As per Accounting Insights, “Whether you’re managing accounts for a small business or a larger organization, knowing how to calculate NRV can help improve cash flow management and enhance your financial reporting.”

Managing accounts receivable means knowing how much money you will collect. The net realizable value (NRV) of accounts receivable helps with this. It shows the real amount you can expect after removing bad debts.

Not all customers pay what they owe. Some invoices remain unpaid. Businesses use NRV to get a clear idea of their actual receivables. Different industries have different expectations for unpaid accounts.

For instance, in the retail sector, Target Corporation reported that their allowance for doubtful accounts was 8.3% of period-end receivables, with net write-offs constituting 4.6% and 4.4 of average receivables on an annualized basis.

Calculating NRV prevents businesses from overestimating their assets. It gives a true picture of financial health. Understanding NRV helps companies make better decisions. It also improves cash flow and financial reporting.

In this blog, we will explain how to calculate NRV step by step. We will also discuss why it matters and how it affects business decisions. Let’s begin!

What Is the Net Realizable Value of Accounts Receivable?

The net realizable value (NRV) of accounts receivable is the amount a company expects to collect from unpaid invoices. It removes amounts that may never be paid.

NRV helps businesses avoid overstating their finances. It shows the true value of receivables on a balance sheet. This method ensures companies report their assets accurately. It follows standard accounting rules. By using NRV, businesses get a clearer picture of their financial health. It helps them make better decisions about cash flow and budgeting.

Why is NRV Important?

- Keeps financial statements accurate and prevents inflated numbers.

- Helps businesses spot revenue losses before they become bigger problems.

- Follows the conservatism principle to avoid overstating financial health.

- Gives a clear picture of cash flow and available funds.

How is NRV Determined?

The net realizable value of accounts receivable is considered unpaid debts. It gives a more accurate measure of an asset’s true value. It accounts for customers who may not pay or take too long to settle their bills. By including these estimates, businesses can plan finances better. It helps in making smarter financial decisions.

We’ll discuss the specific calculation process in the next section.

Key Benefits of NRV Calculation

- Improves financial accuracy by showing a true picture of company assets.

- Ensures compliance with GAAP and IFRS standards, boosting credibility.

- Shows how much revenue will turn into cash.

- Helps businesses prepare for cash flow changes caused by unpaid invoices.

How NRV Influences Business Decisions

- Improves cash flow planning by estimating actual collections.

- Helps you assess credit risk and decide if policy changes are needed.

- Alerts businesses to adjust payment terms for slow-paying customers.

- Encourages proactive follow-ups on overdue invoices to boost cash flow.

By understanding the net realizable value of accounts receivable, companies can manage their receivables more effectively, minimize financial risks, and make data-driven decisions that support long-term stability.

How to Calculate the Net Realizable Value of Accounts Receivable?

Understanding the net realizable value of accounts receivable helps you ensure that your financial records reflect actual expected cash inflows. NRV prevents overstatement of assets and aligns with best accounting practices, improving decision-making for cash flow management and financial reporting.

Net realizable value formula

The NRV formula changes based on the type of asset.

For accounts receivable, use:

NRV = Total Accounts Receivable – Allowance for Doubtful Accounts

Example: A company has $80,000 in receivables and expects $6,000 to be uncollectible.

NRV = $80,000 – $6,000 = $74,000

For inventory, use:

NRV = Expected Selling Price – Costs to Complete and Sell

Example: A product sells for $500 but has $80 in costs.

NRV = $500 – $80 = $420

Since we’re focusing on accounts receivable, the key factor is estimating how much won’t be collected.

Step-by-Step Calculation of Net Realizable Value of Accounts Receivable

The NRV of accounts receivable is calculated in three steps. Each step helps ensure a realistic estimate of what can be collected.

Step 1: Identify Total Accounts Receivable

Start with gross accounts receivable, which includes all unpaid invoices. Keep records updated with recent transactions and credit sales.

