EFT transfer, also known as Electronic Funds Transfer, has gained immense popularity among businesses and individuals as a secure digital payment method. EFT enables the transfer of funds between bank accounts through reliable payment gateways.

This article aims to provide an in-depth understanding of EFT transfer by defining it, discussing its working mechanism, and examining its different types such as ACH transfers, wire transfers, and mobile payments.

Furthermore, we will highlight the various benefits of using EFT for making payments.

What is an Electronic Funds Transfer (EFT)?

Electronic Funds Transfer (EFT) is a method to transfer money electronically between accounts, including those at different banks if both are on the Automated Clearing House (ACH) network.

The EFT payment system is a fast and convenient alternative to physical payment methods such as cash and checks and can include direct deposit, credit card transactions, ATM transactions, electronic checks, phone payments, or mobile payments.

This technology is widely used for bill payments, compensating workers each payday, and sending money to friends and family. The advantages of EFT transfers include safe wire transfers via mobile payments and greater financial transaction efficiency.

Examples of EFT

Example 1:

You may be using EFT transfer as a small business owner to pay your employees’ salary straight into their bank accounts. This process involves collecting relevant details from your staff members, initiating an ACH transfer via the bank’s online platform, and authorizing the transaction. One of the key benefits of EFT transfers is that they are highly secure and encrypted thanks to the payment gateway used. Additionally, funds are typically deposited within two to three business days after authorization. Employees are promptly notified of the payment and can immediately access their funds through their bank accounts.

Example 2:

In certain cases, a company may set up automatic payments for its regular software subscription bills by authorizing the bank to deduct the amount from its checking account each month. Similarly, individuals can opt for recurring bill payments from their bank accounts using ACH Direct Debit to cover regular expenses like mobile phone services, streaming subscriptions, and utility bills. Alternatively, customers have the option to choose recurring credit card transactions as another form of electronic funds transfer (EFT) for making these payments.

How Does Electronic Funds Transfer (EFT) Work?

EFT payments utilize various electronic funds transfer methods, depending on the specific type used. Regardless of the variation, EFT always involves online or electronic fund transfers through a dedicated payment network or system.

To make an EFT payment, you usually need to share the recipient’s bank details, including their account and routing numbers. If you’re sending money from your account, you might also have to provide your account information. It’s important to include details like the account holder’s name, the bank’s name, and the account type (checking or savings). Be sure to confirm the specific requirements with the person or entity you’re paying. For example, it will require a sender and a receiver to transfer funds through the appropriate payment network, typically the ACH network in the United States. The ACH network connects all banks, credit unions, and financial institutions and processes transfers in batches at the end of each business day.

Types of Electronic Fund Transfers

There are 8 types of electronic fund transfers:

Direct Deposit

Direct deposit has become the preferred choice of payment for many employers. This method involves electronically transferring payroll funds straight into the employees’ bank accounts, making it a hassle-free option that requires minimal maintenance from the employer. Setting up direct deposit through solutions such as Wise and Revolut is a breeze and can be done quickly and easily.

ATM Transactions

ATM transactions are a popular form of electronic funds transfer (EFT) payment method. Whenever you withdraw or deposit money from an ATM, you are essentially conducting an EFT payment via ATM transaction.

These transactions can be carried out at banks, retail stores, or even outdoor kiosks situated across the world. Although some ATMs charge a fee for their services, most ATM transactions conducted through your bank are usually free.

ACH Transfer

ACH transfer offers a safe and inexpensive way to transfer funds between banks and financial institutions in the United States. It functions similarly to wire transfers, but people and businesses usually use it for domestic transactions.

An ACH transfer is a practical choice for individuals who aren’t in a hurry because you can anticipate your payments being processed in two to three business days. For a fee, ACH transfers can be routed within one day. This payment method is commonly used for payroll deposits, bill payments, and direct deposit transactions.

Wire Transfer

Wire transfers are a dependable and quick method of transferring money across bank accounts. It uses the ACH network, but it is not an ACH transfer. The funds are deposited straight into the recipient’s account, and the transfer is generally completed the same day.

