If you run a company that sells products to other businesses, you expect them to pay after you send a bill. The money they owe you is called accounts receivable. But keeping track of who owes you, how much, and when they will pay can be tricky.

A recent study by Datos Insights found that 82% of companies not using automated accounts receivable (AR) tools want to start. They believe it will help them get paid faster and keep customers happy. AI-powered AR software makes handling payments much easier. It sends invoices, reminds customers to pay, and records payments automatically. This saves time and reduces errors.

The software can also predict when customers will pay by studying past payment patterns. With AI managing accounts receivable, you can track money more accurately and with less effort.

AI-driven AR automation speeds up payments and makes the process smoother. It handles invoicing, tracks payments, and collects overdue amounts, increasing efficiency. But why is this technology so powerful? Let’s find out.

What is AI Powered Accounts Receivable Automation?

When your business sells goods or services to other businesses, you often have to wait for payment after delivery. Keeping track of these unpaid bills, called accounts receivable, can take a lot of time and may lead to mistakes. AI-powered software can help you manage this process more easily.

This software can send invoices, remind customers to pay, and record transactions using AI. By automating these steps, you can get paid faster, save time, and avoid errors.

Why You Should Use AR Automation Software For Your Business?

If your customers have pending invoices, it’s hard to keep up. The more you grow, the more complicated this process becomes. This is where accounts receivable software helps. It automates invoicing, tracks payments, and reminds customers automatically. Instead of spending hours managing overdue payments, you can focus on running your business while the software handles the details.

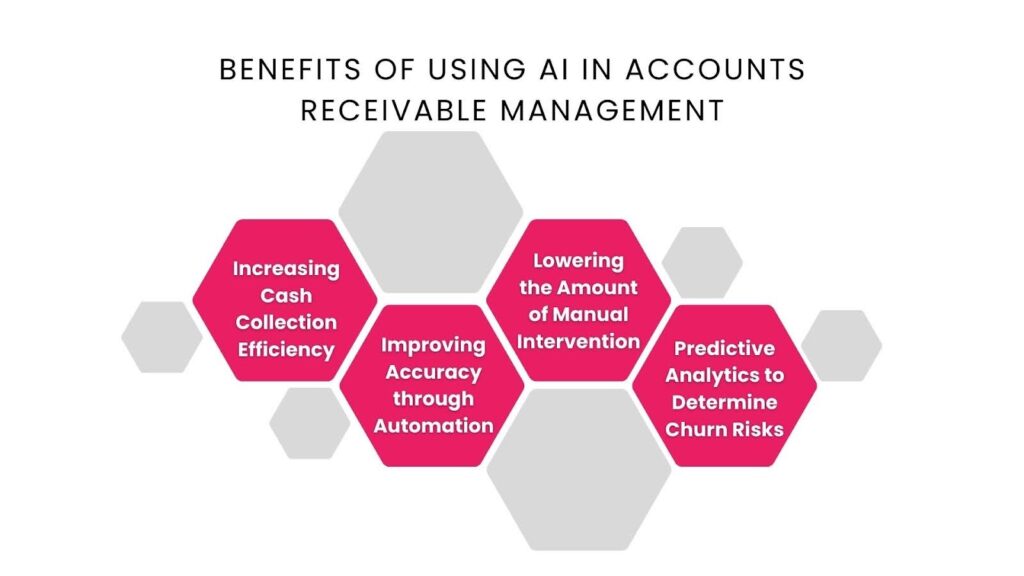

Benefits of Using AI in Accounts Receivable Management

AI offers several benefits to AR management. It makes cash collection faster and more efficient. The benefits of using AI are:

1. Increasing Cash Collection Efficiency

AI can help you get paid more quickly. It helps businesses get paid on time by studying how customers usually pay. Then, it sends reminders when they are most likely to pay.

2. Improving Accuracy through Automated Procedures

Errors may occur when data is entered manually. By automating processes like generating and sending invoices, AI reduces these errors. This guarantees the accuracy of your records.

3. Lowering the Amount of Manual Intervention

Manually managing accounts receivable is time-consuming and labor-intensive. AI manages monotonous tasks, allowing you to concentrate on more crucial aspects of your company.

