When you are a growing business, one of your most important priorities is getting paid fast so that you can reinvest into the business. The thing is: getting paid is hard and chasing invoices is harder.

You can send one email reminder after another and no response. This is especially true if your customers are small to medium businesses, who tend to be more responsive on WhatsApp.

Peakflo helps you get paid faster by automating customer reminders via a centralized workspace. Now you can leverage WhatsApp automated messages to meet your customers where they are!

Don’t think that’s a big deal? Here’s why WhatsApp automation is a game changer for your collection strategy.

1. Connect with Customers via the World’s Most Popular Messaging App

According to Statista, 2 billion active users access the WhatsApp messenger on a monthly basis. This means most of your customers are already on the WhatsApp platform.

The use case of WhatsApp for Business expands across different industries and fields, especially in sales and finance. WhatsApp is known to be the best channel for following up customers, beating out email and any other messaging platforms. With WhatsApp for Business, you can communicate efficiently and build a stronger relationship with customers.

Customers are also more responsive on WhatsApp, which means smoother B2B and B2C communications. Finance and sales teams need to consider WhatsApp as one of the primary modes to contact customers. WhatsApp for Business allows finance and sales to solve disputes easily and collect payments quickly.

In addition, your collection strategy will impact how fast your customers will pay you. This is what Peakflo specializes in and we’d like to help you get paid faster with our wide array of accounts receivable automation features.

2. Set Up Workflows to Streamline Receivable Collections

One of the best collection practices is to establish clear policies for receivable collections. From there, the finance and sales team can decide the best strategy for customer follow-ups. Make sure that all team members are on the same page with to avoid miscommunications. Although it might seem small at a glance, it can actually prolong your invoice cycle.

