Over-the-top sales can be exhilarating, making you feel like you’ve hit your mark financially. But deep down, you know you don’t get to rest just yet because a portion of those revenues might still belong to accounts receivables.

The thing about AR is that you’ll need to convert them into cash and fast. The more they sit idly, the harder they get for you to collect. Get a lot of these on top of each other, and your cash flow takes a huge hit.

If you’re wondering how to optimize your accounts receivable management and collection, stick around. In this article, we’ll be walking you through proven strategies for improving AR, which ultimately improves your business cash flow.

What’s So Important About Improving Accounts Receivable?

If we can have our way, we’d choose to get paid straight. But, in the business world, if you want to compete, you’ve got to make it easier for customers to acquire your goods or services. Selling on credit increases your chances of getting more customers and gaining loyalty.

Having a way to increase revenue can be exciting, but there’s a drawback. There are a lot of businesses out there that deal with late payments on a regular basis, which, as you’ve guessed, isn’t going so well for their cash flow.

If you’ve been dealing with a lot of AR on your balance sheet for quite some time, the next thing you know is you have a cash crunch. You can imagine the importance of optimizing your AR for enhancing your cash flow health.

How to Measure Your Accounts Receivable’s Performance

There are many cash flow KPIs that let you measure how well you’re collecting money customers owe, like DSO, AR collection period, and so on. One of the most critical ones you can calculate is your accounts receivable turnover ratio.

Your accounts receivable turnover ratio directly reflects your company’s AR performance and efficiency. It tells you how many times on average you collect AR during a period, like a year or six months.

Calculating Your Accounts Receivable Turnover Ratio

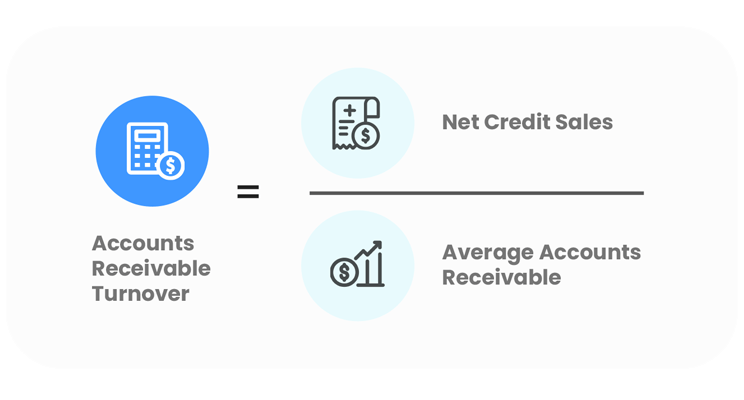

Here’s the accounts receivable turnover formula:

Say you want to measure your accounts receivable turnover ratio last year. Your company made a total net credit sales of $1.5M. You had an AR balance of $130,000 on 1-January, and $170,000 on 31-December gives you an average AR of $150,000.

Using the accounts receivable turnover formula, you divide $1.5M by $200,000 to get a receivables turnover rate of 10.

A rate of 10 tells you that you’ve collected your accounts receivable ten times on average last year.

What Else Do Your Accounts Receivable Turnover Tell You?

You can compare this rate to your competitors or past results to get a clearer picture of your AR performance. Generally, a high turnover tells you that you might already be efficient at managing AR collections. Having a low turnover tells you it may be otherwise.

Improving your AR collection is paramount to achieving your business’s ideal cash flow. Here are seven proven strategies for optimizing your AR to minimize the chances of experiencing cash flow issues.

6 Useful Strategies For Improving Accounts Receivable

1. Get Clear On Your Credit Policies

Optimize policies to your advantage. Even if you’re selling on credit, you’ll always have standards in place when dealing with new and existing customers or problematic ones that affect overall AR performance. Get clear and concise with your policies when it comes to handing out credit and collecting receivables.

Some of the most critical factors you need to consider are:

- Your system for evaluating customer creditworthiness

- Factors that determine credit limits and when you extend them for customers

- The extent to which you collect overdue receivables

- When to take an account over to legal

Remember to enforce policies consistently since they’re no good only on paper. Your sales and finance team are at the forefront when getting these policies into practice. Review all of them regularly to spot flaws and adapt to changing conditions.

2. Enhance Your Billing & Invoicing

Many SMEs don’t recognize the impact of invoicing in getting on-time payments. Your invoices have all the details your customers need to pay you in a timely fashion. You want to ensure that you get all these details right the first time.

Payment delays can occur due to errors in the information written on an invoice. Errors on unit quantities, pricing, discounting, and terms can confuse customers and inadvertently delay payments. Invoice delivery mistakes and slow invoice generation can also result in prolonged accounts.

You can avoid these issues with an invoicing system that sends out accurate, clear, and timely invoices to the right customers. You can do this through invoice automation. Our platform lets you automate all invoicing functions, from physical or e-invoice generation to multi-channel deliveries.

Automation reduces your team’s workload, speed-up your process, and most importantly, helps you avoid errors.

3. Create a Convenient Customer Recording System

Ensure that your customer master record is well-structured and efficient. You’d want a clean and intuitive database that conveniently shows you the status of each customer since billing, collection, and AR tracking relies on this database.

Your master record should reveal all necessary information regarding a specific account, like credit limit, payment terms, and due date. It must also reflect every change, like when a customer’s credit term gets extended or when you freeze an account.

Using AR software to get everything under a centralized dashboard helps organize your customer data. From there, you or your team can collaborate, send out reminders, conduct audits, and promote credit control protocols.

4. Regularly Keep Track of KPIs

Businesses actively keep track of cash flow KPIs. These indicators reveal whether a company meets financial health goals and objectives.

Metrics such as days sales outstanding (DSO), accounts receivable turnover ratio, accounts receivable collection period, and AR aging reports provide a good glimpse of AR performance and cash flow health.

Your financial reports also provide valuable insights into your efficiency. A cash flow statement directly tells you your cash flow health, reflecting how well you’re collecting what you’re owed during a particular period.

The magic happens when you plot these KPIs into beautiful trend lines to see how you’re doing period-over-period. Trends help you spot strengths and weaknesses since they provide an extensive overview of what’s going on.

Consider accounting software to simplify KPI tracking. And with Peakflo connected, you can effortlessly create reports and forecasts, calculate critical cash flow metrics, and monitor changes, ensuring you always remain on top of everything involving AR performance.

5. Find Dents In Your Collection Processes

Getting paid is the intent, and we all love it when it happens. Still, not everyone proactively collects customer balances. To ensure prompt payments, see if there’s something you can further improve in your collection process.

For example, you might want to streamline your recording to give your team a better view of which accounts belong to healthy collectables and which ones are at risk of defaulting.

Also, take a closer look at your collection policies to see if your team implements them. Often, slow collection times result from your team ignoring guidelines, such as when they fail to conduct appropriate follow-ups and reminders.

Maybe your team lacks the know-how to make efficient collections, or perhaps it’s a recording issue where they don’t get correct and timely information. Whichever it is, closely analyzing your current collection process helps spot dents that shouldn’t be there.

6. Make Sure You’re Easy To Pay

Speaking of collection improvements, many businesses still overlook the importance of setting up convenient payment methods to improve customer payment times. Each client is different, and not everyone finds the same payment method easy. Luckily, there’s no stopping you from offering multi-payment channels.

You can offer debit and credit cards, eWallet, and payment processors apart from cash transfers and checks. To take it a step even further, why not provide them with an intuitive dashboard where they can see everything and communicate to you as they see fit?

That’s what we’ve worked on here at Peakflo. When you integrate us into your accounting system, your customers can start enjoying an all-in-one dashboard where they can view invoice statuses, ask queries, or raise concerns. Easy. Your customers can also make multi-channel payments from the dashboard, ensuring you get paid on time.

Peakflo Helps You Get Paid Faster

Why spend too much time chasing payments? With Peakflo, you’ll have everything you need to manage your AR efficiently. Automate tasks and leverage a centralized workplace. Take steps to get paid faster and improve AR.