4. Predictive Analytics to Determine Churn Risks

AI studies how customers act. It looks for signs that someone might stop buying from you. This helps you take action to keep them. For example, AI can track payment patterns. It can find customers who may leave soon. This lets you solve their problems before they go.

Now, let’s get to know how AR software impacts your B2B business.

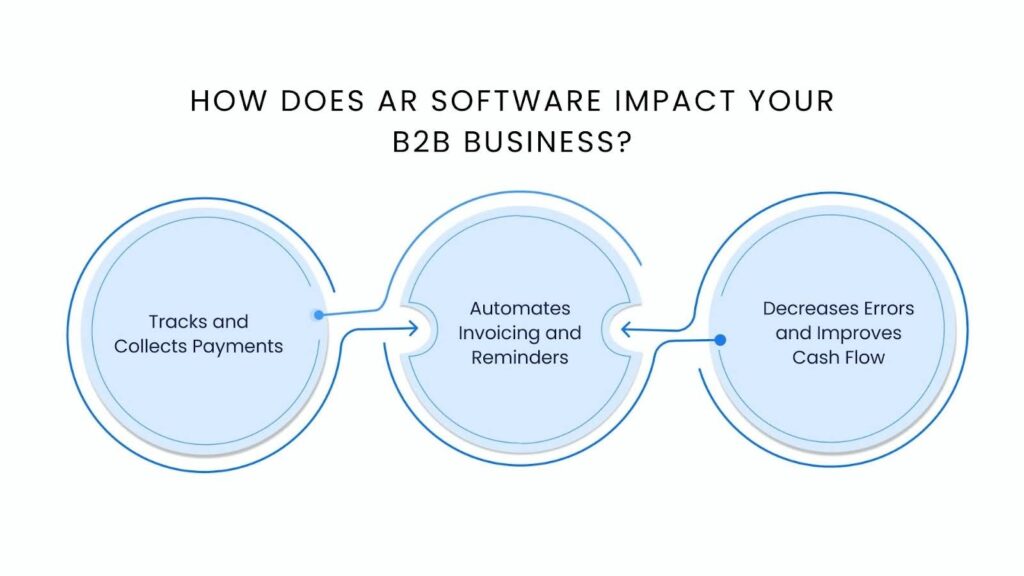

How Does AR Software Impact Your B2B Business?

In B2B transactions, AR software automates invoicing, sends payment reminders, and tracks due dates, making the process smoother.

1. Tracks and Collects Payments

Businesses often wait weeks or months to receive payments in B2B transactions. AR software reduces delays for you by automating invoicing, tracking due dates, and sending reminders.

2. Automates Invoicing and Reminders

AI-driven AR software automatically sends invoices, notifies your customers before due dates, and updates payment records instantly. To help you plan your finances better, the software analyzes historical payment data to predict when your customer is likely to pay.

3. Decreases Errors

AR software reduces manual work, prevents missed payments, and strengthens your customer relationships. This allows you to focus on growth instead of chasing payments while increasing your cash flow.

AI-powered B2B accounts receivable software helps you manage your company’s money better. It makes operations smoother and helps you work with clients more effectively.

Key Features of AI-Powered Accounts Receivable Automation Software

Managing unpaid invoices can be challenging, but AI-powered accounts receivable (AR) software simplifies the process. By automating tasks, tracking payments, and improving accuracy, it helps businesses get paid faster while reducing errors. AI-driven AR solutions optimize cash flow and collections in the following ways:

1. AI-Powered Cash Flow Optimization

AI predicts payment schedules and detects potential delays, helping businesses maintain a steady cash flow. If AI identifies a customer’s pattern of late payments, businesses can take proactive steps, such as adjusting payment terms or offering early payment incentives.

