Those in the startup scene are no longer a stranger to the funding winter that’s taking over the world right now.

The global economy is predicted to be increasingly unstable in the next 6-8 months as a result of multiple factors, from the global supply chain disruption due to the pandemic to the conflict in Eastern Europe.

In light of this, several Silicon Valley investors, such as Y Combinator, have been urging their portfolio founders to reduce costs if they want their businesses to sustain.

“If your plan is to raise money in the next 6-12 months, you might be raising at the peak of the downturn. Remember that your chances of success are extremely low even if your company is doing well. We recommend you change your plan”

Startups are designed to scale at a fast pace and acquire a large portion of the target audience. This leads to a lot of companies burning their cash for large-scale promotion to dominate the market.

Now, a strict policy has been implemented as investors have chosen to be more selective with their investments. Due to the changes in financial trends, investors are now looking to fund startups that can promise them profitability.

As an impact of the funding winter in addition to aggressive financial tactics, hundreds of startups around the world have been laying off thousands of employees. Some companies were even forced to close all operations.

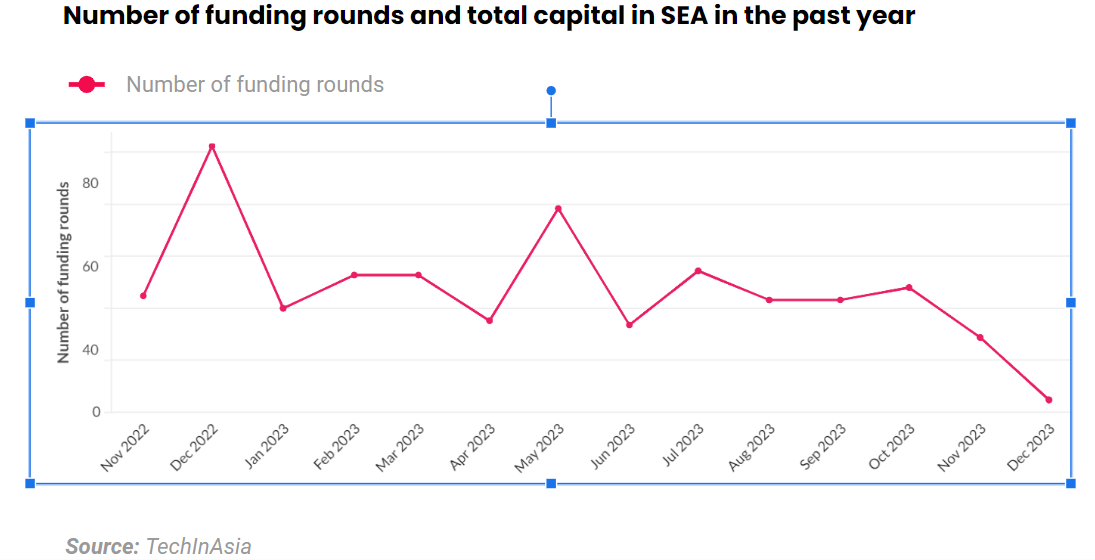

Data from TechInAsia also shows a drastic fall in the number of funding rounds.

Within the range of July to December 2023, the startup funding capital in Southeast Asia has been decreasing gradually.

So, what can companies do to deal with the funding winter? As more venture capitalists are backing down from funding, startups need to plan a survival strategy that targets financial efficiency as a solution.

Digitization and Automation of Manual Processes

The key to surviving funding winter is to re-evaluate the financial management process and cost efficiency.

Slashing operational costs won’t be a reliable long-term strategy as it can impede growth. Say, if a fintech company is to capture 5000 new users next month, then your company must recruit 5-10 new employees.

If the loan amount increases, your company may need to add additional finance staff for collection, verification, and bookkeeping. The demand will keep on coming as the burden of labor costs is getting bigger.

Even if your company decides to keep a small number of people, chances are there’ll be a drop in productivity due to the overwhelming workload.

To prevent such incidents, automating your operations will be an effective solution. Often, the automation of one business process will have a positive impact on the whole organization.

Automation allows your company to spend less time working on repetitive and mundane administrative tasks and more on developing your business.

Here are more benefits of automating your tasks:

- Increase team productivity by 50%

- Prevent errors with manual data entry

- Get real-time, up-to-date financial data

- Improve cross-division collaboration

- Streamline internal and external communication

Peakflo provides a solution to simplify and automate financial operations. With Peakflo, the billing systems run automatically. These include sending bills, scheduling payments when they are due, verifying bill details and payment notifications, and sending mass invoices or notes quickly.

You may want to know more about how Peakflo can help with cutting costs through the AR (Account Receivable) and AP (Account Payable) processes. Let’s find out below!

Save Budgets with Automated Accounts Payable Process

AP automation supports a more efficient performance as it allows your finance team to control and complete financial tasks remotely.

As a result, you can avoid fines for tardiness, thus improving your company’s reputation in the eyes of creditors, business partners, and customers.

