Vendor payments make up a large part of your cash outflow, so it’s important to manage them carefully, even after they’ve been paid. This is where vendor reconciliation comes in. Without regular checks, accounting teams may accidentally make double payments.

Vendor reconciliation is the process of comparing your internal records with your vendor’s financial statements. It’s important to make sure your accounts payable match the vendor’s statement.

In this article, we’ll explain why vendor reconciliation is important, the steps to do it, and its benefits.

What is Vendor Reconciliation?

Vendor reconciliation involves checking for any discrepancies between vendor invoices and the vendor’s account. This is done by comparing your accounts payable balance with your vendor’s payment records. It helps uncover any mistakes or inconsistencies between the amount charged and the goods or services your business receives, making it a crucial step in managing accounts payable.

In the accounts payable vendor reconciliation process, you match vendor documents from various stages. This includes comparing paid and unpaid invoices with bank statements or receipts to track what’s been paid and what’s still owed. Other documents like vendor statements, purchase orders, and goods received notes can also be used to ensure accurate matching.

A supplier statement, for example, lists all paid and unpaid invoices and credit notes. By systematically comparing these documents, discrepancies are identified and recorded in a vendor reconciliation report.

An Example of Vendor Reconciliation

A vendor sends you the following statement at the end of the month:

| Date | Reference | Due Date | Amount | Paid | Balance |

| 3/02/24 | INV-220 | 3/10/24 | $3,400.00 | ($3,000.00) | $400.00 |

| 3/15/24 | INV-221 | 3/20/24 | $1,000.00 | ($1,000.00) | $0.00 |

| Total | $4,400.00 | ($4,000.00) | $400.00 |

According to their records, your outstanding balance is $400 after making a payment of $4,000 during the month.

After reviewing your AP ledger, you find the following account details for this vendor:

| Date | Reference | Net | Account Total |

|---|---|---|---|

| 3/02/24 | INV-220 | $3,400.00 | $3,400.00 |

| 3/05/24 | Check #10043 | ($3,000.00) | $400.00 |

| 3/10/24 | Check #10044 | ($400.00) | $0.00 |

| 3/15/24 | INV-221 | $1,000.00 | $1,000.00 |

| 3/20/24 | Check #10050 | ($1,000.00) | $0.00 |

| Ending Balance | $0.00 |

Your records show that you made a payment of $4,400 to the vendor in March 2024 and your ending balance shows $0 which is $400 less than what they claim you owe.

Looking at the transactions line by line, you identify the discrepancy is due to invoice INV-220 for which you issued two checks of $3,000 and $400 respectively. However, in the vendor statement, only the first payment of $3,000 is recorded and the second payment of $400 might have not been recorded.

You need to contact the vendor to inform them of the error, so they can provide a corrected statement and update their records.

Without reconciling the vendor statement, you might have assumed their balance was correct and ended up overpaying by $400.

While this error may have been an honest mistake, small discrepancies like this can accumulate over time, especially when dealing with multiple vendors. Regular reconciliation can help ensure you’re only paying what you owe, saving you from unnecessary costs.

What Is the Reason for Vendor Reconciliation?

There are several benefits of vendor reconciliation, which enables your business to:

- Having better control over vendor spending: guarantee that the goods, inventory, or services the business receives match the vendor’s charges to prevent overpayments and underpayments,

- Strengthening vendor relationships: vendor reconciliation encourages timely and accurate payments toward vendors, which is an opportunity to maintain good vendor relations.

- Claim discounts: You can also view discounts your vendor has yet to enter. The amount due to the vendor will be reduced if these entries are corrected.

How Do You Reconcile Vendors?