Grouping receivables by aging periods (e.g., 30, 60, or 90 days overdue) helps assess collectability.

Step 2: Estimate the Allowance for Doubtful Accounts

Some invoices may never be paid. Estimate an allowance for doubtful accounts based on past collections, industry trends, and customer payment habits.

Businesses often apply different percentages to overdue invoices depending on how long they have remained unpaid. Regular updates keep this estimate accurate.

Step 3: Subtract the Allowance for Doubtful Accounts

Once the allowance is set, subtract it from total receivables. This gives the net realizable value, the amount expected to be collected.

Example: If total receivables are $50,000, and doubtful accounts are estimated at $5,000, the NRV will be:

$50,000 – $5,000 = $45,000

Following these steps ensures a clear financial picture and better cash flow planning.

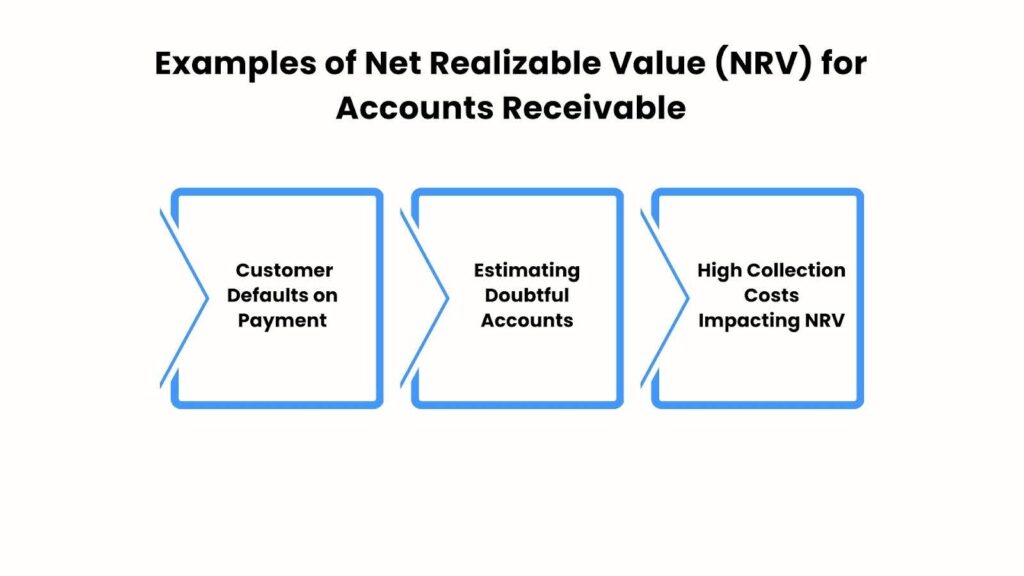

Examples of Net Realizable Value for Accounts Receivable

These examples show how NRV applies to accounts receivable in real situations.

Example 1: Customer Defaults on Payment

A company has $50,000 in outstanding receivables from a corporate customer. The customer files for bankruptcy and only 50% of the amount is expected to be collected. Legal fees for bankruptcy proceedings total $3,000.

NRV Calculation:

NRV = Total Accounts Receivable – Uncollectible Amount – Collection Costs

NRV = $50,000 – (50% of $50,000) – $3,000

NRV = $50,000 – $25,000 – $3,000

NRV = $22,000

Since the NRV is much lower than the original receivable, the company must adjust financial statements and record a bad debt expense of $28,000.

Example 2: Estimating Doubtful Accounts

A business has $100,000 in total accounts receivable. Based on past trends, 8% of customers typically default on payments. Instead of waiting for non-payments, the company creates an allowance for doubtful accounts.

NRV Calculation:

NRV = Total Accounts Receivable – Allowance for Doubtful Accounts

NRV = $100,000 – (8% of $100,000)

NRV = $100,000 – $8,000

NRV = $92,000

This adjustment ensures financial statements show a realistic cash inflow expectation.

