Managing expense claims and reimbursement claims is something every business in Singapore has to deal with. Whether you are a small team or a large company, getting the expense claim process right can save a lot of headaches. Simply put, claim reimbursement is when employees get back the money they have spent on business-related costs.

If you are unsure about the expense claim procedure, do not worry—you are not alone. This guide will walk you through the steps to make the process smoother, clearer, and faster. You will learn what claim and reimbursement mean, how to avoid common mistakes, and how to keep everything organized so employees can get reimbursed quickly.

Understanding Expense Reimbursement

Businesses, regardless of their size, often need to cover travel-related expenses to support operations, such as transportation, lodging, and meals. When employees pay for these costs out of their own pockets, expense reimbursements ensure they get their money back. Unlike regular paychecks, these reimbursements are not taxed.

Sometimes, it is easier for employees to cover certain work-related costs themselves. A formal expense reimbursement plan helps ensure employees get their money back quickly. It also helps management control spending better and take advantage of tax benefits.

Without a clear employee reimbursement process, expense reports and reimbursement requests might get missed, delaying payments. If the plan is unclear, it can lead to frustration for both employees and managers. Known for its futuristic advancements, a lot of businesses are opting for AI-based expense management automation which we will cover in detail below.

Why Expense Reimbursements Matter for Your Business

While reimbursing employees for what they pay makes sense, you may wonder why you need a formal policy for reimbursement claims. Having a clear, accountable plan offers several benefits:

- Not everything employees pay for counts as taxable income.

- Employees are motivated to submit payments on time, helping keep things moving.

- Both staff and management save time and avoid confusion.

Many businesses do not handle reimbursement claims properly or fully. Some companies do not even track how they manage the process. Nearly half of companies do not know how much they are spending on expense reports.

Business expenses are the costs that come with running a business. You can lower your taxes by deducting allowable business expenses from your income. Only certain types of expenses can be deducted to reduce the amount of tax you pay.

Allowable Business Expenses

Allowable business expenses are the costs you can subtract from your business income. This helps lower your taxable income, which in turn reduces your tax bill.

Example: How Allowable Expenses Lower Your Taxable Income?

| Business Revenue: $100,000 Total Business Expenses: $18,000 Non-Allowable Expenses: $12,000 Allowable Expenses: $6,000 Taxable Income: $100,000 – $6,000 = $94,000 (This is your revenue after subtracting allowable expenses) |

Rules for Claiming Allowable Expenses:

- Expenses must be incurred: You incur an expense when you are legally required to pay for it. It does not matter when you make the payment.

- Expenses must be business-related: You need to show that the expense is necessary to earn income for your business.

- Personal expenses are not allowed: If the expense is for personal or private use, it cannot be claimed because it is not related to your business.

- Capital expenses are not allowed: Expenses like buying machinery or property for your business are not allowed as deductions. These are considered capital allowances.

Pro Tip: Instead of claiming tax deductions based on the actual reimbursement claim expenses you have paid, some self-employed people—like commission agents, private hire car drivers, taxi drivers, and delivery workers—can claim a fixed amount. This amount is based on a percentage of their total income, not the actual expenses they have incurred. Make sure to keep all the documents for at least 5 years.

If you want more details, check out the Fixed Expense Deduction Ratio (FEDR) for self-employed individuals.

Disallowable business expenses

Disallowable business expenses are expenses you cannot deduct from your business income. These expenses may be disallowed under the Income Tax Act. They can also be disallowed if they are not fully used to make business income.

Let us understand the difference better with a comparison table.

| Category | Allowable Expenses | Non-Allowable Expenses |

| Operating Costs | 1. Rental for business premises 2. Utilities for business use 3. Office supplies and equipment | 1. Personal living expenses 2. Home utility costs not related to business 3. Personal clothing and accessories |

| Professional Fees | 1. Accounting and audit fees 2. Legal expenses for business 3. Business consulting fees | 1. Fines and legal penalties 2. Personal legal consultations 3. Excessive entertainment expenses |

| Staff-Related | 1. Employee salaries 2. CPF and SDL contributions | 1. Family member salaries (without substantive work) 2. Personal health insurance |

| Marketing | 1. Business advertising costs 2. Trade show and conference fees | 1. Gifts exceeding reasonable business limits 2. Personal social event expenses |

| Travel | 1. Direct business travel expenses 2. Transportation for business meetings | 1. Personal vacation costs 2. Family travel expenses |

| Financial | 1. Business bank charges 2. Loan interest for business purposes | 1. Personal credit card fees 2. Personal loan interest |

