Expense reports are crucial for managing expenses in any organization. They help track and control spending. For employees, managers, and the finance team, managing this process can be complex and important.

| According to GBTA, on average, processing an expense report takes about 20 minutes, with nearly 19% of reports containing errors or missing information, requiring an additional 18 minutes per report to correct. |

Managing employee spending is crucial for any organization and requires careful attention and efficiency.

In this blog, we’ll explain what employee expense reports are, why they’re important, and the challenges they can create. We’ll also share tips on how to make managing these reports easier and more effective.

What is an Employee Expense Report?

An employee expense report is a form employees use to get paid back for work-related expenses. It usually lists the date of the expense, how much was spent, why the expense was necessary, and includes any receipts or proof of payment.

Expense reports are important for businesses because they help track and manage spending, make sure rules and tax regulations are followed, and keep financial records accurate. Employees submit these reports to a manager or the finance team for approval before getting reimbursed, so they play a key role in managing expenses.

What are the Key Elements in an Employee Expense Report?

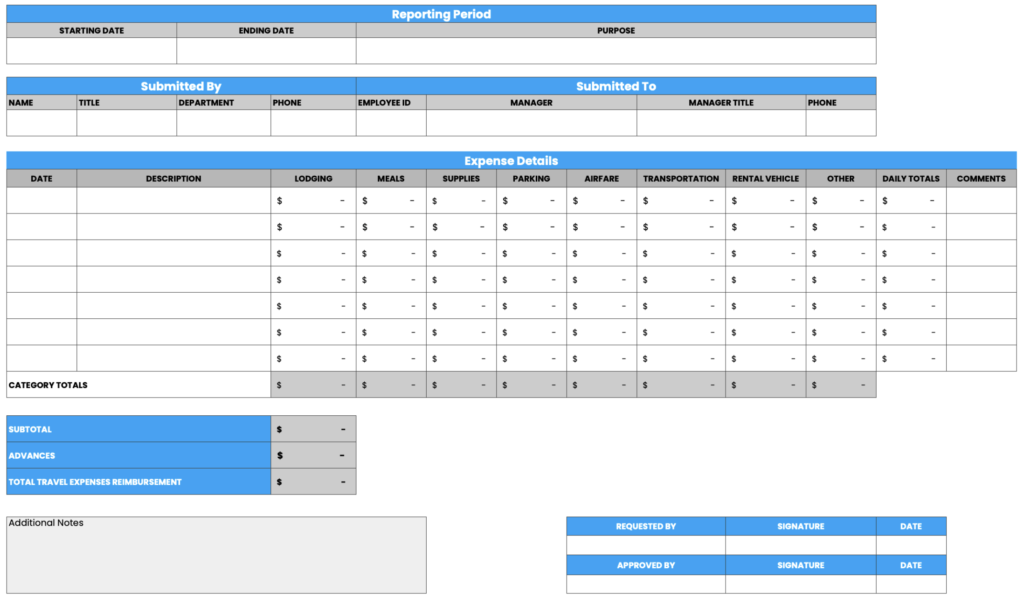

To manage employee spending effectively, you need a system for submitting expense reports. This can be done electronically or on paper. While Excel was once popular for this, expense reporting software now makes it easier. For business purposes, you should decide what information each report needs to have. Most reports include:

- Date of the expense: The day the expense was incurred.

- Employee’s info: Name and relevant identification details of the employee submitting the report.

- Type of expense: Categorization of the expense (e.g., travel, meals, supplies).

- Description: Details explaining the purpose or nature of the expense.

- Subtotal and total: The individual amount for each expense item and the sum of all expenses.

- Vendor’s contact info (if applicable): Name and contact details of the vendor from whom the expense was incurred.

- Client/project (if applicable): Information regarding the specific client or project associated with the expense.

- Receipts or other documentation: Supporting documents such as receipts, invoices, or tickets validating the expense.

This helps the finance team verify expenses and ensure the company gets what it pays for.

Expense Report Template

Here is a sample employee expense report:

What is the Purpose of an Employee Expense Report?

Employee expense reports are useful in several ways, including:

- Tracking and recording business expenses involves keeping a log of all costs that employees have for work-related activities.

- Reimbursement of employees’ out-of-pocket expenses. Employees submit expense reports to request reimbursement for expenses they’ve paid for personally.

- Tracking and controlling company expenses. Expense reports show where and how company money is spent, helping management make smart spending choices.

- Expense reports help keep spending in check by requiring detailed documentation. This ensures that all expenses stay within the budget and follow company rules.

- Expense reports help make spending clear and open, so everyone knows where money is going. This helps ensure that both employees and managers are responsible for their spending.

- Expense reports help you keep track of tax deductions and create a clear record for audits.