Example 3: High Collection Costs Impacting NRV

A company has $30,000 in outstanding invoices. Collecting payments has been difficult. A collection agency charges 15% of the recovered amount, and legal fees are expected to be $500.

NRV Calculation:

NRV = Total Accounts Receivable – Collection Agency Fee – Legal Costs

NRV = $30,000 – (15% of $30,000) – $500

NRV = $30,000 – $4,500 – $500

NRV = $25,000

Since the actual amount recoverable is lower than the total invoices, adjusting records prevents overstated profits. Automating accounts receivable workflows can simplify collections and improve cash flow.

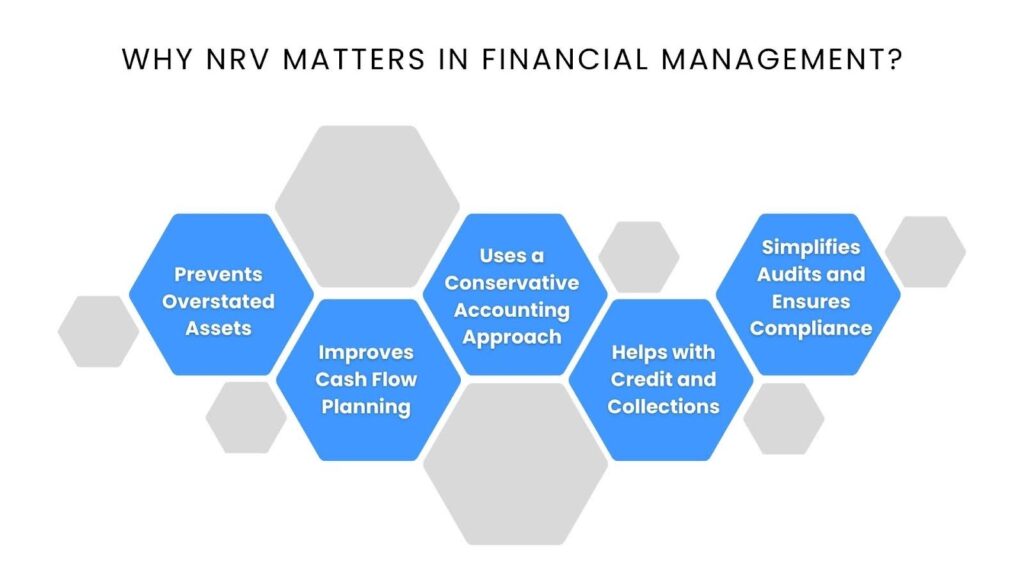

Why NRV Matters in Financial Management?

NRV helps businesses report accurate financials, avoid overstated assets, and manage cash flow effectively. It ensures compliance, improves credit policies, and simplifies audits. Here’s why it’s important:

- Prevents Overstated Assets

NRV makes sure financial reports show the actual value of accounts receivable. It removes amounts that might never be collected. This keeps businesses from overstating assets and gives a more accurate financial picture. Clear records help build trust with your investors and stakeholders.

- Improves Cash Flow Planning

By calculating NRV, businesses get a better idea of how much money they will collect. This helps businesses plan spending, investments, and savings wisely. Knowing expected cash inflows allows businesses to adjust budgets and prepare for unpaid invoices.

NRV follows a realistic way of recording finances. It only counts receivables that are likely to be collected, which lowers the risk of overestimating income. This prevents financial reports from giving a false sense of security.

- Helps with Credit and Collections

By identifying which receivables might go unpaid, businesses can improve credit policies and adjust payment terms. This helps them collect payments faster and reduce financial losses. Companies can decide whether to extend credit or tighten collection efforts.

- Simplifies Audits and Ensures Compliance

NRV calculations help keep financial records clear and audit-ready by following accounting rules like GAAP. Auditors check these numbers to confirm that financial reports are correct. Keeping NRV updated makes audits smoother and reduces reporting errors.

