Granting credit without a thorough assessment of customers’ creditworthiness can pose significant risks, particularly for mid-sized companies. An effective credit application process helps mitigate these risks by ensuring that all essential information is collected, making it easier to make informed credit decisions. This Credit Application Checklist offers a structured approach, gathering crucial data in a user-friendly and efficient format to facilitate a robust credit evaluation.

Why Use the Credit Application Checklist?

A standardized credit application process:

- Reduces Financial Risk: Helps finance teams make informed credit decisions, minimizing exposure to bad debt.

- Improves Efficiency: Streamlines the credit assessment workflow, saving time and resources.

- Supports Compliance: Ensures that applications meet internal policies and external regulatory standards.

Key Elements Included in the Checklist

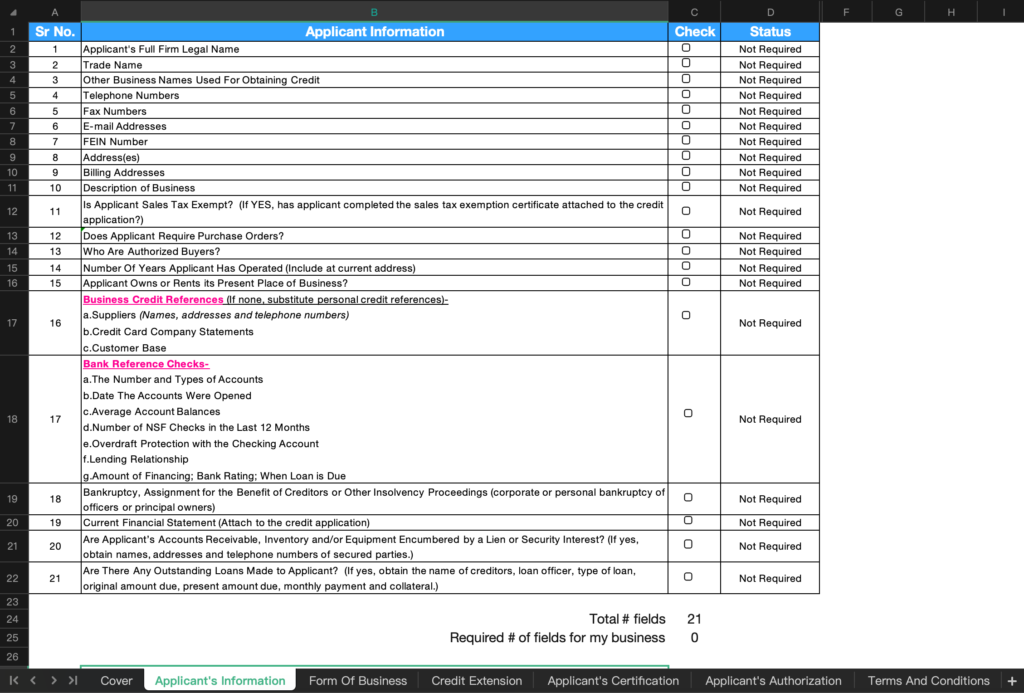

The checklist covers all the essential components of a complete credit application, including:

- Business Information: Legal name, registration details, and contact information.

- Credit Request Details: Amount requested, intended use, and credit terms sought.

- Financial Statements: Up-to-date financial documents to assess liquidity, profitability, and stability.

- Trade References: List of current suppliers and payment history to gauge credit behavior.

How to Use the Checklist

- Download the template

- Go through the checklist items to understand the required information and documents.

- Gather and verify information, ensuring all information is accurate and up-to-date.

- Use the checklist to systematically evaluate the customer’s creditworthiness.