If you want to grow a financially-healthy business in Singapore, understanding the corporate tax filing regulations is crucial. Not only does it help you avoid penalties, but it also enables you to optimize your spending more effectively.

This article will provide the complete guide to corporate tax filing in Singapore, including taxation best practices and the process of submitting tax returns.

Table of Contents

Types of Businesses that Need to File Taxes in Singapore

Generally speaking, there are 3 types of companies obliged to submit tax returns:

- Sole Proprietorship. Most commonly found in small businesses, a sole proprietorship is owned by one person. As such, the owner is personally responsible for the company’s assets and liabilities, including taxes.

- Partnership. It’s a type of business owned by two or more individuals. However, similar to a sole proprietorship, the business and its owners aren’t separated legal entities.

- Private Limited Company. A private corporation is usually a medium-to-large sized business owned by a group of people, with its shares not available to the public. A limited company stands as its own legal entity, meaning that the shareholders’ personal assets and liabilities are separated from the company’s.

Types of Taxes Businesses Need to Pay

If your company belongs to one of the categories, prepare to pay the following taxes:

| Types of taxes | Amount |

| Corporate Income Tax (for private limited companies) | 17% of the taxable income. Startups are given tax exemptions for the first 3 years, where they only need to pay 75% of their first $100,000. |

| Foreign-Source Income Tax | 17% of the taxable earnings received in Singapore. |

| Goods and Services Tax (GST) | 8% of the total value. |

| Income Tax (for sole proprietors and partnerships) | Personal income tax rates will apply (0-22%). |

| Withholding Tax | The rates are 15% for Interests and 10% for royalties. |

| Property Tax | 10% (applicable to flats, warehouses, offices, and factories). |

Singapore Corporate Income Tax Rates

Local and foreign companies that conduct business activities in Singapore are taxed at a flat rate of 17%.

But, how is corporate tax calculated? Here are the steps:

- Determine your company’s gross income of the year.

- Calculate the applicable deductions, including non-taxable income like capital gains and business expenses like employee wages.

- Use this formula to find your taxable income: Taxable Income = Gross Income – Allowed Deductions.

- Once you’ve found the chargeable income, multiply it by 17% to calculate the corporate income tax.

For example, a business made $10,000 solely from product sales in 2022. Its allowed deductions, consisting of office rent and wages, amounted to $3,000.

Therefore, the corporate tax liability is:

Gross Income ($10,000 – $3,000 = $7,000) x Income Tax Rate (17%) = $1,190.

Avoidance of Double Taxation Agreements (DTA) for Singapore Businesses

Double taxation happens when an international business is required to file corporation tax in two different nations – the country where the income arises and the country where the income is received.

To protect multinational companies from paying taxes twice on the same income, countries can make corporate tax filing arrangements called a bilateral tax treaty or an Avoidance of Double Taxation Agreement (DTA).

Singapore has signed DTAs with nearly 100 countries, including Australia, China, India, Indonesia, and the United Kingdom. That means, if your business is a tax resident of Singapore or one of its partners, you will only be taxed once when performing cross-border trades between these nations.

Types of Tax Relief for Singapore Businesses under DTA

In Singapore, there are two common ways of relieving double taxation:

Tax Credits

Often referred to as Double Tax Relief (DTR), a tax credit allows Singaporean companies to claim a credit for the amount of foreign tax paid against their domestic tax of the same income.

There are two different types of tax credits:

- Ordinary credit. The amount of the tax relief is restricted to the lower of the foreign and domestic taxes. For instance, if the foreign tax is $1,000 and the Singaporean tax is $700, DTR will only cover $700 and you still need to pay the remaining $300.

- Full credit. The company is allowed to claim the full amount of the foreign tax.

To claim for DTR, you’ll have to make a request when filing annual income tax returns (Form C) and provide relevant proof.

Tax Exemptions

A tax exemption refers to a condition where your foreign-source income is excluded from the domestic corporate tax.

To reap the benefits of a tax exemption, the following conditions apply:

- The highest corporate tax rate of the foreign country is at least 15%.

