A fiscal year determines your company’s financial cycle. At the end of it, a busy period of tracking financial records, calculating taxes, and preparing financial statements usually follow suit.

For that reason, it’s important to decide your fiscal year closing date carefully, so you can pick a time where your finance team is less occupied with other tasks. If you want to understand more about a fiscal year and the best practices to prepare for it, keep reading.

What Is a Fiscal Year (FY)?

A fiscal year, also known as a financial year, is a 12-month period used by companies for tax and finance reporting purposes. Not only does this period determine your Year of Assessment, but it also enables you to strategically plan for your company’s financial goals.

There are different types of financial periods businesses can adopt:

- Calendar year. The financial year follows the calendar year, which starts on January 1 and ends on December 31.

- Government fiscal year. Certain countries have their own regulations when it comes to fiscal years. For instance, the US government’s fiscal year spans between October 1 to September 30.

- Business seasonality. Companies often use a fiscal year that suits their workload or revenue cycle. For instance, retailers have a busy season between December and January. So, they usually have a year-end closing in February instead.

IRAS Requirements for Fiscal Years

For Singapore-based companies, understanding the Inland Revenue Authority of Singapore (IRAS) requirements for fiscal years is crucial for a smoother tax filing process.

IRAS allows businesses to determine their own fiscal year period. Income earned within this timeline will be taxed the following year. For example, if your fiscal year starts from 1 March 2022 and ends on 28 February 2023, your tax year is 2024.

If your company was established in March 2022, but you choose a closing date on 31 December 2023, then you must file a two-year worth of taxes.

How to Prepare for the Fiscal Year

Now that you understand what a fiscal year is all about, let’s discuss the steps on how your company can prepare for it.

1. Choose a Closing Date

When preparing for a fiscal year, the first decision you need to make is deciding on a closing date. This particular day marks the end of your financial activities in one year and kicks off a whole new cycle.

When settling on a closing date, you will typically opt between an accounting closing or legal closing date. Accounting closure looks at when financial accounts should be sealed off, making sure all transactions are recorded.

On the flip side, legal closure connects to strict auditing regulations and other statutory filings deadlines.

To make sure you’re selecting the most suitable date for your organization, take into account several factors such as resources, workflow processes, tax-planning strategies and meeting statutory filing regulations.

If you are unable to decide on one period only, you may opt for more than one accounting close-off during this fiscal year instead. It’s recommended to track all entries carefully inside each period so that precise reporting can be generated with ease later on.

2. Review Your Accounts Payable

After deciding on an exact closing date, the next step is to review your accounts payable. Here’s how:

- Check vendor invoices. Compare all invoices sent by vendors against your purchase orders to make sure the amounts are accurate and the payment terms are correct.

- Reconcile statements. Regularly compare incoming vendor bills with records of past transactions and identify any discrepancies or problems that may have occurred with payments.

- Prioritize payments. Organize expenses into categories such as current payments due and overdue payments in order to prioritize what needs immediate attention first, then work down the priority list accordingly.

- Prepare reports. Keep track of all of your accounts payable by preparing summary reports on expenses by month or by supplier. This will help you budget your spending better for the next fiscal year.

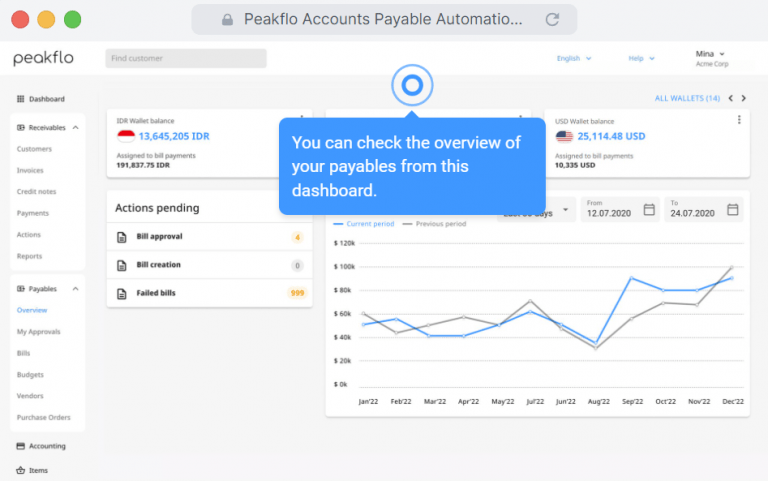

With Peakflo, you can automate all of these tasks and focus on growing your business. Our accounts payable automation solution ensures that your data is up-to-date and 100% accurate for a seamless real-time tracking.

