Running a business means keeping track of how you spend money. But it’s not just about counting your dollars; it’s about knowing exactly where they go. If you’ve ever tried to understand your business’s finances without a plan, you probably know it can get messy.

Organizing your expenses into categories for expenses helps you control your spending and plan ahead. By sorting out each cost, you can see where your money is going.

Think of it like making a financial map to keep you focused on your goals. Having categories for expenses shows where you’re spending too much, helps you spot any unnecessary spending, and makes it easier to stay on track. This article will give you simple tips to categorize expenses and budgets better.

We’ll cover everything from basic expense categories to helpful tools. Let’s start by considering why budgeting and managing expenses are so necessary!

What is Budget and Expense Management?

Budget and expense management is about planning and keeping track of your money to reach your financial goals. It means making a budget, setting spending limits, and organizing where your money goes. This helps you make intelligent choices and gain control over company spending.

Importance of Budget and Expense Management

Managing your budget well gives you a clear picture of your finances. It’s not enough to know how much you’re spending; you also need to know where it’s going, how much, and why.

Organizing your expenses allows you to plan better, spend wisely, and grow your money. It helps you cut unnecessary costs, make sure your spending matches your goals, and change your plans if needed.

Let’s check out why it is crucial for your business:

- Helps track financial health and ensure resources are allocated effectively.

- Identifies areas of overspending to maintain cost efficiency.

- Enables better forecasting and planning for future financial goals.

- Supports decision-making by providing clarity on available funds.

- Reduces the risk of debt by controlling unnecessary expenditures.

- Ensures compliance with organizational financial policies.

- Builds accountability among team members for financial resources.

- Enhances adaptability during unexpected economic changes.

- Facilitates transparency in financial operations and reporting.

- Improves cash flow management to avoid liquidity issues.

What are the Different Categories for Expenses?

You need to have categories for expenses to manage your money well. Every business might have different needs, but these categories are helpful for most:

- Fixed Expenses: These are regular costs such as rent, salaries, and insurance that stay the same each month.

- Variable Expenses: These costs change, such as utilities, materials, and shipping.

- Operational Expenses: Day-to-day expenses such as office supplies, software, and utilities.

- Capital Expenses: Big investments in things that last a long time, such as machinery or buildings.

- Financial Expenses: Payments for loans, interest, and bank fees.

- Marketing Expenses: Costs for advertising, promotions, and social media.

- Employee Expenses: Costs for travel, meals, and training.

Each category helps you see where your money is going, making it easier to make smart decisions and stick to your budget.

Why Should You Categorize Every Expense?

Categorizing your expenses is important for keeping track of your money, making strategic decisions, and avoiding overspending.

1. Getting a Clear Picture of Your Spending

When you organize your expenses, it helps you understand your finances better.

- See Spending Patterns: By organizing categories for expenses (such as marketing, operations, or payroll), you can see exactly where your money is going and spot trends over time.

- Make Smarter Decisions: Breaking down expenses helps you figure out which areas are doing well and which ones need changes.

- Find Ways to Save: Regularly checking your expenses helps you find ways to cut costs or areas to invest in more.

2. Managing Resources More Effectively

Categorizing expenses helps you use your money wisely and run your business smoothly.

- Prioritize Spending: When you organize categories for expenses, you can spend more on things that work well, such as profitable marketing.

- Create Better Budgets: Clear categories for expenses help you make budgets that match your unique business needs.

- Improve Efficiency: Seeing where most of your resources go helps you become more productive.

3. Avoiding Overspending

Sorting your expenses also helps you avoid spending too much.

- Spot Problems Early: Categories show if spending suddenly increases, such as a rise in travel costs, so that you can fix the issue quickly.

- Set Limits: You can set spending limits for each category of expenses based on past data, keeping your budget in check.

- Encouraging Accountability: When expenses are categorized, employees are more likely to stay within budget because they know the limits.

Benefits of Well-Organized Budget Categories

Having well-organized budget categories helps you manage your finances, especially when things change. Here are some key benefits:

1. Better Control of Your Finances

- Easier Tracking: Organized categories make it simple to see how you spend your money and whether it matches your goals.

- Encourage Cost Control: Seeing where money is wasted helps you reduce costs and use resources more wisely.

2. Quick Adjustments When Things Change

- Adapt Quickly: When the economy or market changes, clear categories help you adjust your spending without messing up your operations.

- Make Data-Driven Decisions: Organized categories help you analyze your spending and make smarter decisions to stay competitive.

- Handle Crises: If things go wrong, having a structured budget helps you act fast and make the cuts or changes needed to keep things running.

3. Building Long-Term Financial Health

- Plan for the Future: Categories help you look at past spending so you can plan for future needs and set long-term goals.

