Expense approvals are an essential part of business operations, but the process can be tedious and time-consuming. This article will discuss what expense approvals are, the benefits of automating the process, and provide a step-by-step guide on how to implement a streamlined expense approval system in your travel and expense reimbursement process.

Understanding Expense Approvals

Expense approvals are a crucial step in the expense management process, where employees submit expenses incurred on behalf of the company for approval by designated approvers. These general expenses include travel, meals, office supplies, or other business-related costs.

The approvers, usually managers or finance team members, review the expenses to ensure they adhere to company policies before approving or denying the reimbursement. This step allows managers to track and approve spending as a way to effectively control budgets.

After employees incur business-related expenses and submit their expense reports, they must wait for a manager’s approval before receiving reimbursement from the finance department. This crucial expense approval step should be as efficient and straightforward as possible.

Why is It Important to Track Expenses?

Tracking employee expenses is essential for effective budgeting, cost control, and tax compliance. It ensures adherence to company policies, streamlines the reimbursement process, and provides a reliable audit trail for internal and external purposes. The traditional method of expense reports is time-consuming, error-prone, and susceptible to fraud. This process is not only a hassle for employees but also burdensome for the finance team. Accurate expense data is vital for generating financial reports, offering stakeholders a clear insight into the organization’s financial health and performance.

Pre-Approved Expenses Vs Manual Expense Approvals

When it comes to approving expenses, there are options. Approval can be granted before the expense or afterward.

Pre-Approved Expenses

With pre-approved expenses, managers give the green light before any money is spent. This process ensures the expense is necessary, follows company policies, and fits within the budget. Budgets are updated in real-time, making it easy for everyone to track spending and avoid surprises.

Manual Expense Approvals

Manual approvals happen after the money is spent. Employees submit receipts or proof of payment to their manager, who reviews and approves the expense. It then goes to the finance team for final checks. While this process has more steps, it allows for detailed review and careful monitoring of expenses.

| Criteria | Pre-Approved Expenses | Manual Expense Approvals |

| Process Timing | Approved before the expense is incurred | Approved after the expense is incurred |

| Approval Steps | Managers verify necessity, policy adherence, and budget upfront | Employees submit receipts, and managers review and approve |

| Budget Alignment | Real-time updates ensure alignment with the budget | Budget impact is assessed after the expense is made |

| Transparency | High – visibility for all stakeholders | Moderate – visibility comes post-approval |

| Scrutiny of Expenses | Verified upfront, reducing unnecessary spending | Detailed scrutiny occurs after the expense is submitted |

| Efficiency | Streamlined process, fewer steps | Involves multiple steps, and can be time-consuming |

| Flexibility | Limited flexibility – requires planning and pre-approval | More flexible – allows for unplanned or urgent expenses |

| Risk of Overspending | Lower – expenses are pre-validated | Higher – expenses might exceed budgets before the review |

| Documentation | Minimal – upfront approval reduces back-and-forth | Requires detailed receipts and additional reviews |

Elements of the Expense Approval Process

The expense approval process encompasses various components, including:

- Setting limits on travel costs and allowances.

- Paying employees back for their expenses.

- Keeping track of how much employees spend.

- Enforcing expense policy to control spending.

- Alerting employees when they break spending rules.

- Reviewing spending data to find and fix unusual patterns.

Steps in the Expense Approval Process

An expense approval process usually follows these steps:

- Employees spend money on work-related things, like trips, events, or client gifts.

- They save the receipts and send them to their manager for approval.

- The manager checks the expense and either approves or rejects it. If approved, it goes to the finance team.

- The finance team reviews the expenses to make sure they follow company rules. They then approve or reject them.

- If approved, the employee gets reimbursed. If rejected, the expense is sent back to the employee for corrections.

Common Problems Related to Expense Management

In the absence of a robust expense management policy, the approval process can become chaotic and disorganized. Here are some issues that commonly occur:

Long Approval Cycle

Traditional, manual expense approval processes often involve multiple layers of approval and lengthy back-and-forth communication, which can result in delays and frustration for both employees and approvers.

Depending on the scope and services provided by the organization, the finance team may face a huge volume of approval tasks that can be challenging to manage. The process can become exceedingly tedious for everyone involved when finance teams and managers are tasked with manually verifying Excel sheets and other documents.

