What Is a Quote?

A quote is a commercial document issued by a company to a potential client, notifying them of the prices for the seller’s goods or services. It serves as a non-binding agreement, subject to the client’s acceptance. If the client agrees to the prices, the seller must adhere to the original terms.

All quotes should include a validation date, allowing the seller to make alterations and negotiate with the customer on future agreements.

Types of Quotes

There are two primary categories for quotes:

Product Quotes: This type of quote is used when a business is providing a price for a tangible item or product. It typically includes details such as the quantity, unit price, and any relevant specifications.

Service Quotes: Service-based businesses provide quotes for the cost of performing a particular service. This could include hourly rates, project costs, or other relevant fees associated with the service.

When Are Quotes Used?

Sellers use quotes to inform potential clients about charges for their services or products. This occurs at the beginning of a business relationship when the customer is exploring the market for the best deals. Since a quote is non-binding, the customer has the right to accept or refuse the offer.

Once a client accepts a quote, the terms become fixed, and the seller is obligated to provide services at the quoted prices. Changes can only be made after the expiration of the quote’s validity.

Tips for Preparing Quotes

Use a Template: Utilize a template to ensure all necessary components are included, saving time and ensuring a professional presentation.

Proofreading Is Crucial: Avoid errors in numbers, spelling, or grammar to convey professionalism and prevent misunderstandings.

Add the Details: Provide a breakdown of costs, including labor and materials, for transparency and peace of mind.

Benefits of Utilizing a Quote

Establishes Trust: An official price quote informs the customer and establishes trust, providing a transparent start to the relationship.

Keeps Everyone on the Same Page: After acceptance, both parties are on equal footing, preventing unexpected charges or requests for additional services.

Provides Legal Protection: A signed quotation serves as proof of agreed-upon terms and conditions, offering legal protection in case of disputes or non-compliance.

What Is an Invoice?

An invoice is a commercial document that itemizes and records a transaction between a buyer and a seller. It typically includes details such as the products or services, quantity, agreed-upon prices, and applicable taxes or discounts.

In other words, an invoice serves as a formal request for payment from the seller to the buyer. They can be either paper-based or digital format. It can be paid in one payment or installments.

When creating an invoice, it’s essential to include the following details:

1. Contact Information: Clearly provide the names, addresses, and contact details of both the seller and the buyer.

2. Unique Reference Number: Assign a distinct reference number or code to the invoice for easy tracking and identification.

3. Description of Goods/Services: Clearly outline the goods or services delivered, including descriptions, quantities, and unit prices.

4. Invoice Dates: Include the date the invoice was issued and the date when the goods or services were supplied.

5. Total Amount Due: Specify the total amount due, encompassing any applicable taxes and previously agreed-upon discounts.

6. Invoice Due Date: Clearly state the deadline for payment, indicating the date by which the payment should be made.

7. Payment Terms: Specify any specific terms regarding the payment, such as the accepted methods of payment.

8. Late Payment Fees: If applicable, outline any fees or consequences associated with late payments.

9. Payment Options: Indicate the payment options available, such as bank details or preferred payment platforms.

10. Purchase Order Number: If a purchase order number is relevant, include it for reference.

Freelancers and contractors may also consider including their payment service details (e.g., PayPal, Venmo) to facilitate quicker payment processing.

Types of Invoices

There are different categories of invoices that businesses utilize in different circumstances. Let’s take a look:

Pro Forma Invoices: These are initial invoices sent before starting work, outlining estimated costs for negotiation. Though not legally binding, they set clear financial expectations.

Interim Invoices: Issued during different project stages, interim invoices break down costs, providing clients with real-time expense details in long-term projects.

Final Invoices: The ultimate demand for payment, covering total project costs and all incurred expenses. They offer a comprehensive overview of the financial transaction.

Recurring Invoice: Regularly issued for subscription-based products or services.

Credit Invoice: Issued to provide a credit or refund for returned goods or overpayment.

Debit Invoice: Requests additional payment from a customer for extra goods or services.

Past Due Invoice: Remains unpaid past the due date, often subject to late payment penalties.

Commercial Invoice: Used in international trade to specify goods’ value for customs purposes.

When are Invoices Used?

Invoices are used in business after fulfilling an order. It’s crucial to send the final invoice promptly to maintain a healthy cash flow. Timely invoicing not only ensures payment but also contributes to retaining customers.

For businesses that sell products, an invoice should be issued after the delivery is done. In service-based businesses, an invoice is created once the service has been provided. It’s important to send these documents on time to facilitate both payment and customer satisfaction.

Tips for Preparing Invoices

Clarity in Details: Provide a clear and concise breakdown of products or services with accurate pricing to avoid disputes.

Timely Submission: Send invoices promptly after delivering goods or completing services to maintain cash flow and client satisfaction.

Professional Formatting: Present the invoice professionally with a consistent layout, fonts, and colors for enhanced clarity. Utilize a template for a professional look.

