Are weak accounts payable controls putting your business at risk?

Accounts payable (AP) helps businesses manage payments and cash flow. Yet, weak AP controls can lead to fraud, errors, and compliance risks. According to CNA, Singapore businesses lost SGD 660.7 million to scams in 2022, with invoice fraud on the rise. Poor approval processes and weak payment checks make companies easy targets for financial loss.

Strong accounts payable control measures prevent duplicate payments and unauthorized transactions. They also improve efficiency and ensure compliance with financial rules. For businesses in Singapore, strict AP controls are essential to protect funds and maintain trust.

This guide will explain the key types of AP controls, best practices to improve security, and how automation makes AP processes more efficient.

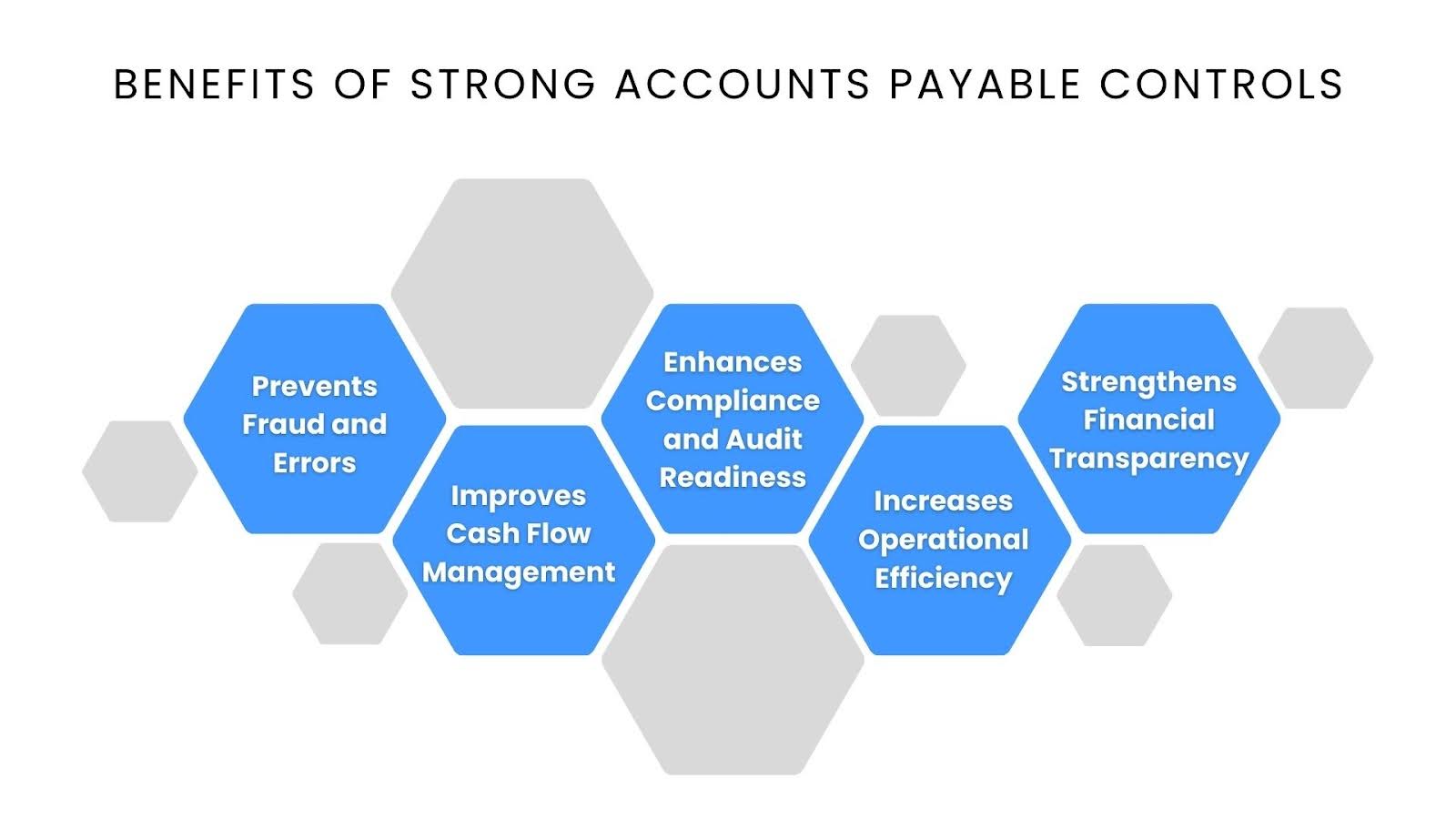

Benefits of Strong Accounts Payable Controls

A well-structured accounts payable (AP) process is essential for maintaining financial stability and operational efficiency. It helps businesses manage payments accurately, reduce risks, and ensure compliance. Here are some of the benefits of a strong AP:

