Within the finance departments of organizations, the role of controllers holds significant importance as they are responsible for ensuring the organization’s seamless functioning and financial integrity.

Acting as a crucial bridge between the finance team and senior management, controllers are entrusted with providing accurate and timely financial information for informed decision-making.

Their multifaceted responsibilities range from meticulously managing financial records to overseeing regulatory compliance.

In this article, we will delve into the pivotal role of controllers, shedding light on their purpose, and job descriptions, distinguishing them from accountants, and highlighting the differences between controllers and CFOs.

Additionally, we will explore the essential qualities and skills required to become an effective controller, aligning with the objectives and aspirations of finance departments.

What Is a Controller?

A Controller, also known as a financial controller, is a senior-level executive within a company’s accounting department. This role is pivotal in the management of a company’s financial undertakings.

The Controller holds the responsibility for managing and maintaining all financial and accounting operations, including budget management, financial reporting, and forecasting.

In essence, a controller is the chief accountant of an organization, ensuring the financial health and integrity of the company.

Job Descriptions of a Financial Controller

A financial controller’s job description varies depending on the size and nature of the organization. However, some common tasks include:

- Financial Management: Controllers are responsible for managing company funds, making sure resources are effectively allocated, and costs are controlled.

- Financial Reporting: They oversee the creation of financial reports, including income statements, balance sheets, and cash flow statements. They ensure these reports are accurate, timely, and in accordance with generally accepted accounting principles (GAAP).

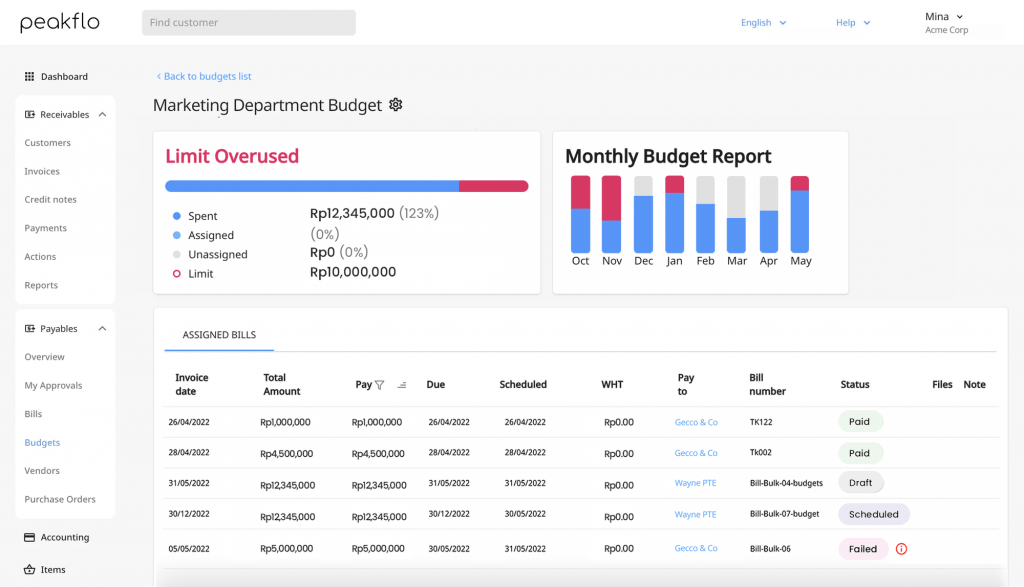

Visualize cash flow health and anticipate the future with Peakflo’s cash inflow forecasts! - Budgeting and Forecasting: Controllers lead the budgeting control process, monitoring expenditures, and forecasting future financial scenarios.

Track your company’s budget in real-time and get notifications when you’re about to exceed the limit - Internal Controls: Controllers develop and implement internal controls to prevent fraud and ensure financial accuracy.

- Regulatory Compliance: They ensure the company’s financial operations comply with relevant laws and regulations.

- Team Management: Controllers often supervise a team of accountants and financial analysts, providing guidance and ensuring the team meets its objectives.

Controller vs Accountant

The terms “controller” and “accountant” are sometimes used interchangeably, but they denote different roles within a company’s financial department. While both roles deal with financial management, their responsibilities and levels of authority differ.

An accountant is typically responsible for recording financial transactions, preparing financial statements, and ensuring tax compliance. They are often involved in the day-to-day financial operations of a company.

On the other hand, a controller has a more strategic and managerial role. They oversee the entire accounting department, ensure the accuracy of financial reports, implement internal controls, and contribute to the company’s financial planning.

Therefore, while an accountant might focus on the details of financial recording and reporting, a controller takes a broader view, using those details to inform higher-level financial decision-making.

Controller vs CFO

While both the Controller and the Chief Financial Officer (CFO) play crucial roles in a company’s financial management, they serve different functions.

The Controller is mainly responsible for managing and supervising the accounting operations and ensuring the accuracy of financial reports. In contrast, the CFO has a more strategic role.

CFOs use the financial data provided by the controller to make informed financial decisions, develop financial strategies, and communicate the company’s financial status to stakeholders.

Furthermore, while the Controller focuses on past and present financial data, the CFO looks forward, planning for the future financial health of the company.

In most organizations, the CFO is the Controller’s direct superior, with the Controller’s role often seen as a stepping stone to the CFO position.

How to Become an Effective Controller

Becoming an effective controller requires a mix of technical skills, leadership abilities, and strategic thinking. Here are some steps:

- Acquire the Necessary Education and Certification: Most controllers have a bachelor’s degree in accounting, finance, or

- a related field. Further qualifications such as a master’s degree in business administration (MBA) or certification as a Certified Public Accountant (CPA) can enhance your credibility.

- Gain Relevant Experience: Experience in accounting, auditing, or finance roles is crucial. Many successful controllers have worked their way up from entry-level accounting positions, gaining a deep understanding of the financial operations and challenges of a business.

- Master Financial Reporting and Regulatory Compliance: Understanding financial reporting standards and regulations is critical. Controllers must ensure their company’s financial practices comply with these standards and laws.

- Develop Leadership Skills: As a controller, you’ll likely manage a team of accountants or financial analysts. Strong leadership skills will help you guide your team, manage conflicts, and motivate your staff to meet their objectives.

- Hone Strategic Thinking: Controllers don’t just manage numbers; they also contribute to the company’s strategic financial planning. The ability to analyze financial data and make informed predictions about future financial performance is vital.

- Stay Updated: The financial world is dynamic, with new regulations, tools, and best practices constantly emerging. Staying updated and continually learning is key to being an effective controller.

Conclusion

In conclusion, the role of a Controller in finance is multidimensional, encompassing everything from routine accounting operations to high-level strategic financial planning. Their work is fundamental to the financial health and success of a company.

By ensuring accuracy in financial reporting, compliance with regulations, and effective financial management, controllers play a crucial role in steering their organizations toward financial stability and growth.

Peakflo is the ultimate AR & AP automation solution for controllers. It streamlines processes, improves efficiency, provides insights, ensures compliance, and promotes seamless collaboration. Experience the power of Peakflo and revolutionize your financial operations.