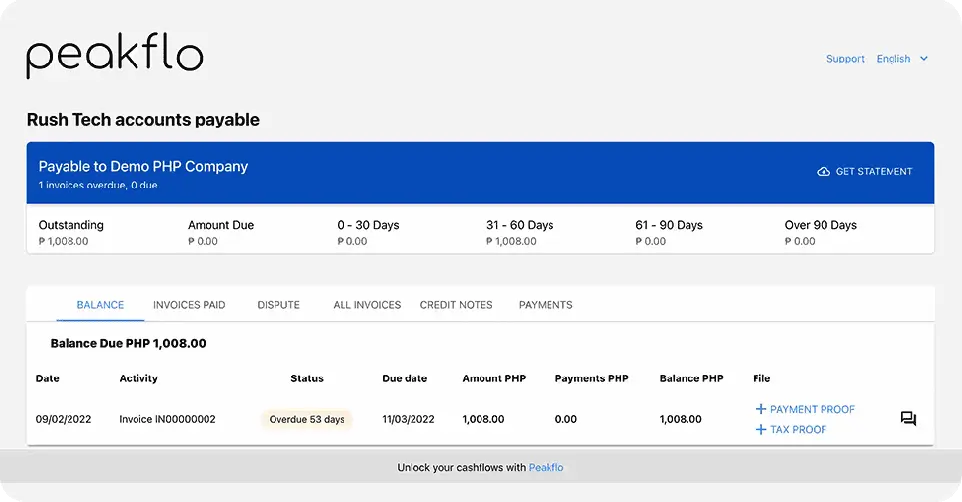

3. Payment Collection

Tracking and matching invoices before making payments are also a big challenge for customers, especially if they’re a large-scaled business.

With our self-serve customer portal, your clients can see the summary of their invoices, make payments via any methods, add taxes, or even raise disputes. On the other end, your business will receive the payments straight to your back account. If there are any issues, you can resolve them quickly with our all-in-one B2B communication platform.

Why Do We Automate Processes?

If there’s one thing every finance team will say yes to, is a lower operational cost.

With process automation, you can finish tasks faster and get more things done, while also keeping your organization lean. This means reduced labor costs and more capital to invest for your growth.

Looking for reliable automation software? Take our 2-minute product tour and see how Peakflo can help you automate finance processes.

Ready to get paid 2x faster and cut bill pay time by half?

Take our product tour and book a free consultation to find out how much your business can save with Peakflo. Take a product tour!