For most people, the new year means a fresh start. Unfortunately, that’s not the case with finance teams. This time of the year is a busy period for accountants, as they need to do the frustrating tax reconciliation process to close the books. If you’re one of them, this article will provide several taxation best practices to help you navigate the challenges of preparing for the tax season.

But before we get to that, let’s define the term taxation first.

What is Taxation?

Taxation is the process by which governments collect revenue from individuals, businesses, or other entities within their jurisdiction. Taxes are mandatory financial charges imposed by the government on various sources of income, transactions, wealth, or consumption. The income raised from this practice helps governments cover expenses and make investments for their country’s growth.

When Can You Start Filing Taxes?

The timing for when you can start filing taxes depends on the tax jurisdiction and the type of taxpayer.

In many countries, including the United States, the tax filing season typically begins in the early months of the year. For Singapore, there is no set timeline for corporate tax filing. Companies have the right to decide on their financial year. The most common choices are at the end of the fiscal quarter or the year-end. Businesses should pay taxes on a preceding-year basis. The deadline itself is on November 30th every year.

Per the regulations, businesses are subject to a corporate tax rate of 17%. Certain types of income, such as interest, royalties, and rentals, are also taxable based on the withholding tax (WHT) law in Singapore. This law regulates the collection of payments made to a non-resident company that will be withheld and paid to the Income Tax Authorities.

What is a Deferred Tax Liability?

A deferred tax liability refers to the amount of taxes a business owes to the government. The deferred tax happens due to the timeline difference between when the income tax was issued and when it’s due for payment.

For instance, company ABC Inc. generated revenue by selling its product in October 2023. However, the tax for that particular transaction is due to be paid in March 2024.

Although the actual tax payment will be made next year, the expense must be recorded in the company’s current balance sheet as a deferred tax liability to avoid confusion.

Is Deferred Tax Liability Good or Bad for Businesses?

A deferred tax liability isn’t necessarily bad for your business, it simply means you must pay taxes at a future date.

However, when not tracked well, it can result in significant penalties. For example, the penalty for late employment taxes is 10% of the total amount, with the number increasing to 15% for further delays.

This can negatively impact your company’s cash flow, especially on the accounts payable side. To help you streamline the tax reconciliation process and avoid tax punishment, we will provide several taxation best practices in the next section.

Taxation Best Practices for a Faster Tax Reconciliation

The average small-to-medium-sized business deals with hundreds of invoices during month-end closing. When not handled properly, there will be thousands of them waiting by the time the tax season arrives.

For each transaction, the company has to track and manage withholding taxes (WHT), which is time-consuming and prone to human errors. Thankfully, there are plenty of solutions to accelerate the taxation process.

Define the Standard Operations for Withholding Tax (WHT) Collections

Chasing WHT payment receipts from customers can be frustrating. Once collected, finance teams also have to manually upload them to their accounting software.

As such, having a systemized procedure for withholding tax collections can make your team’s lives easier.