Ready to Cut Bill Pay Time by Half and Save 90% on Processing Fees?

3. Review Your Accounts Receivable

Reviewing accounts receivable can help ensure that payments are received in a timely manner and that any overdue accounts are identified and handled accordingly.

To start the process, review current customer payments due and what has been paid so far. This will help you determine which customers owe you money and if there is any balance owed.

You should also check for any discrepancies between what was billed and what was paid, such as when customers pay an amount that differs from the invoice or when a payment doesn’t correspond to an invoice.

Next, look for any long-outstanding invoices and contact those customers to discuss payment arrangements. It’s important to follow up quickly on overdue accounts and take action if needed, such as sending reminders or making phone calls or other communications with the customer about their unpaid invoices.

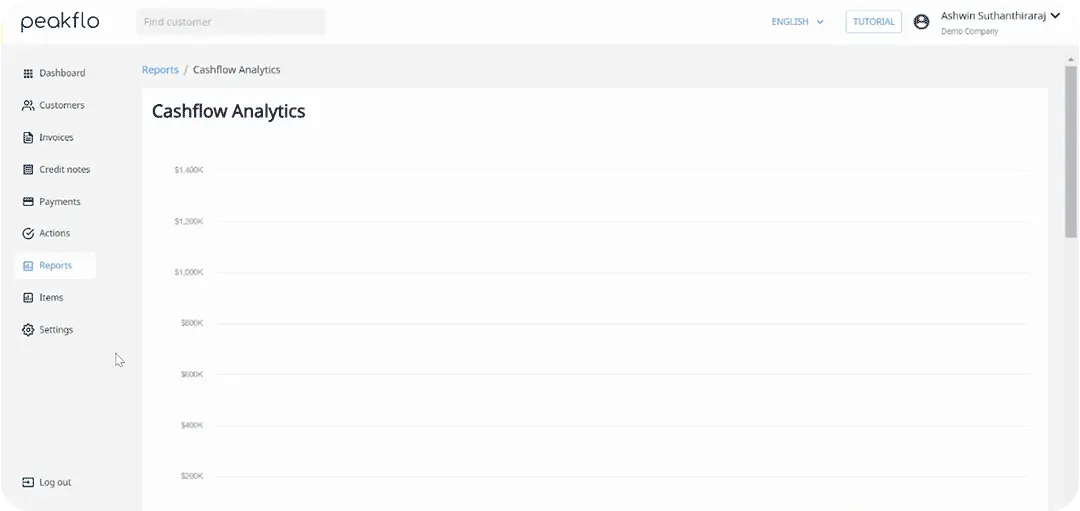

Peakflo helps you get paid faster with our accounts receivable workflows that can be tailored based on the escalation matrix and in terms of frequency, content, and channels.

In addition, our reports enable you to track invoice status and customers’ credit limit in real-time and come with insightful AI predictions to help you make decisions better and take actions quicker.

![]()

4. Reconcile All Financial Transactions

Reconciling helps identify discrepancies that must be corrected prior to the start of the new fiscal year.

The process begins with collecting all documents from last year’s accounting activity such as orders, invoices, bank statements, and other pertinent information. Once all documents are gathered, review each transaction against the source document to verify its accuracy.

This could mean comparing an order with its corresponding invoice, or reconciling bank statements to ensure that deposits and withdrawals were accurately recorded in your accounts.

