As technological innovations take over finance and accounting, chief financial officers (CFO) have become the harbingers of digitization to the finance function. This has led to an increase in the demand for CFOs with experience in digital transformation.

As a result, many CFOs are now responsible for leading the charge in digitizing the finance function. This includes initiatives such as automating financial processes, implementing new technologies such as artificial intelligence and blockchain, and developing new ways to provide insights into financial data.

What Makes a Great Modern CFO?

A great Chief Financial Officer (CFO is a tech-savvy strategic thinker who knows how to handle risks and unforeseen challenges. They go beyond just looking at finances and become an indispensable problem solver and a key player in ensuring their company’s success and progress.

While many CFOs are also accountants, this is not always the case. Some organizations may have a separate Chief Accounting Officer (CAO) who reports to the CFO. The role of a CFO is to employ critical thinking and leadership to influence the company’s direction for the better. To provide the most value for the company, CFOs must also have a knack for technology.

6 Key Qualities that Make a Great Modern CFO

Here are the most important qualities a great CFO should possess.

1. Flexibility and Adaptiveness

Change in the way we do business happens all the time. Like how great companies adapt to sudden disruptions in the market, great CFOs adapt well to challenging new business environments. Since CFOs are already accomplished future predictors, especially regarding their company’s financial positions, they have little trouble adjusting to the changes that come with those predictions.

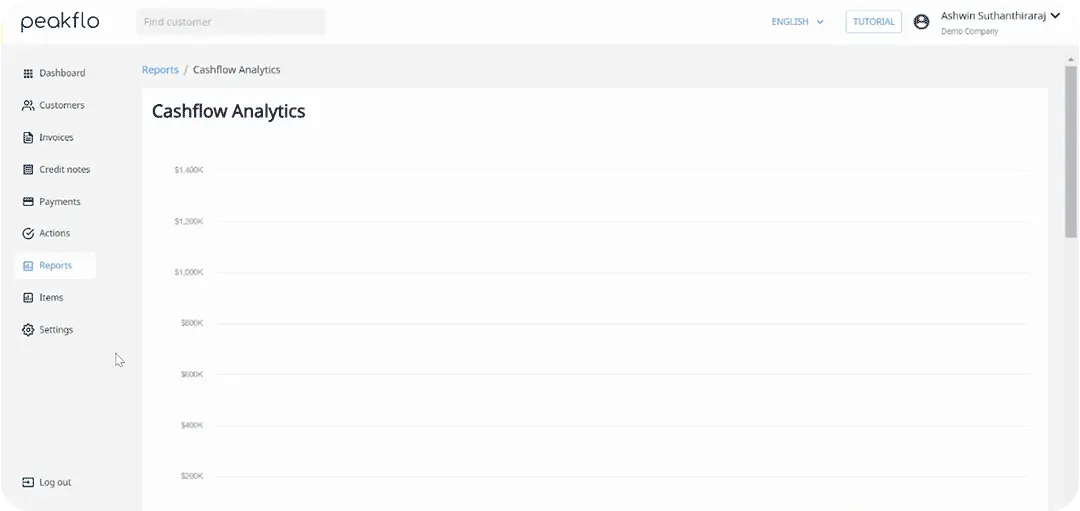

Technology is transforming the way organizations manage their finances. The best CFOs do not shy away from using technology but embrace its benefits. From cash flow analytics to AR automation platforms, they utilize various tools to streamline their finance team processes and increase productivity.

2. Exceptional Cash Management

Cash flow is the lifeblood of any business. Exceptional CFOs understand this truth on a deeper level. They know their company’s cash position and can accordingly act when things go wrong. It’s only natural for company owners to push their accounting and finance teams to create better solutions to cash flow problems. As CFO, your task is to direct this team efficiently towards extraordinary cash management and problem-solving.

Cash flow management is one of the most vital aspects of running a successful company. The way CFOs conduct this operation can make or break a business. To improve cash position, they always keep a close eye on cash, developing financial reports and forecasts while brainstorming ways to cut costs and protect company profits.

AR automation can significantly improve cash management, which is why Peakflo has designed a complete AR automation platform, offering easy-to-use automated workflows to improve AR performance and get paid on time.

3. Strong Understanding of the Value Chain

Effective chief financial officers aren’t just number crunchers. They know their company’s full range of activities end-to-end, from customer feedback to supplier relations to the day-to-day tasks of office workers. Knowing the value chain by heart paints a clearer picture for CFOs to develop sound financial strategies to present to the company’s leaders.

When tending to the company’s finances, efficiency is vital. Efficient CFOs make great efforts to influence the company’s culture towards being finance-focused. Having a finance-first priority means that every activity within the value chain is geared towards improving the company’s bottom line and cash flow. Achieving this requires cross-organizational collaborations and excellent communication skills.

4. They Bring Others On Board

Successful CFOs don’t stand alone. They are great communicators, connecting well with the finance teams, other departments, higher executives, and shareholders. By having the right collaborative skills, they can help direct resources to where it is needed most. Depending on whom they communicate with, they can comfortably tailor their communication style. However, they always maintain transparency and sincerity since they believe that doing otherwise can lead to more problems than solutions.

To ensure exceptional cash management, they focus on building and strengthening their finance team, with members that can complement each other’s weaknesses, including their own. Hardened CFOs are always on the lookout for great talent since they know from experience that even small gaps within a team can lead to big problems in the future.

5. They Think Forward

Leading CFOs have excellent perceptions. They always look beyond what’s in front of them to paint the clearest vision of where the company’s finances will be in the next 18 or 24 months.

They also understand how technology can make operations easier and give their company a competitive edge. However, this doesn’t mean they aren’t willing to roll up their sleeves and do dirty work if it means delivering value to the company.

Being a methodical forward-thinker means setting accurate evaluations for your company’s future cash position. This evaluation can serve as your firm’s benchmark, allowing you and your team to create the most efficient game plan to hit and exceed it.

Peakflo offers a seamless way for CFOs and their finance teams to develop exact cash inflow forecasts based on their recorded cash flow history. Providing finance leaders access to advanced and accurate reporting remains one of our top priorities.

Forward-thinking CFOs or controllers also ensure that their finance team shares their dynamic and progressive qualities.

Since today’s business environment requires finance teams to adapt well to what-if scenarios beyond the financial reports and forecasts, they provide the proper guidance and tools to ensure their team maintains productivity and efficiency.

6. A Knack for Automation and Analytics

Using the right technology can make a massive improvement in how your finance teams conduct their day-to-day activities. The right tools can increase efficiency and productivity in several ways, from automated workflows to easing financial planning and analytics. Ultimately, technology can save you and your team countless hours of work, saving you money and resources in the long run.

Automated Workflows

Your finance team’s primary focus should be managing your cash flow to ensure that money is always on hand to meet the company’s daily needs. But, most finance teams get stuck in a loop of repetitive, time-consuming processes that you could otherwise automate. Technologies that provide automated workflows allow you to eliminate tedious manual tasks. This means that your team can save more time and energy on far more critical things, such as developing an effective AR and AP strategy.

How Peakflo Helps CFOs and Finance Leaders

Chief financial officers, controllers, and finance managers regularly analyze vast amounts of information as they flow in and out of the company. One of the biggest challenges these leaders face today is structuring workflows in an environment where plans and data must be generated as quickly and accurately as possible.

Peakflo has developed a way for finance leaders to get a clear view of their company’s finances in one easy-to-use platform, with features that enable you to increase your team’s productivity and make it easier for customers to pay. We’ll simplify all of your A/R and cash collection processes so you can improve your most valued driver – cash flow.