The heavier the workload, the higher the probability of errors. Finance teams and managers may find it difficult to approve all items or reject some requests. This is because each document needs personalized scrutiny and a solid understanding of its significance.

As a result, meeting deadlines for approving or rejecting requests can be challenging, negatively affecting the approval process’s efficiency and accuracy.

Improper Expense Distribution

Once a proposal and budget have been approved, it is essential to ensure proper execution from the moment of approval to the completion of the purchase.

For example, if approval is granted for buying five computers, the components should be obtained within the budget constraints and promptly delivered to the individuals who need them.

Delays in this process can lead to decreased productivity, suboptimal utilization of resources, and employee dissatisfaction due to not receiving the required tools, such as software, hardware, or other forms of support, on time. Additionally, a sluggish reimbursement process for employees can negatively affect overall productivity.

Overall, manual expense management systems can lead to errors, such as duplicate or incorrect expense entries, which can distort the company’s financial records.

By streamlining the expense approval process and adopting automated solutions, organizations can minimize these issues, ensuring accurate financial records and maintaining employee satisfaction.

Inefficient Budget Management

In the context of expense approvals, automation is often mentioned, but managers cannot blindly approve every request that lands on their desks.

They need to check the monthly and yearly budget, scrutinize the Opex (operational expenditure) reports, and go through several Excel sheets to ensure correctness. A misstep could cause chaos if the wrong items are approved, leaving more critical ones without the required funds for acquisition.

It’s important for managers to not approve an expense simply because there is spare cash or an unallocated budget.

Multiple factors need to be taken into account, including long-term financial planning, unforeseen future expenses, and recurring costs before approving any significant operating expenditures.

Only the most pressing needs can be greenlit immediately, while other requests must be assessed based on their priority. Poor budget management can negatively impact an organization’s financial health.

Furthermore, in the absence of a centralized expense tracking system, managers might find it challenging to effectively monitor and manage departmental budgets.

By adopting an automated expense approval system, managers can better oversee budgets and make well-informed decisions, contributing to the organization’s financial stability and ongoing success.

Why Automate Expense Approval Process?

Modern companies do not need to adhere to the cumbersome expense approval processes and long waiting periods.

There’s a better way: automated expense approvals. By automating expense approval processes, businesses can:

- Improve Transparency at Scale: Automation software helps to maintain accurate records and provides visibility into the company’s expenses, making it easier to track and analyze spending patterns.

- Save Time: Automated expense approval systems speed up the approval process by streamlining workflows and reducing manual work for both employees and approvers.

- Simplify Auditing: An automated system makes it easier for auditors to review expenses, ensuring compliance with company policies and reducing the risk of fraud.

- Manage Budgets Strategically: With a clear view of company spending, managers can make informed decisions on budget allocations and spending priorities.

- No More Overloads: Automation helps to distribute the workload evenly among approvers, preventing bottlenecks and reducing stress.

Find out more about how automation can empower your finance teams by downloading the eBook below.

Automate Expense Approval Process in 6 Steps

Ready to streamline your expense approval management? Follow the step-by-step below:

1. Choose a Reliable Automation Software

Selecting the right expense management software is crucial for a successful automation process. Look for a solution that is user-friendly, secure, and can integrate with your existing accounting systems.

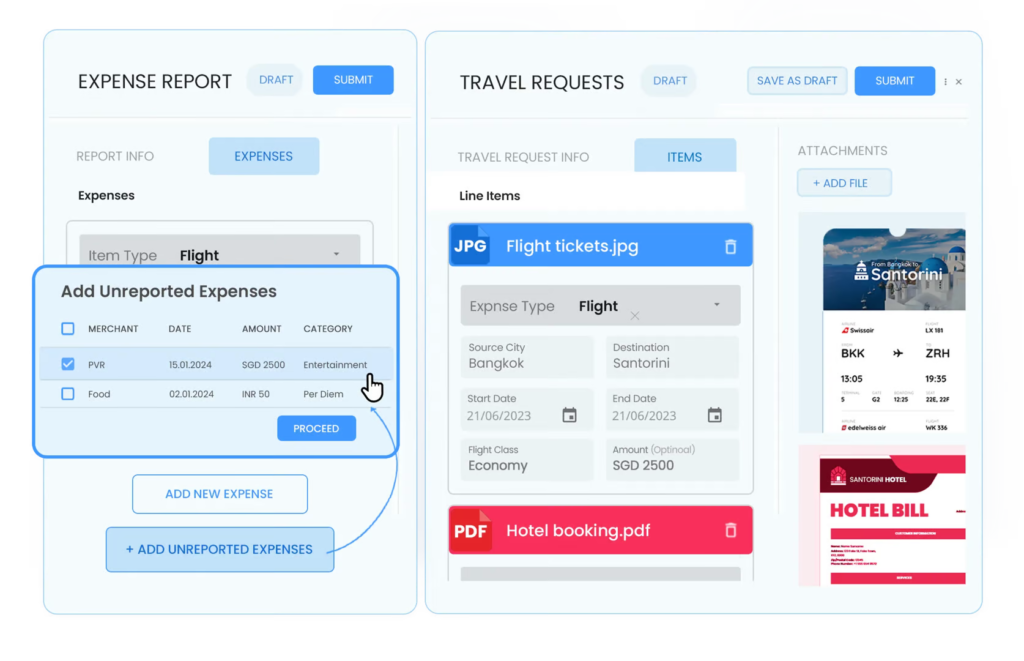

One option that fits all these criteria is Peakflo. Our Travel and Expense Reimbursement automation simplifies expense approvals with automated workflows, allowing you to save hundreds of man-hours wasted on time-consuming approval procedures.

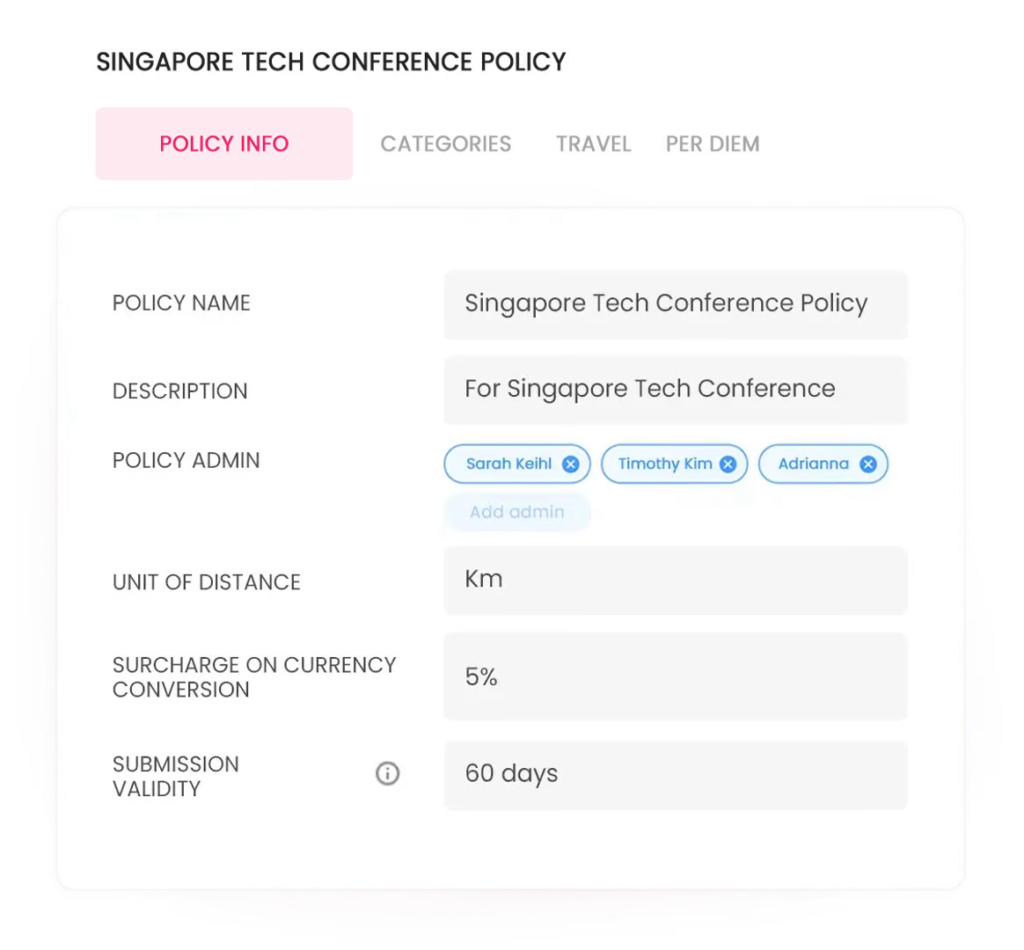

2. Revisit Existing Policies

When managing expense reports manually, companies often follow ambiguous policies that are hard to remember, so it’s crucial to use this opportunity to refine your expense policy.