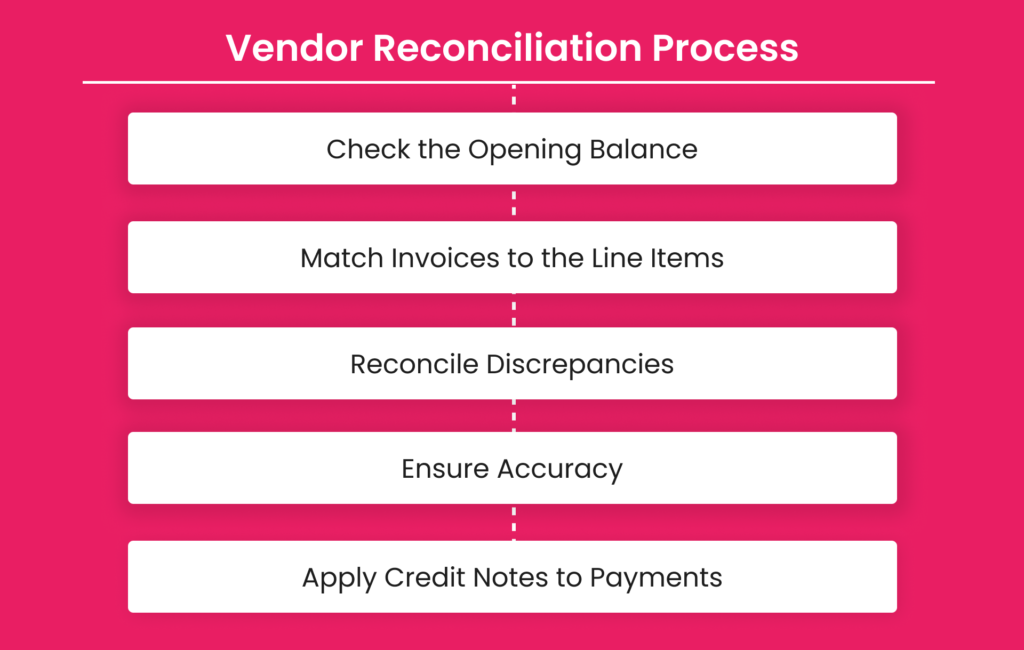

To understand how to reconcile the vendor’s account, you see the vendor reconciliation process flowchart below.

1. Check the Opening Balance

To start off, you will have to check and ensure that the amount is tallied between the opening balance of the vendor’s account payable ledger and the vendor’s balance statement. In addition, your closing balance from the previous month should also be tallied to the opening of the current month.

2. Match Invoices to the Line Items

Next, thoroughly match line items from the vendor’s invoice and the vendor’s statement. This can commonly be done when the items have been delivered so you can examine whether the amount on the invoice reflects the delivered quantity.

In case you find items that are both in the invoice and supplier statement, you can exclude them for the upcoming step.

3. Reconcile Discrepancies

Then, ensure the items that remain after the filtration from the previous step reflect the items within the vendor statement outside of the account payable ledger. This is also known as the items on the vendor statement that aren’t added to the account payable ledger. You can discuss these discrepancies with your vendor and find out the root cause.

This can be caused by timing differences, which occur when you have already paid, but the vendors did not receive the notification immediately. It is also possible the imbalance is due to missing records of transactions from either party.

4. Ensure Accuracies

Make sure that purchase transaction documents are authorized and follow what has been processed. The management of vendor invoices also has to be inspected, as they have to be recorded and posted timely by the account payable team.

5. Apply Credit Notes to Payments

While this verification is typically done before payments are made, it’s advisable to double-check for any missed offers and discounts. It’s also important to include credit notes in the verification process. Without them, it would be impossible to determine why a payment appears in the vendor’s statements but in the debit section of your own statement.

What Are the Challenges of Vendor Reconciliation?

Vendor reconciliation is done frequently, which could take much of your time and energy.

While reconciling the vendor’s account, you must ensure the process is done on time. This might be a great challenge itself, as your company might have a lot of vendors. However, delays in vendor reconciliation might lead to discrepancies that could affect the company’s financial reporting.

There are also supporting documents, such as purchase orders and goods receipts, that could come in different formats, such as excel sheets or printed papers. If done manually, reconciling these documents might add unnecessary stress and reduce your productivity.

Why Should You Automate Vendor Reconciliation?

With all the weariness of doing endless reconciling vendor accounts, you might need a system that could help facilitate the reconciliation process. With Peakflo, you can automate your process of vendor reconciliation by reducing any redundant steps.

