Financial closing is a crucial accounting function for every company. Month-end closing during the end of the year is just as time-consuming and frustrating as the year-end closing for finance teams. The monotonous routine of recording income, reconciling expenses, and making finance reports can take as long as 3 weeks for month-end and almost a month for year-end closing. If continued, such processes will prevent teams from finishing other important tasks, lowering their productivity and even taking off the opportunity costs to scale the business.

If you’re looking to have a more efficient month-end or year-end closing, you’ve come to the right place. This article will cover how accounts receivable and accounts payable automation will benefit your month-end and year-end closing processes.

Challenges of Manual Financial Closing

In the absence of advanced automation in Accounts Receivable and Accounts Payable processes, organizations encounter several substantial challenges during the critical phases of financial closings.

Time-Intensive and Repetitive Processes

Manual financial closing processes, involving tasks like data entry, verification, and reconciliation, consume a considerable amount of time. The repetitive nature of these tasks extends the closing cycle, leading to prolonged timelines for finalizing financial records. The manual effort required to navigate through various documents and entries contributes to inefficiencies in time management.

Prone to Errors

The reliance on manual processes increases the likelihood of errors and discrepancies in financial records. From typos in numerical values to misinterpretation of information, the reliance on manual processes can compromise the accuracy of financial data. These errors, if undetected, may lead to miscalculations, impacting the reliability of financial statements.

Lack of Visibility

Without the aid of automation, financial teams often operate with limited real-time visibility into their accounts receivable and payable. This lack of instantaneous access to crucial financial information makes it challenging to make informed decisions. Timely insights into receivables and payables are crucial for effective cash flow management, which is compromised in a manual processing environment.

Spreadsheet Challenges

Manual financial closing processes often heavily rely on spreadsheets for data organization and analysis. While spreadsheets are versatile, they are also susceptible to errors and version control issues. Managing complex financial data in spreadsheets can lead to confusion, especially in collaborative environments, where multiple team members may be working on the same document simultaneously.

Stress on Finance Teams

The manual nature of financial closing processes places a substantial burden on finance teams, particularly during critical periods like month-end and year-end closings. The pressure to meet tight deadlines and ensure the accuracy of financial records can contribute to heightened stress levels among team members. This stress not only impacts job satisfaction but also has the potential to compromise the overall productivity and well-being of the finance team.

Streamlining the Closing Process with Peakflo’s AR and AP Automation

Incorporating both Accounts Receivable (AR) and Accounts Payable (AP) automation creates a seamless financial management system, offering several advantages:

Synergy Between AR and AP Automation: The integration ensures that AR and AP systems work together harmoniously, sharing information in real-time for a comprehensive financial overview.

Seamless Data Exchange: Automated AR and AP systems facilitate the smooth exchange of data, eliminating manual data entry and reducing the risk of errors during the closing process.

Comprehensive Financial Visibility: By integrating both automation processes, organizations gain a holistic view of their financial landscape, enabling better decision-making during financial closing.

Streamlined Workflows: Integrated automation optimizes workflows by aligning AR and AP processes, enhancing efficiency, and reducing the time required for financial tasks.

Improved Accuracy and Consistency: Data consistency is maintained across AR and AP functions, minimizing discrepancies and ensuring accuracy in financial records during critical financial closing periods.

Enhanced Reporting Capabilities: The integration of AR and AP automation enhances reporting capabilities, providing finance teams with detailed insights into both receivables and payables for more informed decision-making.

Sync Invoices and Bills in a Centralized System

Manual AR and AP data collection processes are susceptible to errors. Team members might use different systems for different tasks, namely Excel for customer data, Outlook for sending emails, and an ERP for managing invoices.

As a result, it’s difficult to gain transparency regarding invoice status, making it hard to track who approved the invoice and when it happened.