- Prevents Fraud and Errors: A strong accounts payable framework helps catch fraudulent invoices and duplicate payments. Clear approval steps ensure only valid transactions go through.

- Improves Cash Flow Management: With proper accounts payable control, businesses can track payments, avoid late fees, and keep cash reserves stable. Paying suppliers on time also builds trust.

- Enhances Compliance and Audit Readiness: Clear documentation and approval steps keep businesses compliant with financial rules. Well-organized records make audits faster and less stressful.

- Increases Operational Efficiency: Automation and structured processes reduce manual work. Faster invoice approvals and fewer errors help businesses save time and money.

- Strengthens Financial Transparency: A strong accounts payable framework gives a clear view of outstanding payments. It helps businesses plan budgets and avoid overspending.

With these benefits in place, businesses must adopt the right AP controls to secure their payment processes. Let’s study the key types of internal controls in accounts payable.

Key Types of Internal Controls in Accounts Payable

A strong accounts payable framework helps businesses manage payments securely and avoid financial risks. Here are the key controls every business should implement:

A. Obligation to Pay Controls

Ensuring that payments are legitimate and accurate is crucial for financial security. These controls help verify expenses before payments are made.

- Purchase Order Approval: Proper approval of purchase orders prevents overspending and unauthorized purchases. It ensures that all expenses are approved before an order is placed.

- Invoice Approval: Invoices must be cross-verified with purchase orders and receipts to confirm accuracy. This step prevents businesses from paying incorrect or fraudulent invoices.

- Three-Way and Four-Way Matching: Matching invoices with purchase orders, receipts, and sometimes inspection reports ensures that businesses only pay for received and approved goods or services.

- Duplicate Payment Auditing: Checking for duplicate invoices helps prevent overpayments. Regular audits ensure businesses do not pay the same invoice more than once.

B. Data Entry Controls

Accurate data entry is essential for avoiding errors and ensuring smooth payment processing. These controls help maintain data integrity.

- Record Invoice Before Approval: Logging invoices as soon as they are received helps track payment timelines. It prevents missed payments and improves cash flow planning.

- Record Invoice After Approval: Recording invoices after approval ensures accuracy. It avoids incorrect data entry and prevents unverified payments from being processed.

- Digital Storage and Automation: Using digital records reduces manual errors and improves document retrieval. Automation speeds up approvals and strengthens accounts payable control.

C. Payment Entry Controls

Secure and authorized payments are critical for financial safety. These controls add multiple layers of security to payment processes.

- Segregation of Duties: Dividing payment tasks among different employees reduces fraud risks. No single person should handle invoice approval, processing, and payment.

- Manual Check Signing and Double Signing: Requiring two authorizations for large payments adds an extra layer of security. It prevents unauthorized or fraudulent transactions.

- Secure Check Storage: Lockboxes and restricted access ensure that cheques and payment tools are stored safely. It reduces the risk of theft or misuse.

- Tracking Check Numbers: Monitoring cheque sequences helps prevent fraud and lost payments. Businesses can track missing or altered cheques before payments go through.

Having the right accounts payable controls in place improves financial security and reduces risks. Now, let’s discuss the best practices for enhancing security, accuracy, and efficiency.

Best Practices for Strengthening Internal Controls in AP

It’s important to follow proven best practices to strengthen your accounts payable process. These practices ensure accuracy, security, and efficiency while reducing the risk of fraud and errors. Let’s explore how you can enhance your AP controls.

- Centralized Documentation and Automation: Centralizing AP records in a digital system helps streamline approval workflows and improves document accessibility. Automation reduces manual errors, speeds up processes, and ensures consistency in payment processing.

- Transition to Electronic Payments: Switching to electronic payments improves security by reducing the risk of cheque fraud and manual errors. It also speeds up payment processing, ensuring suppliers are paid on time.

