You’ve closed a record number of sales this quarter, yet your business is struggling to pay vendors and cover daily expenses. Sounds contradictory, right? The culprit might just be hidden in your Days Sales Outstanding (DSO) and Accounts Receivable (AR) processes.

Managing AR effectively isn’t just about chasing overdue invoices—it’s about understanding how quickly your business can convert sales into cash. Your DSO acts as the key performance metric that reveals how healthy your cash flow truly is. A high DSO can tie up capital, while a low DSO can fuel your growth.

But here’s the good news: mastering AR and DSO doesn’t have to be complex. In this guide, we’ll break it all down—what DSO means, how to calculate it, and actionable tips to optimize it for financial success.

What is Days Sales Outstanding (DSO)?

Days Sales Outstanding measure how long it takes a company to collect payment after a sale. It relates closely to accounts receivable and is influenced by customer debts and business revenue.

Knowing DSO is key to evaluating credit and collections efficiency. A high DSO signals collection problems, while a low DSO indicates smooth processes and good cash flow.

Why DSO Matters:

- Cash Flow Management: DSO affects cash flow. Delayed payments make it hard to cover bills and grow.

- Credit and Collections Efficiency: DSO shows how well credit policies and collections efforts work.

- Liquidity Insight: DSO analysis reveals how easily a company can turn AR into cash.

The Formula for Calculating DSO

You can use a simple formula to calculate the DSO

| DSO = (Accounts Receivable / Net Credit Sales) × Number of Days |

Let’s break down the components involved:

- Accounts Receivable: This is the total money customers owe your business for unpaid invoices.

- Net Credit Sales: This is the total credit sales in a period, excluding cash transactions.

- Number of Days: Use a 30-day, 60-day, or 90-day period to assess your DSO over time.

Benefits of Understanding DSO Calculation

Knowing how to calculate DSO helps you manage cash flow better. It allows you to:

- Monitor Trends: Track DSO changes to spot issues early.

- Adjust Credit Terms: If DSO is high, consider tightening credit or speeding up collections.

- Plan for Cash Flow: Predict cash shortages and plan ahead.

Example Calculations of DSO

Let’s put this formula into action with an example:

Suppose your company has accounts receivable of $800,000 and net credit sales of $2.5 million over a 90-day period. The DSO would be calculated as:

DSO=(800,000/2,500,000)×90=28.8 days

This means it takes your business an average of 28.8 days to collect payments from customers.

What Does This Mean?

High DSO: A DSO of 60 days or more could signal potential issues with your collections process. Consider reviewing your credit policies and checking if customers are often late paying invoices.

Low DSO: A DSO of 20-30 days may mean your collections process is efficient. Your cash flow should be good.

Interpreting High and Low DSO Values

When analyzing your DSO, know what high and low values mean in your context.

What a High DSO Indicates

A high DSO often means your customers are taking too long to pay, which can lead to cash flow problems. High DSO might be caused by:

- Inefficient Collections Processes: Slow invoicing or follow-ups.

- Customer Credit Issues: Poor payment history or customers struggling financially.

- Weak Credit Policies: Offering too generous credit terms without adequate risk management.

What a Low DSO Indicates

A low DSO suggests that your company is collecting payments quickly. It may seem ideal. But, we must balance fast collections with good customer relationships. A very low DSO could signal:

- Tight Credit Policies: Perhaps you’re being overly cautious with customer credit.

- High Customer Turnover: Your business may be losing clients because of payment terms.

Industry-Specific Benchmarks

DSO varies by industry, and it’s important to compare your company’s DSO to industry standards. For example:

- Technology & SaaS Companies: They typically have a DSO ranging from 30-45 days.

- E-Commerce & Retail: They can have a DSO closer to 15-30 days, depending on their invoicing cycles.

- Manufacturing and Wholesale: They usually have longer DSOs, about 45-60 days. This is due to larger order volumes and complex payment terms.

Pro Tip: Monitor your DSO over time and compare it with competitors in your industry. Tracking trends and knowing benchmarks will help you spot inefficiencies in your finances.

Improving Days Sales Outstanding

To reduce DSO and improve cash flow, here are a few strategies you can implement:

- Offer Early Payment Incentives: Provide discounts or incentives for customers who pay early. This can help speed up collections while maintaining good relationships with clients.

- Strengthen Invoicing Processes: Make sure your invoices are clear and accurate. Send them promptly after delivering goods or services. Delays in invoicing can delay payments.

- Implement Automated Payment Reminders: Use automated systems to send reminders for overdue invoices. This will reduce the need for manual follow-ups and ensure consistent communication.

- Tighten Credit Policies: Establish stricter criteria for extending credit to customers. Conduct thorough credit checks before offering payment terms.

- Set DSO Targets: Make DSO a key performance indicator (KPI) for your finance team. Setting and reviewing DSO targets will help your team focus on reducing unpaid bills.

