Due to the sharp decline in the global macroeconomic outlook, a lot of startups and SMEs are actively cutting down expenses to extend their runway.

Consequently, many businesses across different sectors — including the big names — are laying off their employees.

In today’s rising state of inflation, companies need to find a way to survive with less manpower and capital to operate their business.

Saurabh Chauhan, our founder and CEO, will present the strategies to streamline finance process to power through these uncertain times.

Table of Contents

Why cutting costs is becoming more and more crucial for startups and SMEs?

Recently, the tech winter – signaled by the lowering rates of funding capital – has hit startups across all levels. Founders are now faced with the challenges to change their mindset, plan ahead, and make sure their company survives, as quoted from the Y Combinator’s letter.

ASEAN companies, in specific, are lacking in innovation and technology, development and competitiveness, and access to finance. These challenges, however, are easier said than done.

Technological and human resources are costly to acquire. Moreover, as the impact of the funding winter, a lot of companies might not have sufficient capital to optimize themselves in those domains.

But, there’s one solution that can help companies achieve their goals without disrupting their current processes. Keep on reading to find out.

Why should you consider automating your finance operations?

A lot of finance functions across companies spend time on tasks that add the least amount of value, such as transactional processes.

However, high-value tasks such as strategic finance, namely working cross-functionally with teams across different departments to strategize their and the overall company growth, receive the least amount of attention.

The reasons?

1. Invoicing is not straightforward, even if done on an accounting software

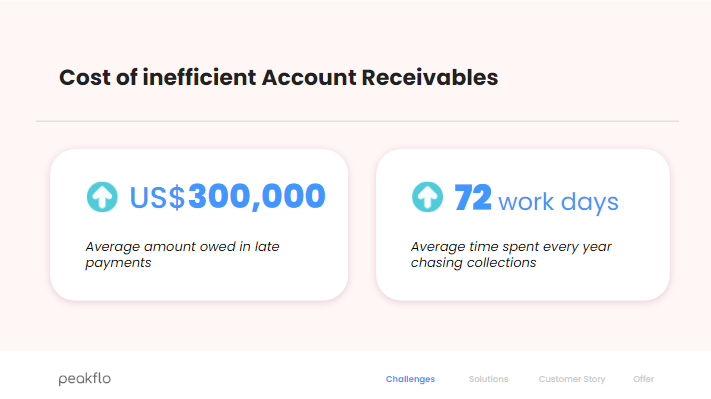

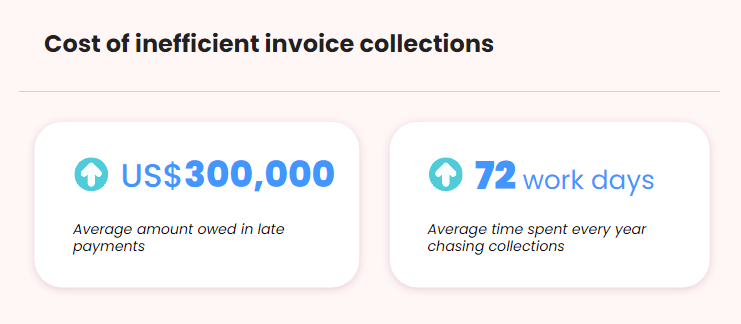

High-level data points from prove that:

Companies have to chase US$300,000 in late payments, impacting their cash flow and working capital needs, and a total of 72 work days doing manual collections, invoicing, payment reconciliation, month-end closing, and such.

Why does this happen?