- Regular Audit and Review: Regular audits help detect discrepancies and verify that controls are working as intended. Routine reviews also ensure compliance with financial regulations and help identify areas for improvement.

- Use of Checks and Balances: Implementing segregation of duties ensures no single person has control over the entire AP process. It maintains accountability and reduces the chances of fraud or error.

- Clear Approval Hierarchies: Establishing a clear approval hierarchy ensures that the appropriate personnel authorizes all payments. It reduces the risk of unauthorized payments and ensures financial control.

By integrating these best practices into your business, you can strengthen your accounts payable control. Next, we’ll look at the steps needed to successfully implement these practices.

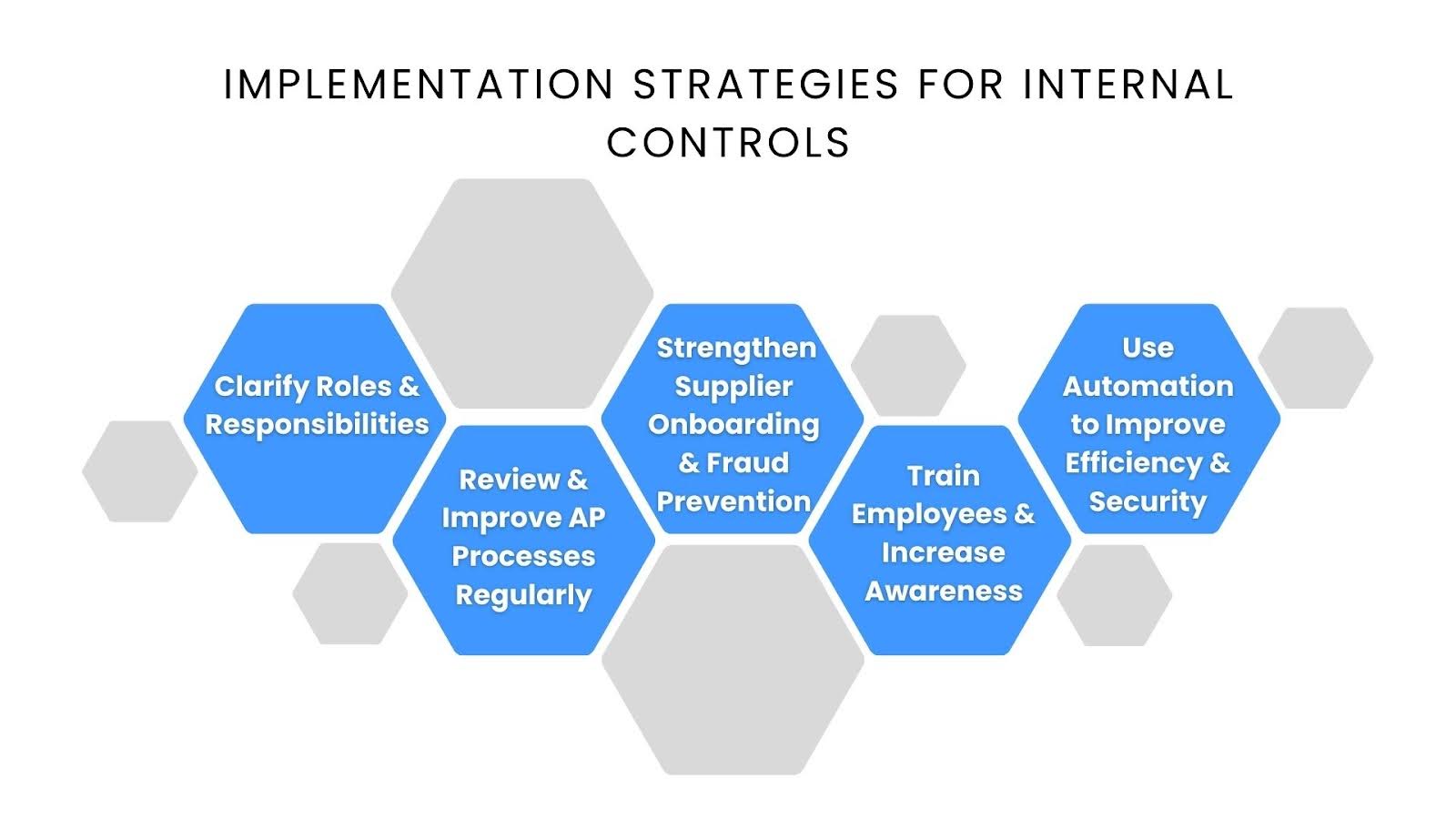

Implementation Strategies for Internal Controls

To successfully implement strong internal controls, businesses need a clear action plan. These strategies will help ensure that controls are effective, roles are clearly defined, and processes stay secure and efficient. Let us see how you can implement these key strategies.