- By looking at expense reports, businesses can spot spending trends and find ways to cut costs or make spending more efficient.

- Expense reports help employees share their spending with the finance team, so the finance team can review and process expense reimbursements requests.

- Expense reports give useful information for financial planning. They help businesses decide how to use their money wisely and make smart financial choices.

- Keeping accurate financial records is crucial for reporting and compliance. Expense reports help ensure these records are correct.

How is Expense Reporting Beneficial for Your Organization?

Expense reports and the expense reporting process offer several benefits for both individuals and organizations. One major advantage is keeping track of finances and ensuring transparency. By recording each expense, individuals can see their spending habits and make better financial choices. For businesses, expense reports offer clarity and accountability, making sure that funds are used properly and according to company rules.

Another important benefit is budget management. By sorting and reviewing expenses, individuals and organizations can spot areas where they might be overspending and make adjustments to stay within their budget. This helps in planning finances better and using resources more effectively.

Expense reports are also key for tax deductions and reimbursements. Individuals can claim eligible expenses on their tax returns to lower their taxable income. For businesses, these reports help in repaying employees for valid business costs, which can boost employee satisfaction and reduce the financial strain on staff.

Additionally, expense reports create an audit trail that is useful during internal or external audits. For businesses, keeping accurate and detailed expense reports is essential for meeting regulations and showing financial responsibility.

Expense reports also support accurate financial reporting. They provide a clear breakdown of spending, which is important for creating financial statements and other reports. Moreover, by analyzing expense reports, businesses can make informed decisions about cutting costs, investing, and planning strategies.

Step-by-Step Guide to Creating an Employee Expense Report

Creating an employee expense report might feel overwhelming, but if you follow a clear guide, it gets easier. Here’s a straightforward way to create one:

- Collect all receipts, invoices, and any other paperwork related to the expenses you want to report.

- Decide if you’ll use a digital expense management system or a paper form to submit your report. Digital systems are usually easier and faster.

- Start by entering your name, employee ID, department, and contact info at the top of the expense report form.

- For each expense, write down the date, a brief description, and the purpose of the expense.

- Sort each expense into categories like travel, meals, lodging, or transportation. This helps with budgeting and review later.

- Include clear and readable copies of your receipts and invoices for each expense.

- Calculate the total for each category and the overall total. Double-check your math to make sure it’s correct.

- After submission, the report will go through an approval process, usually involving a manager or supervisor. Be ready to provide more info or make changes if needed.

- After approval, you’ll get reimbursed, usually via direct deposit or a check.

Challenges Faced by Employees and Organizations in Managing Expense Reports Manually

Challenges Faced by Employees

Receipt Management: Keeping track of and organizing receipts can be cumbersome, especially when traveling frequently or making multiple purchases.

Policy Compliance: It can be tough to understand and stick to expense policies, which might lead to mistakes in reporting.

Manual Data Entry: Filling out expense reports by hand takes a lot of time and can cause errors.

Unclear Expense Categories: Employees might find it hard to put expenses in the right categories, which can lead to incorrect reports.

Lost or Late Receipts: Losing receipts or getting them late can delay expense report submissions.

Challenges Faced by Organizations

Policy Enforcement: Ensuring that employees comply with expense policies and guidelines can be difficult, especially in large organizations.

Expense Fraud: Detecting and preventing fraudulent expense claims can be a significant challenge for organizations.

Data Accuracy: Keeping expense data accurate is important for financial reporting and compliance, but it can be hard, especially with manual reporting.

Integration with Accounting Systems: Integrating expense reports with ERPs and accounting systems for reimbursement and financial reporting purposes can be complex and time-consuming.

Approval Workflow: Handling the approval process for expense reports can be slow and messy, especially if there are many approval levels.

Digitizing Expense Reports: A Path Forward

Digitizing expense reports helps businesses run more smoothly by cutting down on manual errors and saving time. Automation makes it easier to submit, approve, and reimburse expenses. This boosts efficiency and creates a clear record for compliance and financial reporting.

Benefits of Expense Report Automation for Employees

Upload Receipts on the Go

Employees can create expenses or upload receipts directly into the software via mobile or laptop from anywhere, anytime.

No More Manual Data Entry

Solutions using OCR technology remove the need to enter expenses by hand. They can scan the data and automatically update the expense form in just a few seconds.

No Need to Resubmit Expense Reports

Automated systems can make sure that company expense rules are followed by flagging expenses that don’t meet the guidelines. This helps cut down on mistakes during expense submissions and saves employees from having to repeatedly correct and resubmit their expense reports.

Track the Progress in Real-Time

Employees can easily see the status of their expense reports—whether they’ve been submitted, approved, or if the claim is in the process of being reimbursed.