Peakflo can enhance the benefits of the vendor reconciliation process by:

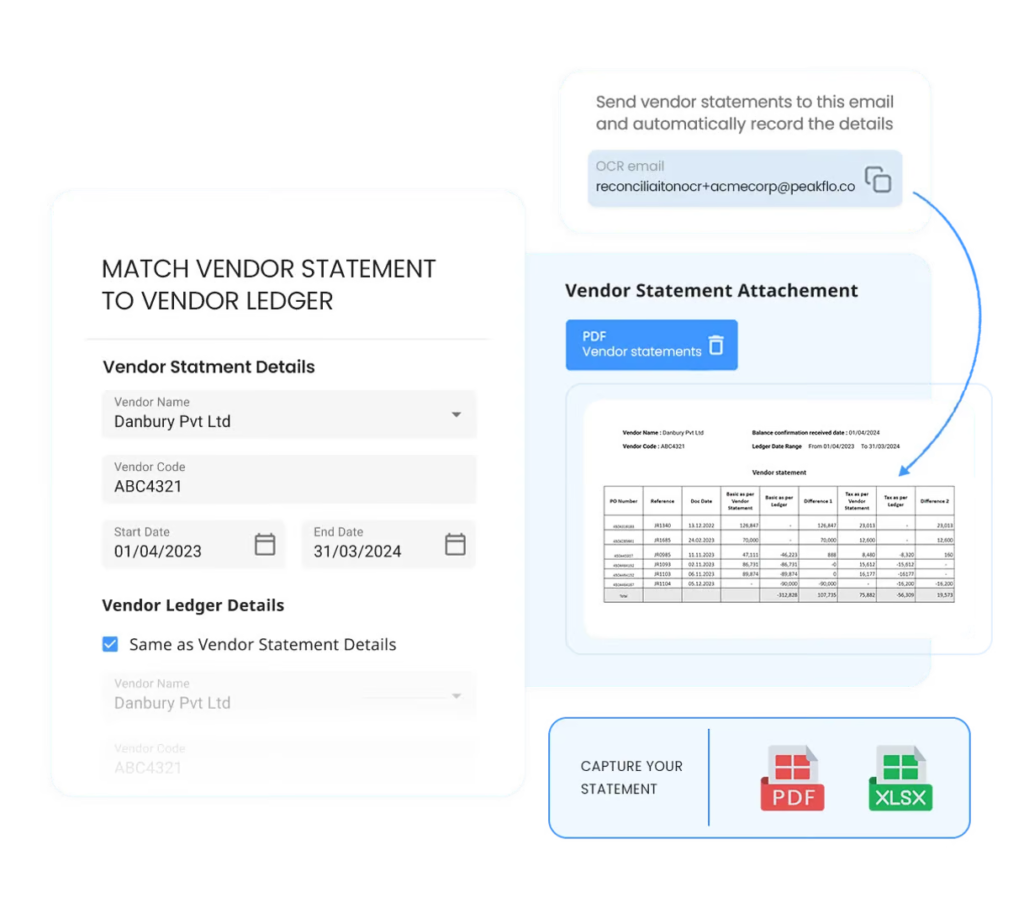

AI-Powered Vendor Statement Capture

Manually extracting data from PDF or Excel statements is time-consuming and error-prone. With Peakflo’s AI-powered statement capture, vendors can send statements directly to a dedicated email, and Peakflo will automatically extract all the details with high accuracy. Your team can also upload PDF or Excel files, making the reconciliation process quicker and easier.