- Grow Safely: Tracking expenses helps you invest in growth while keeping risks low for a balanced future.

- Stay Strong Over Time: A clear budget helps you build savings, prepare for changes, and stay competitive in the long run.

4 Effective Ways to Track Your Expenses

Budgeting and keeping track of expenses are important for businesses to stay financially healthy. Having a good system to track spending can make a big difference.

1. Align With Your Business Structure and Industry

The type of business you have (like a sole proprietorship, partnership, or corporation) and the industry you’re in affect how you should organize your expenses. Different industries have different costs, and some expenses may be more common or follow special rules based on your field.

Make sure your expense categories fit the specific needs of your business and the types of costs you often face. For example, a tech company might have a category for “Software Development Costs,” while a retail store might track “Inventory Purchases.”

2. Choosing the Right Tools for Tracking Expenses

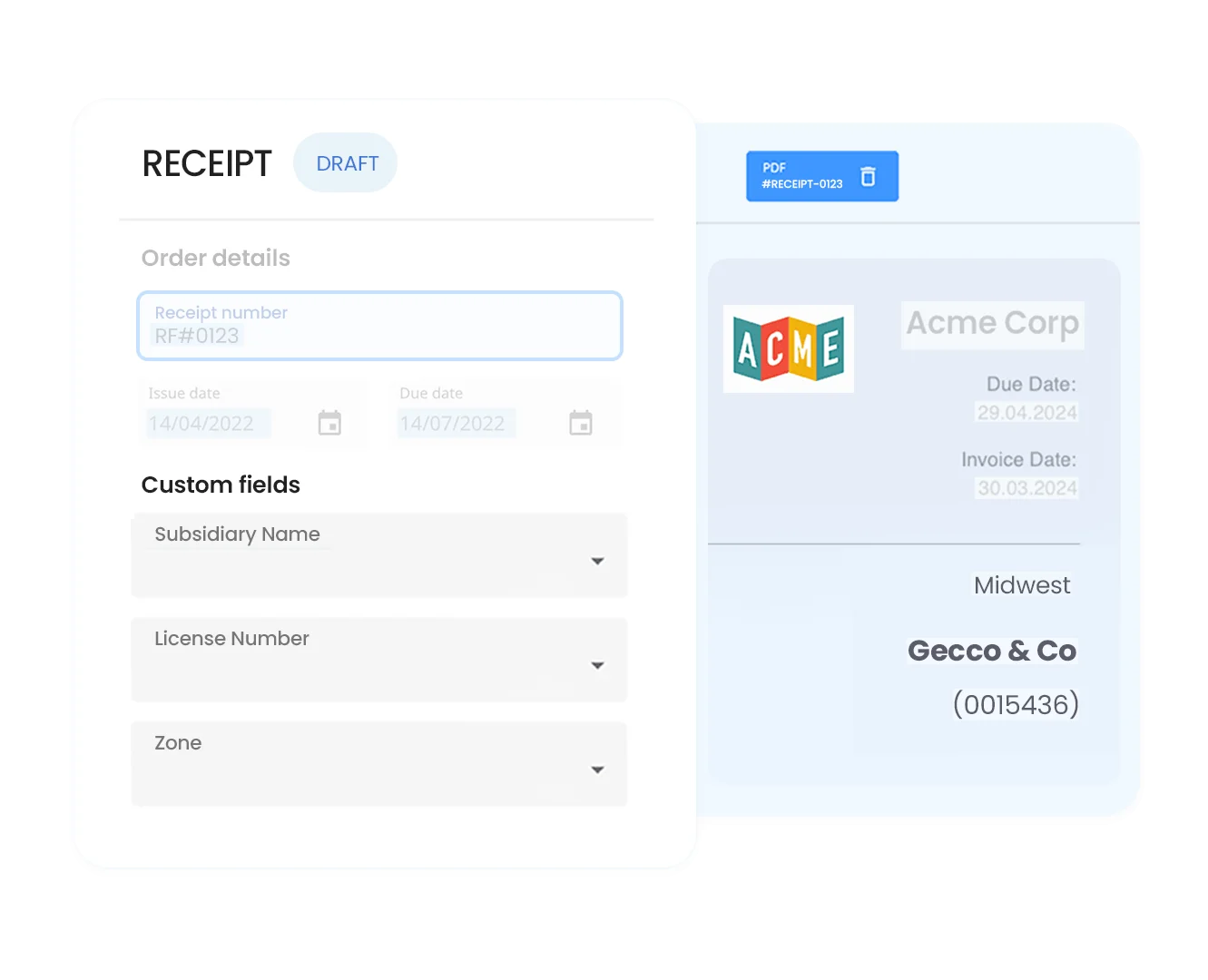

The first step in tracking your expenses is choosing the right tools. Peakflo makes this easier with:

- Expense Reports: Peakflo has features such as scanning receipts, handling different currencies, and expense reporting. This helps you organize your travel and expense reimbursement quickly and easily.

