The payment system has become a critical part of the global economy, especially for small to medium businesses. By implementing the right payment methods, you can make transactions more secure, efficient, and cost-effective.

In this article, we’ll explore the definition of a payment system, its examples, and the best method for Small to Medium Enterprises (SMEs).

What is Meant by a Payment System?

A payment system refers to a method that enables financial transactions between businesses and customers in a secure way.

Nowadays, modern payment systems also provide additional features like fraud protection and analytics, allowing businesses to understand their customers’ buying habits better.

This helps companies create unique customer experiences that drive revenue and keep them competitive in the industry. By implementing the latest technology, businesses can benefit from efficient payment systems and save processing fees by paying in advance.

How Does the Payment System Work?

A payment system is a complex network of processes and entities that facilitate the transfer of funds between a payer (the person or entity making a payment) and a payee (the person or entity receiving the payment). The specifics can vary based on the type of payment system (e.g., traditional, electronic, mobile), but here is a general overview of how a payment system typically works:

- Initiation of Payment: The customer begins the payment process by initiating a transaction.

- Authorization: Verification of the payer’s identity and confirmation of available funds or credit.

- Payment Instrument: Use of a specific payment method such as cash, credit cards, or digital wallets.

- Payment Gateway: For online transactions, an interface ensuring secure communication between the merchant and financial institutions.

- Transmission of Payment Information: Secure transfer of payment details from payer to payee.

- Clearance: Validation of the transaction’s legitimacy and the payer’s ability to proceed.

- Settlement: Transfer of funds from the payer’s account to the payee’s account.

- Confirmation: Both parties receive notification or confirmation of the completed transaction.

- Record Keeping: Maintenance of transaction records for reconciliation and tracking purposes.

- Security Measures: Implementation of encryption, authentication, and fraud detection throughout the process to safeguard sensitive information.

What are the Examples of Payment Systems?

When it comes to payment systems for companies, there are several options available, including credit payment systems (credit cards), debit cards, prepaid cards, mobile wallets, direct deposits, electronic bank transfers, QR codes, AutoPay, digital currencies, and many more.

However, these four types of payment systems are among the most popular on the list: cash, cards, mobile payments, and electronic bank transfers.

Check out the pros and cons of the payment methods below!

| Payment Option | Pros | Cons |

| Cash |

|

|

| Cards |

|

|

| Mobile Payment |

|

|

| Electronic bank transfer |

|

|

From the four payment options above, it can be seen that each option has different pros and cons.

Businesses can combine several payment options into one integrated payment system. Thus, there will be various options during transactions while still being easy to track.

Some of the most famous payment system examples that businesses commonly use are Stripe, MasterCard, and Skrill.

Why is It Important for SMEs to Implement a Payment System?

Implementing a payment system is crucial for businesses for several reasons:

Efficiency and Accuracy

Automation of payment processes reduces manual errors and streamlines the entire payment workflow. This helps in ensuring that payments are accurate and timely, minimizing the risk of human error.

Cost Savings

Automated payment systems can reduce operational costs associated with manual processing, such as printing and mailing checks, manual data entry, and the need for physical paperwork. This can result in significant cost savings over time.

Vendor Relationships

Timely and accurate payments contribute to building positive relationships with suppliers and vendors. A good reputation for prompt payments can often lead to better credit terms, discounts, and improved vendor relationships.

Compliance and Security

Implementing a payment system helps ensure compliance with financial regulations and security standards. This is especially important in industries with strict regulatory requirements, where non-compliance can result in fines or legal issues.

Real-Time Visibility

Payment systems often come with reporting and analytics capabilities, providing real-time visibility into budget management. This allows businesses to make informed decisions based on up-to-date financial data.

What Is the Best Method of Payment for Small to Medium Enterprises (SMEs)?

SMEs often struggle to compete with larger companies in terms of scale, market access, and even payment system — meaning that they must often find creative ways to succeed.

The biggest payment challenges for SMEs typically involve costs, security, and availability.

Cost

When it comes to cost, according to data from the Federal Reserve Bank of Kansas City, SMEs have traditionally paid more than larger businesses for point-of-sale transactions.