Peakflo offers various perks in AP automation processes – here are some of them:

Peakflo offers various perks in AP automation processes – here are some of them:

Streamline Procure-to-Pay Process

Having an efficient procure-to-pay process is important to rightsize finance operations costs while supporting profitable growth. Our software allows you to create and approve purchase quotes in one dashboard. You can also set custom approval workflows with the right stakeholders and assign them to a budget. Once the purchase quote is approved by all stakeholders, the system will convert it into a purchase order and forward it to the vendor immediately.

Make Payments Securely at 0% Markup

Research found that SMEs spend $22,000 monthly on transaction fees. The costs can significantly increase as you do more transactions. As a result, the company has a hard time allocating a budget for higher-tier necessities.

Opt for a solution that doesn’t charge any fees with every transaction in a foreign currency. By paying via our digital wallet, you can reduce local or international payment fees by 75%. In addition, pay bills securely with encryption technology. This way, no need to worry about your data being unsecured.

Track Your Company’s Spending in Real-Time

Spreadsheet tracking can cause team-wide frustrations as it requires tons of maintenance. Plenty of teams lose advantageous opportunities to scale their goals with tactful forecasting. Our dashboard allows you to easily track all types of reports, from budgets to aging balances and removes the need for spreadsheets. In addition, you will get a notification if you exceed the spending limit that has been set by your company. This allows you to make a strategic decision immediately.

Save Hundreds of Man-Hours Wasted in Reconciliation

Reconciling data in paper-based spreadsheets can be a frustrating task. Standard finance software usually does not offer many integrations to begin with. Peakflo supports the most comprehensive options to integrate your accounting software – from Quickbooks to Xero. Importing your data only takes a few clicks, reducing time-consuming manual labor.

Cut Costs with Automated Accounts Receivable Process

For any business, maintaining a smooth cash flow is crucial to achieving optimal performance.

According to a survey from Quickbooks, poor accounts receivable management could lead to a business owed $300,000 in late payments. Also, it can waste staff time and make them less productive, prevent growth, and overall create poor cash flow for the business.

Here are some advantages that you can get with AR automation:

Here are some advantages that you can get with AR automation:

Get Paid 10-20 Days Faster

Adhoc follow-ups are a long process that has the potential to hurt your relationships with clients due to miscommunication. To avoid that, you can send multichannel, customized invoice reminders when the date is due from our portal. These automatic reminders help your business receive payment 2x faster than the conventional method.

Save 100 Hours/Month

In a manual setting, the staff needs to send invoice reminders one by one to customers, make books, reconcile financial data, and resolve day-to-day disputes. This whole process can take up to 100 hours of manpower, blocking the company from revenue-generating activities. Peakflo simplifies billing tasks in a modern, fast, and real-time manner.

Manage Cashflow Digitally

Lack of seamless visibility of real-time financial forecasts can lead to revenue collection delays. Keeping track of cash inflow and outflow in multiple sheets can also create siloed communications within the internal scope. Having accessible cash flow analytics that integrates financial reports will give you more visibility to make actionable decisions.

Peakflo provides real-time, smart finance reports to visualize cash flow health, predict future cash inflows, get a big picture of when an invoice is likely overdue, and understand your customers’ payment behaviors.

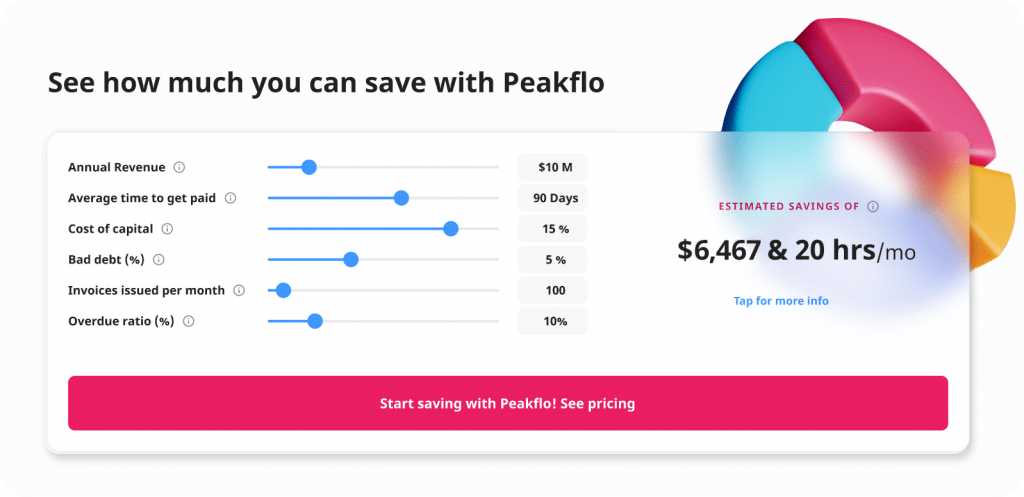

Use Savings Calculator Tool to Estimate Your Savings

Use the savings calculator tool to see the amount of money and hours that you can save with Peakflo. This way, you can estimate the monthly income projections that your company generates and analyze future financial performance.

Say, if your company has an annual revenue of $15 million and your average time to get paid is 90 days, you can save up to $9,247 from shorter payment time and $2,250 from bad debt as well as 123 hours of manual work every month.

Conclusion

Conclusion

And there you have it! Even though “winter is coming”, now you know how to prepare the right strategy to survive the storm.