Staying competitive requires businesses to operate efficiently in every area. One department that can benefit from efficiency improvements is Accounts Payable (AP).

Traditional AP processes often rely on manual, paper-based systems, which can be time-consuming, error-prone, and costly. However, automating your AP process can provide a wealth of benefits for businesses of all sizes.

AP automation is software that manages the entire accounts payable process. This includes verifying, processing, and approving invoices, making payments to suppliers, and recording those payments in the accounting system. It allows companies to handle large amounts of invoices and financial transactions with suppliers in a safe, efficient, and compliant way.

In this blog, we’ll explore the key AP automation benefits and how it can transform your business operations.

1. Reduced Manual Errors

Manual AP processes are prone to human errors. Mistakes in data entry, incorrect invoice to purchase order matching, duplicate payments, or missed deadlines can all occur when handling invoices by hand. These errors can lead to financial losses and strain relationships with vendors.

AP automation drastically reduces the risk of human error. By automating data entry, invoice matching, and approvals, businesses can ensure that invoices are processed accurately and on time. Automation also detects and flags potential errors, such as duplicate invoices or mismatched amounts, preventing costly mistakes before they happen.

2. Time Savings and Increased Productivity

Processing invoices manually can be a slow and labor-intensive task. Employees often spend a significant amount of time entering data, matching invoices to purchase orders, and chasing approvals. This takes time away from more strategic, value-added activities.

With AP automation, the entire process is streamlined. Invoices are automatically captured, matched, and routed for approval, reducing the need for manual intervention. Employees can focus on higher-level tasks, such as analyzing spending trends or negotiating better terms with vendors, rather than being bogged down by paperwork.

3. Cost Savings

Manual AP processes can be expensive. There are costs associated with printing, mailing, and storing paper invoices. Additionally, the labor costs of processing each invoice manually add up over time.

AP automation reduces these costs by eliminating the need for paper-based processes. Invoices are captured electronically, stored in a central system, and can be retrieved with a few clicks. This not only reduces the cost of handling invoices but also minimizes the need for physical storage space. Furthermore, businesses can take advantage of early payment discounts offered by vendors, as automated systems ensure timely processing of payments.

