In high-stakes B2B transactions, where every detail counts, managing the Order to Cash (O2C) process efficiently can make or break your financial health.

Imagine a scenario where errors in credit assessment, delays in invoicing, and inefficient payment collections are impacting your bottom line. Such issues can strain resources, damage customer relationships, and hinder growth.

Order to Cash software has the potential to revolutionize how your business handles invoicing, payments, and everything in between. In this blog, we’ll delve into the world of order to cash software, exploring its importance, key features, and the transformative benefits it can bring to your business.

What is an Order to Cash Software?

Order to Cash software is a tool that automates and manages the entire process from receiving customer orders to collecting payments. It streamlines several key tasks: assessing customer creditworthiness, generating and sending invoices, collecting payments, and managing accounts receivable.

By integrating these functions into a single system, O2C software helps businesses improve efficiency, reduce errors, and maintain accurate financial records. It guarantees that invoices are delivered on time, disputes are addressed effectively, and payments are collected quickly, resulting in improved cash flow and financial management.

Steps in the Order-to-Cash Process

1. Order Management

A customer places an order through various channels. The system checks inventory, verifies the customer’s credit, records the order, ships the goods, and triggers automatic reordering to keep stock levels up.

2. Credit Management

Before processing an order, the customer’s creditworthiness is assessed to ensure they can pay. This helps to mitigate the risk of nonpayment.

3. Customer Invoicing

An invoice is created and delivered to the customer for payment. The invoicing system must support a variety of formats, delivery methods, and documentation needs.

4. Accounts Receivable

After shipping, invoices are tracked and payments are reconciled. Sending reminders for upcoming payments and resolving any invoicing errors are part of this step.

5. Payment Collection

Payment options are clearly outlined at purchase. Payments are collected via online methods or bank transfers and matched to the respective orders. Unpaid invoices are followed up or sent to collections if necessary.

6. Data Management

Efficient data management is crucial. The order management system connects with inventory and invoicing systems to ensure accurate order fulfillment, invoice creation, and payment reconciliation. Automation in these areas improves efficiency and accuracy.

Major Challenges in the Order-to-Cash Process

One of the most difficult issues for accounts receivable teams is operating in silo. This means that the credit team often doesn’t know what the collections team is doing. This lack of communication can lead to a poor customer experience and longer DSO, which in turn increases write-offs.

Here are some major problems faced by O2C teams:

1. Manual Invoicing

Creating invoices manually is a big challenge, especially when customers have different preferences. Large companies might want invoices uploaded to their accounts payable portals, while smaller businesses may prefer paper invoices. This manual process is slow and prone to errors.

2. Handling Multiple Payment Methods

Managing various payment methods is complicated. Customers might use checks, ACH transfers, credit cards, or other electronic payments. Dealing with international payments adds complexity due to foreign exchange fees.

3. Inefficient Collections Process

Collections teams often lack real-time information about a customer’s credit risk and payment status. This means they might prioritize the wrong customers, miss high-risk accounts, and contact low-risk ones unnecessarily.

4. Slow Dispute Resolution

When customers raise disputes, teams have to gather documents and investigate manually. This process is time-consuming, leading to delays in resolving issues and recovering funds from incorrect deductions.

5. Siloed Operations and Poor Data Integration

Without integrated systems, different parts of the O2C process work in isolation. For example, a collections agent may contact a customer who has already paid, leading to confusion and a poor customer experience.

6. High Operating Costs

Large companies face higher costs in the O2C process, including fees for banking services and invoicing. These expenses, combined with slow payment recovery, can impact overall working capital.

Why is Order to Cash Software Crucial for B2B?

Optimizing the order-to-cash process is critical to corporate success. Using advanced technology may boost cash flow and efficiency. Here’s how.

1. Boosting Cash Flow Efficiency

In today’s uncertain economy, businesses aim to improve their cash flow by reducing DSO and bad debt. Automation of credit assessments, invoicing, and payment processing improves efficiency and reduces manual effort leading to better cash flow management.

2. Faster and Cost-Effective Implementation

Finance leaders prefer solutions that are quick to implement and have lower IT costs. Automated order to cash software that integrates with ERP systems offers faster ROI analysis and easier deployment.

3. Real-Time Data Access and Accuracy

Centralized data systems allow employees to access and update data instantly. Notifications can trigger updates, and integrating systems like order management with inventory ensures accurate, real-time information. Automated invoicing systems can pull order details, check credit limits, and send invoices efficiently.