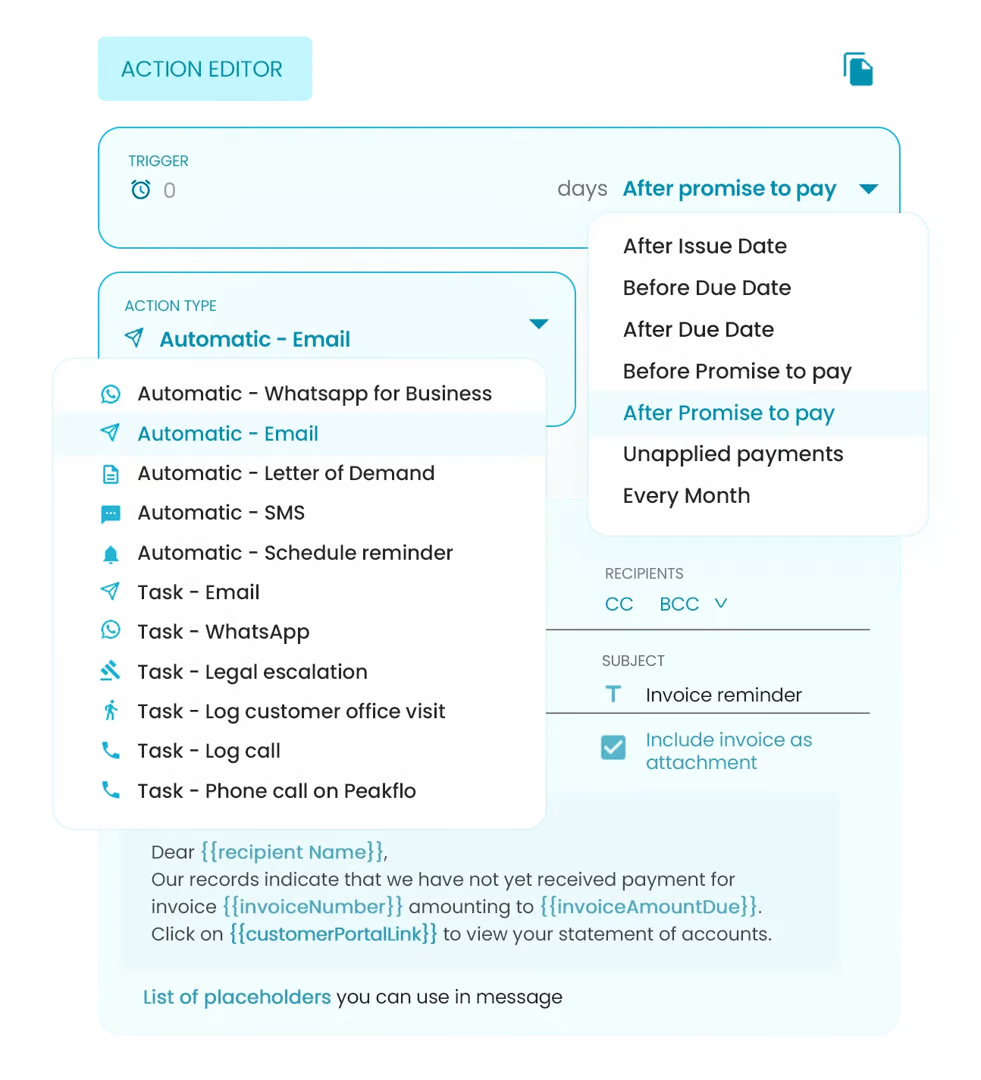

2. Automated Reminders for Payments

The B2B accounts receivable software reminds your customers to make payments rather than doing so by hand. For instance, Peakflo has assisted companies in collecting payments 10–15 days more quickly by sending out over 100,000 automated payment reminders.

3. Intelligent Decisions Through Real-Time Analytics

AI-driven solutions provide real-time insights into which clients have paid and which are overdue. These analytics help businesses adjust their strategies and make timely decisions. By forecasting cash flow patterns, it enable precise financial planning.

4. Connecting to Current Accounting Systems

The accounting tools you currently use can be integrated with this software. This integration guarantees that all your financial data remains centralized. It makes work easier without changing how you already do things. It connects smoothly with many accounting programs to fit right into your process.

5. Variable Payment Methods for Faster Transactions

Customers can pay you more easily because the B2B accounts receivable software offers a variety of payment options. This flexibility encourages faster payments, which increases your cash flow. Offering multiple payment options, such as digital wallets, credit cards, and bank transfers, encourages customers to pay invoices on time.

By using AI-powered AR software, businesses can accelerate cash inflows, reduce errors, and minimize manual work. Automation, predictive insights, and flexible payment options allow companies to improve AR processes, improve financial stability, and focus on growth.

To get the most out of AI in accounts receivable, you need a smart plan. Following best practices can improve efficiency and make the switch to automation smooth.

Best Practices for AI-Powered AR Software

AI-powered B2B accounts receivable software can make this process faster and more efficient for you. Let’s examine some recommended procedures for using this technology.

1. Clarifying Credit Policies

Define precise guidelines for when and how customers must pay you. Specify the credit terms, including the payment dates and any early payment discounts. AI-powered AR software looks at past customer payments. It then suggests the right credit limits.

2. Simplifying the Invoicing Procedure

To prevent payment delays, you can create and send invoices as soon as possible. AI-driven AR software can automate the creation and delivery of invoices, cutting down on errors and manual labor for you.

3. Promoting Prompt Payments from Customers

Remind your customers to make their payments on time and provide easy ways for them to do so. AI-powered software can send payment reminders automatically. These reminders are based on how your users behave. This helps you get paid faster.

4. Making Decisions by Using Insights and Data

Use data to guide your decision-making regarding your AR procedures. AI-powered software helps analyze customer payment habits and create real-time financial reports, making it easier to make smart decisions that boost cash flow.

AI-driven AR automation is not limited to one sector. Businesses in different industries gain many benefits. They collect payments faster and have fewer overdue bills. They also manage credit more effectively. Let’s explore a few practical examples.

Industry-Wide Applications and Uses

AI-powered software helps you handle payments from other companies. It makes tracking who owes money easier and ensures payments are received on time. Let’s examine the ways this technology can help you.

1. Companies with Extended Credit Terms

If your business offers long credit periods, you may have to wait a long time for payments. AI-driven software can keep track of these deadlines and politely remind customers when payments are due. This ensures customers don’t forget to pay. As a result, businesses receive their payments faster.

2. Sectors Requiring Comprehensive Credit Management

Certain sectors require meticulous monitoring of consumer credit. AI can forecast potential payment delays by analyzing customer payment histories. Having this knowledge allows you to decide whether to grant credit.

3. Businesses Managing a High Volume of Transactions

Handling a large number of transactions can be overwhelming. AI-powered software automates tasks for you like sending invoices and recording payments, minimizing manual labor. It simplifies the way invoices are created, sent, and tracked, making the entire process faster and more organized.

4. Companies Seeking to Reduce Past-Due Payments

Late payments can create cash flow problems. AI can identify trends in consumer behavior, enabling you to address issues before they lead to past-due accounts. By using such software, you can maintain a healthier cash flow and reduce the number of late payments.

AI-powered software for managing accounts receivable helps you process payments more smoothly. It makes operations faster and more organized. This also helps you keep your finances stable and secure.

Implementing AI-powered B2B accounts receivable software presents both challenges and opportunities. Let’s address these challenges and solutions for a successful adoption.

Challenges and Solutions in Applying AI AR Software

Many businesses use AI to streamline an AR process. These applications assist you in processes such as reminding clients to pay and sending invoices. However, there are certain difficulties when using AI for B2B accounts receivable software. Let’s examine these difficulties and your solutions.

1. Maintaining the Privacy and Security of Data

The system handles private data about your clients and company when you use AI to manage accounts receivable. It is essential to safeguard this data against theft or illegal access. To accomplish this:

- Employ Strong Security Measures: To protect data, make sure the software you select has strong security features.

- Respect Privacy Laws: Comply with rules that safeguard your client data.

- Update Systems Regularly: Regular updates that help you protect against emerging security risks.

2. Encouraging Everyone to Use the New Technology

You may be unwilling to embrace new technology because you might be accustomed to outdated methods. To assist you in adopting AI-driven B2B accounts receivable software:

- Training: Give your staff members the knowledge and tools they need to confidently comprehend and use the new system.

- Emphasize the Benefits: Demonstrate how the software facilitates and improves their productivity.

- Begin Slowly: Introduce the new system gradually so that everyone can get used to it.

3. Adapting the Software to Your Company’s Requirements

Every company operates differently, with distinct customer interactions and billing cycles. To make sure the AI program meets your unique requirements:

- Pick Flexible Software: Choose an application that can be tailored to your company’s needs.

- Work with the Provider: Collaborate with the software provider to customize the system to meet your needs.

