Managing employee travel expenses efficiently is crucial for both employees and employers. From understanding the types of allowance to the reimbursement process, we’ll explore key strategies and roadblocks encountered along the way. In the blog, we will discuss best practices for optimizing employee travel allowance to empower your workforce.

What is Travel Allowance?

Travel allowance is an important part of employee compensation, especially for those who often travel for work. It covers or reimburses expenses like transportation, accommodation, meals, and other costs during business trips.

In short, it’s financial support to ensure employees don’t have to pay out of pocket while doing their jobs away from the office.

For example, John, a sales manager at XYZ Corp, receives an allowance of $200 per day for business trips. This covers his transportation, meals, and hotel expenses while traveling for client meetings.

Types of Travel Allowance

- Per Diem Allowance:

This is a daily allowance given to cover expenses like food, lodging, transportation, and other small costs during travel. It’s simple and flexible because employees get a set amount each day, no matter how much they actually spend.

For example, if an employee travels for work, they might receive $50 per day as a daily allowance. Even if they spend only $40 one day or $60 the next, they still get $50 each day. - Reimbursed Expenses:

Some companies use a reimbursement model for travel allowances. In this setup, employees pay for their travel costs first and then submit expense receipts to get their money back. This method needs detailed paperwork but ensures employees are paid back for the amount they spent.

For example, an employee travels for a work meeting and spends $200 on flights and $100 on hotel stays. After the trip, they submit the receipts for these expenses. The company reviews the receipts and reimburses the employee $300. - Flat Travel Allowance:

Employees get a set amount of money in advance to pay for their travel expenses. They need to use this money wisely during their trip.

For example, Sarah is going on a business trip. Her company gives her $500 upfront to cover her travel costs, like food, transportation, and hotel stays. She plans her spending carefully to make sure the $500 lasts for the entire trip.

What is Covered as a Business Travel Allowance?

Business travel allowance typically extends to various aspects of travel, including:

- Airfare: Covering the cost of flights or other modes of transportation required for business travel.

- Lodging: Reimbursing expenses related to hotel accommodations or other lodging arrangements necessary during the trip.

- Meals: Providing funds or reimbursement for meals consumed during the business trip.

- Incidentals: This may include expenses like ground transportation, parking fees, Wi-Fi charges, and other miscellaneous costs incurred while traveling for work.

How Does the Travel Allowance Process Work?

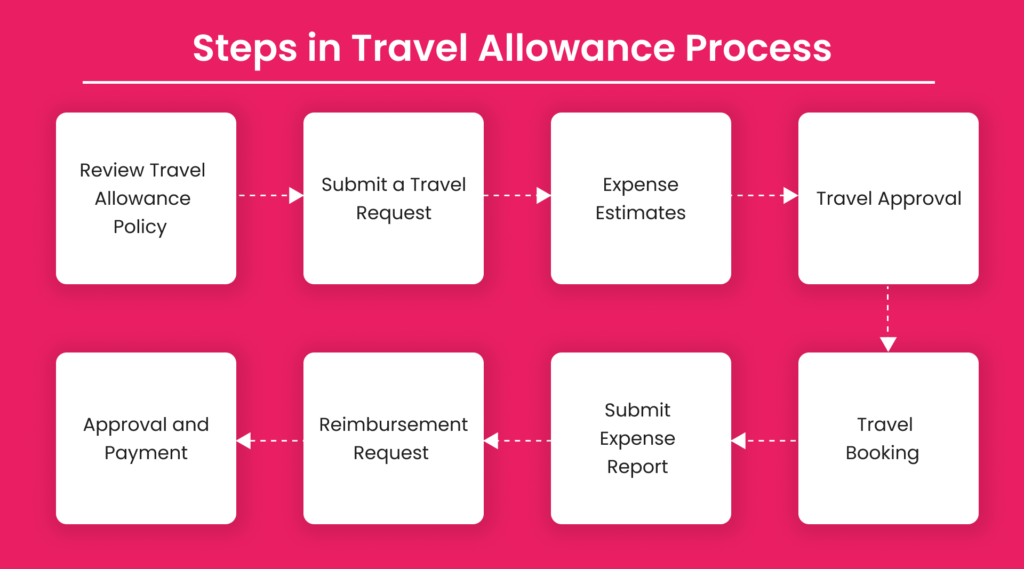

Employees can request travel reimbursement by following a structured process set by their employer. Here’s a typical step-by-step guide for requesting a travel allowance:

1. Review Travel Allowance Policy

Before requesting an allowance, employees should review their company’s travel and expense reimbursement policy to understand the eligibility criteria, covered expenses, and the reimbursement process.

2. Submit a Travel Request

If travel is planned, employees may need to fill out a travel request or authorization form. This form usually asks for details like the purpose of the trip, dates, destination, estimated expenses, and any approved budget or allowance.

3. Expense Estimates

Based on the travel request, employees should estimate their expenses for transportation, accommodation, meals, and other incidentals. This helps in planning and budgeting for the trip.

4. Travel Approval

Once the travel request is submitted, it goes through an approval process. Managers or the finance team may review and approve the request based on the company’s policies and budget constraints.