- The company has paid the tax for the foreign income.

There are also tax exemption schemes for local companies:

- Start-up Tax Exemption Scheme. During the first three years, startups are given 75% exemptions on their first $100,000 and 50% on the next $100,000 of taxable income.

- Partial Tax Exemption Scheme. All companies are given 75% exemptions on their first $10,000 and 50% on the next $190,000 of chargeable earnings.

Deductible and non-deductible Business Expenses

A deductible is an expense that a company can exclude from its gross income during corporate tax filing. In contrast, a non-deductible expense is included in the taxable income.

Deductible Expenses

Deductible expenses are usually operational costs necessary to run a business, such as:

- Office rents

- Employee salaries

- Good supplies

- Phone bills

- Utilities

- Office supplies

- Business trips

- Health insurance

Non-deductible Expenses

Non-deductible expenses are usually deemed unnecessary or indirectly related to your business operations, including:

- Commuting expenses to and from the office

- Entertainment expenses

- Employee meals for lunch

- Gifts

- Political or lobbying expenses

How to File Taxes for Small to Medium Enterprises (SMEs)

First, you need to know which form C your business should file:

- Form C is for all Singapore-based corporations.

- Form C-S is for Singaporean companies with an annual revenue below 5 million SGD.

- Form C-S Lite is for Singaporean businesses with an annual revenue below 200,000 SGD.

Then, follow these steps:

1. Mark the Date to File Taxes

The first step is to mark the corporate tax filing due date on your calendar to avoid late-payment penalty.

But, what is the filing deadline for corporation tax returns in Singapore? Generally, filing notifications will be sent during January and February. Then, companies can start submitting the Form C/C-S/C-S Lite from May 1 to November 30 the latest.

2. Prepare the Relevant Business Records

After that, prepare the necessary documents:

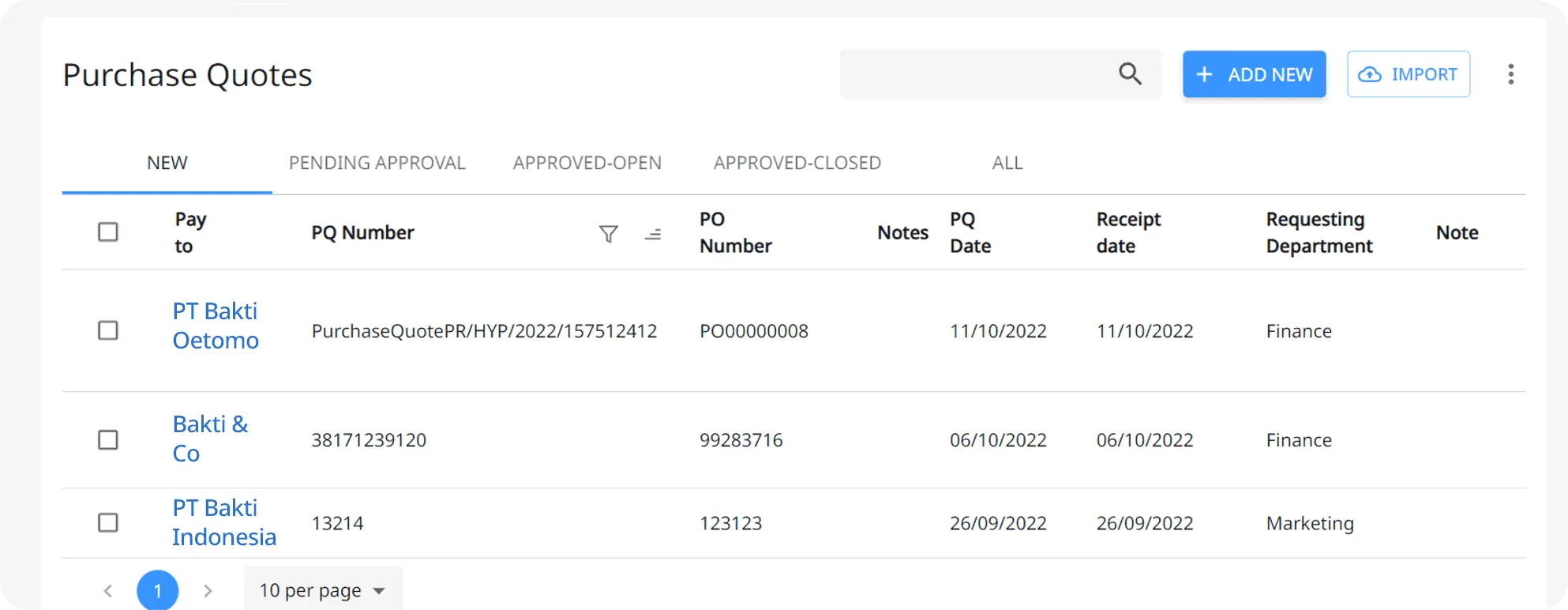

Daily Purchases Record

This document should mention the purchase date, supplier name, description of goods and services, payable amount, and payment method.

Use software like Peakflo to streamline accounts payable processes, all in one place. Peakflo records your daily purchases in a centralized dashboard that’s easy to use. You can export all this data in a single click for an easier reporting, then import them to your accounting software for an automatic 2-way synchronization.

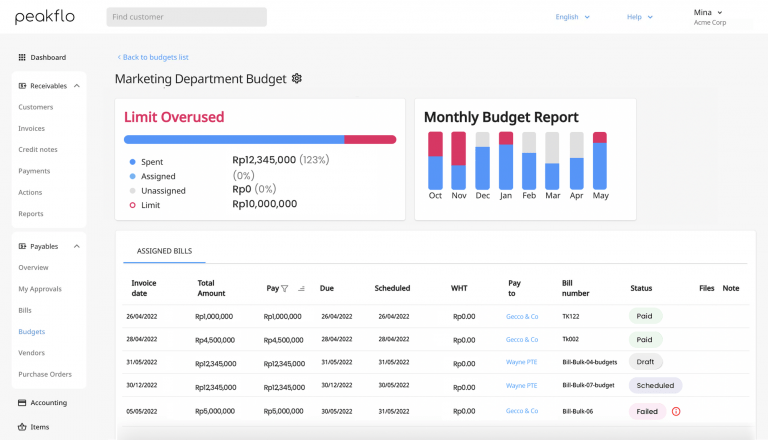

Monthly Record of All Business Expenses

Each department in your company has to provide monthly expense reports, containing details like the date, cost description, payable amount, payment method, and vendor name.

With our budgeting feature, tracking expenses and generating reports have never been easier. For faster reconciliation, finance teams can also export and import the following bills to their accounting software:

- Details of daily transport expenses. Record transport expenses for business trips or office commuting easily. With Peakflo, you can simplify record-keeping for employee expenses such as reimbursements and transport expenses.

- Particulars of monthly staff remuneration expenses. Whether tracking employee wages, commissions, or reimbursements, Peakflo’s budget management feature comes with real-time reports to scale transparency across the organization.