Clear Payment Terms: Specify payment terms, due dates, and any late fees to set expectations and encourage timely payments.

Follow-Up System: Implement a systematic follow-up for overdue payments, sending polite reminders to ensure prompt settlement.

Benefits of Utilizing an Invoice

Enhances Business Analysis: Invoices serve as a valuable source of data for business analytics, helping companies analyze product performance and customer preferences. This insight is crucial for identifying trends and shaping future strategies.

Facilitates Tax Compliance: Detailed invoices and accurate pricing records simplify the tax filing process, ensuring a smooth experience during tax season. In the event of an audit, accessible transaction data helps resolve disputes efficiently.

Provides Legal Protection: Similar to quotes, invoices offer legal protection to both parties involved. Signed documents not only safeguard entities in case of conflicts but also act as a deterrent, discouraging potential disputes from arising in the first place.

Key Differences between Quotes and Invoices

Quotes and invoices play distinct roles, each serving a specific purpose in the sales process. A quote is typically issued before the commencement of work or delivery, providing an estimated cost and terms for goods or services. It serves as a negotiation tool and outlines the groundwork for an agreement. On the other hand, an invoice is generated after the completion of work or delivery, formally requesting payment from the client. Unlike quotes, invoices are legally binding documents that detail the actual costs, quantities, and payment terms agreed upon. This table highlights key differences between quotes and invoices, shedding light on their unique functions, timing, and legal implications in the realm of business transactions.

A Way Forward

The key distinction between a quote and an invoice lies in their purpose. A quote serves as an offer, outlining the set price for a product or service. On the other hand, an invoice is sent to collect the previously agreed-upon amount after the product or service has been provided.

Running a successful business involves mastering the art of creating, sending, and following up on both quotes and invoices. This understanding is crucial for smooth financial transactions and maintaining positive business relationships.

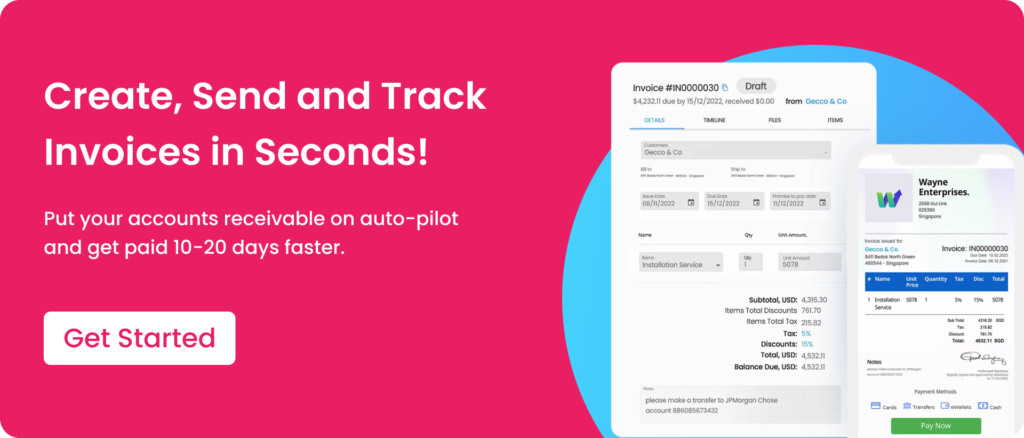

Peakflo’s Invoicing solution plays a pivotal role in simplifying the invoicing process. It facilitates the efficient generation, delivery, and tracking of invoices, ensuring timely and accurate payment collection.

Additionally, Peakflo’s Accounts Payable module streamlines the quote creation process, automating approval workflows and seamlessly generating purchase orders from approved quotes. This integrated approach enhances overall efficiency and helps businesses manage their financial processes with ease.

FAQ

Can a quote be used as an invoice?

No, a quote cannot be used as an invoice because it is not a demand for payment. A quote precedes any work and cannot be accepted by a customer’s accounting department as proof of completed work.

Is a quote a receipt?

No, a quote is not a receipt. A receipt serves as a written acknowledgment that products or services have been delivered, while a quote is issued before any work is planned or performed.

What is the difference between an invoice and a receipt?

An invoice requests payment and initiates a transaction, while a receipt acknowledges that the transaction is complete after payment has been received. A receipt serves as proof of payment.

What are the best practices for creating quotes and invoices?

Best practices for creating quotes and invoices involve using professional software tools, maintaining records for future reference, and adhering to legal requirements, including necessary tax information.

What is the difference between a quote and a contract?

A contract is a legally binding document signed by both parties, indicating agreement to stipulated terms. In contrast, a quote is a summary of potential business terms and is not legally binding.

![Why AI Sales Calls Are Making Good Sales Reps Even Better [2025 Guide] ai sales calls](https://blog.peakflo.co/wp-content/uploads/2025/09/65168cf6-3001-4733-8cbc-12d5684cf449-218x150.webp)