5. Travel Booking

Once approved, employees can book their travel, including flights, hotels, and rental cars. Be sure to keep all receipts and booking confirmations for reimbursement.

6. Submit Expense Report

Upon completion of the trip, employees are required to submit an expense report. This report details all expenses incurred during the trip, along with receipts and any other required documentation.

7. Reimbursement Request

Employees can request reimbursement for the total amount of their expenses or up to the approved allowance limit. The request should be submitted following the company’s reimbursement process, which may include submitting the report through an online portal or sending it directly to the finance department.

8. Approval and Payment

The submitted expense report and reimbursement request are reviewed and approved by the appropriate department. Once approved, the employee will receive payment for the approved amount, either through direct deposit or a check.

Roadblocks Encountered During Travel Allowance Process

Processing travel allowances can be challenging for employees. One major issue is the complicated reimbursement process, which often requires submitting detailed expense reports, collecting and organizing receipts, and following strict company rules. This can be slow and difficult, especially for employees who are unfamiliar with the process or have limited administrative help.

Another challenge is the possibility of delays in getting reimbursed. Because processing travel allowances is done manually, it can take time to review and approve expense reports. As a result, employees may have to wait longer to get their reimbursement, which can be frustrating, especially if they spent a lot of money during their trip.

There could also be confusion about how travel allowances are understood and reimbursed. Employees may not be clear on which expenses can be reimbursed and what documents are needed, which could lead to misunderstandings and disputes with the finance department.

Travel allowance processing can result in a frustrating and time-consuming experience for employees, highlighting the need for companies to streamline and simplify the reimbursement process to ensure a smoother experience for all parties involved.

How can Companies Improve Travel Allowance Processing for Employees?

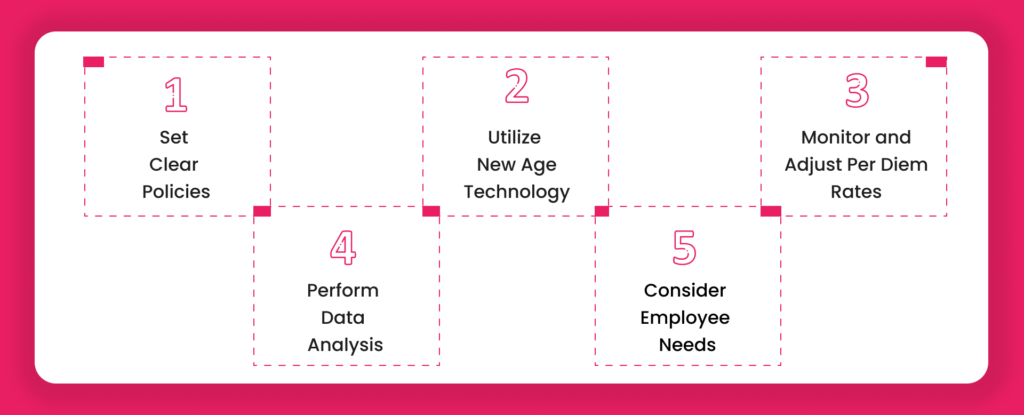

To make the travel allowance processing more efficient and employee-friendly, companies can implement several strategies:

1. Set Clear Policies

Establishing transparent and easily accessible travel allowance policies is crucial. Explain who can get travel reimbursement, what expenses are covered, and how to request reimbursement. Make sure employees understand the rules and know where to find the information they need.

2. Utilize New-Age Technology

Using travel management software can make the reimbursement process easier. It can automatically track expenses, submit them, and get approvals, cutting down on mistakes and saving time. It also gives employees and managers a clear view of travel costs, helping them make better decisions.

3. Monitor and Adjust Per Diem Rates

Make sure to regularly check and update per diem rates to keep them aligned with current travel costs. Take into account factors like inflation, seasonal changes, and shifts in travel habits. Offering competitive per diem rates can help attract and retain talent.

4. Perform Data Analysis

Use data analytics to identify trends and patterns in travel expenses. This can help find ways to cut costs or make processes better. For example, looking at data might show that some travel routes are cheaper, helping companies plan travel more efficiently.

5. Consider Employee Needs

Business travelers have special needs. Consider giving extra support or allowances for employees traveling with their families or for long trips. Offering flexibility in travel allowances can boost employee satisfaction and productivity.

Closing Thoughts

Travel allowances are important for supporting business trips and making sure employees are fairly reimbursed for their costs. By having clear policies, using technology, and keeping track of expenses, companies can improve their travel allowance programs for the benefit of both employees and the business.

Peakflo’s Travel and Expense Management solution plays a crucial role in simplifying and enhancing the employee travel reimbursement process. With Peakflo’s advanced features like automatic expense tracking, real-time views of travel expenses, and smooth reimbursement processes, companies can simplify how they handle travel and expenses. This helps reduce the workload for employees while making sure travel policies are followed and reimbursements are made on time.

Peakflo empowers companies to provide a more efficient and employee-friendly travel experience, ultimately enhancing employee satisfaction and productivity.