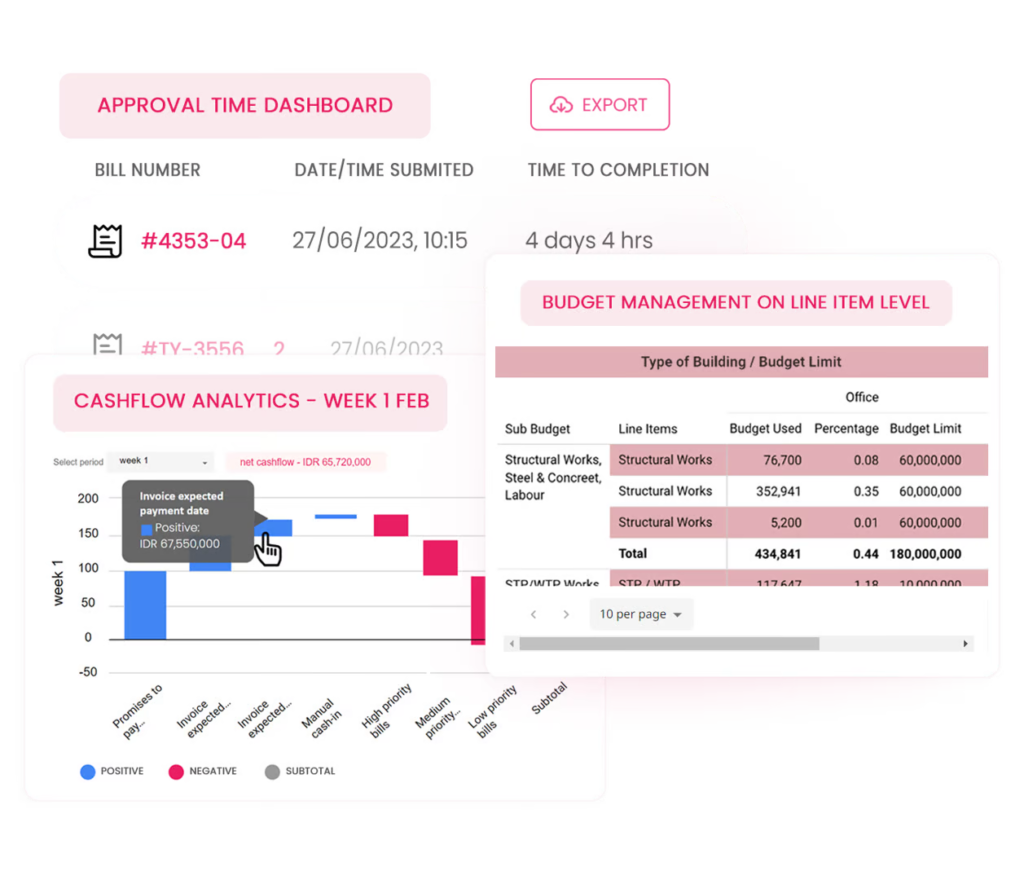

4. Improved Visibility and Control

One of the biggest challenges with manual AP processes is the lack of visibility. It can be difficult to track the status of invoices, identify bottlenecks, or manage cash flow effectively when everything is handled manually.

AP automation provides real-time visibility into the entire accounts payable process. Managers can easily see where each invoice is in the approval process, track payment statuses, and monitor spending patterns. This level of control enables better decision-making and helps businesses manage cash flow more effectively.

5. Enhanced Compliance and Security

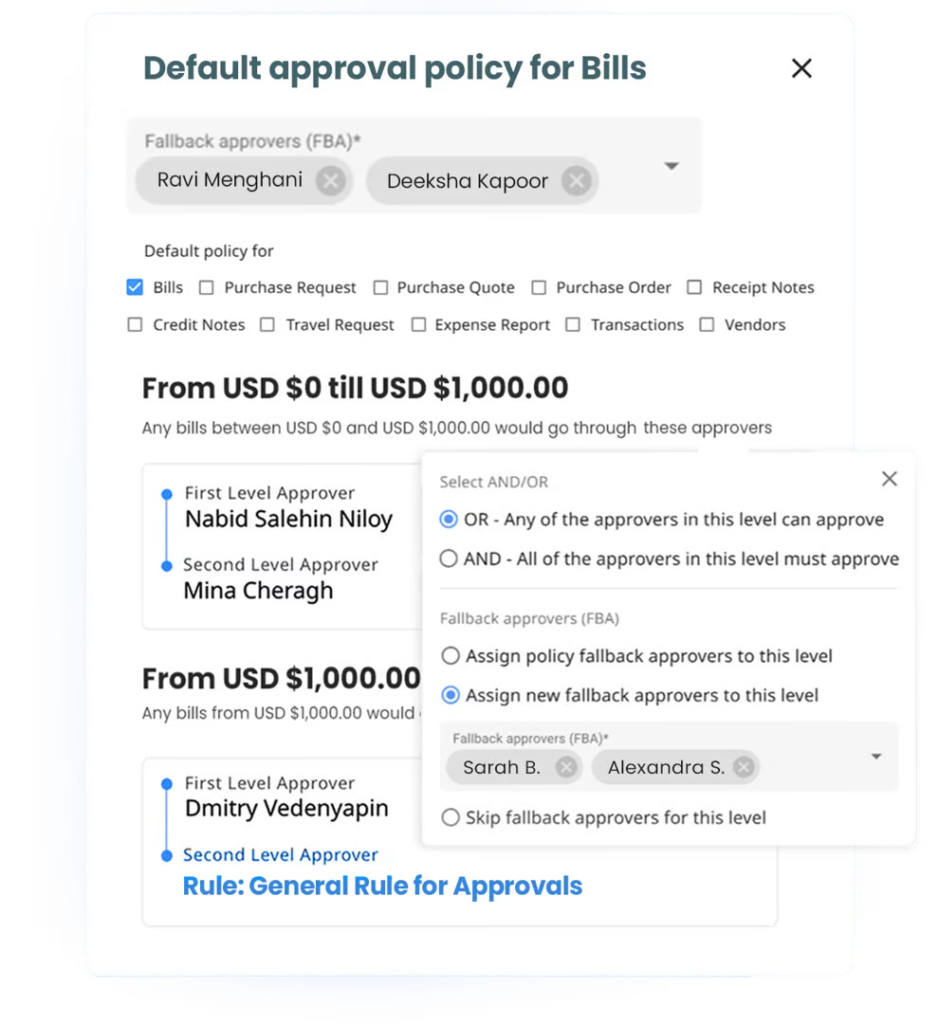

Compliance with tax regulations, industry standards, and internal policies is crucial for businesses, especially when it comes to financial processes. Manual AP processes can make it challenging to maintain accurate records, track approvals, and ensure that all invoices are processed according to the company’s policies.