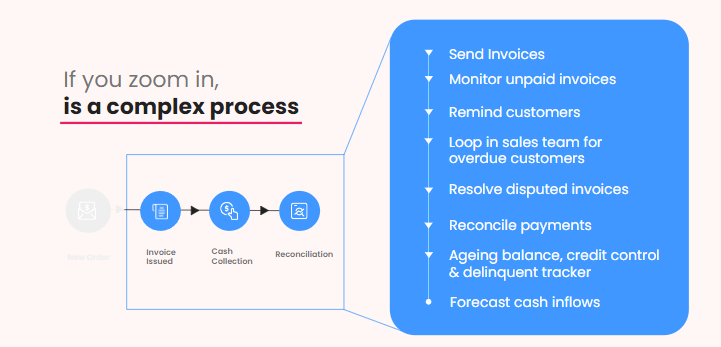

On the surface, the AR process looks simple. But, invoicing involves a lot of subcomponents that cause the whole process to be challenging to manage — even with the help of an accounting software.

Each customer has different invoicing requirements, data points, and formats. These tasks can be highly complex, especially for companies that have to issue hundreds of invoices monthly.

As a result, account managers spend most of their time chasing collections instead of generating revenue. Afterward, finance officers need to reconcile the data, but matching the payment proofs against the customer is another problem.

Moreover, companies still keep track of their financial performance through manual spreadsheets, which is time-consuming to maintain regularly and eventually does not give the team sufficient insights.

📖 Also read: How to Future-proof your Finance Functions (Panel Discussion at the Accounting and Finance Show Singapore 2022)

2. Billing and payment processes are complex and difficult to manage

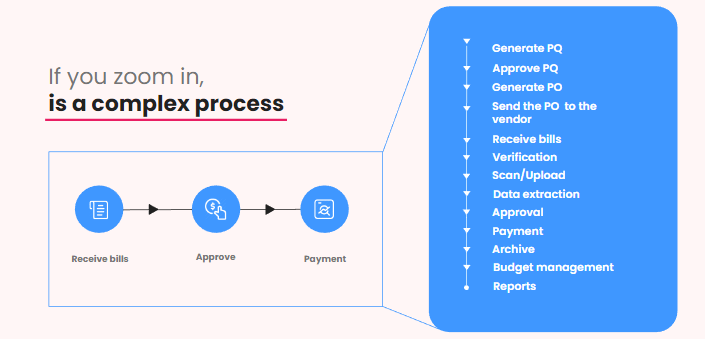

Manual accounts payable costs US$3.00 per bill processing, which then spreads out to hundreds to thousands of invoices getting stuck and a total of 52 work days.

Likewise, the accounts payable process might look simple at first. Turned out, vendor or reimbursement payment process is lengthy, tedious, and most of all, time-consuming to manage.

First, the procurement team has to create a purchase request. Then, the accountant has to seek approvals and send notifications to approvers one by one, and the internal team needs to wait for the vendor to send an invoice.

Payments are also difficult to manage. The treasury team or sometimes the CFO, depending on the nature of the business, has to open another platform to proceed with payments and manually key in the transactions.

How to automate AR and AP without disrupting your entire finance process?

Improve existing finance functions

Putting automation in place can be a viable solution without ripping apart the current processes.

Automation helps your finance operations to connect seamlessly to a single source of truth by extracting the relevant information to the company.

Involve users to build custom workflows based on an escalation matrix

- For Accounts Receivable: users can create invoicing, collection, and payment reconciliation rules. The system will instantly send the data back to the accounting software to slip into month-end closing.

