DPO is a key metric that tells you how many days, on average, your business takes to pay its suppliers. It helps you assess the efficiency of your accounts payable processes and your ability to manage cash flow strategically.

A higher DPO means you’re holding onto cash longer—but too high can signal potential payment delays or strained vendor relationships.

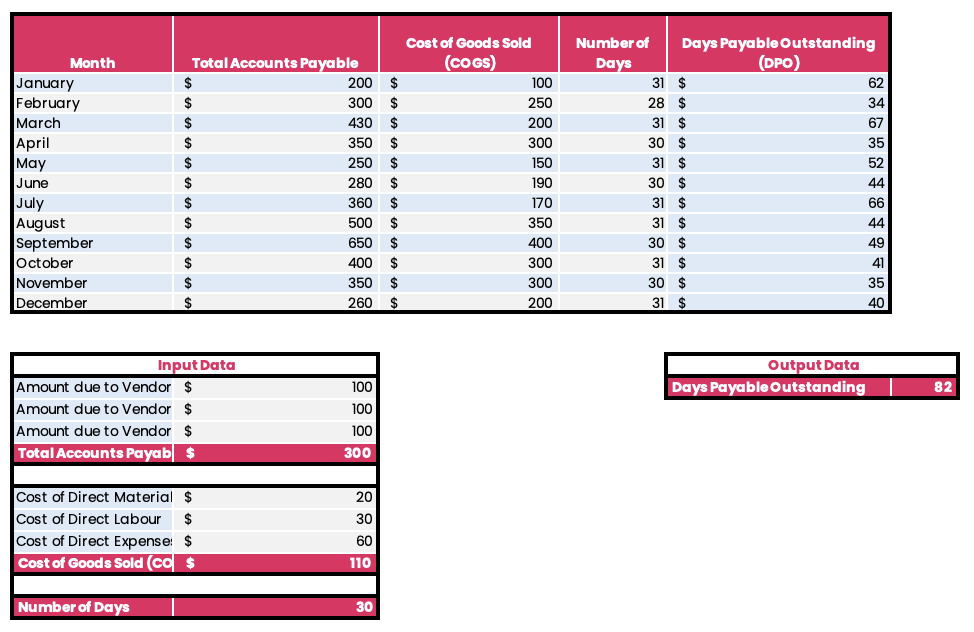

To make it easier for you, we’ve created a free downloadable DPO calculator template from Peakflo that helps you track and optimize your payables.

DPO Formula (with Example)

The basic formula for DPO is:

DPO = (Total Accounts Payable / Cost of Goods Sold) × Number of Days

Let’s look at an example from our calculator template:

- Total Accounts Payable: $300

- Cost of Goods Sold (COGS): $110

- Number of Days: 30

DPO = (300 / 110) × 30 = 81.81 ≈ 82 Days

This means your company takes roughly 82 days to settle its payables.

Why Is DPO Important?

A well-monitored DPO helps finance teams:

- Track Payment Practices: Understand how long you’re taking to pay vendors.

- Optimize Working Capital: Longer DPO frees up short-term cash for other business needs.

- Maintain Vendor Trust: Balance timely payments with smart cash flow management.

- Benchmark Performance: Compare payment practices against industry peers.

While higher DPO can be a sign of good cash flow control, excessively long DPO may hurt vendor relationships or credit terms.

How the DPO Calculator Works

Our free Excel-based DPO calculator helps you:

- Calculate monthly and average DPO automatically

- Plug in Accounts Payable, COGS, and number of days

- Get visual tables to track payment trends across months

Make informed decisions to adjust vendor payment strategies

Tips to Improve Your DPO

Here’s how finance teams can optimize their DPO without hurting vendor relationships:

- Negotiate better payment terms – Align terms with your cash flow cycles.

- Centralize AP processes – Avoid duplicate or late payments through automation.

- Use spend analysis – Identify which vendors need tighter controls.

- Automate approval workflows – Speed up invoice-to-payment cycle while maintaining control.

How Peakflo Helps You Maximize DPO

Peakflo’s AP automation platform gives finance teams the power to:

- Automate invoice capture and approval

- Ensure timely but strategic vendor payments

- Gain real-time visibility into AP aging and DPO

- Keep vendors happy with transparent communication and status updates

With smart workflows and centralized controls, Peakflo helps you hold onto cash longer—without compromising vendor relationships.

Ready to Transform Your AP Process?

Manual payables tracking can hold your finance team back. With Peakflo, you can automate invoice approvals, avoid late payments, and extend DPO without hurting vendor trust.

📞 Book a free demo with Peakflo to see how we help companies reduce manual effort, gain real-time visibility, and optimize working capital.

![Why AI Sales Calls Are Making Good Sales Reps Even Better [2025 Guide] ai sales calls](https://blog.peakflo.co/wp-content/uploads/2025/09/65168cf6-3001-4733-8cbc-12d5684cf449-218x150.webp)