- Test Intensively: Test the software carefully to make sure it works well with your company’s systems. Check if it runs smoothly and supports your daily tasks. Fix any issues before making it a required tool for your team.

4. Confirming That the New Software Is Compatible with Your Current Systems

Your company likely uses different software for various tasks. It’s crucial that these existing systems and the new AI-powered AR software can interact and function together. To achieve this:

- Verify Compatibility: Ensure the new software is compatible with your existing systems.

- Use Standard Formats: To ensure smooth data transfer between systems, use standard data formats.

- Seek Professional Assistance: Speak with your IT experts to help with the integration process.

Peakflo keeps your data safe with strong security features. Its easy-to-use design helps your team get started quickly. You can customize it to fit your company’s unique needs. It also works smoothly with the systems you already use. With Peakflo, you can manage your accounts receivable more efficiently and focus on growing your business.

Choosing the right AI-powered B2B accounts receivable software requires careful evaluation. Most importantly, it should be simple and easy for everyone to use. These factors will help you pick the best option for your needs.

Considerations for Choosing an AI-Powered AR Automation Software

Picking the right AI-powered B2B accounts receivable software is like finding the perfect tool to make payments faster and smoother for your company. It helps you collect money on time, reduce mistakes, and keep your finances organized. Let’s examine the important factors to consider:

1. Determining Specific Business Requirements

First, consider what your company specifically needs. Do you need help with sending invoices, reminding clients to pay, or keeping track of who has paid and who hasn’t?

2. Assessing Integration Capabilities

Next, check if the software is compatible with the tools you currently use. The new software should work well with the systems you already use, like customer management or accounting software. This helps keep everything running smoothly without changing how you currently do things.

3. Ensuring the Software Is Scalable

Your software should be able to grow with your company. Choose a system that works smoothly, even with more clients and invoices. It should not slow down or freeze when handling extra tasks and increasing transaction volumes as your business scales.

4. Prioritizing User-Friendly Interfaces

Lastly, ensure that the software is user-friendly and has a clear and easy-to-use dashboard. An intuitive interface reduces errors and saves time by making it easy for you and your team to learn.

By focusing on these features, you can find a tool that suits your business. This makes handling money simpler and more efficient.

How Can Peakflo Help With Accounts Receivable Automation Software?

Peakflo offers various features to help you manage your overall accounts receivable. Let’s break them down:

- Customizable Workflows: You can create workflows that fit your customer’s needs. This makes the invoicing process faster and helps avoid overdue payments.