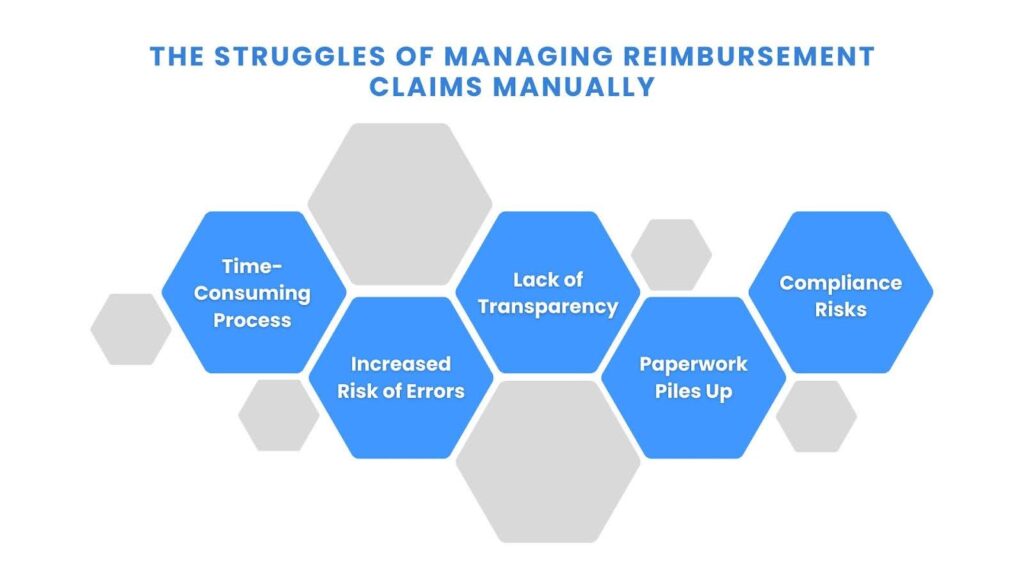

The Struggles of Managing Reimbursement Claims Manually

Handling expense reimbursement manually can create a lot of headaches for both employees and employers in Singapore. While it may seem simple at first, the process often becomes time-consuming, error-prone, and frustrating. Here are some common challenges:

- Time-Consuming Process

Employees gather receipts, fill out forms, and submit everything for approval. This can take days or even weeks, depending on the company’s approval workflow. For employers, the review and approval process can also be slow and tedious, distracting them from more important tasks.

- Increased Risk of Errors

Manual entry leaves room for mistakes. Employees might forget to include receipts or miscalculate amounts. Employers may miss out on verifying claims, leading to over-reimbursement or under-reimbursement. These mistakes often require time to fix, adding extra work for everyone involved.

- Lack of Transparency

When everything is done manually, it is difficult to track the status of a reimbursement claim. Employees might not know if their claims have been approved, and employers may struggle to get a clear overview of company expenses. This lack of visibility can lead to frustration and confusion on both sides.

- Paperwork Piles Up

With paper receipts and forms everywhere, keeping track of reimbursement claims becomes a messy task. Lost receipts or misplaced forms are common issues, making it hard to stay organized. This can cause delays in processing and even lead to disputes about missing claims.

- Compliance Risks

Singapore’s tax rules are strict. Without an automated system, companies may miss out on important deductions or accidentally overlook compliance requirements. This can lead to penalties or issues during tax season, which could have been avoided with a more streamlined process.

Streamline Your Travel Reimbursement Process with Peakflo

If you are tired of wasting time with manual travel expense reimbursements, Peakflo can help. It lets you automate the process and save time. With Peakflo’s expense reimbursement automation, you can easily handle travel requests, expense reports, and reimbursements—all at a reasonable cost. But first, let us tell you how we do it!

- Receipt Capture and Data Extraction: Employees can upload photos of expense receipts to the system. The software automatically pulls important details from these receipts, so there’s no need to enter data manually. This makes reimbursement claims faster and more accurate.

- Automated Expense Reports: Employees can quickly create and submit expense reports covered by the company. This ensures they are reimbursed for any costs paid on the company’s behalf. The system uses pre-set rules to assign the correct approval policy to each report automatically. Employees can also create expense reports in seconds by combining unreported expenses with a single click. This makes managing expenses simple and stress-free.

- Policy Compliance Checks: The software checks if expenses follow company rules, such as spending limits and approved categories. If an expense does not, it is flagged for a manager to review before approving the reimbursement claim.

- Approval Workflows: The software lets companies set up approval workflows based on specific rules. Approvers can review all the details, receipts, and policy checks in one place. They can then approve, reject, or ask for changes to the reimbursement claim.

- ERP Integrations: Peakflo’s expense management system connects smoothly with accounting and ERP systems. Once expenses are approved, the data is automatically updated in the accounting software. This removes the need for manual data entry, simplifies reports, and speeds up the reimbursement claim process.

- Processing Reimbursements: After expenses are approved, the system begins the reimbursement claim process. Depending on the company’s payment method, it can send money via direct deposit, checks, or electronic transfers. The system tracks the status of each reimbursement and lets employees know when there are updates.

- Audit Trails and Record-Keeping: Peakflo’s AI system keeps a clear record of every step—starting from capturing receipts to making payments. It saves digital copies of receipts, expense reports, and related documents. This makes it easy to reference, follow rules, and prepare for audits.

Conclusion

Managing expense claims does not have to be a hassle. Automate the process, save time, and eliminate errors. Whether it is travel or office supplies, streamlining reimbursements keeps things smooth and your finances in check.

Peakflo’s Travel and Expense Reimbursement solution does it all. It syncs with your accounting system, speeds up approvals, and gets reimbursements done faster—without the headache.

Ready for an easier way to handle expenses? Book a demo with Peakflo today and see how simple it can be!