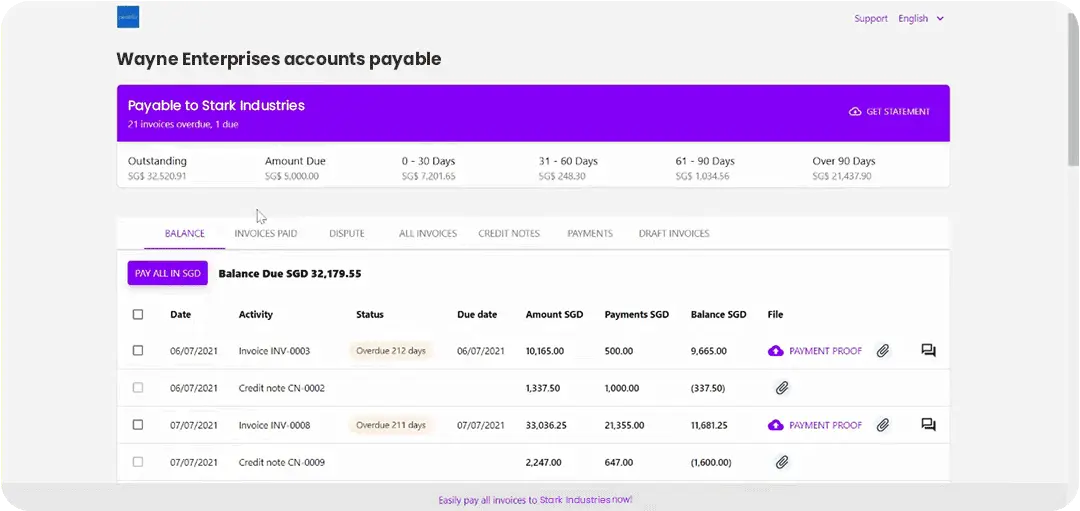

- Statement of account. Peakflo keeps the statement of account for all invoices. Finance teams can then export the data for seamless reporting and customers can view pending invoices through the self-serve portal where they can also clear payments and resolve disputes.

- Balance sheet. No need to manually input your balance sheet to the accounting software. Peakflo automatically syncs chart of accounts, invoices, payments, and all the necessary data to your accounting software.

3. Calculate Your Profit and Loss

To determine your taxable income, you’ll need to calculate your net profit or loss of the year. Here’s how:

- Gather all banking records to track digital payments.

- Prepare all invoices and bills to track cash purchases.

- Calculate your total revenue and expenses, including interests, taxes, depreciation, and amortization.

- Use this formula to find your net proft/loss:

Profit/Loss = Total Sales – Total Expenses.

Let’s take a look at this example.

| Income Sources | Amount |

| Main product sales | $100,000 |

| Affiliate marketing | $5,000 |

| Stock dividends | $45,000 |

| Total Revenue | $150,000 |

| Expenses | Amount |

| Employee salaries and bonus | $20,000 |

| Supplier payments | $50,000 |

| Office rent | $1,000 |

| Corporate income tax (17%) | $25,500 |

| Total Expenses | $96,500 |

Thus, the net profit is $150,000 – $96,500 = $53,500.

4. E-File Corporate Tax Requirements to the IRAS

Once all the necessary documents are ready, here’s how to file corporation tax to the IRAS:

- First, you need a Singapore Personal Access or Singpass – visit the Singpass website to create a new account. Foreign individuals can apply for a Singpass Foreign Account (SFA) instead.

- Prepare the required documents, such as your income details and business registration number.

- Access myTaxPortal and log in with your Singpass.

- Verify your business’ name, address, income, deductions, and reliefs.

- Declare other sources of income.

- Enter your allowed deductions and tax reliefs.

Once the corporate tax filing process is successful, an acknowledgement page will appear.

Why You Should File Taxes On-Time

Filing taxes before the due date helps you:

- Avoid penalties. Tax penalties in Singapore are not to be messed around with. If you’re found guilty of evading or underpaying taxes, you’ll have to pay three times the amount and a $10,000 fine. Otherwise, prepare to spend the next three years in prison.

- Budget more effectively. Although corporate tax filing can be done once a financial year, it’s still necessary to calculate the tax amount during month-end closing. This way, you can budget your spending throughout the year more effectively. With Peakflo, you can speed up budget reporting and recapping by 2x and control expenses before exceeding the budget limit.

- Manage cash flow better. As mentioned before, paying taxes late leads to heavy penalties, putting your financial health in jeopardy. To avoid this, you’ll need to conduct monthly tax forecasting to manage your cash flow better. Peakflo’s cash flow management software makes it easy to track revenue collections and forecast future cash inflows and outflows with AI predictions.

Which Software Is Best for Corporate Income Tax Filing?