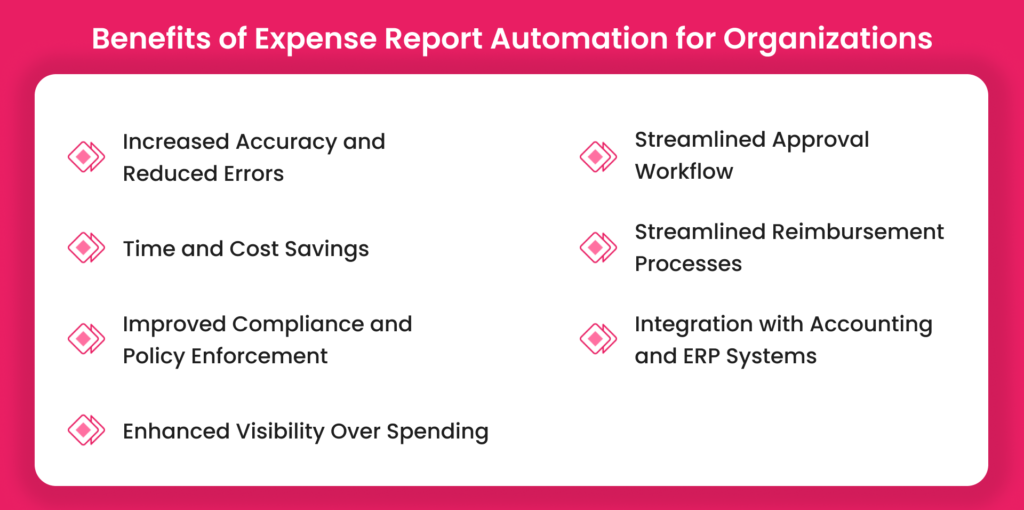

Benefits of Expense Report Automation for Organizations

Increased Accuracy and Reduced Errors

Automated software can perform real-time calculations, ensuring accurate reimbursement amounts. Additionally, automation tools can flag potential errors or policy violations, allowing employers to resolve issues before they escalate.

Time and Cost Savings

Expense report automation saves a lot of time and effort by cutting down on the need to manually check and approve reports. This means employers spend less money because employees can focus on more important tasks instead of handling paperwork.

Improved Compliance and Policy Enforcement

Expense report automation software can automatically check if expenses follow company rules when they are submitted. If an expense breaks any rules, the software will flag it. This helps make sure all expenses fit the company’s policies and reduces the chance of fraud. The software also keeps a clear record of all expense activities, making it easier to track everything.

Enhanced Visibility Over Spending

Expense report automation gives employers a clear view of their travel and expense management processes in real time. With these automated systems, employers can see the latest expense data, monitor spending habits, and spot trends. This helps with better financial planning, controlling costs, and making informed decisions.

Streamlined Approval Workflow

Automated workflows let employers set up approval hierarchies so that expenses are checked and approved by the right people. This helps keep better control over spending.

Streamlined Reimbursement Processes

Manual reimbursement processes can take a lot of time, causing delays in paying back employees. With expense report automation, the reimbursement process becomes much quicker. Once an expense report is approved, the payment is made automatically, so there’s no need to issue checks or handle cash. This makes the process faster and easier for both employers and employees.

Integration with Accounting and ERP Systems

Expense report automation software connects smoothly with accounting and ERP systems. It automatically transfers expense data, so you don’t have to enter it manually. This reduces mistakes and makes sure reports are accurate and on time.

Closing Thoughts

As technology keeps improving, expense reporting will get even better with more automation, integration, and smart analytics. By adopting these new tools, businesses can stay ahead and make their financial processes more efficient.

Embrace the future of expense reporting by implementing a robust solution like Peakflo’s Travel and Expense Management. Streamline your expense reporting process and take control of your company’s finances today.

By choosing the right tools, using best practices, and keeping up with new technology, companies can improve how they handle expenses and become more efficient and accurate.

FAQ

Employee expenses typically include costs related to business travel, such as travel fares, hotel stays, and meals. These expenses are often reimbursed by the company if employees pay for them out of pocket.

Employee expense analysis is a process used to understand how money is spent within a company. By collecting and reviewing invoices, receipts, and other financial documents, businesses can identify where they might be overspending or where there might be inefficiencies.

Examples of employee expenses include buying office supplies, booking business trips, or paying for hotel rooms. These costs can either be reimbursed by the company or covered directly by the company using advances or corporate credit cards.

Expense claims are requests made by employees to be reimbursed for business-related costs they have paid themselves. These claims can include expenses for travel, meals, hotel stays, transportation, office supplies, and other necessary costs.