4. Streamlined Systems Integration

Integrating different CRMs and systems helps eliminate isolated workflows. This standardization allows easy data migration, better reporting, and smoother audits. A consistent model optimizes all parts of the O2C process, including invoicing, collections, payment processing, and reconciliation.

5. Enhancing Customer Experience

A customer-focused approach can improve loyalty and payment timeliness. Businesses are upgrading their O2C processes with features like digital wallets, self-service portals, and e-invoices to enhance customer satisfaction.

6. Improved Tracking and Oversight

Automated dashboards offer a clear view of account statuses and process information. Teams can identify high-risk accounts and address issues before they lead to overdue payments, improving overall tracking and management.

How Can Peakflo Help?

Peakflo is designed to revolutionize the order-to-cash process by automating key functions, helping accounts receivable teams work more efficiently and effectively. With its comprehensive suite of tools, Peakflo simplifies tasks like credit control, invoice creation, payment reminders, dispute resolution, and cash application.

By automating these processes, AR teams can reduce manual work, minimize errors, and speed up collections. This not only improves cash flow but also ensures that businesses can maintain strong relationships with their customers by providing a seamless and efficient payment experience.

Peakflo’s order to cash software empower AR teams to focus on higher-value activities, ultimately driving better financial outcomes for the entire organization.

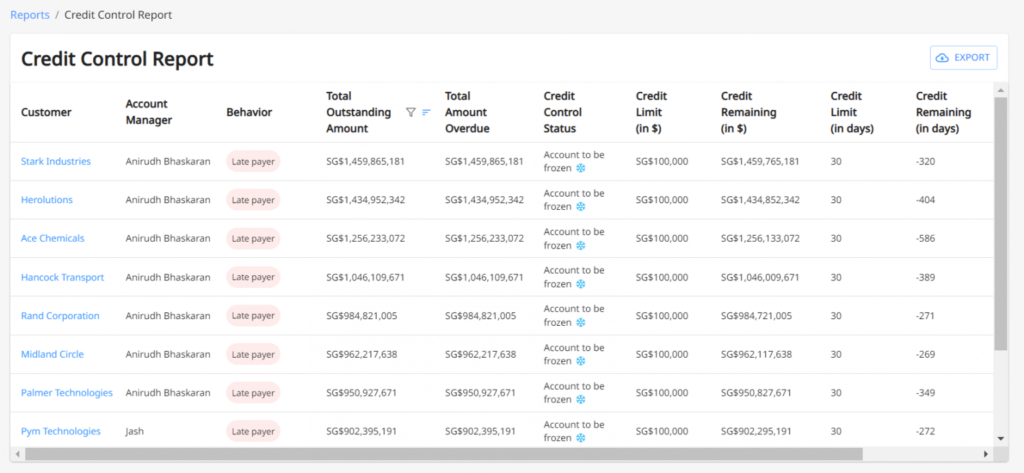

Control Customer Credit with Credit Control Report

Peakflo’s Credit Control Report is a valuable tool for managing customer credit terms. It monitors each customer’s credit limit and usage, helping businesses keep credit exposure within safe limits. Over time, this report can reveal patterns in credit usage, allowing businesses to adjust their credit policies as needed.

