Mature financial management is very important for companies. One of them can be done through managing accounts receivable billing . This step will have a big impact on the profits that the company can obtain.

This applies to companies that offer products to consumers and implement a prepayment system. Later, the remaining payment will go into accounts receivable or also known as accounts receivable.

This kind of system has been implemented by many companies. One reason is because this system is quite profitable. Companies can achieve the desired profits thanks to this system.

Apa Itu Accounts Receivable Billing (AR Billing)?

In accounting, accounts receivable billing or accounts receivable collection is the process of billing customers who have purchased goods or services and have not paid for them. This involves creating invoices, sending them to customers and tracking payments.

AR billing also includes any necessary follow-up with customers who are slow to pay or delinquent on their payments, as well as handling any disputes that may arise between the business and the customer. This process helps ensure that businesses are paid on time and can help improve cash flow. It could be said that this is a collection of receivables from related consumers.

It is important to know that AR billing is an important thing that must be considered in order to keep the company’s cash flow stable. In addition, receivable accounts are binding and regulated by law. So it is bound and consumers are obliged to pay the credit for which they are responsible.

Are Billing and Accounts Receivable the Same Thing?

In this accounts receivable collection system, you will become familiar with billing and accounts receivable. So are they the same thing or are they different? It is clear that billing and accounts receivable are two very different things.

The two have differences in that accounts receivable are credit records that must be paid by the debtor to the creditor. Meanwhile, billing is the process of issuing invoices to customers for goods or services that have been provided. In the company’s receivables collection procedure, billing will be used as a tool or medium for collecting receivables.

So, accounts receivable are only records of receivables owned by the company. Meanwhile, billing is a receivable bill that the company will give to consumers or parties who have debt.

Why is AR Billing Important?

It should be noted that accounts receivable billing actually has a crucial function for company operations. AR billing will be evidence that simplifies the process of collecting receivables from consumers.

This billing will be an official letter that proves that the company has collected the amount of money that the consumer owes. The notes are clear, and the amount to be paid is clearly stated.

Not only for companies, AR billing also has benefits for consumers who have debt. The existence of AR billing will make it easier for consumers to make payments or pay off their credit.

There are many cases of company receivables jamming due to the absence of a good and correct AR billing system. The receivables collection system becomes chaotic, and consumers are also unable to pay their obligations according to the provisions.

What is the Difference between Invoicing and Billing?

Talking about billing or bills, is there a difference with invoices ? In the financial management of a company, these two things will always be present. The terms invoice and billing also certainly don’t sound foreign to your ears.

It turns out that these two terms have different meanings. Invoice means a document issued by the seller or company as proof of the transaction. So this invoice is like a memorandum document that contains transaction information and is legal evidence.

Meanwhile, billing is a billing document that is used to remind consumers about receivable transactions that have been carried out with a company. So this bill is not just proof of a transaction or sale and purchase agreement. If compared, the invoice is a proof of transaction document that will be given at the beginning to consumers.

The total purchase value will be listed on the invoice complete with the purchase date and payment method applied. This is different from billing which is not necessarily given at the start. Usually, billing will be provided periodically to consumers in accordance with the payment provisions based on the receivables system.

Billing will be submitted at certain times and the nominal value can also vary. Unlike invoices which contain total transaction costs, billing will contain information on costs per bill. From here you can clearly see what the difference is between invoicing and billing . Even though they are different, both have important functions for a company’s financial reports.

Receivables Collection System Best Practices

Actually, the way to collect receivables in each company can be different. Depends on the system implemented. However, here are some receivable collection system practices that are considered the most effective:

1. Cross-Departmental Collaboration

The first point, it is highly recommended for companies to work together and collaborate across departments in the receivables collection system. So this billing step will involve several types of departments in the company.

2. Credit and Collection Policy

Companies must enforce fairly strict credit and collection policies. The accounts receivable billing system should be managed well so that the billing method is correct and can be done on time.

This credit and collection policy is also a reference so that consumers can be more disciplined in paying debts. If there are no clear rules or policies, it will be difficult for consumers to comply with making payments.

3. Payment Communication System

Companies must also pay attention to the payment communication system in place. This is quite important because payment systems can vary. So it’s better to plan from the start so that the payment and billing process becomes easier.

4. Electronic Invoicing with Payment Collection

It is highly recommended for companies to use electronic invoicing. In today’s digital era, using electronic invoices is considered more effective and efficient.

Collecting receivables payments can certainly be made easier thanks to electronic invoices. Collecting receivables payments can also be more effective and profitable for the company.

Make AR Billing easier with Peakflo

The accounts receivable billing process can now run more easily and effectively thanks to a platform called Peakflo. The features in Peakflo will make it easier for your company to manage receivables collection.

