Every organization or company requires a solid business strategy that can help them reach their goals and objectives. From hiring new employees to allocating resources, this strategy will guide you in defining the best methods to implement within your company.

Creating a business strategy plan is indeed a lucrative and time-consuming process. However, when executed properly, a strategy that aligns with your company’s vision can help you become the market leader in the competition.

Thus, in this article, we will cover all the bases of a business strategy – from its definition and various types available to the steps of creating a well-written one and common mistakes to avoid.

At the end of the article, you will also find the best business strategies to improve your financial management along with the best tool that helps you implement them. Without further ado, let’s get started.

What Is a Business Strategy and Why Is It Important?

A business strategy outlines a roadmap that an organization or a company needs to take to reach both its short-term and long-term goals. It consists of a set of principles that advises your company’s decisions, actions, and priorities.

Serving as the central framework, a business strategy also guides the decision-making process involved in every department. Ensuring each and every one of them is in line with the company’s values, mission, and overall direction.

A well-defined and coherent strategy can be a critical factor in the success of your company. This is because it acts as a blueprint for various aspects of your business, from organizational and supply chain management to financial and monetary plans.

Furthermore, here are some of the reasons why a business strategy is crucial:

- Serve as effective planning – a business strategy plan contains a set of rules and critical steps to implementing. Hence, giving you an effective plan to reach your company’s objectives.

- Identify strengths and drawbacks – the process of developing a business strategy helps you evaluate your company’s strengths and eliminate its weaknesses. Thus, allowing you to create a strategy that will work in your favor.

- Improve efficiency – a solid business strategy helps you effectively allocate resources and expenses in every activity. This automatically results in a more efficient and productive workflow.

- Provide full control – with a well-made strategy, it is easier for you to assess, check, and control whether or not each task is progressing according to plan. Otherwise, you can determine ways of improving them to meet your objectives.

Without one, the core of your business and its values become unclear and resulting in various issues. These include vague goals and objectives, improper resource allocation, unorganized structure, departments working in silos, and many more.

One example of a successful business strategy is the one implemented by PayPal. Their secret was to continuously build new strategic partnerships to acquire new customers, improve customer experiences, and offer greater payment flexibility.

Starting with their partnerships with Mastercard, today PayPal acclaims 54% share in the payment processing market. All of these came from their partnerships with large and small merchants, including Visa, American Express, Discover, JCB, Diners Club, and EnRoute.

Types of Business Strategies

Naturally, companies create business strategies as frameworks targeted at particular areas of the business. These strategies aim to maximize the growth and development of all facets of the company.

Hence, the types of business strategies can vary from finance and supply chain to marketing and operations. Below are some of the common types of business strategies to inspire you:

1. Financial and Monetary Strategy

Financial strategy relates to asset acquisition, financing, and management. This strategy focuses on generating profit for the business and making sure it has a sustainable return on investment (ROI).

In other words, the financial strategy is all about managing the financial resources of the company. This includes accounting, reporting, budgeting, collecting accounts receivable, and risk management. The goal of this strategy is to save costs and maximize profit.

An example of a successful financial strategy can be seen in Swiss Re’s Marketing 2.0 playbook. This playbook set clear guidelines and enabled marketing to execute product upselling and cross-selling that was able to deliver sustainable profits to its shareholders.

2. Human Resource Strategy

Human resource strategy aims to bring people and companies together so that both parties’ goals and objectives can be achieved. It provides a framework that links people management and development to long-term company goals.

The HR strategy affects certain aspects of the business from talent acquisition and performance review to employee training and compensation. Therefore, it is important to create one that aligns with your company’s mission and overall direction.

One good example is a human resource strategy implemented by Coates. The company has developed the Performance Development Plan (PDP) to encourage its employees to incorporate their company values into daily practices.

3. Product Differentiation Strategy

A product differentiation strategy is an approach that fulfills the demands of a narrow market. This strategy goes hand-in-hand with ensuring a strong value proposition to make your products or services appeal to the target market.

A successful product differentiation strategy can lead to brand loyalty and an increase in sales. This is because it raises the audience’s interest and gives them reasons to believe that they need your product rather than the others.

An example of solid product differentiation can be seen in Apple. They differentiate their products by pricing them higher than their competitors, implying that they have better quality and the latest technology. Apple also triggers the audience’s interest by introducing hype before the product launch.

How to Create a Business Strategy?

Now that you understand the definition of a business strategy, its importance to a company, and the different types available – it’s time to look at the steps on how to write a business strategy of your own.

The strategy plan developing process can be broken down into five critical steps:

1. Define your business’ vision

To have a well-made, coherent, and successful business strategy, the first thing you need to do is define your company’s vision. This will serve as a foundation for developing the other aspects of the strategic plan.

Once you have a solid vision, you can then define your value proposition, ideal consumer profile, and core market. This will help you ensure that your strategy is in-line with the needs of your target market.

2. Set your top-level objectives

A company’s top-level objectives may vary from growing revenue, market penetration, to shareholder value creation. However, these objectives are different from one another. Assess your priorities and set your objectives to achieve.

