Have you ever wondered why smooth invoice payments are important for businesses? Delayed or inconsistent payments can disrupt cash flow and create unnecessary complications. This often happens due to inefficiencies in the accounts payable process.

Invoices are essential for keeping finances clear and ensuring compliance with the law. In Singapore, with its Goods and Services Tax (GST) framework and strict regulations, businesses of all sizes must understand how invoice payment works. For example, in 2019, 28% of surveyed enterprises in the infocomm and media sector used e-invoicing.

This guide focuses on invoice payment needs in Singapore, covering key components, regulatory requirements, and best practices to streamline your accounts payable operations.

Understanding Invoice Payment in Singapore

Invoices are formal documents issued by sellers to buyers. They list the goods or services provided and request payment. Invoices play an important role in maintaining financial clarity, tracking transactions, and ensuring compliance with regulations.

Proper invoicing practices are not just helpful—they’re necessary—in Singapore, where businesses must follow strict financial rules. Whether you run a small business or a large corporation, having clear and accurate invoices helps avoid misunderstandings, supports tax compliance, and keeps operations running smoothly.

For example, GST-registered businesses must issue invoices that meet specific requirements, such as including the GST registration number and clearly showing the tax amount.

Invoices help sellers track payments, reduce disputes, and maintain a steady cash flow. Buyers, on the other hand, provide transparency by confirming what they’re being charged for and when payment is due. A well-prepared invoice builds trust between both parties by ensuring that every detail of the transaction is clearly documented.

Why Are Invoices Important in Singapore?

Invoices play a key role in Singapore’s financial ecosystem by facilitating accurate financial transactions, ensuring proper accounting practices, and maintaining tax compliance. They are essential for:

Sales Tracking: Invoices are records of all your sales, giving you a clear view of your earnings and helping you plan for growth.

Managing Payments: They help you keep track of what has been paid and what is still due, making cash flow management simpler and more reliable.

Tax Compliance: GST-registered businesses rely on accurate invoices to report and pay taxes correctly. A GST-compliant invoice shows the total amount charged and the GST breakdown.

Audits and Reviews: Invoice payments provide an organized trail of transactions, which can be invaluable during financial audits or internal reviews.

To issue authentic invoices, you must ensure they include specific components that meet Singapore’s regulatory standards.

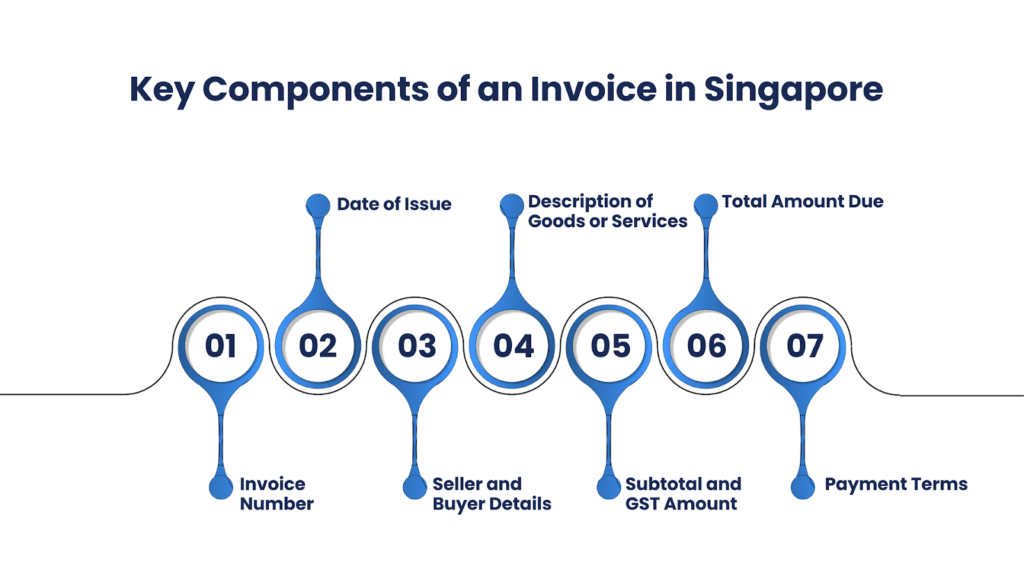

Key Components of an Invoice Payment in Singapore

Every part of an invoice has a purpose, from showing payment details to following GST rules. By understanding these components, you can improve accuracy, avoid payment delays, and effectively meet compliance standards.