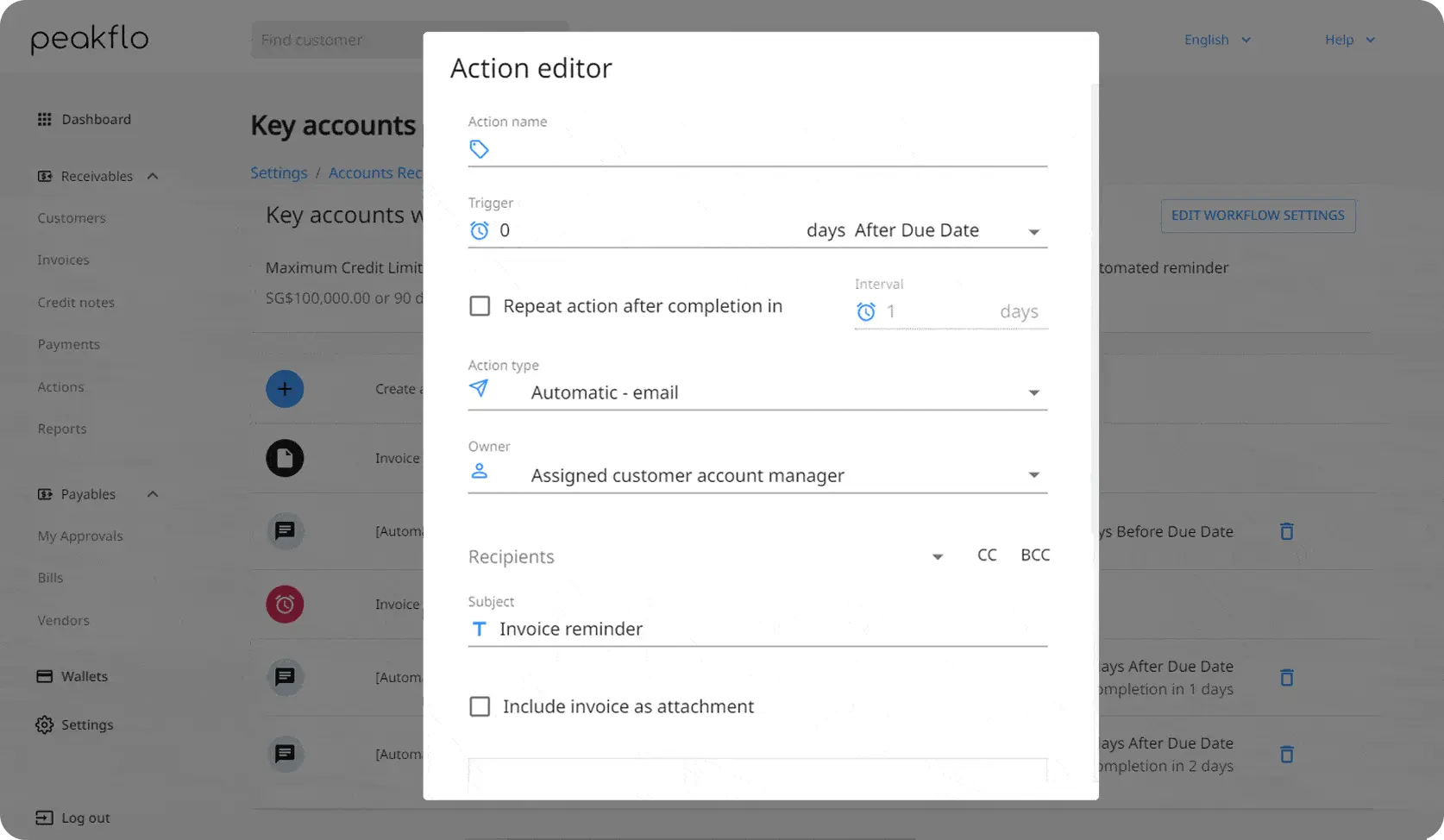

In Peakflo, the finance team can easily create a workflow that already caters to the industry’s best practices so you can customize it based on your organization’s standard of operations.

Start by defining the maximum credit limit in both financial and time. Doing so will give you more control over customers’ credits and make the right decisions on the next steps to take, for instance account freeze.

What’s more, Peakflo allows you to apply this workflow not only for invoice collections, but also for withholding tax (WHT) and partial payment collections. This is will ensure you to receive any types of payments on time.

3. Send WhatsApp Automated Messages for Invoice Reminders

The most annoying issue that could happen to a business is late payment as it can affect your cash flow negatively in the long run. It’s important for the finance and sales team to brainstorm internally for an effective follow-up strategy.

WhatsApp is already a strong channel to begin with and coupled with Peakflo’s automated payment reminder modules you can boost your collection performance.

Using Peakflo’s smart workflows, the finance team can add actions that include multi-channel reminders that support WhatsApp automation. You can even control the timing and the frequency to automatically send a WhatsApp message to customers.

Furthermore, add manual or automatic matrixes such as letter of demand or legal escalation for a tighter invoice payment follow-up flow.