AP automation ensures compliance by maintaining a digital audit trail of every transaction. This means that every invoice, approval, and payment is tracked and recorded, making it easier to comply with internal policies and external regulations. In addition, automated systems offer enhanced security, as sensitive financial data is protected within a secure platform, reducing the risk of fraud or unauthorized access.

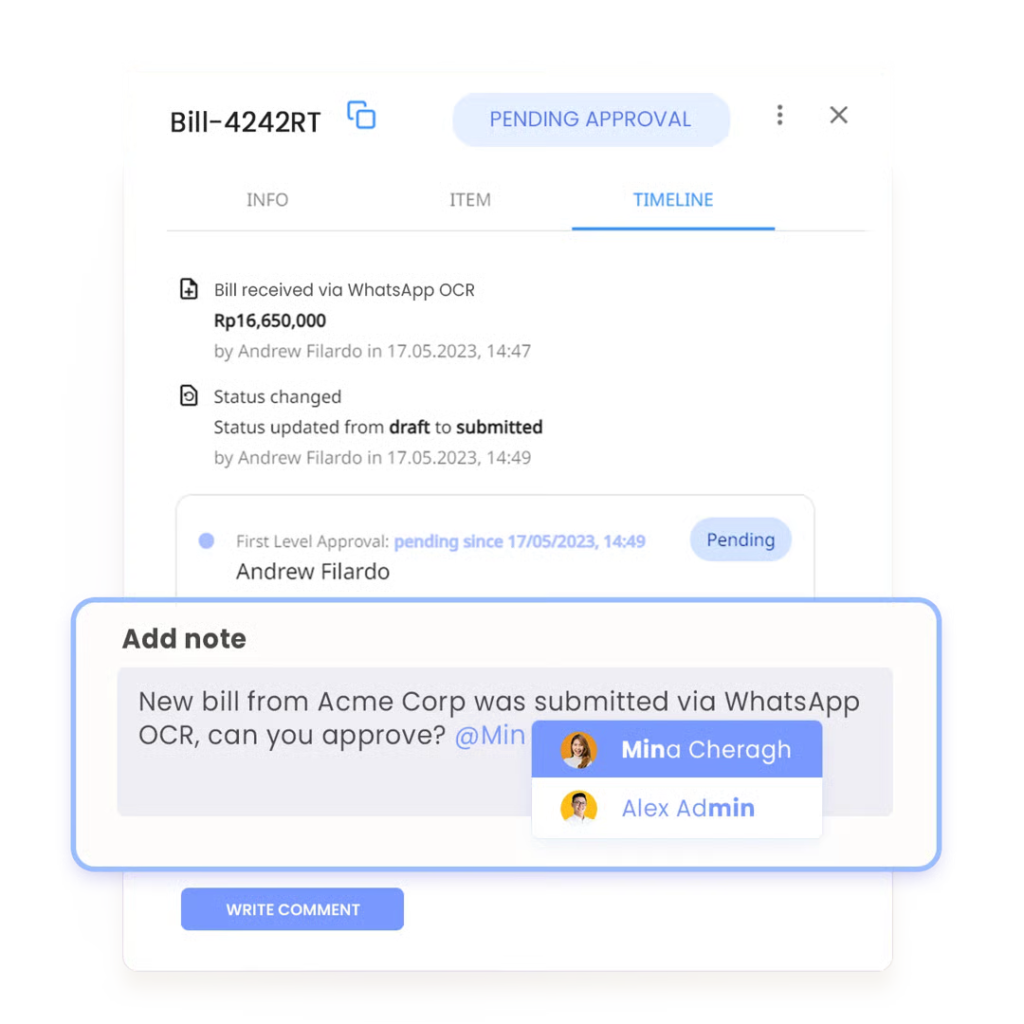

6. Faster Invoice Approvals

A common frustration in many businesses is the time it takes to get invoices approved. Manual processes often involve passing physical documents from one person to another, leading to delays, lost paperwork, and frustration.