A well-prepared invoice not only ensures timely payments but also compliance with local regulations. The following elements are mandatory:

- Invoice Number: A unique identifier to distinguish invoices.

- Date of Issue: Indicates when the invoice was created, helping track payment timelines.

- Seller and Buyer Details: Includes names, addresses, and GST registration numbers (if applicable).

- Description of Goods or Services: A detailed breakdown prevents disputes over unclear terms.

- Subtotal and GST Amount: Clearly states the cost before and after taxes.

- Total Amount Due: Ensures clarity on what the buyer owes.

- Payment Terms: Specifies the due date and accepted payment methods.

For example, a software company might issue an invoice stating, “January 2025 SaaS Subscription: $500 + $35 GST = $535 total.”

Invoice Payment Regulations in Singapore

In Singapore, adhering to invoice regulations is necessary for maintaining compliance, avoiding penalties, and ensuring smooth accounts payable processes. Proper invoicing supports efficient payment workflows and builds credibility with vendors.

In accounts payable, handling invoices properly is necessary to ensure timely payments, maintain compliance, and avoid penalties. Efficient invoice management helps you build strong vendor relationships and organize financial operations.

Goods and Services Tax (GST) Requirements

GST is a tax applied to most goods and services in Singapore. Businesses in Singapore need to process supplier invoices in compliance with GST regulations. Here’s what to keep in mind:

GST on Supplier Invoices:

If a supplier provides goods or services with GST, the invoice must clearly display the GST amount. For example:

- Goods Cost: SGD 1,000

- GST (7%): SGD 70

- Total Amount Due: SGD 1,070

Checking the GST Registration Number:

When processing an invoice, ensure the supplier’s GST registration number is included. This verifies that the supplier is GST-compliant, reducing risks during audits.

Verifying Invoices for Accuracy

Before making payments, the AP team must verify invoices to avoid errors or disputes:

- Confirm the amounts and GST calculations are accurate.

- Check that goods or services were received as specified.

- Flag any discrepancies for resolution before payment.

Record-Keeping for Audits

You must store all paid invoices, whether digital or physical, for at least five years. Proper records simplify audits, help resolve disputes, and ensure financial reports remain accurate. Organized record-keeping also supports smoother vendor reconciliation.

By focusing on these practices, you can organize your accounts payable process and avoid issues like delayed payments, non-compliance, or vendor disputes.

Invoice Payment Process: A Step-by-Step Guide

The invoice payment process might sound simple, but having a structured approach makes all the difference. It helps businesses avoid mistakes, stay organized, and keep vendors happy. Here’s a clear guide to managing the invoice payment process effectively:

1. Receiving and Logging the Invoice

Invoices can arrive in different ways—email, mail, or electronic platforms. It’s important to have a system in place to handle them consistently. All invoices should be captured in one system so none are overlooked.

Once the invoice is received, record the key details. This includes the invoice number, date, vendor name, and amount. Using tools like AI-powered OCR can automate this step. It helps ensure that every detail is accurate and saves time for your team.

Why it matters: Keeping track of invoices as soon as they arrive helps prevent delays or missing payments.

2. Verifying Invoice Details

Before approving an invoice, make sure the information matches what was agreed upon. This step involves checking the invoice against the purchase order and any delivery receipts. This process, known as “three-way matching,” ensures that the prices, quantities, and terms are correct.

If there are any errors—like missing items or incorrect amounts—work with the vendor to resolve them right away. Addressing issues early avoids bigger problems later in the process.

Why it matters: Verifying invoices ensures you’re only paying for what you actually received, at the agreed price.

3. Routing for Approval

After verifying the invoice, it needs to go through the approval process. This step ensures that the right person authorizes every payment. Your company’s policies should define who can approve different types of invoices. For example, small payments might only need one approval, while larger amounts may require more oversight.