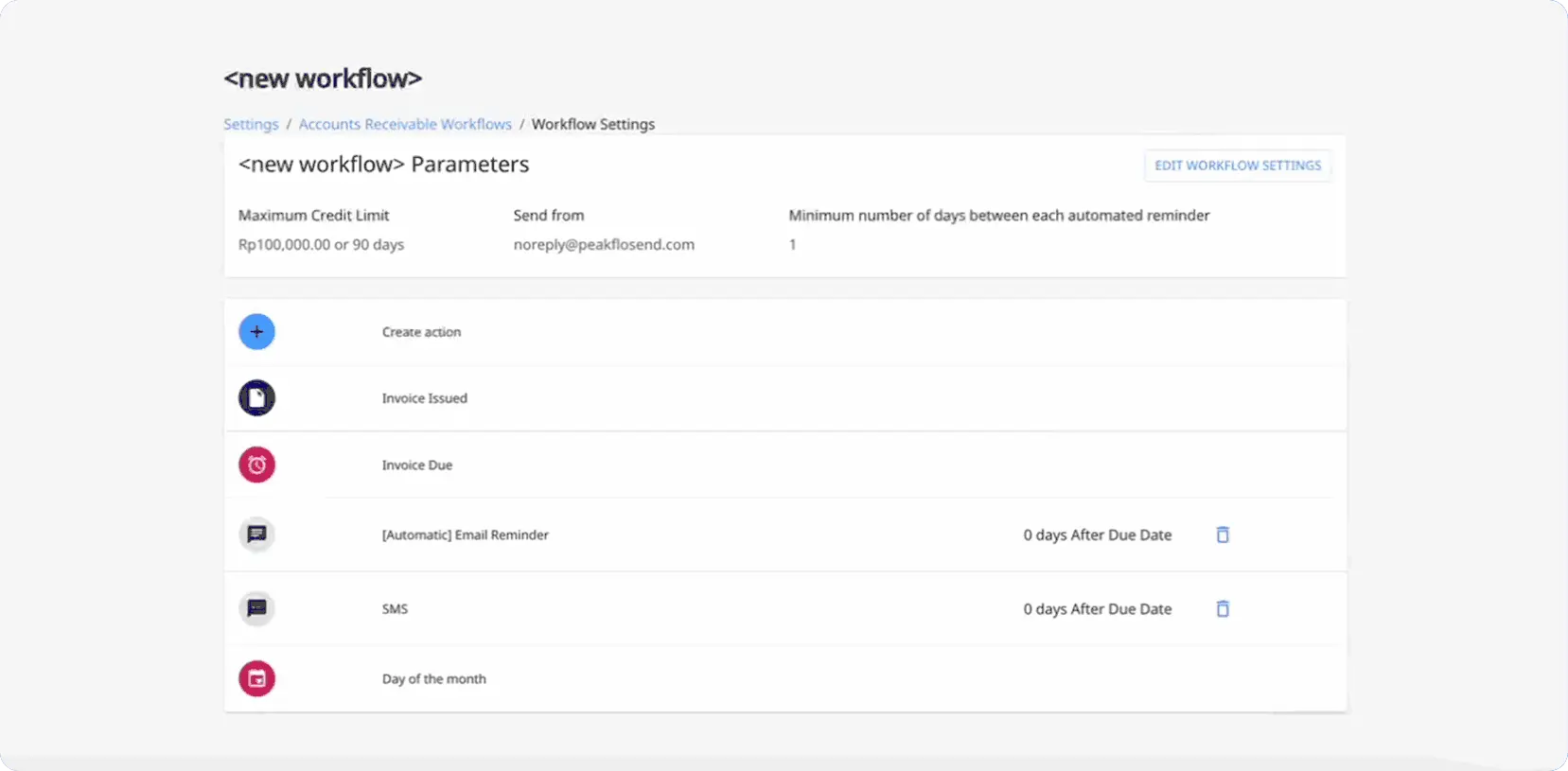

This is the area where accounts receivable and payable software excels. Accountants can create workflows for WHT collections and provide more flexibility for payment options. Customers can simply select the relevant WHT, upload their tax proof, and pay the auto-calculated amount in one place. As a result, your business will receive tax collections faster, simplifying reporting and reconciliation further.

Map Out the Taxes to the Right Invoices and Bills

In most companies, using spreadsheets for tracking taxes on bills and invoices is commonplace. This is a waste of your time and effort better spent on other productive financial procedures.

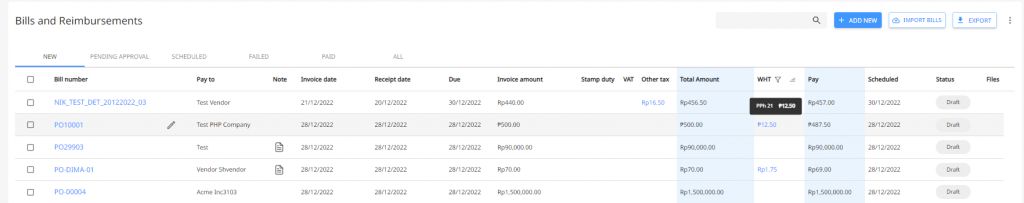

Thankfully, you can speed up the process using automation tools. Through Peakflo’s user interface, instantly track the type of tax along with the amount mapped to specific transactions. This way, you no longer have to do manual calculations that can result in costly inaccuracies.

What’s more, our system automatically syncs taxes, bills, invoices, payments, and charts of accounts on both ends with your accounting software. This will save your organization hundreds of man-hours on manual data entry and prevent any duplications.

Simplify Tax Reporting and Calculations

Each month, finance teams have to calculate thousands of records from different departments, and create tax reports based on them.

Without an automated system, that means chasing each team for the right information, reconciling the amount, and inputting them on spreadsheets one by one. Sounds time-consuming, isn’t it?

With the help of technology, you can simplify tax reporting. The automation tool helps you ensure that all customers submit their tax proofs with automatic easily customizable reminders in terms of content, timing, and frequency.

The tool will automatically generate the most up-to-date data on tax tied to certain invoices or customers and serve the reports that you can export in CSV or according to your accounting software format in a click.

Streamline Tax Reconciliation

To ensure a speedy and error-free taxation process, using automation software is your best bet.

It helps you streamline tax reconciliation from start to finish:

- Create automated workflows for WHT collections and customer reminders.

- Match the type of taxes and the amount with the bill or invoice automatically.

- Track all payments and taxes in real-time reports.

- Gather tax documents from different customers, vendors, or employees on time.

- Reconcile the tax amount on accounts payable and receivable automatically.

- Create tax reports faster with the most accurate and up-to-date data.

Utilize Automation to Drive a Better Tax Reconciliation

If you’re not sure which automation tool to try, worry not. Peakflo is here to help your business deal with the tax season better.

Our features include:

- Tax breakdown for invoices and bills. Find out the type and amount of taxes mapped to each invoice and bill in a single dashboard.

- Automated reminders for WHT collections. Send follow-ups via email, WhatsApp, or SMS to make sure your customers have uploaded their payment and tax-proof documents.

- Automated WHT extraction. Our system will automatically extract withholding taxes by codes at year-end for a faster closing.

- Tax calculations. Say goodbye to manual calculations of taxes for the whole year, Peakflo will take care of it.

- Faster tax closing. With the tax calculations taken care of, reconcile all accounts faster and save hundreds of man-hours better spent on more strategic tasks.

So, are you ready to get started with Peakflo? Schedule a free consultation now.