When big quantities of money must be transferred locally or globally, this sort of transaction is common. The most common example of this is sending money through Western Union, or for real estate acquisitions.

Additionally, Wire transfers are often more costly than ACH transfers.

Debit and Credit Cards

Debit cards draw on funds you have deposited at the bank, while credit cards allow you to borrow money up to a certain limit. The debit transactions typically result in lower fees for merchants. Both types of cards are secure and allow for instantaneous funds transfer.

Pay by Phone System

Pay-by-phone payment systems operate by sharing your banking details with the service provider who then debits the agreed-upon amount from your account. This method ensures that you can conveniently settle bills using pay-by-phone services.

Mobile Payments

Mobile payments are a method of transactions done between individuals, consumers, and businesses using a portable electronic device, such as a smartphone or tablet. Generally, mobile payments are made through payment apps such as PayPal, Venmo, and Apple Cash. This method is widely used for peer-to-peer transactions.

Mobile payment also facilitates as a gateway to other mobile financial services including mobile banking, insurance, credit/lending, and investments.

Electronic Check (eCheck)

eCheck, also known as electronic check, is a highly convenient form of EFT payment that replaces traditional paper checks. It involves generating a digital check using the account information provided by the checking account holder.

This process has eliminated the need for physical paper checks and allows for swift and secure transactions. While eChecks are not commonly used for personal payments, they are widely accepted for all other types of digital transfers.

What is the Electronic Funds Transfer Act (EFTA)?

The Electronic Funds Transfer Act (EFTA) is a consumer protection law in the United States that regulates electronic transactions involving funds. Enacted in 1978, the EFTA establishes the rights and responsibilities of individuals engaging in electronic funds transfers (EFT).

The law ensures transparency and safeguards for consumers by mandating disclosure of terms and conditions related to EFT services, liability limitations for lost or stolen cards, and prompt investigation of errors or unauthorized transactions.

EFTA also addresses the issue of unauthorized access to bank accounts and promotes the secure and fair use of electronic payment systems. Overall, the EFTA plays a crucial role in safeguarding consumers’ interests in the realm of electronic financial transactions.

Benefits of EFT

EFT is popular in use among businesses and individuals as it provides a lot of advantages:

1. Security

EFT eliminates the possibility of misplaced or stolen cheques. Because there are strong policies and processes in place to guard against fraud, payments received through the ACH network are regarded as secure.

When making payments electronically, both your personal and financial information are protected by secure systems that use strong encryption and other cutting-edge security features.

2. Cost-saving

EFT transfer is a cost-effective payment method that eliminates the need for paper checks or cash. It is usually free or has low processing fees, although some banks may charge a fee as small as $3 for sending an EFT to a different bank. Payroll direct deposits are generally free, and there is usually no fee for receiving an EFT payment.

3. Time-effective

EFT transfer is an automated method that no longer requires manual processing, reducing any risk of human errors. The requests can be made anytime as it is available for 24 hours. The RBI notifies banks and customers in case of service disruptions.

4. Convenience

Using EFT transfer, individuals can make payments digitally anywhere, at any time. Furthermore, it enables real-time fund transfers to beneficiary accounts. As most banks are EFT-enabled, transferring funds across the country has become hassle-free.

Pay International or Domestic Vendors Securely and Conveniently with Peakflo

EFT is a method of electronic payment transfers between bank accounts authorized under the ACH network. There are different types of EFT, so evaluate your needs properly when selecting which method to go with.

When it comes to processing payments, the most important factors are security, convenience, and time efficiency. Peakflo provides all these benefits with its AR and AP software to simplify payments both on the business’s and customer’s end.

