Debt collection can be tricky. While some may think it’s just about calling and asking for overdue payments, it’s actually more complicated.

There are many rules to follow, making it a big challenge for collection teams to recover payments. That’s why collectors need to be well-prepared. A good collection call script can be a helpful tool for them when talking to customers.

What are Collection Calls and When to Use Them?

Collection calls are a crucial component of the payment recovery process, typically employed when customers fail to meet their financial obligations on time. These calls serve as a direct and proactive method for collection teams to communicate with customers, aiming to secure payment for overdue invoices.

Listed below are some scenarios when collection calls become necessary:

- When a customer has missed one or more payments.

- To address the overdue status and mitigate the risk of write-offs.

- When customers do not reply to multiple dunning reminders.

- To negotiate payment terms with the customer.

- To prevent legal escalations and find a common ground for settlement.

Essential Steps to Take Before Making a Collection Call

Before making a collection call, follow these six steps for a smooth process:

- Gather Information: Collect details about the customer’s account, invoices, payment history, and past communication.

- Check Account History: Look at any past payment issues, disputes, or agreements to help guide your conversation.

- Set Clear Goals: Know what you want to achieve with the call, whether it’s a reminder, discussing a late payment, or solving a dispute.

- Pick the Right Time: Choose a good time for the call, keeping in mind when the customer is likely available.

- Prepare Your Message: Plan a simple script to help you communicate clearly.

- Expect Objections: Think about possible objections and prepare answers that show you’re willing to find a solution.

Mastering Collection Calls: Proven Tips for Effective Communication

Maintaining a positive experience is important when making collection calls. As a debt collector, it’s important to balance being understanding with staying in control. Start the call confidently with a friendly greeting to set a positive tone. Use the customer’s name or refer to past conversations to make it more personal.

Listen carefully to what the customer says, so you can understand their concerns. Being patient and having the right attitude helps keep the customer satisfied and more likely to make the payment.

Be Proactive

Initiate collection activities before the due date to avoid a reactive approach. Prepare by having collection call scripts and email templates ready. Enhance your proactive approach by prioritizing high-risk customers first.

Document Everything

Keep detailed notes of customer conversations. Record the date of each call, any promises to pay, planned payment dates, actions needed, and agreements made. This will help resolve disputes quickly and ensure a smooth handover if another collector takes over.

Demonstrate Empathy

When talking to customers about their overdue invoices, it’s important to be understanding and supportive. Approach them with friendliness, respect, and kindness. Listen to their concerns carefully. This helps build strong relationships and can improve the chances of getting the payment.

Avoid Hasty Conclusions

Focus on finding the real issues instead of jumping to quick conclusions. Ask open-ended questions, understand the root causes, and explore customer concerns to provide better support in settling dues.

Handle Defensive Customers

Avoid getting sidetracked, refrain from arguments, and stay prepared to avoid misunderstandings from defensive customers. Maintain composure and focus on tackling the situation.

Here are a few common excuses and their suggested responses:

1. “I never received the invoice from you.” – Immediately email the invoice, confirming receipt during the call.

2. “I got busy and forgot to pay.” – Acknowledge it happens and work to secure payment or a commitment for prompt payment.

3. “We are facing cash problems right now.” – Offer a payment plan or explore the possibility of receiving a partial payment on the same day.

4. “I am not the right contact. Payments are handled by someone else.” Obtain their name and contact information. Ask the current contact to pass along your details and a call request.

Addressing these excuses with proactive solutions can help move the conversation forward and increase the chances of successful debt recovery.

Use the Right Tone

Apply the right tone of voice based on the account, customer profile, and use case. Speak assertively without being rude, considering the impact of voice pitch and maintaining a positive attitude.

Prepare Action Items

Jot down action items during calls, including expected payment dates, confirmation of overdue invoices, and any required documents. This proactive approach minimizes the need for later reconnections.