Review your company’s existing policies to ensure they are clear, up-to-date, and comprehensive. Address any gaps and establish guidelines for expense submission, approval limits, and reimbursement timelines.

Write your policy in clear language to prevent confusion, making it flexible enough for emergencies and special circumstances. Specify which managers make final decisions on approvals and detail the approval workflow steps.

Ensure all team members can easily reference the policy and remember best practices. By doing so, you’ll lay a solid foundation for a seamless transition to an automated expense approval system.

Using Peakflo, design workflows that reflect your organization’s specific requirements. Customize based on expense policy, expense limits, and approval policies.

By adopting Peakflo, save time, minimize errors, and have more control in ensuring that your approval system is following the company’s standard of practices.

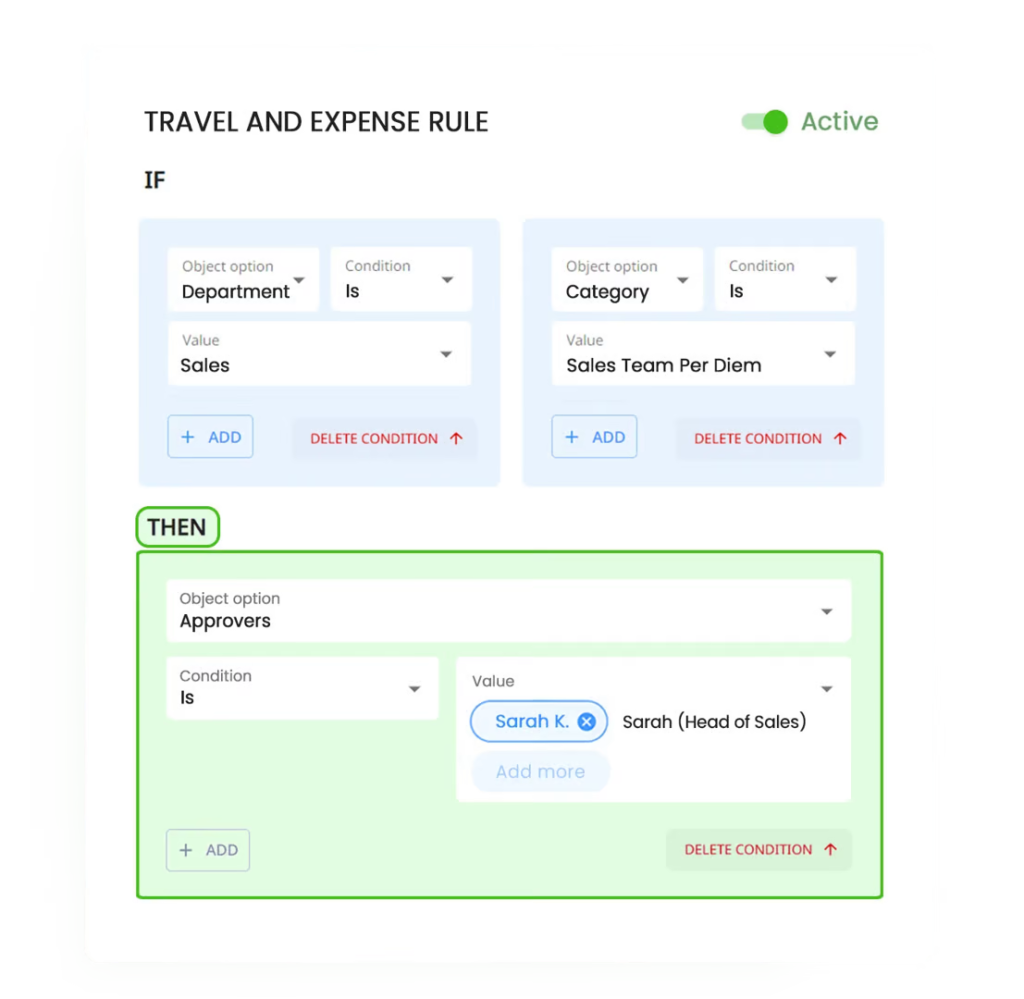

3. Tag the Relevant Approvers

Design and implement workflows in the automation software that reflect your company’s expense approval processes.

With Peakflo, you can add up multi-level approvals, route expense approvals based on department or amount, and configure notifications for approvers and employees. This way, you can provide a more efficient and transparent expense approval process.

4. Strategize How You’d Like to Follow Up Approvers

Establish a system for following up with approvers who may be slow to review and approve expenses.

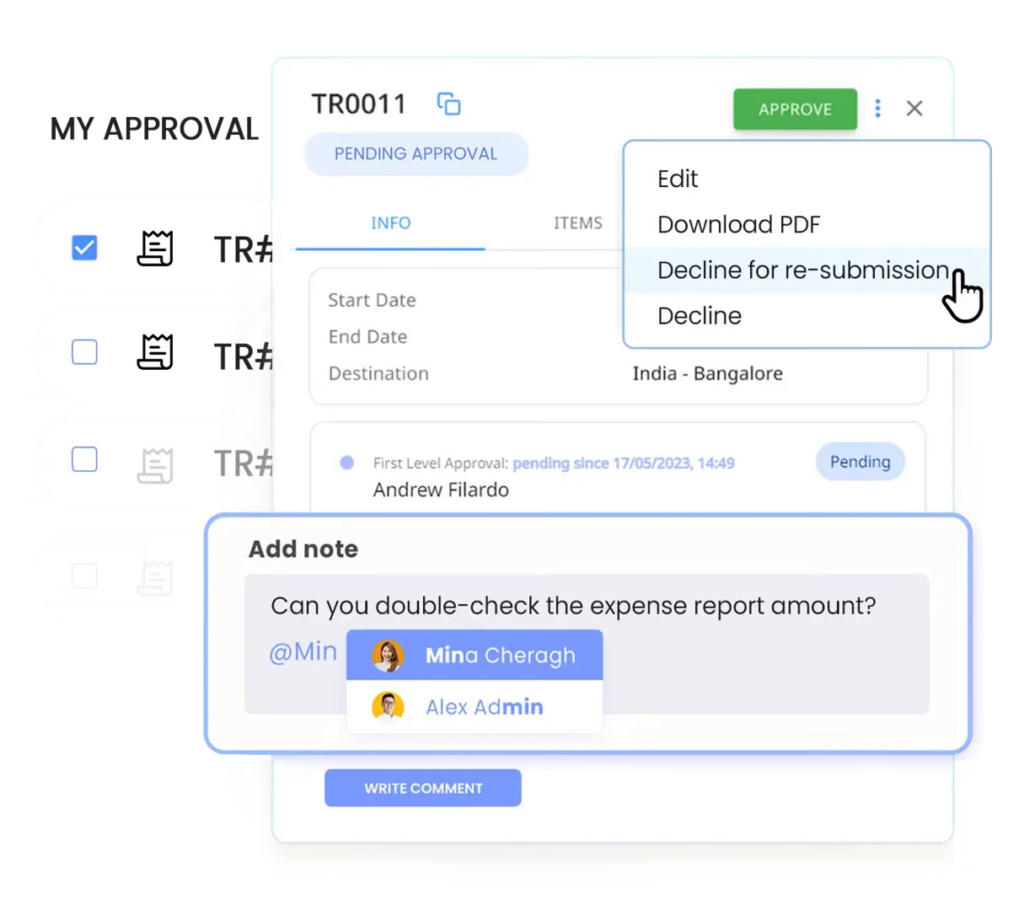

With Peakflo, approvers will have a dedicated dashboard to track approvals for travel requests and expense reports.

Instead of manually chasing approvers in long chains of emails, Peakflo will do the chasing for you.

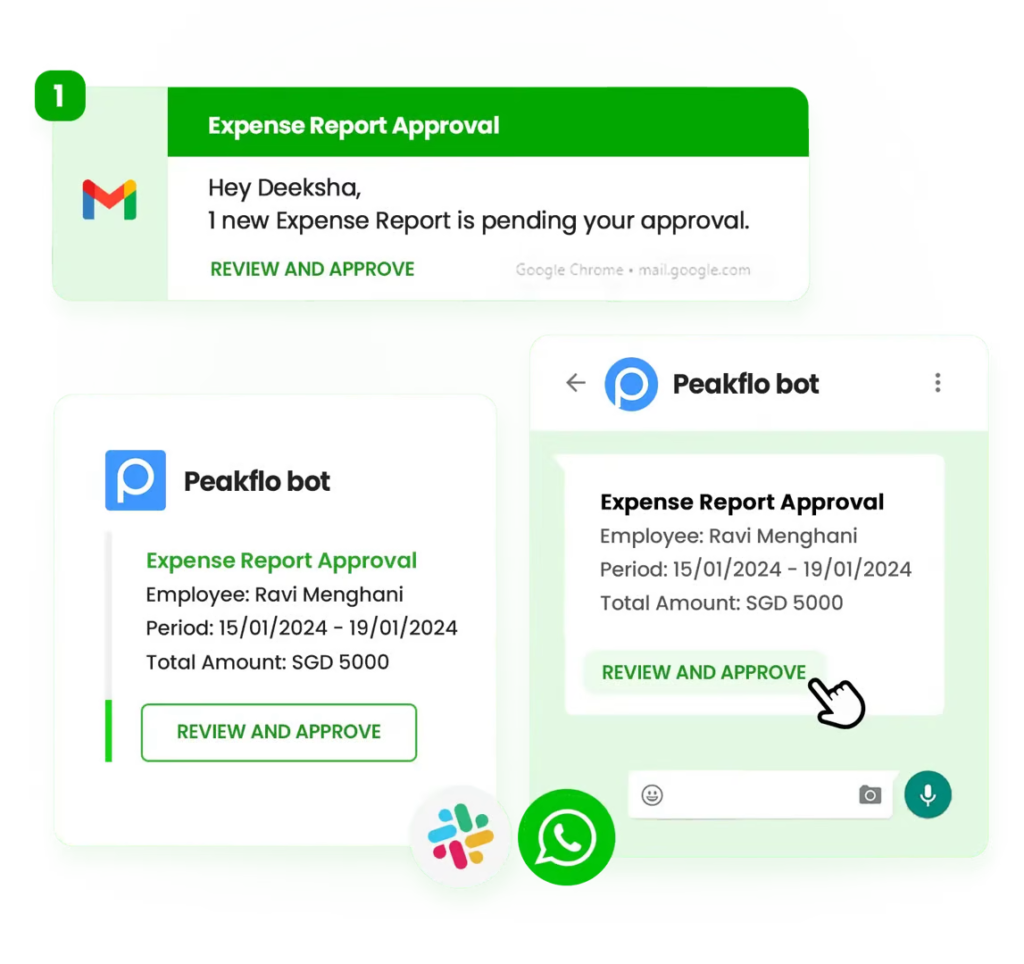

If an email doesn’t work, Peakflo allows you to personalize where and how you’d like to follow up on approvals to fast-track the process. You can leverage mobile approvals via WhatsApp for Business or Slack and update stakeholders to streamline communications.

Resolving issues will also be quicker and easier as you can simply mention a team member in Peakflo, allowing them to review and revise immediately.

By implementing Peakflo you can ensure that your expense approval process runs smoothly and efficiently, eliminating any blockers for your team or organization as a whole.