A clear plan helps ensure internal controls work effectively, roles are well-defined, and processes stay secure. Here’s how to strengthen your AP framework:

1. Clarify Roles & Responsibilities

- Assign tasks clearly to avoid overlap and prevent unauthorized access.

- Set up approval workflows to ensure accountability.

- Reduce errors and improve process efficiency.

2. Review & Improve AP Processes Regularly

- Identify weak spots and adjust workflows to keep up with business needs.

- Ensure compliance with updated policies and regulations.

- Keep financial operations smooth and well-organized.

3. Strengthen Supplier Onboarding & Fraud Prevention

- Verify suppliers thoroughly before approval to reduce risks.

- Use automated tools to track suspicious transactions.

- Follow strict approval steps to catch and prevent fraud.

4. Train Employees & Increase Awareness

- Keep your teams updated on AP policies, fraud risks, and compliance rules.

- Provide hands-on training for new tools and processes.

- Encourage a detail-oriented approach to prevent financial mistakes.

5. Use AP Automation to Improve Efficiency & Security

- Automate invoice processing to cut down manual work and errors.

- Track cash flow in real-time for better financial control.

- Maintain digital records for easy audits and approvals.

These strategies help you create a strong AP system. For even better accuracy and control, tools like Peakflo simplify AP workflows and keep finances in check.

Why Singaporean Businesses Should Use Peakflo for AP Automation?

Peakflo, a product-first startup, helps strengthen your accounts payable control and streamline workflows, making your AP processes more efficient and secure. By adopting automation, your business can focus on growth while ensuring smooth financial operations. Here is how Peakflo helps:

- End-to-End Procurement Automation

Peakflo is more than just a tool for procurement; it’s a complete procure-to-pay solution. By automating every step, from purchase requisitions to order creation, Peakflo reduces manual tasks and ensures smooth operations. This unified platform makes AP processes more efficient, saving time and reducing errors.

- Save Time and Reduce Errors in Invoice Processing

Peakflo’s accounts payable software can save businesses up to 1,000 man-hours per month while reducing invoice errors by up to 80%. Features like AI-powered invoice OCR, automated PO matching, and smart approval workflows help eliminate manual validation, letting your team focus on more strategic tasks.

- Designed for Businesses with Complex Needs

Peakflo is ideal for businesses managing large invoice volumes or operating in multiple regions. Centralizing AP tasks improves visibility and streamlines operations. Whether dealing with delayed month-end closings or disorganized vendor data, Peakflo ensures your operations run smoothly.

- Vendor Management Made Simple

Peakflo simplifies vendor onboarding and management by securely onboarding and validating supplier information. It allows vendors to track orders, submit invoices, and check payment statuses, all through a secure portal. For MSME vendors, the WhatsApp vendor portal makes it easy to send invoices, check statements, and manage approvals.

- Effortless Payment Automation and Reconciliation

Peakflo automates payments and reconciliations, ensuring accuracy and saving time. With features like AI-powered vendor statement reconciliations, businesses can speed up reconciliation tasks by 20x while managing payments through bulk or advance scheduling.

Conclusion

Effective accounts payable controls are essential for businesses looking to improve financial accuracy, prevent fraud, and optimize operations. From understanding the types of internal controls like purchase orders and invoice approvals to implementing best practices such as regular audits and clear role definitions, strong AP frameworks are essential for sustainable business growth.

By integrating automation tools like Peakflo, businesses can save time, reduce errors, and streamline complex AP tasks. Whether it’s simplifying vendor management or speeding up payment reconciliations, Peakflo offers a comprehensive solution to meet the needs of Singaporean businesses.

Ready to transform your accounts payable processes? Book a demo with Peakflo today and see how it can enhance your AP operations.