Managing accounts receivable is no easy feat—especially when juggling hundreds of invoices, late payments, and tracking customer credit performance. One of the most insightful KPIs to monitor the health of your collections process is the Collection Effectiveness Index (CEI).

To make it easier, we’ve created a free downloadable CEI calculator template that helps you measure monthly collection efficiency and identify areas for improvement.

What Is the Collection Effectiveness Index (CEI)?

The Collection Effectiveness Index (CEI) measures how efficiently your business converts accounts receivable into actual cash within a defined period. It gives you a percentage-based view of how well your team collects what’s due—factoring in new sales, past receivables, and overdue invoices.

Unlike DSO (Days Sales Outstanding), which is time-based, CEI gives you a sharper view of your collections performance in a specific period.

CEI Formula (with Example)

Here’s how CEI is calculated:

CEI = [(Beginning Receivables + Credit Sales – Ending Total Receivables) / (Beginning Receivables + Credit Sales – Ending Current Receivables)] × 100

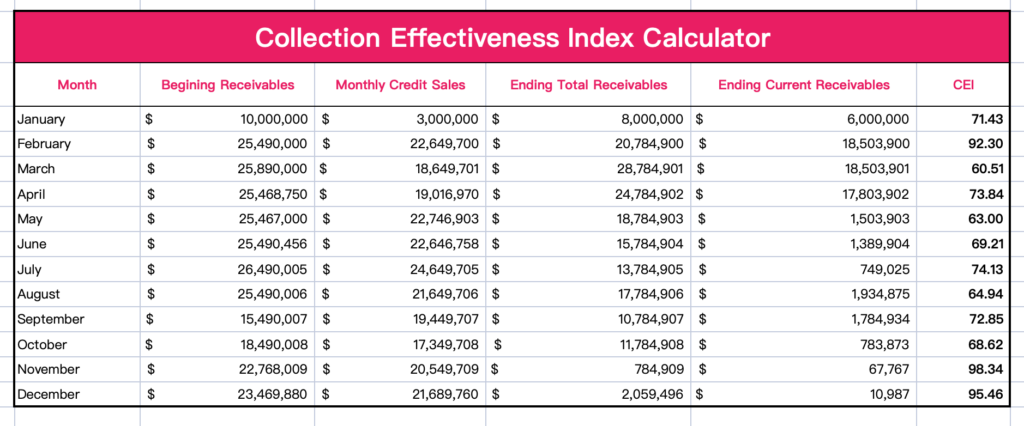

Let’s look at an example from our calculator template:

- Beginning Receivables: $1,00,00,000

- Monthly Credit Sales: $30,00,000

- Ending Total Receivables: $80,00,000

- Ending Current Receivables: $60,00,000

Plug it into the formula:

CEI = [(1,00,00,000 + 30,00,000 – 80,00,000) / (1,00,00,000 + 30,00,000 – 60,00,000)] × 100

CEI = (50,00,000 / 70,00,000) × 100 = 71.43%

This means the business collected 71.43% of the amount it could have collected that month.

Why Is CEI Important?

- Benchmark Your Collection Efficiency: Track how much of your AR is actually being collected.

- Spot Cash Flow Issues Early: A declining CEI is a red flag.

- Improve Collection Practices: Use CEI trends to inform dunning strategies, automation tools, or customer segmentation.

A CEI of 80% and above is generally considered good. Anything below that indicates there’s room to tighten up your receivables strategy.

How the CEI Calculator Works?

Our free CEI calculator helps you:

✅ Auto-calculate CEI month-by-month

✅ Track changes in collections efficiency

✅ Spot overdue risks early

✅ Share insights easily across finance teams

Tips to Improve Your CEI

- Automate Invoice Reminders – Don’t wait for due dates to follow up.

- Offer Flexible Payment Options – Make it easy for customers to pay on time.

- Prioritize High-Risk Accounts – Focus efforts where delays are likely.

- Set Up Clear Credit Policies – Tailor payment terms based on customer risk.

- Leverage AR Automation – Tools like Peakflo streamline collections and improve visibility.

How Peakflo Helps You Maximize CEI

Peakflo’s AI-powered AR automation helps companies improve their CEI by:

- Sending personalized, smart reminders

- Offering multi-channel, multi-language communication

- Enabling multiple payment options

- Giving real-time visibility into receivables and collection workflows

Want to see it in action? Book a demo with Peakflo today.