This is because SMEs may lack access to efficiency-enhancing technologies and have fewer resources with which to negotiate better rates with merchants or financial institutions.

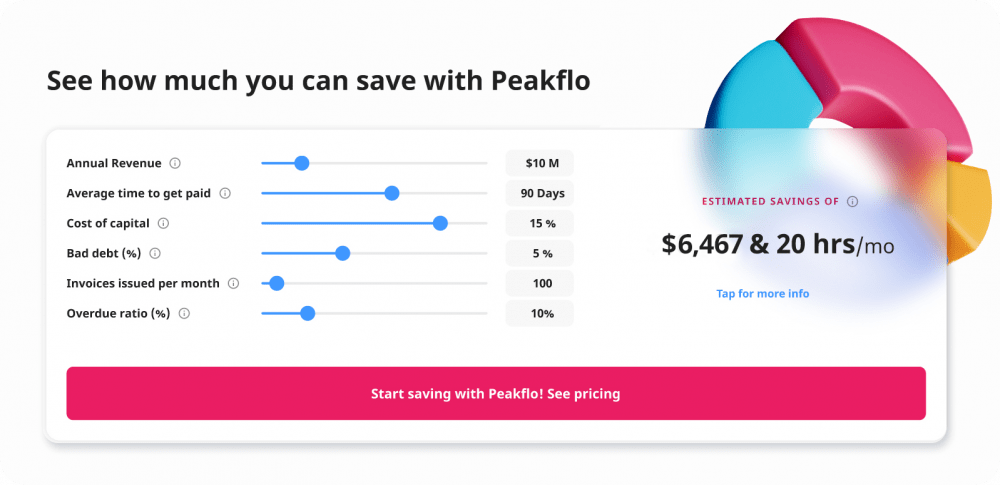

It’s important to look for a payment solution whose robust features compromise its competitive pricing. For a better evaluation, try out our savings calculator below.

Security

Security is another major challenge that many SMEs face when processing payments.

Weak security standards can lead to customers’ data being stolen or accounts being compromised, causing serious damage to the business and resulting in regulatory fines or reputational harm.

Additionally, cybersecurity threats such as malware, phishing schemes, and ransomware can cause serious disruptions for SMEs without proper protection.

An example of a payment system that will protect you from security risks is Peakflo. Our payment system follows the best practices in the industry and is hosted on the Google Cloud Platform as. Peakflo’s payment platform is ISO 27001, ISO 27017, ISO 27018, SOC 1, SOC 2, and SOC 3 compliant, plus it’s consistent with GDPR and CCPA.

Availability of Payment Options

The availability of payment options can also be a challenge facing SMEs and their customers.

Customers increasingly prefer digital payments as opposed to paper ones — something that is not always available or feasible with limited resources or technological capabilities.