- Accounting Software Integration: Peakflo can connect with accounting software such as QuickBooks or Xero. This saves time and reduces mistakes by automatically syncing your expenses.

3. Regular Reviews of Your Finances

To stay on top of your spending, it’s important to review your finances regularly.

- Monthly Financial Reviews: With Peakflo, you can review your spending each month with budget reports. Get instant alerts once the budget limit exceeds 50%, 80%, or 90%, and when the budget is finished or has exceeded the initial amount.

- Real-Time Reporting: Peakflo allows you to stay on top of your cash flow. With AI-powered analytics, you can monitor your cash flow health and gain insights into future cash flow trends.

4. Keeping Records of Transactions

Making sure all your transactions are recorded is key to good expense tracking. Peakflo helps you keep your financial records accurate and up-to-date.

- Standardized Documentation: Peakflo helps organize receipts, invoices, and other documents. This reduces mistakes and makes your financial records easier to manage.

- Real-Time Transaction Recording: With Peakflo’s audit trails, every communication and transaction is logged right away, so nothing gets missed.

- Advanced Data Handling: Peakflo uses AI to extract information from PDFs or handwritten notes automatically. This reduces the need for manual data entry and makes tracking more efficient.

- Custom Field Mapping: Peakflo simplifies data organization by capturing specific details from documents, such as names or numbers. This makes it easier to sort and track important financial information.

Analyzing and Adjusting Categories for Better Budgeting

Effective budgeting and expense management help businesses grow. Companies need to analyze and adjust their spending categories to manage expenses well.

1. Reviewing Spending Patterns and Trends

Looking at spending patterns can help find areas of overspending and where savings can be made.

- Data Analysis: By organizing financial data, businesses can find spending trends. For example, some expenses may be higher during certain seasons, such as more retail spending around holidays.

For instance, Peakflo’s budget management keeps planned finances in check. Companies can decide whether to adjust the budget or find cheaper spending options when costs surpass the budget.

- Customer Insights: Studying when customers spend the most can help businesses offer products or services at the correct times, such as during holidays or events.

- Benchmarking: Comparing a business’s spending to that of other similar companies can show if they are spending too much or too little, helping them make better decisions.

2. Changing Categories Based on Income or Expenses

When income or expenses change, businesses may need to adjust their categories.

- Income Changes: If income drops, a business might need to focus on necessary costs and reduce recreational spending. For example, a store with lower sales might reduce its marketing budget.

- Expense Adjustments: Businesses may need to merge some categories or create new ones for new costs, such as digital ads or remote work tools.

3. Aligning Categories with Long-Term Goals

Aligning your spending categories with long-term goals helps businesses grow steadily.

- Goal Setting: Financial goals should guide how businesses categorize expenses. Peakflo helps with budgeting tools that keep spending in line with big-picture goals.

- Performance Monitoring: Setting goals for each category lets businesses track their progress and adjust spending as needed.

4. Avoiding Category Confusion

Clear categories for expenses help avoid confusion and ensure accurate spending.

- Clear Definitions: Define each category clearly so everyone knows where to put expenses. For example, separating “Marketing” and “Advertising” helps avoid mix-ups.

- Regular Reviews: Review categories regularly to make sure there’s no overlap or unnecessary categories. This keeps everything clear and organized.

- Training and Communication: Teach employees how to categorize expenses correctly so they stick to the plan. Using Peakflo, businesses can create clear definitions for each category, keeping everything organized and accurate. This makes it easier to see where money is going and make better decisions.

Conclusion

Organizing your expenses into clear categories helps your business stay financially strong. It gives you control over your budget and lets you make better decisions. With Peakflo, it’s easy to track expenses, spot trends, and adjust strategies as your business grows.

Peakflo makes managing expenses and budgets simple and efficient. With expense reimbursement, employees can easily submit their expenses, and managers can quickly review and approve them, saving time and reducing mistakes. Peakflo ensures that all expenses are tracked and organized so businesses stay on top of their spending.

When it comes to budget management, Peakflo helps businesses plan and control their budgets by giving clear insights into where money is being spent. It helps you set realistic budget goals, track progress, and make adjustments when needed. Peakflo’s easy-to-use platform helps companies stay on budget and make smarter financial decisions, all while reducing the complexity of managing expenses.

Ready to optimize your expense management? Request a demo with Peakflo today to see how it can support your business’s budget goals.