How Often Should You Calculate NRV?

NRV isn’t a one-time calculation. You should assess it periodically, monthly, quarterly, or annually, depending on your business needs. Regular reviews help you adjust for changing market conditions, customer payment behavior, and economic factors that affect collections.

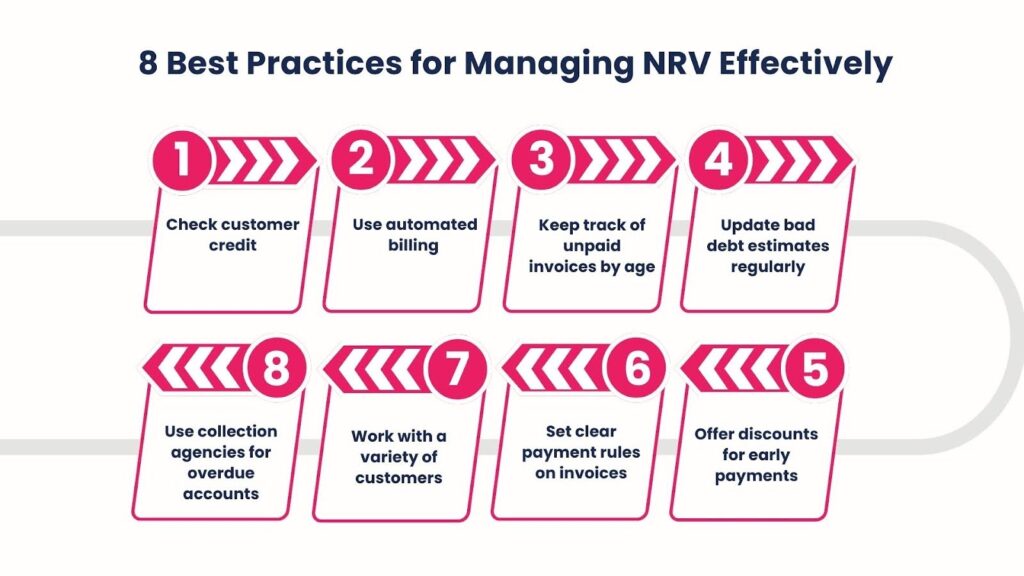

8 Best Practices for Managing NRV Effectively

Managing net realizable value helps businesses reduce bad debt, improve cash flow, and keep financial records accurate. The right strategies make collections easier and prevent overstatement of assets. Below are eight key ways to manage NRV better.

- Check customer credit before giving credit: Review customer financial history and payment behavior before offering credit. A credit check helps you avoid giving credit to customers who may not pay.

- Use automated billing and payment reminders: Automation makes it easier to track unpaid invoices and remind customers to pay. Set up automatic reminders for overdue payments to increase collections.

- Keep track of unpaid invoices by age: Sort unpaid invoices by how long they have been overdue. This helps businesses focus on collecting high-risk payments before they become uncollectible.

- Update bad debt estimates regularly: Adjust your bad debt allowance based on past collections and customer trends. This ensures financial statements show a more realistic picture of expected revenue.

- Offer discounts for early payments: Encourage customers to pay on time by offering small discounts for early payments. This helps businesses avoid overdue accounts and improve cash flow.

- Set clear payment rules on invoices: Make sure invoices include clear due dates, payment options, and late penalties. This helps customers understand their payment obligations and reduces confusion.

- Work with a variety of customers: Relying on a few customers can be risky if they fail to pay. A diverse customer base provides a steady cash flow and lowers financial risk.

- Use collection agencies for overdue accounts: If customers don’t pay after multiple reminders, consider using a collection agency. Professional collectors can help recover unpaid amounts before they become losses.

By using NRV calculations in financial planning, businesses can reduce bad debt, prevent revenue overstatements, and improve cash flow. If tracking receivables manually is too hard, automated tools like Peakflo can make your collection strategies easier.