Follow-Up

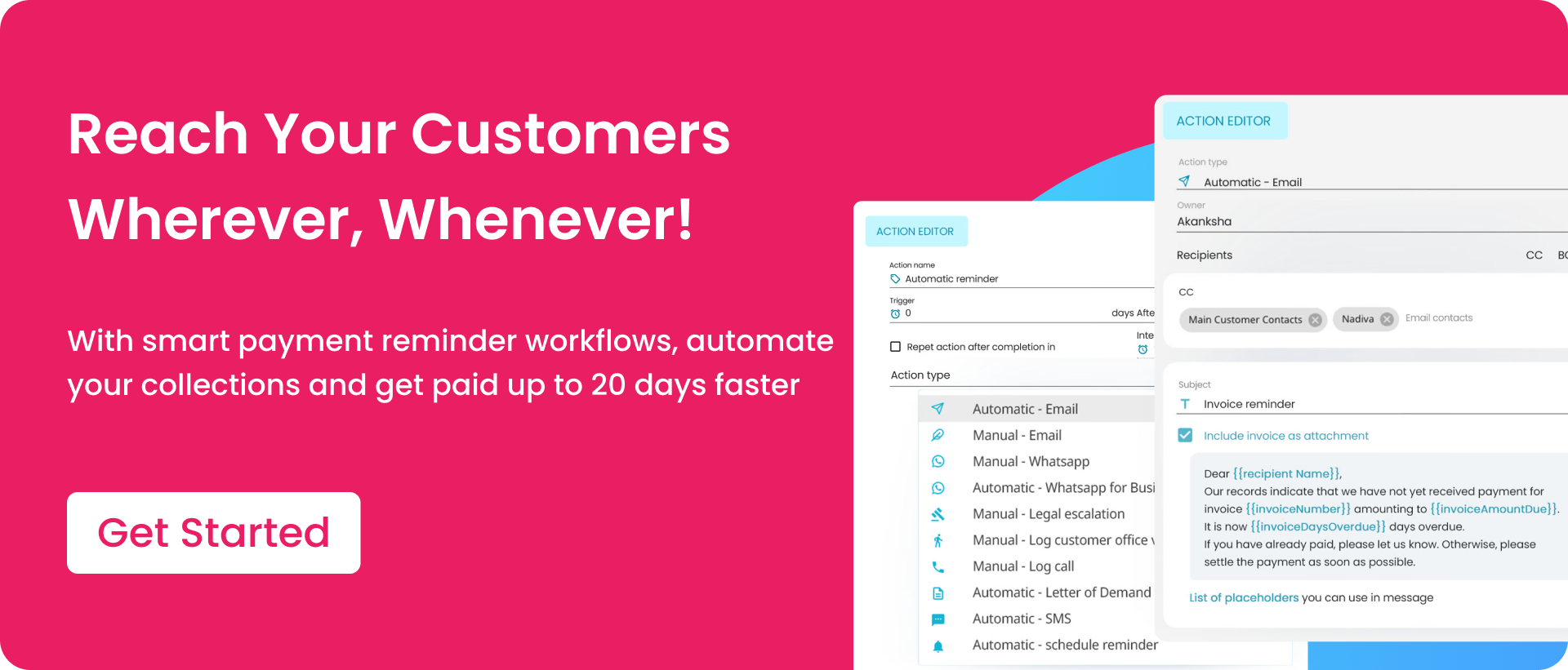

Consistency is key, so conduct timely follow-ups to serve as reminders, clarify customers about consequences, and clearly state the next steps for payment. Automate payment reminders to streamline the process.

Effective Collection Call Script

Here is a sample collection call script:

| You: Hey [Customer Name], it’s [Your Name] calling from [Your Company Name]. I’m with the Accounts Receivable team. I’m calling to check in about the invoice [Invoice Number]. It looks like there’s an outstanding balance of [Amount] which is about [XX] days overdue. Just making sure everything’s okay with the invoice. If it is, could you please let me know when we can expect the payment? Scenario #1 Customer: Oh! I was occupied with other priorities. I’ll make the payment today. You: Awesome! Thanks for letting me know. I’ll jot that down, and we’ll keep an eye out for your payment. Scenario #2 Customer: There is an issue with the invoice you sent. I won’t pay until it’s fixed. You: Got it. Let’s sort that out. What’s the problem? Depending on what it is, I’ll try to fix it now. If not, I’ll explain the next steps, and I’ll check in again to make sure it’s all sorted. |

When using a collection call script, it’s crucial to remain adaptable and handle unforeseen situations. We have curated 7 effective debt collection call scripts that can be customized for your specific requirements. Download the scripts from the link given below to gain access to how to tackle complicated scenarios.

Closing Notes

Reaching out to customers for payment recovery is an effective collection practice. In this blog, we aimed to cover all aspects of how to make effective collection calls. However, recognizing the uniqueness of each customer is essential. It requires careful attention to deduce the right approach for each customer during interactions.

Incorporating reminder communication workflows can enhance the efficiency of the collection process, allowing collectors to allocate their time to strategic tasks. Peakflo’s Collection Task Management Solution enables you to set up automated and manual workflows based on your collection strategy. The collections team can easily manage follow-up phone calls by making notes and following a read-to-use script from the solution. It also allows you to add collection scripts from your existing repository. With just a click, you will be able to access and execute your pending and future tasks.

Explore Peakflo’s Accounts Receivable solution to streamline collections and accelerate payment recovery.

FAQ

1. What is an example of a collection call script?

Example: Hi [Customer Name], this is [Your Name] from [Your Company]. I’m calling about your overdue invoice [invoice number] for [amount due], which was due on [due date]. I wanted to check if there’s a reason for the delay and if I can help in any way.

2. What does a debt collector say?

A debt collector confirms who you are, tells you about the unpaid debt, and asks for payment. They may also discuss options like setting up a payment plan.

3. How do I prepare for a collection call?

Before the call, gather all details about the unpaid invoice, the customer’s account, and past conversations. Be clear about your goal and ready to discuss or negotiate payment options.

![Why AI Sales Calls Are Making Good Sales Reps Even Better [2025 Guide] ai sales calls](https://blog.peakflo.co/wp-content/uploads/2025/09/65168cf6-3001-4733-8cbc-12d5684cf449-218x150.webp)