4. Communicate Intricate Details Effortlessly

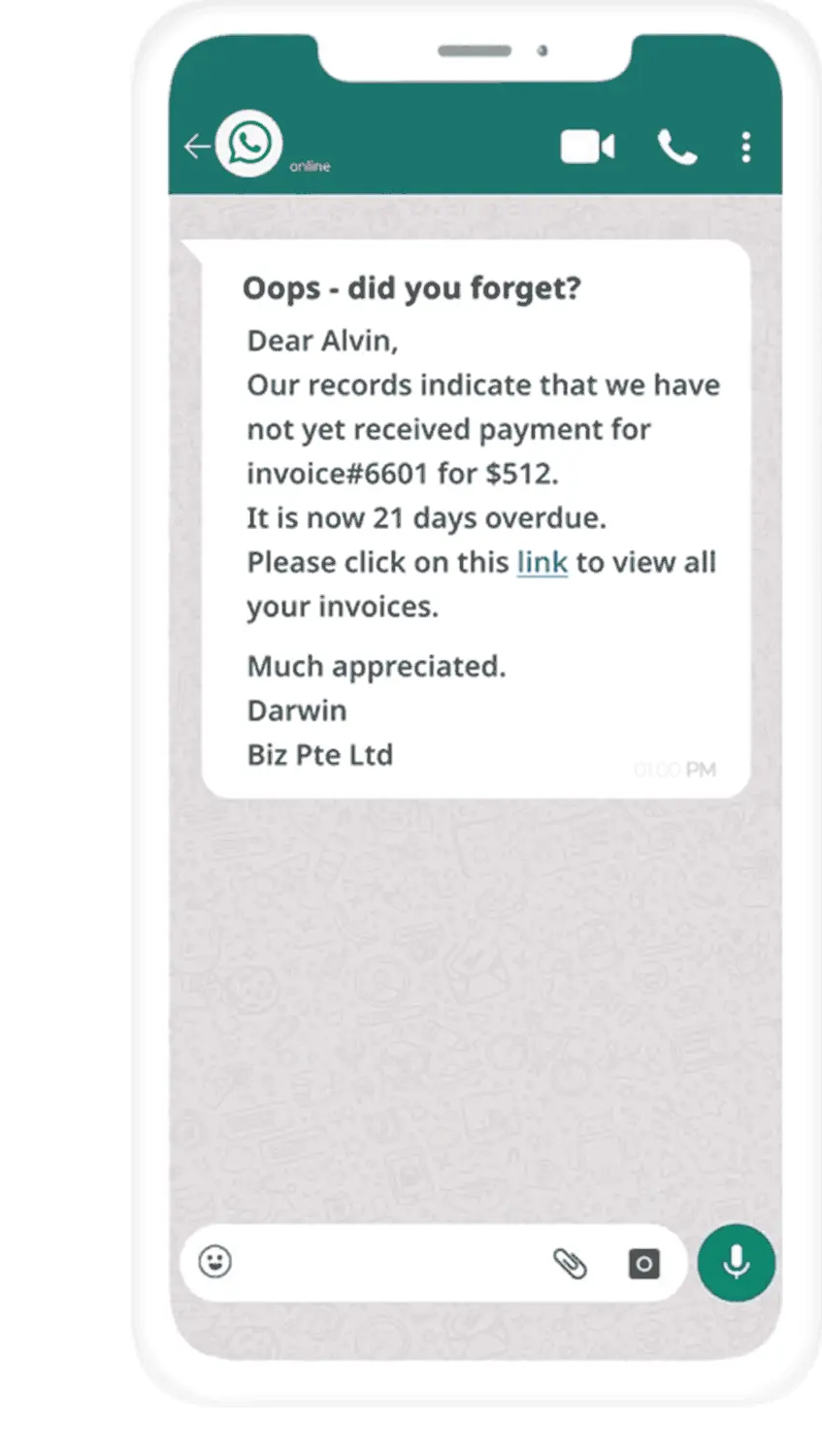

The right message and tone of voice can persuade customers to pay immediately when you send a message on WhatsApp.

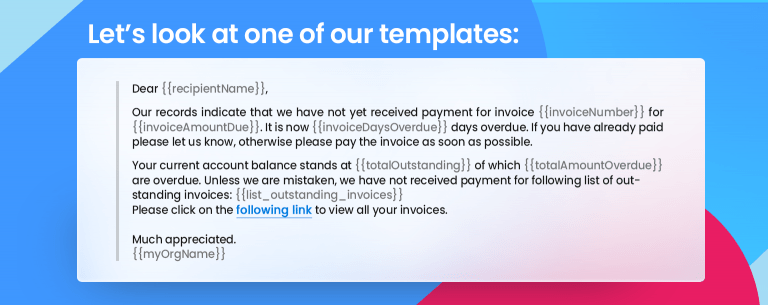

For the first time, you can convey the same high-fidelity information of email reminders with WhatsApp automation. Peakflo provides customizable payment reminder templates, allowing you to autofill specific details such as the outstanding invoice number to the total outstanding amount. This will save you more time on customer follow-ups so you can focus on higher-value tasks that contribute to business growth!

4. Engage Customers More to Pay Their Invoices

When you send an invoice reminder via the WhatsApp message, a customer portal link will be embedded to facilitate customers with an effortless payment experience.

In the portal, your customers can view summary of accounts based on any period, check their invoices, ask questions, raise disputes, and even pay outstanding amount. Peakflo supports various payment methods including bank transfers, eWallet, and card.

5. Stay on Top of Deliverability on All Reminders

When customers are not paying, sometimes it’s not on you. Sometimes it’s due to deliverability issues when you send a WhatsApp message.

With Peakflo, you can track bounced reminders, the last open date, and the history of actions. Peakflo also helps you troubleshoot deliverability blockers with bounce reasons so you can focus on fixing the problem.

6. Capture Communications in Full Detail

It might be challenging to keep a full record of communications for every invoice, especially if you’re chasing multiple customers at once.

Using WhatsApp for business, you can allow Peakflo to track and showcase an audit trail of not just the invoice reminders sent to your customers but also their responses. All this gets rolled up in reports as well as your customer’s timeline, complete with a full communication history with each customer.

7. Keep Improving As You Go

The potential for improving your collections strategy is limitless. This is why you need to regularly keep an eye on reports to plan on the next move based on the most accurate data.

Peakflo provides customer status tracking reports that come with AI predictions so you can get full insights into customers’ payment patterns. Thinking of stepping up your game? Easy, categorize your customers according to their payment behaviors and adapt this to your workflow.

As an example, you can create workflows for late payers and keep them on a tight follow-up loop with the right actions and escalation matrixes.

![]()

Automate WhatsApp and Collect Invoice Payments Faster!

So, are you ready to try Peakflo’s WhatsApp automation and streamline invoice collections?

We are ready to help you too. Just click the button below for a free consultation with our expert.