The Accounts Receivable Aging Report template is an essential tool for businesses aiming to track outstanding invoices and maintain a clear view of cash flow. This template offers a clear snapshot of which customers are behind on payments, by how long, and how much each one owes. By categorizing receivables based on the age of each invoice, this template helps businesses identify late payments, forecast cash inflows, and take proactive steps to manage and collect overdue accounts.

Download the Accounts Receivable Aging Report Template Now!

Why Use an AR Aging Report?

- Improving Cash Flow: This report enables finance teams to keep track of overdue payments, which directly impact cash flow. By identifying late payments, teams can prioritize follow-ups with customers to collect payments more efficiently.

- Customer Insights: A detailed AR Aging Report provides insights into customer behavior. Businesses can identify patterns in late payments, helping them adjust credit terms or payment schedules for specific customers.

- Risk Management: Knowing which accounts are overdue and by how much allows companies to manage credit risk effectively. If certain customers consistently have overdue payments, the finance team can flag them and decide whether to adjust payment terms or consider halting credit.

- Efficient Resource Allocation: By categorizing receivables, the AR Aging Report can help companies decide where to allocate collection resources. For example, accounts in the “61-90 days” or “over 90 days” categories might need priority collection efforts.

Key Features of the Accounts Receivable Aging Report Template

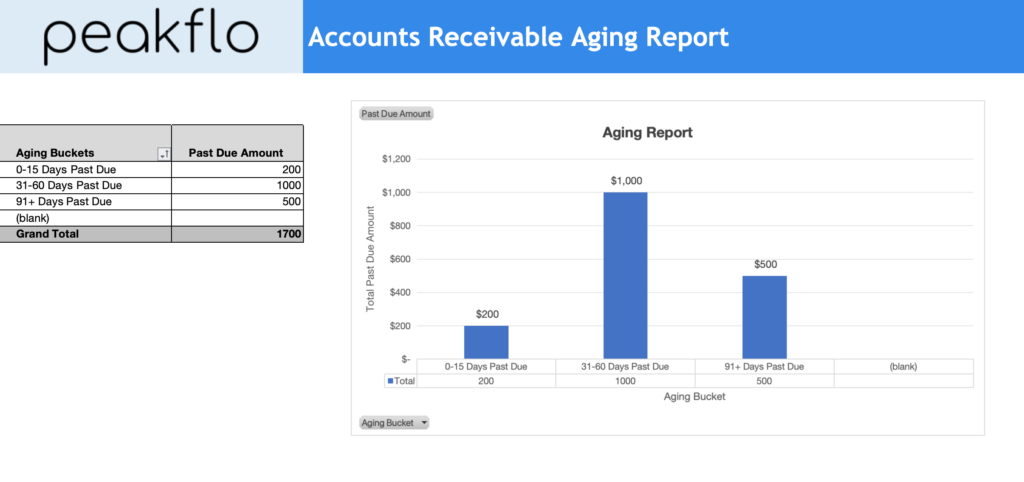

- Age Segmentation: Automatic categorization of receivables into aging buckets, making it easy to see which accounts need attention.

- Customizable Columns: The template allows users to customize age ranges and column headers to suit unique business needs.

- Total Outstanding Balance: Calculates total receivables and subtotals by aging bucket, providing a quick financial overview.

- Visual Data Representation: With built-in charts and graphs, this template helps present data visually, making it easier for management to review overdue accounts at a glance.

How to Use the Template?

- Data Entry: Input customer information and invoice information into the template.

- Age Calculation: The template automatically calculates the age of each invoice based on today’s date, sorting them into aging categories.

- Review and Act: Use the report to identify overdue accounts, prioritize follow-ups, and take necessary actions to encourage timely payments.