Managing expenses is a critical aspect of maintaining financial health and understanding what falls under reimbursable expense is the key.

But what exactly are reimbursable expenses, and why should they matter to you? Whether you’re a business owner, an employee, or simply someone curious about financial management, grasping the concept of reimbursable expenses can lead to significant savings and improved financial efficiency.

What Are Reimbursable Expenses?

Reimbursable expenses are costs that employees incur on behalf of their employer, which the employer agrees to pay back. These expenses are typically related to business activities such as travel, meals, lodging, and other necessary expenditures incurred while performing work duties.

Reimbursable expenses are usually governed by company policies and guidelines, outlining what expenses are eligible for reimbursement and the process for submitting and approving them. They are essential for maintaining operations, completing projects, and fostering business growth.

Why Does Reimbursable Expenses Matter?

Understanding reimbursable expenses is crucial for businesses of all sizes. For employers, it ensures transparency and accountability in financial transactions. For employees, it guarantees fair compensation for any money spent on behalf of the company. Proper management of reimbursable expenses can also contribute to better budgeting, accurate financial reporting, and tax savings.

Reimbursable expenses are important in business for several reasons:

- Operational speed: Reimbursable expenses allow employees to make necessary purchases or arrangements quickly without waiting for formal approvals, which can speed up business operations.

- Accurate documentation: When companies reimburse employees for expenses, all costs are accurately recorded in the company’s financial records. This is important for budgeting and financial planning.

- Building trust: Consistently reimbursing employees for work-related expenses helps build trust. Employees feel

What Can be Considered as Reimbursable?

Reimbursable expenses are typically determined by a company’s expense reimbursement policy, which may include:

- Expenses should be directly related to an employee’s role or essential for the company’s operations.

- There are often limits set for certain expenses, such as meals or lodging, to ensure they are reasonable.

- Employees are usually required to provide valid receipts or other proof of purchase for reimbursement claims.

- Some companies allocate a specific budget per employee for expenses, and claims must stay within this budget.

Examples of Reimbursable Expenses

- Travel Expenses: This includes airfare, train tickets, rental cars, and mileage for using a personal vehicle for business purposes.

- Lodging: Hotel stays during business trips are often reimbursable.

- Meals: The cost of meals incurred during business travel or client meetings is often eligible for reimbursement, though some companies may have limits or per diem rates.

- Transportation: Expenses for taxis, rideshares, and public transportation for business purposes are typically reimbursable.

- Client Entertainment: Costs associated with entertaining clients or business associates, such as meals or event tickets, may be eligible for reimbursement.

- Communication Expenses: Costs related to business communication, such as phone calls, internet charges, and postage, may be reimbursable.

Examples of Non-Reimbursable Expenses

Non-reimbursable expenses are costs that employees pay for but are not reimbursed by the employer. These expenses are usually considered personal or optional for business operations. Examples include:

- Commuting costs: Daily travel expenses between home and the regular workplace.

- Personal entertainment: Expenses for personal leisure activities, entertainment, or hobbies.

- Non-business meals: Meals that are not related to business meetings or travel.

- Personal purchases: Items or services purchased for personal use.

Common Mistakes Made When Claiming Reimbursable Expenses

Employees need to familiarize themselves with their company’s reimbursement policies and procedures to avoid the common mistakes listed below:

1. Missing receipts: Forgetting to keep or submit receipts for expenses, which is often required for reimbursement.

2. Non-compliant expenses: Claiming expenses that are not allowed or covered under the company’s reimbursement policy.

3. Overlapping expenses: Claiming expenses that have already been reimbursed or covered by another source.

4. Incomplete information: Failing to provide all necessary details or documentation required for the claim, leading to delays or rejections.

5. Exceeding limits: Claiming expenses that exceed the set limits or budgets for certain categories of expenses.

6. Late submissions: Submitting reimbursement claims after the specified deadline, which may result in the claim being denied.

7. Lack of detail: Not providing enough detail or explanation for the expense, making it difficult for the approver to understand why it is reimbursable.

8. Misclassification: Incorrectly categorizing expenses, leading to confusion or disputes over whether they are reimbursable.

Best Practices for Managing Reimbursable Expenses

1. Establish Clear Policies

Businesses should have well-defined reimbursement policies outlining what expenses are eligible for reimbursement, the documentation required, spending limits, and the approval process. Clear policies help avoid confusion and ensure consistency in expense management.

2. Documentation and Record-Keeping

Proper documentation is essential to support reimbursement claims. Employees should retain receipts, invoices, and other relevant records for all reimbursable expenses. Adopting digital tools and expense management software can streamline this process and reduce paperwork.