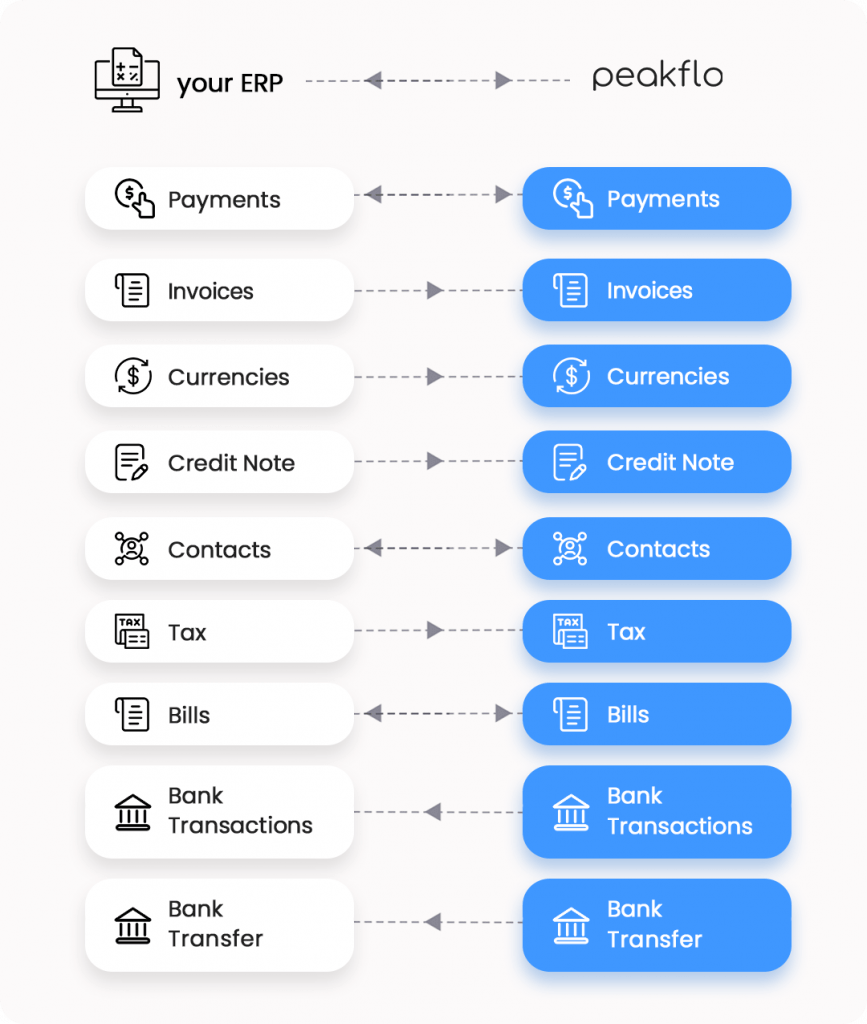

This is the area where Peakflo’s AP and AR automation can help. Peakflo will integrate all your data and details into one source of truth.

You can easily sync your accounts, payments, invoices, credit notes, bills, taxes, and any other data.

Importing your data will also be seamless and error-free. Peakflo supports 2-way data sync with spreadsheets and any accounting software, such as Xero, Quickbooks, and NetSuite.

Once you import bills to Peakflo, our system will automatically capture details about the vendors, chart of accounts, taxes, and bank accounts.

Same with invoices, Peakflo will capture the status, contact information, and other details so you can focus on higher-priority tasks.

The data will immediately be synced in a centralized dashboard without affecting your existing system. Instead, Peakflo will improve your current workflow and streamline your finance operations.

Reconcile All Accounts and Transactions

Reconciliation in accounting is a long and often frustrating process, even if you’re using accounting software.

You’ll need to match each payment with the right bank statement and then look up the reference numbers manually. If there are data discrepancies, you’ll need to identify the issues and make adjustments.

Smaller organizations might be able to handle the manual workflow. However, for larger companies dealing with 100+ invoices monthly, manual reconciliation can be time-consuming and error-prone, making it hard for the finance teams to make strategic decisions.

For those reasons, it’s clear that implementing accounts payable and accounts receivable management software is the best option to ensure maximum efficiency and accuracy.

Peakflo’s Automated Reconciliation simplifies the process for your team. Our system automates the financial records matching process, reducing human errors and boosting team productivity by 50%.

Finance teams can easily create payment rules for outstanding invoices. Once payments have been settled to their bank accounts, Peakflo will mark the invoices as paid and reconcile the transactions in their accounting software.

Payments made through the Peakflo wallet will also be automatically reconciled with bank statements in your accounting software.

Boost Productivity with a Centralized Workspace for Your Team

To recap monthly sales, the accounting team needs to ask other departments for the required information first, leading to data silos.

Due to the heavy workload, sometimes sales teams are required to help with the month-end closing process. Instead of focusing on sales and revenue, business and account managers are often busy with invoice follow-ups.

Thus, a centralized workspace is necessary to minimize scattered communication between departments. With Peakflo, you can invite every team in your organization with roles-based access to collaborate on the same projects, improving productivity by 50%.

Peakflo will maintain the communications between the finance team and other departments as well as vendors in a timeline, complete with an audit trail. You can trigger personalized WhatsApp, SMS, and email reminders using a pre-made template, or create the message from scratch.

The finance and sales teams can handle dispute resolutions through a unique Customer Portal. Here, they can get more visibility on the summary of invoices, clear payments quickly, and chase collections effectively.

What’s more, our software comes with an added Team Activity Report for easier management. This feature lets finance leads track their team’s progress and productivity.

Eliminate Spreadsheets and Automate Reporting

Despite its popularity and affordability, using spreadsheets can hamper your month-end and year-end reporting process.

That’s because everyone on the team can access and edit the same information, potentially resulting in errors and siloed data. The lack of data visualizations also makes it painful to scroll through thousands of rows and columns.

That’s why empowering your finance team with automation is becoming more important. Our accounts receivable and payable software lets you track a comprehensive set of user-friendly reports in real-time, free from any errors.

For instance, you can check your company’s cash flow health, with metrics like days sales outstanding, outstanding amount, overdue, and bad debt. This analytics also comes with AI predictions, helping finance leaders plan with data-driven decisions.

You will also have access to reports, such as invoice status tracking, customer status tracking, and credit control. Financial closing can be frustrating for the finance team and even other departments, especially during the end of the year.

Oftentimes, manual reconciliation can result in redundant processes and fragmented communications between teams. Manual spreadsheet inputs have a higher potential for inaccurate reporting.

By automating processes, syncing your data, and consolidating your communications in one source of truth, teams can focus on strategic tasks to improve business growth.

So, what are you waiting for? Ready to cut month-end and year-end closing time by 50% in 2023?

![Why AI Sales Calls Are Making Good Sales Reps Even Better [2025 Guide] ai sales calls](https://blog.peakflo.co/wp-content/uploads/2025/09/65168cf6-3001-4733-8cbc-12d5684cf449-218x150.webp)