Weighing the Pros and Cons of Net Realizable Value of Accounts Receivable

Now that you know how to manage NRV effectively, it’s important to understand the pros and cons of using the net realizable value method for accounts receivable. NRV offers many benefits, but there are also some challenges.

Let’s go over the advantages and disadvantages in a simple table to help you decide if NRV works for your business.

| Advantages | Disadvantages |

| Accurate financial reporting: NRV ensures that accounts receivable are not overstated, giving you a clear view of your company’s true financial health. | Time-consuming: NRV calculations take time, as you need to carefully assess credit risk and market conditions. |

| Compliance with accounting standards: NRV helps your business follow rules like GAAP and IFRS, making sure you stay compliant with regulations. | Dependency on estimates: NRV is based on estimates, such as predicting bad debt, which can sometimes lead to mistakes in your financial reports. |

| Better decision-making: Using NRV helps you make smarter decisions about pricing, inventory, and managing cash flow. | Market fluctuations: Since NRV depends on economic conditions, frequent adjustments may be needed, making your financial reports more volatile. |

| Reflects true asset value: NRV gives a more accurate picture of the value of your receivables, so your financial reports are more reliable. | Possible inconsistency across companies: NRV can change depending on the economy, so you may need to update it often, which can cause your reports to be less stable. |

| Helps in financial planning: NRV helps with risk management so you can plan for future financial needs and avoid unexpected problems. | Frequent adjustments: Different businesses may calculate NRV differently, making it harder to compare companies’ financials. |

This summary should help you understand both the advantages and challenges of NRV in accounts receivable. With this knowledge, you’ll be able to make better-informed decisions for your business.

How to Include the Net Realizable Value of Accounts Receivable on the Balance Sheet?

When creating your balance sheet, include the net realizable value of accounts receivable. This gives a clearer financial picture and shows the actual amount expected to be collected.

Key points to remember:

- Net accounts receivable is recorded as an asset, like cash and inventory.

- If you list only gross receivables, add an allowance for doubtful accounts to show potential losses.

- Use the NRV formula to calculate the realistic value of receivables.

- Show the adjusted amount separately on the balance sheet for better clarity.

This method ensures accurate financial reporting and helps you with better decision-making.

How Peakflo’s Accounts Receivable and Invoicing Solutions Help You?

Peakflo has tools that help you manage invoicing and accounts receivable more easily. These features help you keep track of cash flow and improve your financial process. Here’s an overview of the main features:

- Automated Invoicing: Peakflo automatically creates and sends invoices. This saves you time and ensures your invoices are sent on time, helping you get paid faster.

- Payment Reminders: You can set up automatic reminders to let your clients know when payments are due or overdue. This helps make sure you get paid on time and keeps your cash flow steady.

- Customer Portal: With the customer portal, your clients can see their invoices and payment history. This makes it easier for them to manage their accounts and helps speed up payments.

- Reporting and Analytics: Peakflo provides AI-powered reports that show you payment trends, outstanding invoices, and customer behavior. This helps you make smarter financial decisions and manage your cash flow better.

- Integration with Accounting Software: Peakflo connects with your current accounting software. This reduces errors and saves time, so you don’t need to enter data manually.

- Automated Reconciliation and Cash Application: Peakflo automatically matches payments to invoices, making month-end closing faster and easier. Your finance team can focus on more important tasks instead of manual work.

Using these features, along with task management and CRM tools, will help your business manage accounts receivable more efficiently and improve your overall financial health.

Conclusion

Calculating net realizable value is important for accurate financial records. It helps avoid overstating assets and gives a clear view of your cash flow. This improves decision-making and ensures you stay compliant with regulations.

If you want to make managing accounts receivable easier and more accurate, Peakflo’s automated tools can help. Request a demo or take a product tour to see how Peakflo can help you improve your AR management process.