3. Compliance and Approval Process

Implementing a robust approval process ensures that reimbursable expenses comply with company policies and are reasonable and necessary for business purposes. Supervisors or designated approvers should review and authorize expense claims promptly.

4. Timely Submission and Reimbursement

Encourage employees to submit expense reports on time to avoid delays in reimbursement. Prompt reimbursement builds trust and motivates employees while minimizing out-of-pocket expenses.

5. Monitor and Analyze Spending

Regularly review expense reports to identify trends, potential areas of overspending, and opportunities for cost optimization. Analyzing spending patterns can help businesses make informed decisions and refine their reimbursement policies as needed.

Maximizing Returns on Reimbursable Expenses

1. Negotiate Discounts and Deals

When booking travel or making large purchases, explore opportunities to negotiate discounts or take advantage of corporate rates. Many service providers offer special deals for businesses, which can lead to significant savings over time.

2. Leverage Rewards Programs

Utilize corporate credit cards or rewards programs that offer cashback, travel miles, or other perks for business-related spending. These rewards can add up quickly and provide additional value beyond simple reimbursement.

3. Optimize Tax Benefits

Certain reimbursable expenses may be tax-deductible for businesses, reducing their overall tax liability. Consult with a tax professional to understand the tax implications of different types of expenses and maximize potential deductions.

4. Encourage Cost-Conscious Behavior

Promote a cost-conscious culture within the organization, encouraging employees to seek cost-effective solutions and avoid unnecessary expenses. Providing training or incentives for prudent spending can help reinforce this mindset.

Closing Thoughts

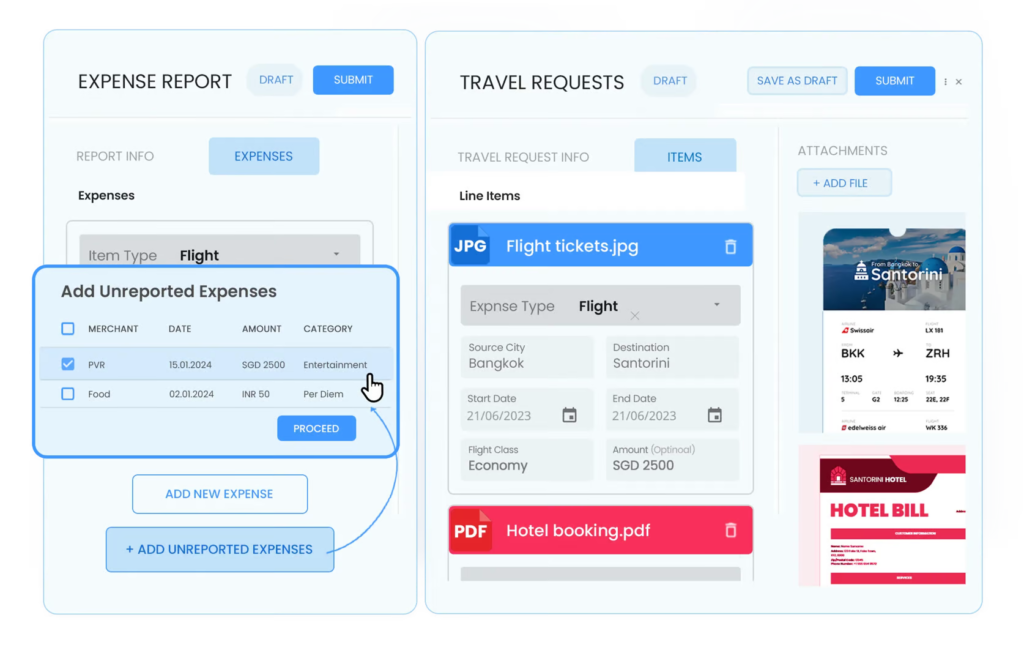

Reimbursable expenses are an essential part of business operations, allowing employees to carry out their duties without bearing the full cost themselves. Peakflo’s Travel and Expense Management solution offers a comprehensive suite of tools designed to streamline expense management and empower employees to focus on their core responsibilities.

One of the key features is its ability to set spending limits and controls, establish approval workflows, and allocate budgets to different teams. This level of customization gives companies greater control over their expenses while providing finance teams with visibility into spending patterns.

The user-friendly interface makes it easy for employees to capture and submit receipts, eliminating delays in the reimbursement process. This not only improves efficiency but also simplifies month-end close processes, making them less time-consuming and more manageable.