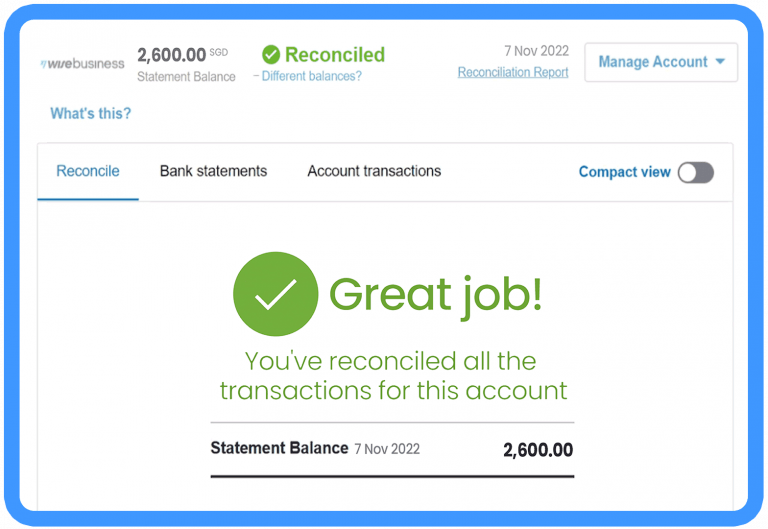

This process can be very time consuming but it is essential for catching errors and making sure that everything has been accounted for properly. To make the process simpler, you can utilize the reconciliation feature by Peakflo. Integrate your accounting software and save up to hundreds of man-hours in reconciliation during month end closing and year end closing.

After completing the reconciliation process, accountants can generate reports showing a complete breakdown of where funds were spent during the previous fiscal year and how they will be allocated in upcoming years.

The goal of reconciling all financial transactions is to make sure there are no material misstatements or omissions that could throw off future budget forecasts or decision-making processes.

5. Prepare Financial and Tax Reports

Preparing for a fiscal year requires a significant amount of planning and organization. One of the key tasks associated with this preparation is the preparation of financial and tax reports. Financial statements include an income statement, balance sheet, statement of retained earnings, and statement of cash flows.

When it comes to the financial side of your business, there are two types of reporting: internal and external.

Internal reports are used by employees within a company to track progress and measure performance. These reports may include information such as revenue, expenses, profits/losses, and budgets.

External financial reporting is meant for investors or other outside entities. These documents require more detailed information about the company’s overall financial health, including balance sheets, income statements, and cash flow statements.

Businesses also have certain tax reporting requirements they must adhere to each year in order to remain in good standing with federal or state taxing authorities.

These documents are necessary for proper financial reporting and compliance with applicable laws. It is important to understand how to properly create and maintain these documents in order to ensure that your business is properly prepared for a new fiscal year.

Simplify Fiscal Year with Automated Accounting from Peakflo

Fortunately, there are plenty of resources available to help you simplify the process of preparing reports at the end of your fiscal year, such as Peakflo — a simple automated accounting software for your businesses.

With Peakflo, you can minimize the time and effort for preparing a fiscal year, especially when it comes to creating reports.

Our accounts receivable reports features include DSO report, Aging Balance report, Invoice Status Tracking report, Customer Status Tracking report, Customer-level DSO, Promise-to-pay amount, Credit Control report, Team Activity report, and Cash flow analytics.

Meanwhile, our accounts payable feature consists of pending actions in the Peakflo account, list of AP Wallets with currency and current balance, and summary of expenses in the selected period.

Ready to transform your business with the next-gen AP and AR automation, but not sure where to start or still have a lot of doubts in terms of the product fit? Find out the leader’s guide by downloading the eBook below.

Fiscal Year FAQs

What is a Fiscal Year?

A fiscal year is an annual accounting period that typically starts on the first day of a month and ends on the last day of another month. The government and corporations often use a different date than the calendar year in order to track expenses and income accurately.

How do I Prepare for a Fiscal Year?

Preparing for a fiscal year involves assessing your current finances and organizing your accounts accordingly. This includes choosing a closing date, reviewing your accounts payable and receivable, reconciling all financial transactions, and preparing financial tax and reports.

When Should I Start Preparing?

It’s best to start preparing at least one month before the new fiscal year begins, so you can have enough time to review all of your financial information and address any issues that arise.