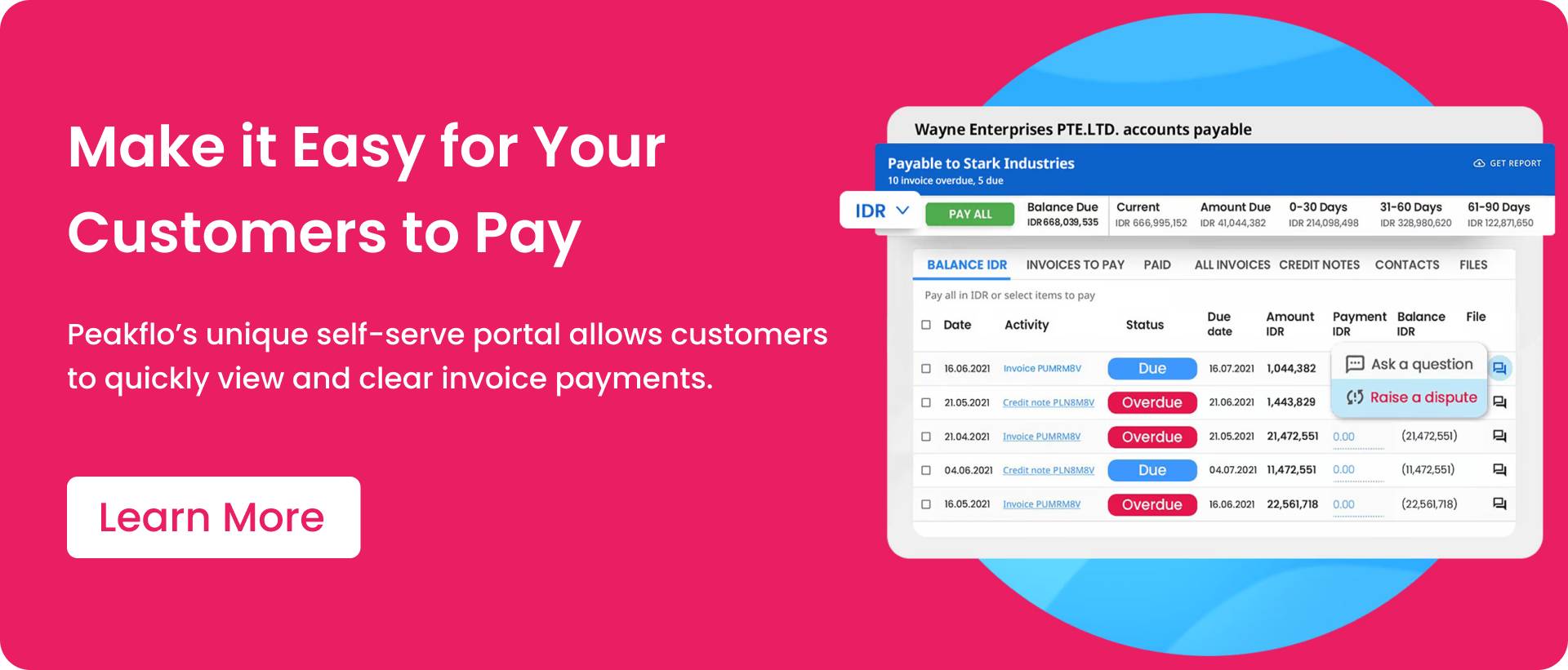

With Peakflo’s all-in-one customer portal, get paid in your sleep while providing versatility in payment methods for your customers. Peakflo maps your customers’ payments with the right invoice instantly, so you can just relax while we handle the record-keeping for you.