Simplifying Invoice Mismatch Detection

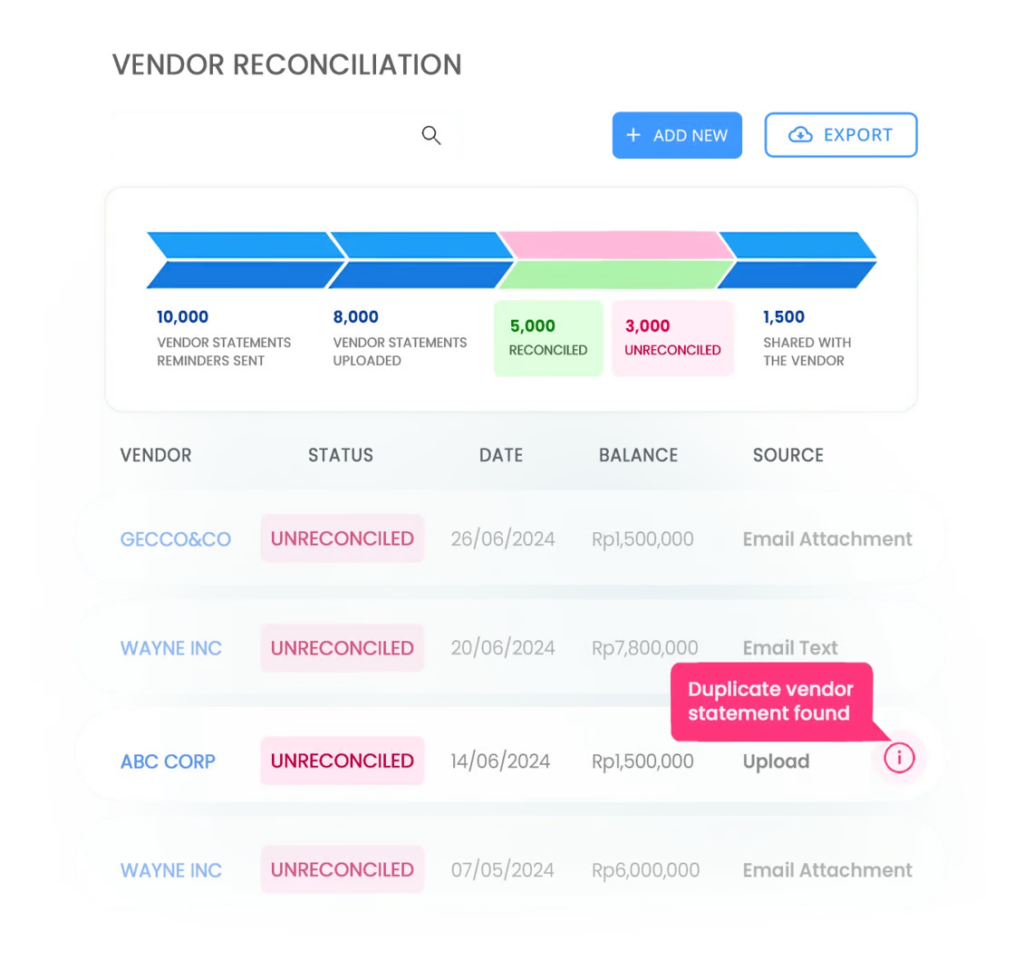

Peakflo’s AI-powered vendor reconciliation helps your AP team quickly find and fix invoice mismatches. It automatically checks each line item—like subtotal, tax, and withholding tax—calculates any differences, and flags discrepancies, saving time and reducing errors.

With Peakflo, you can quickly share any mismatches with your vendors. They can view all discrepancies in one place and send you the corrected statements via email, making the reconciliation process smoother and faster.

Organize Vendor Communications in One Place

With our user-friendly dashboard, your finance team and the vendor can communicate hassle-free. You can grant limited access to your vendors, which they can view and edit their personal information, include payment preferences, and oversee invoice payments safely.

Integrate with Ease

Peakflo can be seamlessly integrated into your accounting software, such as Xero, NetSuite, Jurnal, Quickbooks, or Zoho CRM. This way, you can leverage our automation into your current work and activate 2-way sync for faster reconciliation.

Sync the transactions and three-way match to your accounting software and say goodbye to manual data exports and imports.

Improve Reports and Audits

With Peakflo, your Accounts Payable team can easily track all vendor reconciliations, giving them full visibility of the process. It helps auditors complete their work faster and ensures no duplicate documents are paid, keeping your vendor data accurate and preventing overpayments.

Conclusion

Peakflo’s Procure-to-Pay and Vendor Management solution plays a crucial role in streamlining vendor reconciliation processes. By automating and centralizing key aspects of vendor management, such as invoice processing, payment approvals, and vendor communication, Peakflo simplifies the reconciliation process. Its ability to capture and integrate credit notes ensures that discrepancies are promptly identified and resolved.

Peakflo empowers businesses to manage their vendor relationships more efficiently, leading to improved accuracy, reduced manual effort, and enhanced financial transparency.

Intrigued about automating your finance process? Take a look at our product tour!