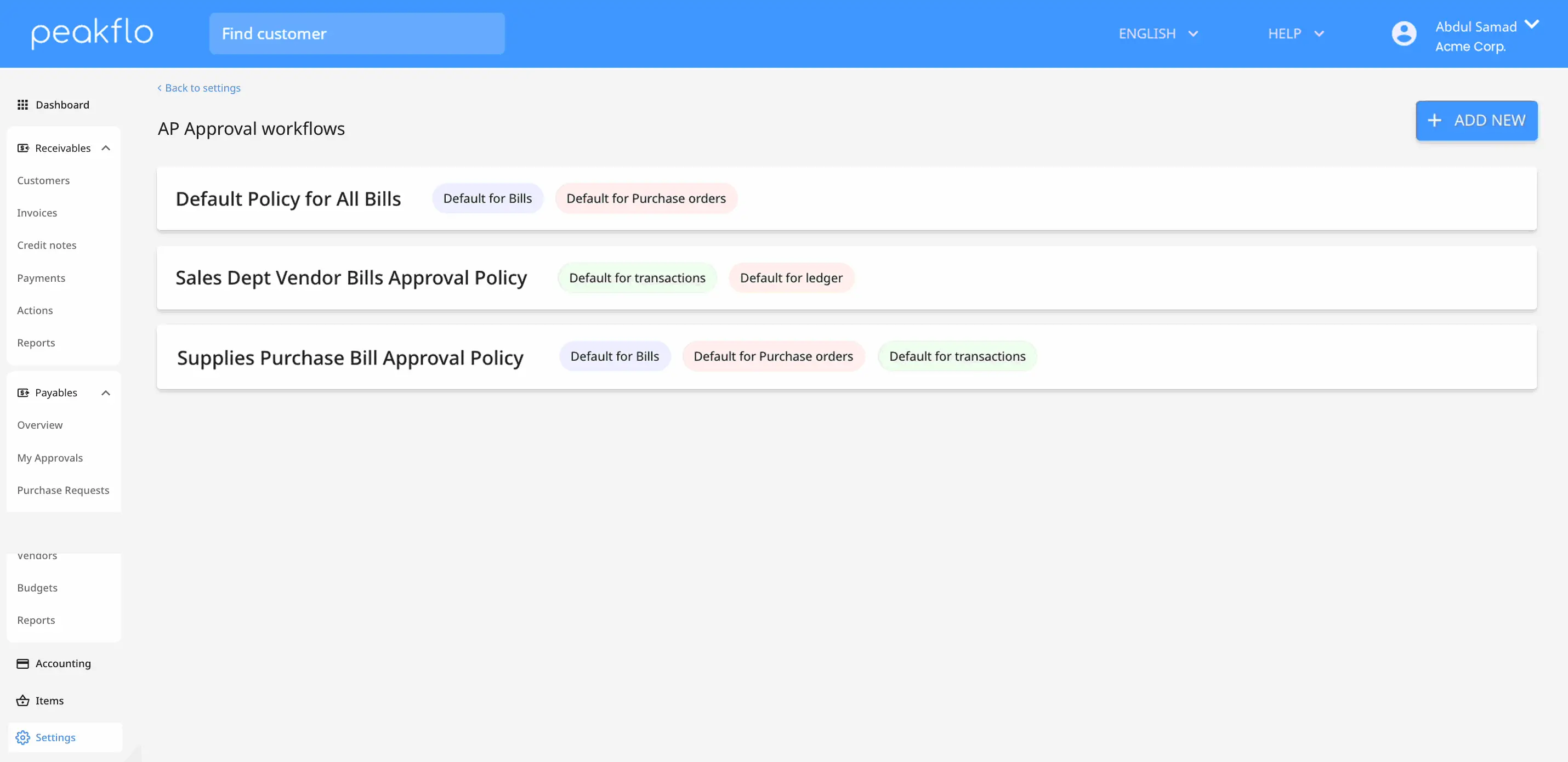

- For Accounts Payable: users can enable custom approval workflows for all the vendor invoices coming in, forward to the OCR (optical character recognition) mailbox, then send the data to the approvers and then back to the system.

The results? Manual processes reduced, and lots of money and time saved. 📈

For more details, take a look at how the following companies, from a small finance team to a large enterprise, save their time and money with automation:

How EstimateOne saves 376 hours and collects AU$ 83.3k faster with PeakfloRead nowHow EverPlate’s operational team saves 60 man-hours per month, gets paid 15 days faster with PeakfloRead nowHow NinjaVan saved 100+ manhours per month and reduced DSO by 12 days using PeakfloRead now

Previous

Next

Key Takeaways 🔑

- Manual accounts receivable and payable processes are ineffective; costing money and time.

- Onboarding an automated system will help save money and time, ensuring business growth even during the toughest times. 🚀

Interested to know more?

Book a call

Take a product tour

Share on: