Multi-entity companies face unique challenges, particularly when managing accounts payable processes across subsidiaries, cost centers, and business units. Traditional invoice processing methods, though effective in simpler setups, often struggle to keep up with the complexity and volume inherent in multi-entity companies.

Enter AI-powered invoice processing—a transformative solution that is rapidly gaining traction for its ability to streamline and optimize these intricate tasks.

The Complexities of Invoice Processing in Multi-Entity Companies

For multi-entity companies, managing invoices is no small feat. AP teams are tasked with mapping complex invoices across various subsidiaries, cost centers, and GL codes.

This process becomes even more complex when dealing with non-purchase order invoices, which require precise coding at the time of invoice booking.

Manual data entry, which has traditionally been the go-to method, is time-consuming and prone to errors. In fact, the painstaking process of manually keying in and mapping invoice data can lead to a significant resource drain.

A typical employee may only be able to process around 40 invoices a day, making it difficult for AP teams to keep up with the demands of multi-entity companies.

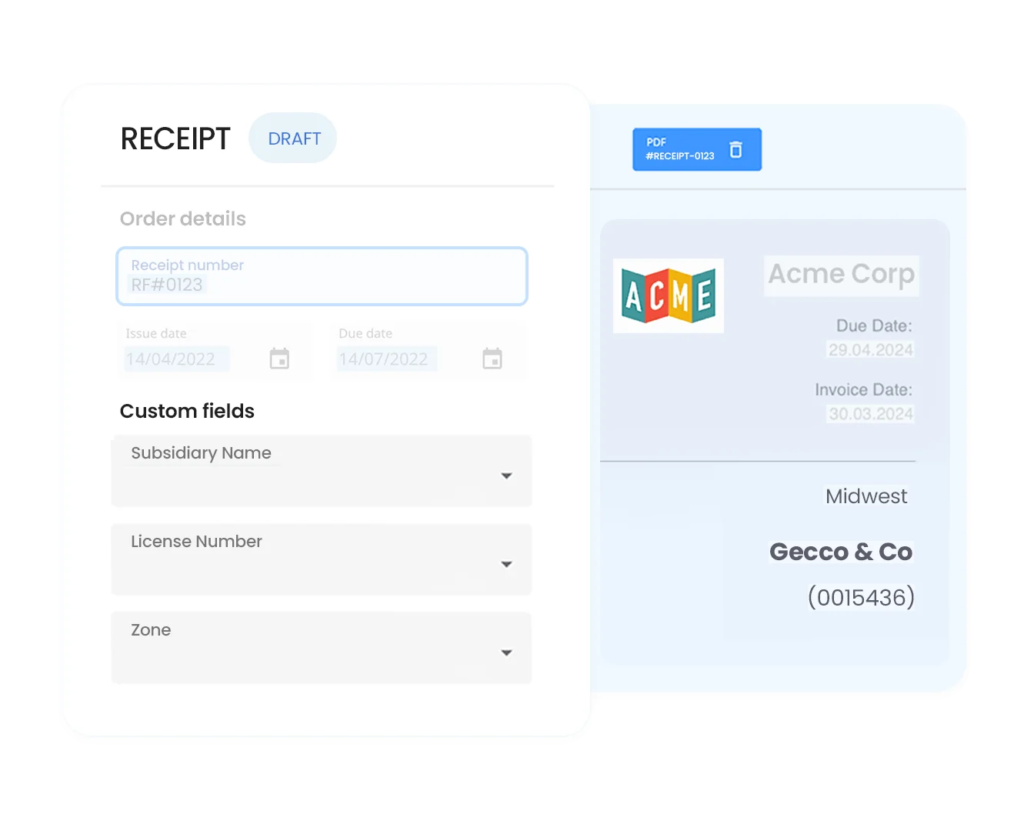

The Power of AI in Custom Field Capture

AI-powered invoice processing offers a game-changing solution to these challenges.

Unlike Optical Character Recognition (OCR) systems, which simply read and extract data from invoices, AI-driven solutions go a step further—they understand the context of the data.

This context-aware capability enables AI to accurately map custom fields such as subsidiary names, license numbers, and zones with precision that traditional methods simply cannot achieve.

The difference in processing power is stark. While manual methods might limit an employee to handling around 40 invoices daily, AI can process over 1,000 invoices in the same time frame.

AI systems are designed to learn and adapt, improving their accuracy over time. This dramatic increase in efficiency speeds up the AP process and significantly reduces the potential for errors.

Real-World Impact: Improved Accuracy and Accelerated Soft Closing

The benefits of AI-powered invoice processing extend beyond just speed and efficiency.

By eliminating manual entry errors, these systems enhance the accuracy of invoice processing, leading to more reliable financial data and reporting. This accuracy is particularly crucial during soft closing periods, where timely and precise data is essential for making informed financial decisions.

Moreover, by automating repetitive tasks, AI frees up AP teams to focus on more strategic activities.

Finance professionals can direct their attention to higher-value tasks such as financial analysis, strategy development, and process improvement instead of being bogged down by the hassle of data entry.`

Embracing the Future of Finance

The integration of AI into invoice processing represents a significant step forward for multi-entity companies. As the volume and complexity of financial data continue to grow, the ability to process invoices accurately and efficiently becomes increasingly important.

So, is your finance team ready to embrace this transformation?

By leveraging AI-powered solutions, you can reduce the burden of repetitive tasks, improve the accuracy of your financial processes, and ultimately enable your team to focus on what really matters—driving your business forward.

![Why AI Sales Calls Are Making Good Sales Reps Even Better [2025 Guide] ai sales calls](https://blog.peakflo.co/wp-content/uploads/2025/09/65168cf6-3001-4733-8cbc-12d5684cf449-218x150.webp)