With AP automation, invoices are routed to the appropriate approvers electronically. Approvers can review and approve invoices from anywhere, whether in the office or remotely. This speeds up the entire process and ensures that invoices are approved and paid on time, avoiding late payment fees and improving vendor relationships.

7. Better Vendor Relationships

Vendors play a crucial role in the success of any business. Maintaining strong relationships with them requires timely payments and clear communication. Unfortunately, manual AP processes often lead to delays in payments, which can strain these relationships.

AP automation ensures that invoices are processed quickly and accurately, resulting in timely payments to vendors. Additionally, automated systems can provide vendors with visibility into the status of their invoices, reducing the need for follow-up calls or emails. By improving the overall payment process, businesses can foster better relationships with their vendors and even negotiate better terms.

8. Scalability for Business Growth

As businesses grow, so does the volume of invoices they need to process. Manual AP processes can become overwhelming and may be unable to keep up with the increasing workload. This can lead to delays, errors, and inefficiencies.

AP automation is highly scalable and can handle large volumes of invoices with ease. Whether your business processes a few invoices per month or thousands, automated systems can manage the workload without the need for additional staff. This scalability allows businesses to grow without being held back by inefficiencies in the AP department.

9. Improved Cash Flow Management

Managing cash flow effectively is essential for the financial health of any business. However, manual AP processes can make it difficult to track when invoices are due, leading to late payments or missed early payment discounts.

With AP automation, businesses have better visibility into their outstanding invoices and can manage their cash flow more effectively. Automatic payment disbursement and real-time tracking ensure that payments are made on time, helping businesses avoid late fees and take advantage of discounts offered by vendors for early payments.

10. Environmentally Friendly

Reducing paper usage is an important step towards creating a more environmentally sustainable business. Traditional AP processes involve printing, mailing, and storing paper invoices, contributing to waste and a larger carbon footprint.

AP automation eliminates the need for paper invoices, significantly reducing the amount of paper your business uses. By switching to e-invoices and approvals, businesses can contribute to a greener environment while also enjoying the AP automation benefits.

11. Seamless Integration with Other Business Systems

Traditionally, accounts payable has operated in isolation, receiving information from other departments but rarely sharing it back. By integrating AP automation with systems such as SAP, NetSuite, and Microsoft Dynamics, key decision-makers across the company gain full visibility into the AP process. This transparency helps transform AP from a back-office function into a value-adding part of the business.

12. Streamlining and Customizing Workflows

AP automation allows businesses to standardize processes while offering the flexibility to customize workflows according to industry-specific needs. Many automation tools can be tailored to meet the unique requirements of your organization, ensuring efficient processes today and the ability to adapt to future changes. This flexibility leads to more efficient, aligned operations.

13. Boosting Team Collaboration and Efficiency

Automation can significantly improve team morale and productivity by reducing repetitive, tedious tasks. When AP teams no longer need to spend hours on the most disliked tasks, they can focus on more important and strategic activities. AP automation consolidates workflows, making it easier for teams to collaborate and work together efficiently.

14. Enhanced Fraud Detection and Prevention

Fraud remains a significant risk for businesses, with billions lost globally each year. AP automation powered by AI helps detect fraud by controlling invoice access and flagging suspicious activities such as duplicate payments or false billing. This added visibility and control reduce the risk of fraud and ensure compliance with regulations.

15. Easy Access to AP Data from Anywhere

Cloud-based AP automation solutions, such as Peakflo, allow businesses to access accounts payable information anytime, from anywhere. Whether working remotely, traveling, or in the office, authorized team members can review, approve, or initiate payments and check invoice statuses. This mobility is especially valuable in today’s fast-paced, flexible work environment.

A Way Forward

With advancements in technology, businesses are implementing automation to streamline their processes and reap AP automation benefits. From reducing errors and costs to improving cash flow management and vendor relationships, AP automation is a powerful tool that can transform the way businesses handle their finances. By embracing automation, companies can position themselves for long-term success in an increasingly competitive marketplace.

If you’re looking to simplify your accounts payable process, reduce errors, and save time, Peakflo’s AP automation solution is here to help. Our platform is designed to handle large volumes of invoices, streamline approvals, and integrate seamlessly with your existing accounting systems. Whether you’re looking to improve compliance, boost productivity, or enhance vendor relationships, Peakflo has the tools to transform your AP department. Get in touch today to learn how Peakflo can automate your AP process and help your business thrive!