Ultimately, a business strategy plan aims to answer the questions of how your company can compete, grow, and thrive. Hence, when developing a strategy it is crucial to set realistic objectives.

3. Analyze your business and the competition

Once you have set your vision and main objectives, next on the list is to analyze your business. This requires you to understand and be aware of your company’s SWOT (strengths, weaknesses, opportunities, and threats).

Not only the SWOT analysis will help identify the internal condition of your company, but it will also help you study and compare them with the external situation that is the market you’re aiming to dive in.

4. Develop your USP

The next step is to identify how your business will compete in the market, generate demand, and increase its sales and margins. To do this, you need to set yourself apart from the competition by developing your own Unique Selling Proposition (USP).

If you’re in a competitive industry chances are consumers will not purchase two of the same products. Thus, it is greatly important to explore your products or services, examine their values, and set prices accordingly to their perceived values.

5. Build a strategy framework

With the fourth step completed, you have finally formulated an overall business strategy plan. However, there is still a final step to take – it is to translate that generic strategy into a more department-specific one.

This step ensures the success of the organizational business strategy plan, as it also helps define the vision and needs of each department and aligns them with the company’s overall objectives.

Common Mistakes to Avoid when Implementing a Business Strategy

A business strategy can only be successful if it’s well-executed. To do so, there are some common mistakes to watch out for. Avoid them and you’ll have a higher chance of success when implementing your business strategy plan.

By avoiding these pitfalls, you’re one step closer to having a business strategy that is coherent, effective, and valuable.

1. Poor communication

Communication is a crucial element of a successful business strategy implementation. Therefore, it is important to make sure that every individual involved in the process understands the strategy clearly.

When it comes to strategic communication, multiple repetitions are not necessarily the best. It is not the number of times you explain the strategy, but more the quality of the communication.

If needed, you can assign a PR to deliver your intentions or ask your head of departments to describe the strategy and how it works using their own words. Their answers will show whether or not your communication and information flow timely.

2. Rigid adherence to the plan

Sticking to your plan is important, however, being overly strict with your plan might cause you more harm than good. A viable strategy plan should be flexible to adapt to the changing market demands.

Thus, be sure to examine and evaluate to see whether your strategy is meeting your performance benchmarks. Otherwise, don’t hesitate to make necessary adjustments when implementing it, even if it means changing to a completely new strategy.

3. Lack of decision-making and accountability

It is true that ultimately the CEO is responsible for executing a business strategy plan of a company. However, the CEO can’t be the sole responsible individual in this process.

To ensure success, accountability should be made at all levels of the company or organization.

The same goes for decision-making. Everyone in the company should have a say in bettering the business strategy, to ensure it’s the most feasible plan for each department and overall company.

4. No measurement and review

An effective business strategy implementation should constantly be examined, evaluated, and reviewed. Each outcome needs to be measured to see whether it’s consistent with the benchmark that has been set.

Every time you launch a new strategy, it is paramount to keep track of how things are going, listen to feedback, and monitor what the data is telling you. If you find things are not working, be sure to find the root cause and fix it immediately.

Best Business Strategies to Improve Your Financial Management

A successful business strategy comes alongside comprehensive and ever-growing financial planning and management.

With good financial management, your business can manage the effective use of resources, meet stakeholders’ expectations, reduce operating expenses, and have an adequate supply of funds for long-term financial stability.

In this section, we will cover the four best strategies to improve your financial management.

1. Analyze financial performance

A streamlined financial statement evaluation is a crucial step in determining financial strategies. Monitoring your cash flow, analyzing, and taking action based on the data stated on your balance sheets can help tremendously in defining the strategies.

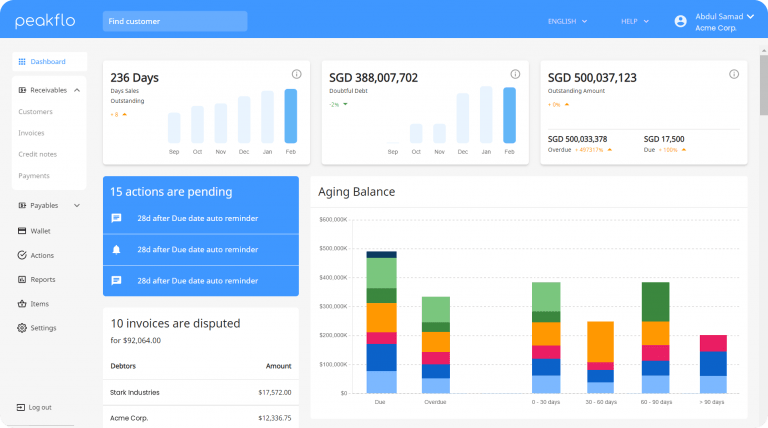

Luckily, Peakflo is here to make your financial performance task a breeze. Here are some of the ways we can help you:

- Eliminate manual spreadsheet tracking with Peakflo‘s multitude of automated reports

- Visualize cash flow health and predict future cash inflows

- Understand the payment behavior of customers through AI-powered reports

- Stay on top of pending payments with the aging payable report

Once you have collected information about your company’s cash flow performance, and current financial position, you can now start thorough financial planning based on accurate data and evidence.