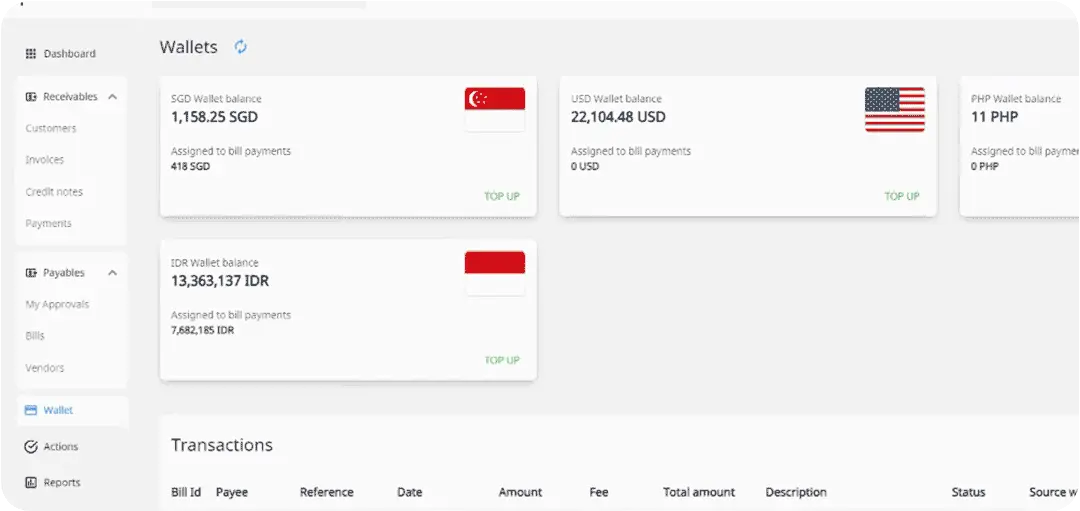

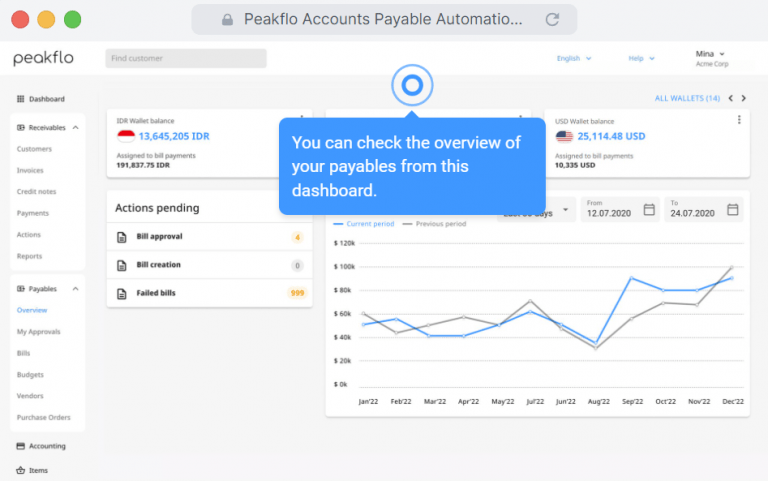

This can be achieved by selecting an integrated platform that facilitates comprehensive payment support. Using Peakflo, pay off domestic and international vendors with a multi-currency wallet. The user interface is highly intuitive to provide you with the most seamless payment experience.

Our accounts payable software prevents you from missing any payments by sending reminders to your finance team when a payment is due. If there aren’t enough funds in the wallet, will also notify the amount for the top-up.

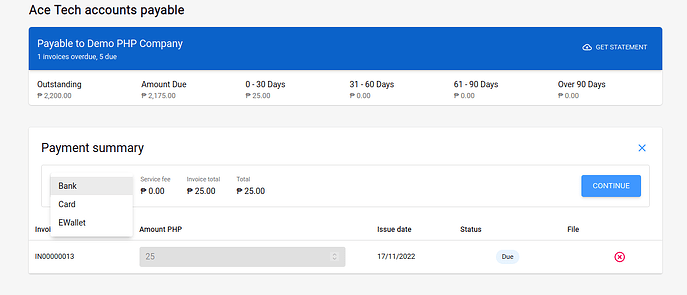

Additionally, Peakflo ensures businesses collect payments faster with its all-in-one portal. Customers will have the most flexible options to pay with credit or debit cards, banks, or e-wallet. They can also access the summary of their invoices, attach payment proofs, pay withholding taxes, and raise disputes. To further establish authority, can customize the portal with your company branding.

Best Platform for SME Payment System to Cut Bill Pay Time By 2x

Peakflo provides SMEs with a reliable solution for getting paid quickly and efficiently. The cloud-based software application makes it easy to manage payment transactions in one place.

Trusted by 50+ finance teams, here are how Peakflo can help companies pay faster:

- The finance team can set up a multi-level approval workflow for a different range of amounts. For faster approvals, approvers can even approve directly via WhatsApp.

- Accountants can schedule a payment right on the due date or even pay in bulk.

- Enable 2-way sync with your accounting software to save hundreds of man-hours on payment reconciliation during the month-end or year-end.

- All transactions are encrypted under the 256-bit Advanced Encryption Standard, keeping your data secure.

Get ready to experience a smooth payment system for your business now!

Ready to Cut Bill Pay Time by Half and Save 90% on Processing Fees?

Take me to the product tour!