How Peakflo Can Assist in Managing DSO

Using Peakflo to automate AR processes can improve your DSO. Here’s how:

Reducing Days Sales Outstanding is crucial for maintaining a healthy cash flow and ensuring smooth business operations. Peakflo offers a suite of automation-driven solutions that help businesses streamline invoicing, optimize credit policies, simplify payments, and improve accounts receivable management. Here’s how Peakflo can assist in managing and reducing your DSO:

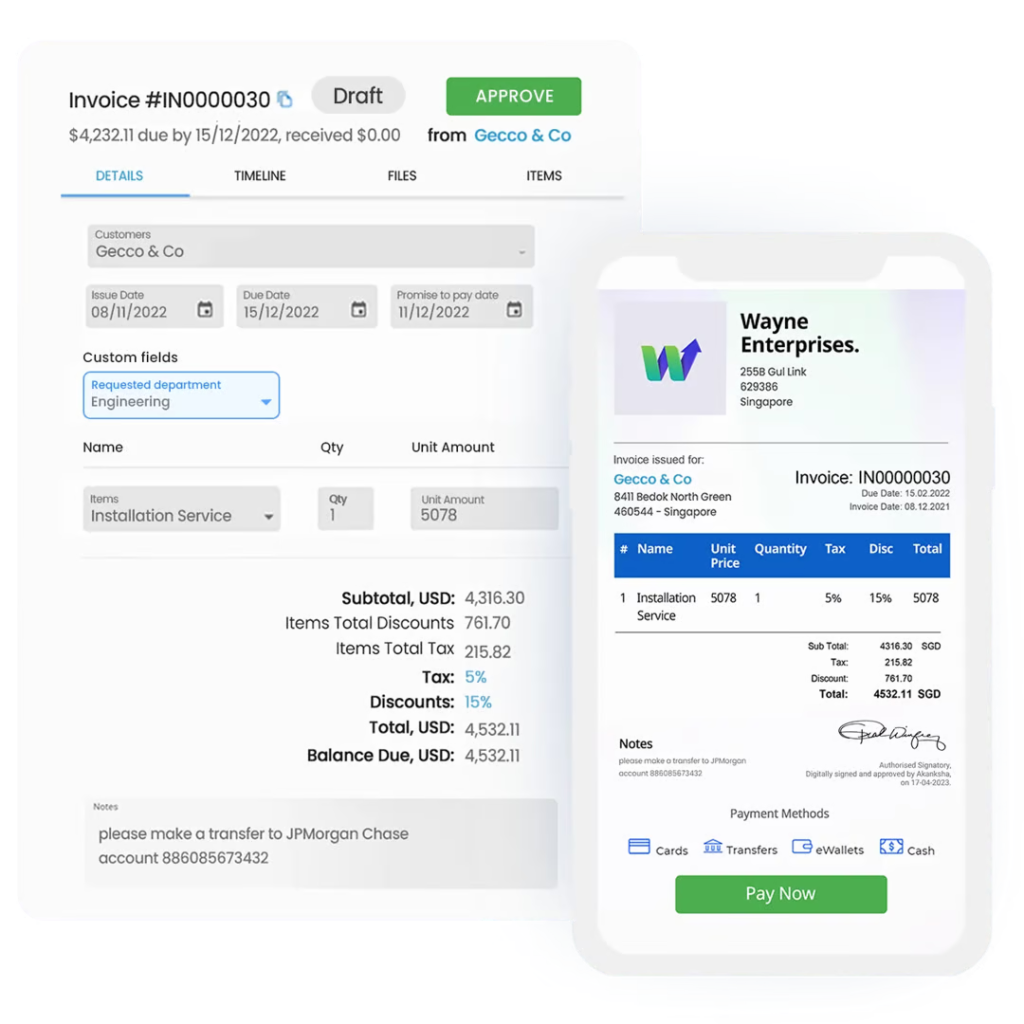

1. Streamline Invoicing Processes with Automation

Peakflo ensures faster and more accurate invoicing through automation, eliminating manual errors and delays that impact payment collection. With Peakflo, you can:

- Generate and send invoices automatically, reducing processing time.

- Ensure invoices contain all necessary details to prevent disputes and confusion.

- Use automated reminders to keep customers informed about upcoming and overdue payments.

2. Simplify Payments for Faster Collection

Peakflo enhances the payment experience for customers, ensuring quicker settlements and fewer payment delays. Key features include:

- A centralized customer portal, allows customers to pay via multiple methods such as credit cards, bank transfers, and digital wallets.

- The ability to attach proof of payment and view transaction summaries in one place.

- Automated reconciliation to match payments with invoices seamlessly.

3. Improve Accounts Receivable Management with Automation

Peakflo’s intelligent accounts receivable automation ensures that businesses can efficiently track and collect outstanding payments. It helps by:

- Automating follow-ups with personalized reminders via email, SMS, and WhatsApp.

- Offering customizable payment plans for customers facing financial challenges.

- Providing actionable insights through real-time AR dashboards to track overdue invoices and DSO trends.

4. AI-Powered Analytics

Peakflo’s AI-driven analytics offer predictive insights into cash flow and customer payment behaviors. The system can flag customers at risk of changing payment patterns, allowing businesses to take proactive measures.

Additionally, AI-powered reports can help you understand collection efficiency and monitor customers that may require special attention.

The Impact of Using Automated Software

Research shows that businesses using automated AR and DSO management tools experience a significant reduction in their DSO.

Their primary drivers for embracing automation include enhancing productivity, boosting efficiency, and achieving significant cost savings.

Conclusion

Days Sales Outstanding is vital for cash flow and liquidity. Knowing how to calculate DSO, interpret it, and reduce it is key to financial health.

Peakflo simplifies accounts receivable management, automates tasks, and offers cash flow insights. By enhancing AR processes and DSO, you boost financial stability and growth.

Want to optimize your AR and DSO management? Click here to explore how Peakflo can help you streamline your financial processes and improve cash flow today!