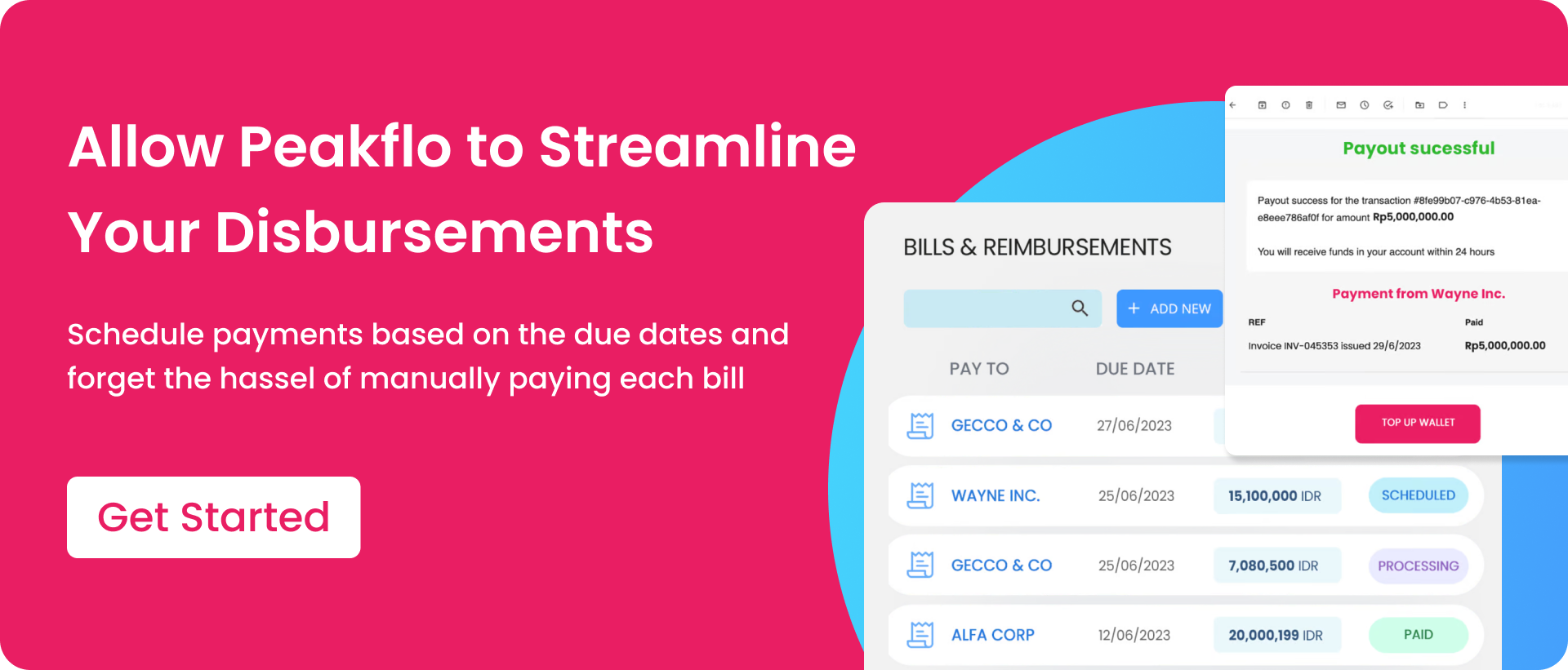

Additionally, Peakflo helps you pay bills 2x faster. Our end-to-end automation will streamline your procurement-to-payment operations and you can save 90% on the FX markup rate.

Interested? Try out Peakflo today!

Frequently Asked Questions

How Long Does It Take for an EFT Transfer to Process?

How long an EFT transfer will take to process is highly dependent on the type of transfer you’re doing. ACH transfers typically take two to three business days to complete whereas mobile payments are completed immediately. Domestic wire transfers are completed within 24 hours while international wire transfers can take 3-5 business days.

How Much Does It Cost to Make an EFT Transfer?

Depending on the type of transfer and the bank, EFT transfers have different costs. Sometimes, banks may charge up to $3 for sending EFT to another bank. Wire transfers are more expensive than ACH transfers, which are typically free or have little processing fees.

Is It Safe to Use EFT for Large Transactions?

EFT transfer is a secure payment method that is suitable for large transactions.

Which Types of Bank Accounts are used for an EFT?

An EFT payment can be made using a checking account or a deposit account.

How to cancel an EFT payment?

How to cancel an EFT payment?

To cancel an EFT payment, promptly reach out to your bank or financial institution. Adhere to the instructions provided by the bank, which may involve filling out a form or following specific steps based on their requirements. After initiating the cancellation, confirm the process’s completion with your bank to ensure that the funds remain secure and the transaction has been successfully terminated. It’s crucial to act swiftly and communicate effectively with your bank to navigate the cancellation process smoothly.