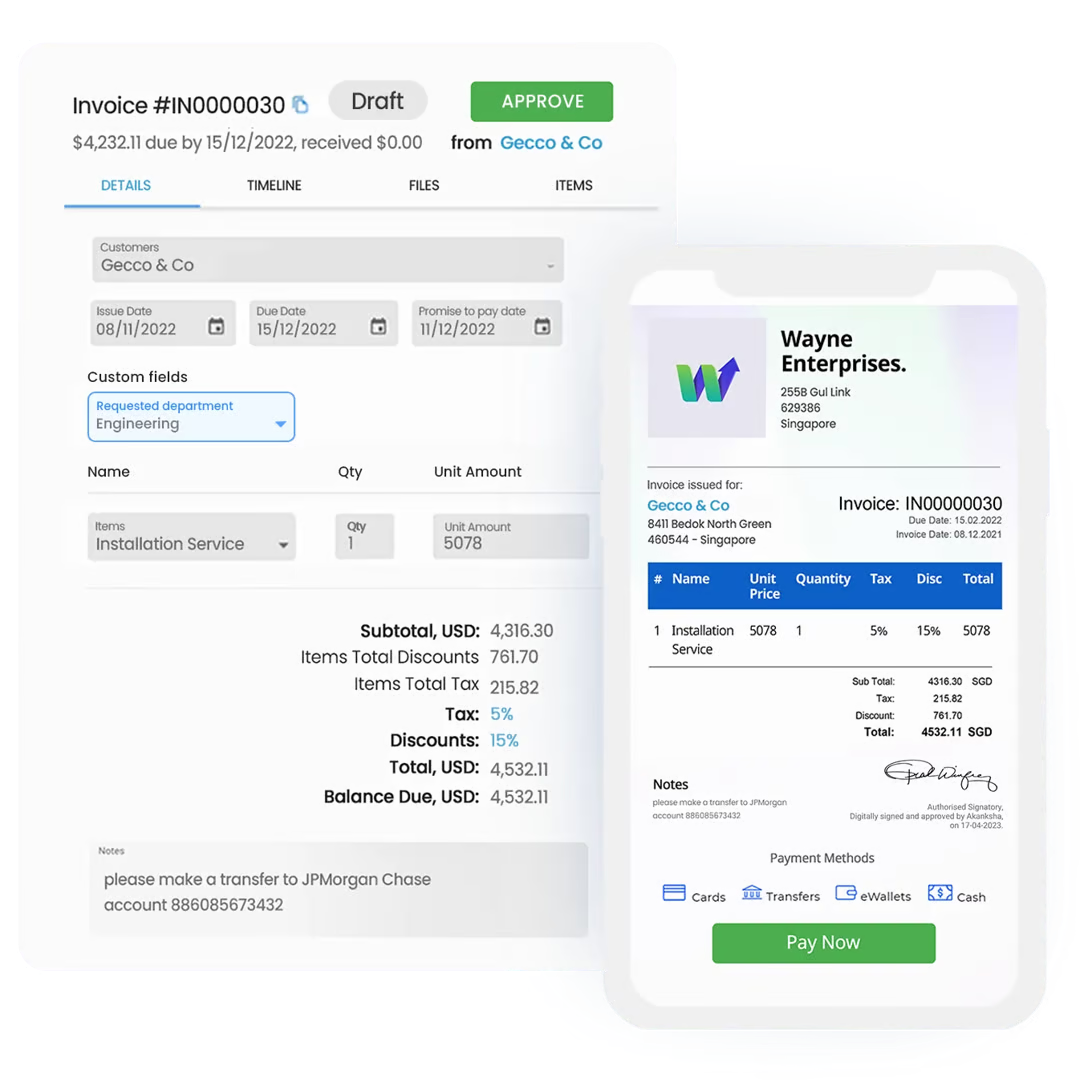

- Proforma Invoice Validation: Before finalizing payments, customers can review and approve proforma invoices. This ensures all the details are correct and prevents issues later.

- Automated Payment Reminders: Peakflo sends reminders automatically. These reminders are sent by email, SMS, or phone. This helps make sure customers pay on time without extra effort from your team.

- Integration with Accounting Software: Peakflo works with your existing accounting software. This keeps all your data in sync, reducing the chances of mistakes.

- Dispute Management: Peakflo helps you track customer disputes. This makes it easier and faster to resolve problems so payments can continue smoothly.

- AI-Powered Reports: Peakflo generates detailed reports. These reports show overdue invoices and customer payment trends, helping you manage cash flow.

- Invoice Tracking: The system keeps track of overdue invoices and upcoming due dates. This makes it easy to see which payments are pending and helps stay on top of collections.

- E-Invoicing: Peakflo lets you send digital invoices. These invoices can include approval policies and e-signatures. This speeds up the invoicing process and reduces delays.

- Customer Portal: Your customers can view and pay invoices through a simple online portal. This makes it easy for them to handle payments directly.

- Cash Application: Payments are automatically matched with the correct invoices and bank statements. This reduces manual work and ensures everything is accurate.

- Finance CRM & Task Management: Peakflo tracks customer interactions and helps organize tasks. This keeps your team organized and ensures nothing is missed during collections.

These features make managing your accounts receivable easier and faster through Peakflo and its excellent automation. Peakflo helps businesses get paid on time, reduce errors, and stay organized at all times.

Conclusion

AI helps you get paid faster by automating payment reminders and predicting when customers will pay. It analyzes past payments to forecast future cash flow, helping businesses plan better.

With AI, you can spend less time on routine tasks and more on important work. As AI improves, AR processes will become even more efficient, making financial tracking easier. AI-powered tools also work with other business systems, ensuring smooth money management, fewer mistakes, and steady cash flow.

Peakflo sends payment reminders and provides real-time insights. It can lower costs by up to 70%, respond twice as fast, and reach 99% accuracy in customer interactions. It also speeds up query resolution by 40%. Request a demo to automate invoicing, reminders, and cash applications.