5. Put Anomaly Detection on Auto-Pilot

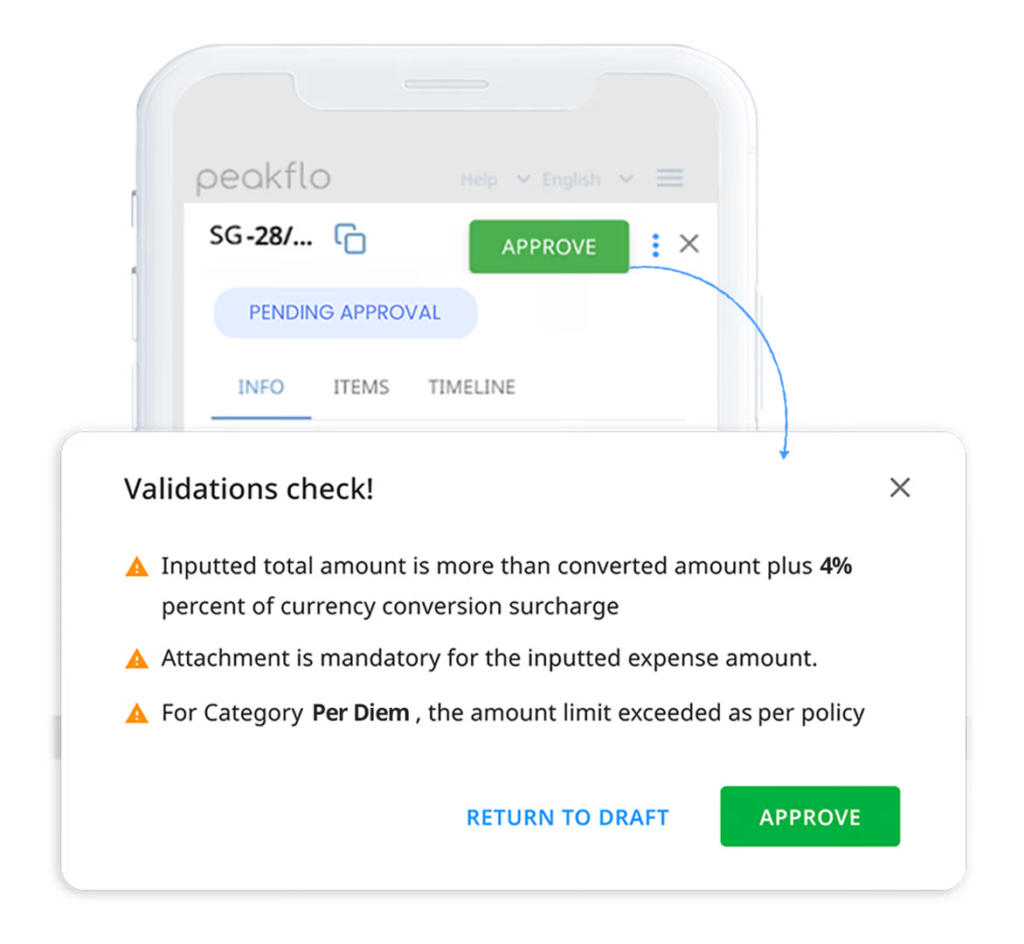

Finance teams often struggle with expense reports that include hidden costs, duplicate claims, or even fraudulent submissions. Manually spotting these issues can be time-consuming and challenging.

Peakflo’s AI-powered system helps you catch unusual expense claims in real-time. It flags anything that looks out of place—like unusually high amounts, duplicate submissions, or expenses that don’t follow company policies.

Before an expense report gets approved, Peakflo automatically checks it against your company’s travel and expense policies. Any violations are flagged right away, saving you time and preventing costly mistakes.

Track, Manage, and Approve Better

Automating the expense approval process can significantly improve the efficiency, transparency, and control of your company’s spending. By choosing the right software, revisiting existing policies, and implementing effective workflows and rules, you’ll be well on your way to streamlining your expense approval process and creating a more efficient and transparent financial management system.

Peakflo makes every step of the travel and expense reimbursement process streamlined, including tracking and approving expenses. It’s time to track your company’s reimbursements in real-time from travel request creation to expense reports. Instead of using spreadsheets to manage expense reports, easily submit and approve expense claims and manage your budgets professionally.

FAQ

What is an approved expense?

An approved expense is a cost that has been reviewed and authorized by the appropriate person or department within a company. It means the expense is considered valid and can be reimbursed or paid by the company.

What is expenditure approval?

Expenditure approval is the process of reviewing and authorizing a proposed expense before it is incurred. It ensures that the expense aligns with company policies and budgets before any payment is made.

What is the expense claim approval process?

The expense claim approval process involves submitting a claim for reimbursement, which is then reviewed by a manager or finance team. The claim is checked for accuracy and compliance with company policies before being approved for payment.