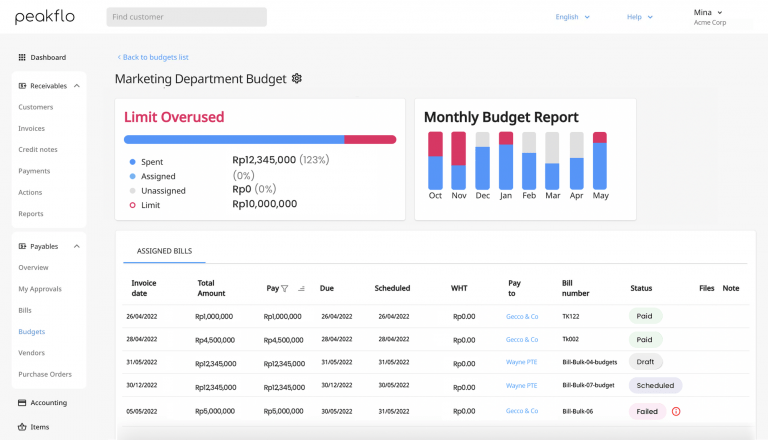

2. Create and monitor budgets

Budgets enable your company to set goals and priorities more accurately. The better you create and monitor your budgets, the more effective your actions toward the business objectives will be.

Depending on the size of your company, you might need separate budgets for different departments. Each budget should break down revenue and foreseen expenses by monthly, quarterly, or every year.

This is indeed a tedious task, but fret-not – our accounts payable software is here to make this process easier. Here’s how we can help you along the way:

- Put budget management on easy mode for your organization

- Gain more visibility over all your business expenses for more strategic decision-making

- Keep track of your spending in real-time and get notifications when you’re about to exceed the limit

3. Control debtors

Once your company has been operating in business for a while, you’re bound to have returning customers. To keep them as your loyal customers, one good way is to provide them with credit purchase facilities.

However, if you decide to adopt this strategy, it is important to set everything straight from the get-go. How much funds you allocate, the credit capital you provide, and the method you apply for debt repayment.

An easy way to keep track of debtors and reduce the risk of late or non-payment is to use an automated credit management system – Peakflo can help you with just that. Take a look at what we can do to help:

- Get a big picture on invoices likely to be overdue

- Understand detailed collection efficiency for each month’s invoices

- Keep a tab on customer credit limits via credit control report

![]()

4. Keep your records up-to-date and secure

Another paramount step in effective financial management is to protect your data and records.

When you protect these assets, you ensure that the company’s financial management strategies are safe from external influences and malicious acts, such as manipulation or fraud.

The good news is, Peakflo’s security measures can help you maintain your financial management worry-free. Additionally, we also provide automated integrations that make collaboration between teams more efficient.

- 2-way sync with your accounting software integration to save hundreds of man-hours wasted in reconciliation

- Peakflo adheres to the best industry practices, and the Google Cloud Platform hosts our services. All your data is encrypted under the 256-bit Advanced Encryption Standard.

Streamline Your Financial Strategies with Peakflo!

Skip the hassle and work more efficiently with Peakflo! Put your accounts payable and receivable on automated mode. We will take care of your tedious financial management process and turn it into a walk in the park.

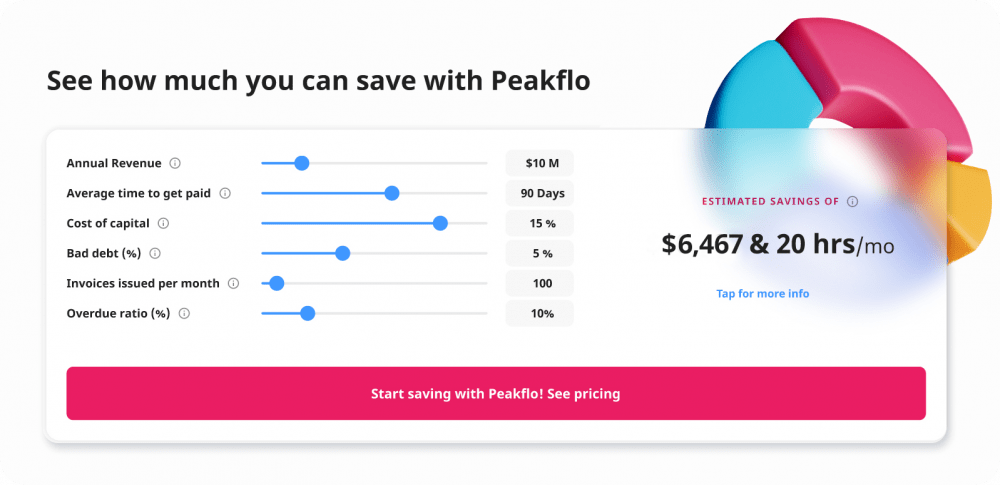

Spend more time on growing your business, and less on managing your payments. See how much you can save with Peakflo with our savings calculator and book a free consultation with our finance experts.