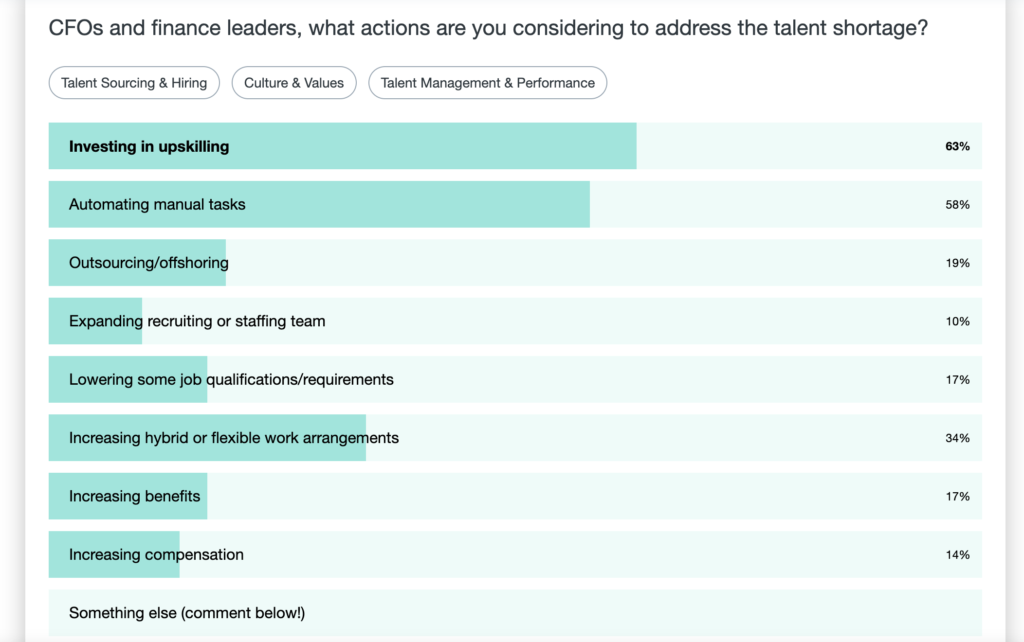

In 2024, 83% of finance leaders reported facing a talent shortage, with 10% noting that the situation is worsening. For finance departments, this poses significant challenges, including disruptions in cash flow management, delays in processing times, and strained relationships with customers and vendors.

With fewer hands on deck, finance teams must navigate increasing workloads without compromising on accuracy or efficiency. But how can lean finance teams excel when talent is scarce?

The Rise of Automation in Finance

Short-staffed departments are finding solutions in automation. A recent Gartner survey highlights that 58% of CFOs and finance leaders are investing in automation to address talent gaps.

Automation isn’t just a temporary fix—it’s a transformative shift in how finance operations are managed. By automating repetitive, time-consuming tasks like invoice data entry, payment processing, and dunning emails, finance teams can free up valuable time for higher-level strategic initiatives. Moreover, automation systems can flag errors and discrepancies in real-time, making reconciliations and month-end closes significantly faster and more accurate.

A Real-World Example: Automating Accounts Payable

One of the clearest examples of automation’s impact is in accounts payable (AP). Traditionally, processing an invoice manually takes 10–12 minutes per invoice. With automation, this time is slashed to just 1–2 minutes.

Think about the time savings this represents for a team processing hundreds or even thousands of invoices each month. By automating AP, lean finance teams can handle a higher volume of transactions without needing additional resources.

The Strategic Advantage of Automation

The benefits of automation extend beyond efficiency. By removing repetitive tasks from their plates, finance professionals can focus on:

- Strategic Decision-Making: With more time available, teams can analyze financial data and provide insights that drive growth and innovation.

- Strengthening Vendor Relationships: Faster invoice processing means vendors get paid on time, improving trust and collaboration.

- Cash Flow Optimization: Automated systems provide real-time visibility into cash flow, enabling better planning and forecasting.

Automation is no longer a “nice-to-have” but a necessity for lean finance teams aiming to do more with less. These tools not only boost productivity but also enhance accuracy, reduce errors, and help finance departments remain agile in the face of challenges.

What’s Your Strategy to Combat Talent Shortage?

The talent shortage in finance isn’t going away anytime soon. As the demand for skilled professionals continues to outpace supply, finance leaders must rethink their strategies. Are you leveraging automation to fill the gaps? Are you equipping your teams with the tools they need to succeed?

For lean finance teams, the choice is clear: embrace automation or risk falling behind. By automating key processes, finance leaders can turn a challenging situation into an opportunity for growth and innovation.

So, as a finance leader, what steps are you taking to combat the talent shortage?