Automation can make this step faster. Approval workflows notify the right people and track progress, so invoices don’t get stuck in someone’s inbox.

Why it matters: A clear and efficient approval process keeps payments on schedule and reduces delays.

4. Scheduling and Processing Invoice Payments

Once an invoice is approved, schedule the payment. Align the payment date with the due date on the invoice. This ensures you avoid late fees and, if possible, take advantage of early payment discounts.

Select a payment method that works best for the vendor. Options like ACH transfers, credit cards, or electronic payments are reliable and easy to track. Double-check all payment details before processing to avoid any errors.

Why it matters: Paying invoices on time strengthens vendor relationships and helps maintain smooth cash flow.

5. Keeping Records and Reconciling Accounts

After payments are made, store all related records. Keep copies of invoices, approval confirmations, and payment receipts. These documents are important for audits, tax filings, and future reviews.

Reconcile accounts payable records with bank statements regularly. This helps you spot any discrepancies, such as missing payments or duplicate transactions. It also ensures that your financial data is accurate and up to date.

Why it matters: Good record-keeping and regular reconciliation improve financial accuracy and transparency.

A clear and well-organized invoice payment process is key to running a smooth accounts payable system. It ensures payments are accurate, vendors are satisfied, and your team stays on top of their tasks. By following these steps, you can save time, reduce errors, and improve your overall workflow.

How Peakflo Can Help with Invoicing Needs

Managing accounts payable isn’t easy, especially if your team is stuck with manual processes. Tasks like handling invoices, matching purchase orders, and making payments can be time-consuming and leave room for mistakes.

Peakflo is here to change that. With its smart tools, Peakflo makes these processes faster, simpler, and more reliable. Here’s how:

1. Simplify Invoice Processing

Processing invoices manually is slow and often leads to errors. Peakflo’s AI-powered invoice processing takes care of this by automating everything. It scans invoices and captures details like the vendor’s name, amount, and date—all in just seconds.

This means no more tedious data entry or misplaced information. Your invoices are processed quickly and stored in an organized system, making it easy for your team to find them whenever needed. With Peakflo, you can focus on other priorities while your invoicing runs smoothly.

2. Get Accurate PO Matching Every Time

Matching invoices with purchase orders (POs) is important for ensuring accurate payments. However, it’s also one of the most time-consuming parts of accounts payable. Peakflo simplifies this process with automated two-way and three-way matching tools.

These tools check invoices against purchase orders and receipt notes to ensure the details match. If there’s a discrepancy—like an incorrect price or missing items—it’s flagged immediately. This keeps your payments error-free and prevents unnecessary spending or delays.

3. Streamline AP Payments and Reconciliation

Paying vendors on time is essential to maintaining strong relationships. Peakflo makes it easier by automating payment schedules and offering flexible payment options like bank transfers or e-payments. Payments are processed quickly, and everything is tracked for transparency.

Peakflo also simplifies reconciliation by automatically matching payments with invoices. This ensures your accounts are always accurate and up to date. If there’s a mismatch, your team is alerted right away so it can be resolved quickly. No more chasing numbers or dealing with messy records.

Conclusion

Invoices are a key part of managing accounts payable. They aren’t just documents—they help keep your business organized and running smoothly. When managed well, invoices ensure payments are made on time, vendors are happy, and cash flow stays under control.

In a country like Singapore, where financial regulations are strict, managing invoices properly is especially important. It helps businesses stay compliant with tax rules, avoid disputes, and prepare for audits with less stress. Automating tasks like invoice processing, matching, and payment tracking can save time, reduce errors, and make the entire accounts payable process more efficient.

Peakflo simplifies all these steps. It automates invoice workflows, matches POs accurately, and keeps payments on track. With Peakflo, finance teams can work faster, avoid mistakes, and get real-time insights to make better decisions. These tools take the pressure off your team, so they can focus on tasks that help the business grow.

If you’re ready to improve how your business handles invoices and payments, Peakflo can help. Request a demo to see how it can transform your accounts payable process and free up time for what matters most.