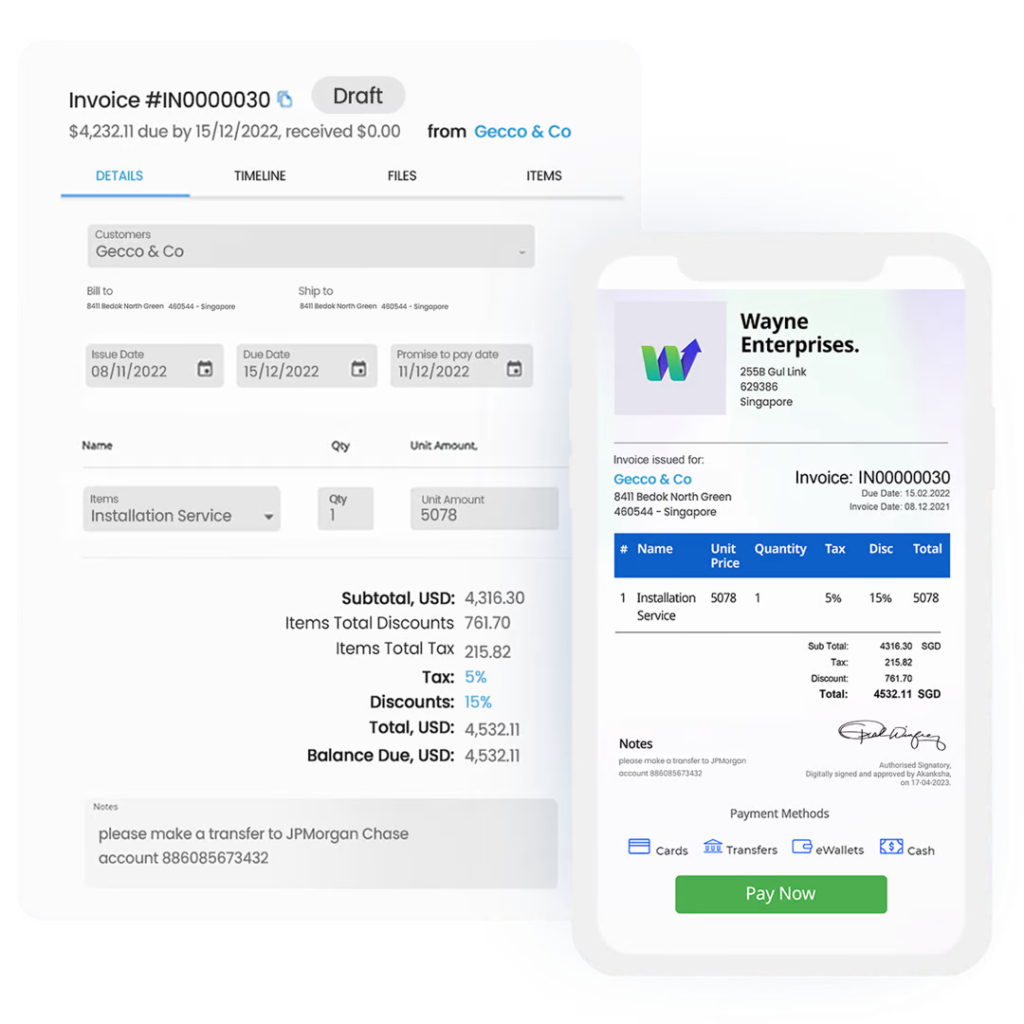

Manage Invoice Creation and Delivery

With Peakflo, you can easily create professional e-invoices that reflect your company’s branding. The system allows you to customize line items, discounts, and tax rates. You can also validate and approve draft invoices before sending them to customers. For recurring billing, Peakflo simplifies the process by supporting weekly, monthly, and annual invoices. Whether it’s tax, GST, recurring, or pro forma invoices, Peakflo’s e-Invoicing solution makes it easy to create, send, and track them.

Speed Up Collections with Multi-Channel Payment Reminders

Peakflo’s Collection Automation lets you send automated payment reminders through multiple channels, ensuring customers get reminders at the right time and through their preferred methods, like email, SMS, WhatsApp, LINE, or Zalo. You can set up workflows triggered by the invoice due date, promise-to-pay date, unapplied payments, or specific intervals, helping your business get paid faster. Peakflo’s smart payment reminder workflows can automate collections and help you get paid up to 20 days sooner.

Resolve Disputes with the Customer Portal

Peakflo’s Customer Portal makes it easy to handle invoice disputes. Customers can raise disputes with specific reasons through the portal, and the right stakeholders will be notified instantly via email. The accounts receivable team and customers can access all relevant documents, uploaded files, and communications in one place, ensuring a clear audit trail and making dispute resolution smoother.

Automate Cash Application with AI-powered Cash Posting

Peakflo’s Cash Application solution uses AI-powered OCR technology to capture remittance details, match transactions, and post them directly to your ERP or accounting software. This AI-powered tool can automatically match payments with invoices and customer accounts, reducing manual work and improving accuracy.

Closing Thoughts

Manual processes can slow down your cash flow, increase errors, and create friction in customer relationships. With Peakflo’s Order to Cash software, you can transform your operations, ensuring faster collections, accurate cash posting, and seamless invoicing.

Imagine what your AR team could achieve with more time, fewer errors, and the ability to focus on strategic tasks. Don’t let outdated processes hold your business back. It’s time to move beyond outdated manual processes and embrace a solution that drives efficiency, accuracy, and growth.