The AR billing process with Peakflo can take place efficiently. Not only that, this system will also help the receivables collection process to minimize errors . As a result, profits from the receivables system to consumers can be further optimized. Peakflo presents features that simplify the process of creating AR billing .

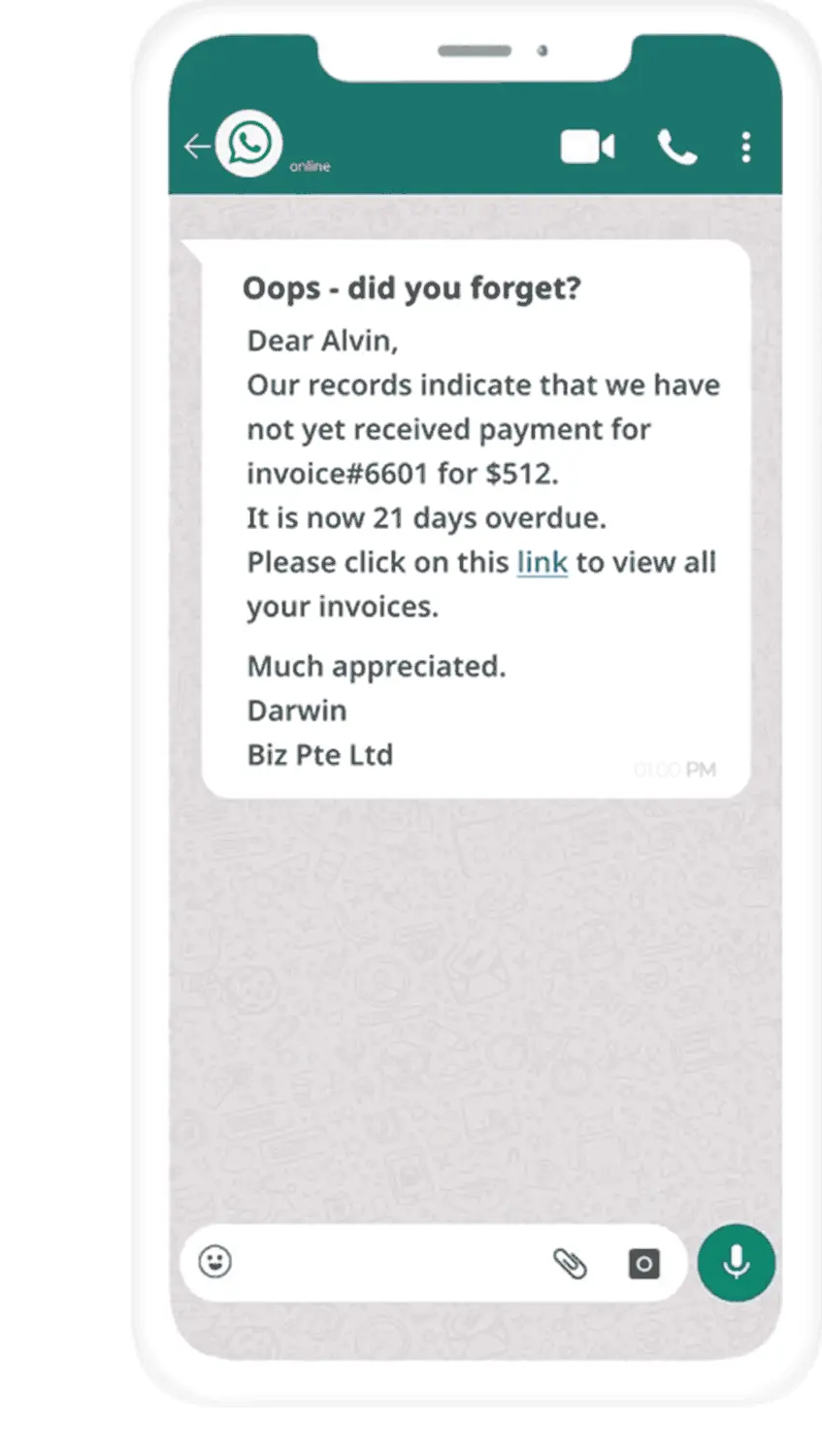

Submitting billing or invoices to consumers can also be easier because it takes place digitally and is on target according to the system. Now you no longer need to be confused about the company’s receivable billing accounts . With Peakflo you can send automatic payment reminders to customers via WhatsApp or email with personalized content and according to the desired schedule.

All finance or sales team conversations with customers will also be clearly recorded with an audit trail on the timeline.

You can also directly track invoice status in real-time.

![]()

Save your time with Peakflo, a reliable account payable and receivable software that is ready to help streamline all your financial operations. Click here for more complete information.