If you’re looking for a tool that makes corporate tax filing stress-free, look no further. Peakflo has several helpful features:

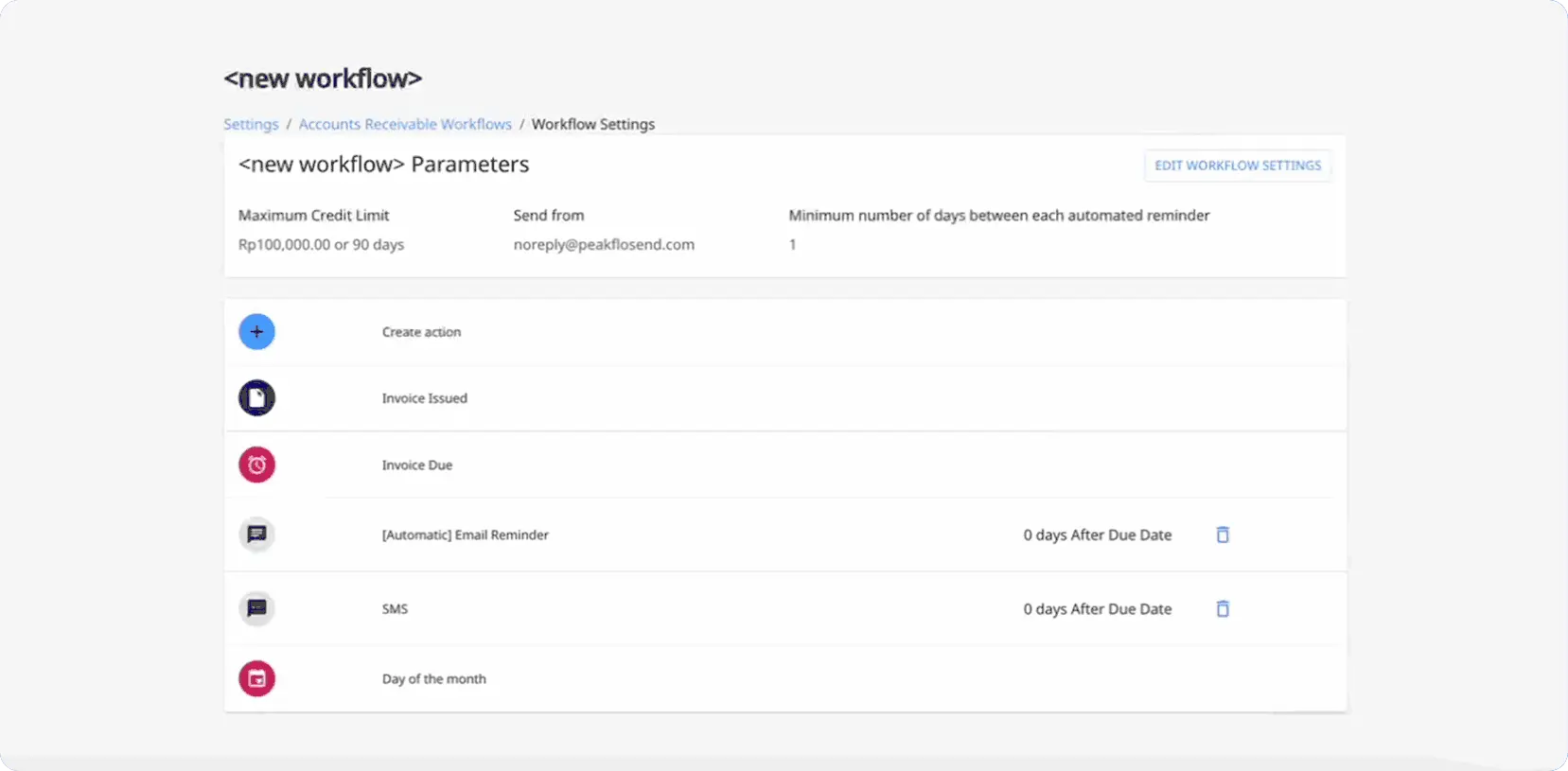

- Automated reminders for WHT collections. Chasing customers to submit their tax proof documents can be frustrating. Thankfully, our system lets you send automated reminders through email, WhatsApp, or SMS.

- Faster tax closing. With Peakflo, reconciling your accounts will only take 15 minutes. This eliminates year-end closing headache and saves your time for more strategic financial tasks.

If you need more resources on how to automate financial operations, download our free Guide to Automation for CFOs in 2023 eBook