If you have ever had to travel for work, you know that managing expenses can be tricky. Companies often provide employees with a per diem allowance to help cover the cost of meals, accommodation, and other daily expenses while on business trips. But what exactly is a per diem allowance in Singapore, and how does it work?

In this guide, we will break it down, giving you a clear understanding of what you need to know, especially when it comes to the regulations set by the Inland Revenue Authority of Singapore (IRAS).

Whether you are a customer managing business travel or an employee traveling for work, understanding per diem expense guidelines will help you make the most of your per diem allowance.

What is a Per Diem Allowance?

A per diem allowance is a fixed daily amount that an employer provides to employees for business travel. The term “per diem” comes from Latin, meaning “per day.” It covers basic travel expenses such as food, accommodation, and incidental costs—without requiring employees to submit individual receipts for every purchase.

A typical per diem allowance covers three main categories of expenses:

- Meals: Breakfast, lunch, and dinner while traveling.

- Accommodation: Hotel or other lodging costs during the trip.

- Incidentals: Small, everyday expenses such as fuel, local transportation (taxi fares), and other minor costs.

For example, if an employee is traveling for three days, they might receive a per diem allowance that covers meals, lodging, and small expenses for each day. This makes it easier to track expenses and allows employees to manage their budget while on the road.

But do they cover everything? No. Per diem rates do not cover every type of business expense. Some costs are not part of the allowance. Although these rules may differ for companies, here are a few examples:

- Hotel stays during international trips

- Rides to and from airports overseas

- Tickets for flights, trains, or other travel to your destination

- Entertainment expenses like client dinners, team-building events, or similar activities

These costs should be handled through a separate travel reimbursement process.

In Singapore, companies offer per diem allowances for domestic and international business trips. The allowance can vary depending on the destination, the duration of the trip, and the company’s policies. However, companies need to ensure that their per diem allowance rates comply with IRAS guidelines to avoid any potential tax issues.

The Benefits of Per Diem Management

Managing per diem allowances correctly offers clear benefits for both employers and employees. It can make processes smoother, reduce paperwork, and help control costs. Let us look at the main advantages of good per diem management:

- Simple Expense Tracking

With per diem allowances, employees do not need to save and submit receipts for each expense. Instead, they get a fixed daily amount. This makes it easier for them and cuts down on paperwork for the employer.

- Easier Budgeting

A set daily rate helps businesses plan out-of-pocket expenses more accurately. Employers know how much to expect each day. This helps avoid surprises and keeps budgets on track.

- Less Risk of Over-Spending

Because the per diem allowance is fixed, employees are more likely to stay within limits. They do not need to worry about spending too much, unlike reimbursement methods, where every expense needs to be accounted for.

- Employee Satisfaction

Employees do not need to spend time collecting receipts or waiting for reimbursement. This saves time and reduces frustration. With less paperwork, employees can focus on their work, leading to better satisfaction.

How is the Per Diem Allowance Calculated in Singapore?

The calculation of per diem allowance in Singapore depends on several factors, including the destination, the company’s policy, and IRAS guidelines. Here is a breakdown of how it is typically calculated:

- Destination-Based Rates: The per diem allowance usually varies depending on the country or city. For more expensive destinations, such as the United States or Europe, the allowance tends to be higher compared to less costly locations.

- Company Policy: Employers are free to set their own per diem rates, but these should stay within reasonable limits to comply with IRAS guidelines. Companies need to ensure the rates are sufficient to cover necessary expenses without being excessive.

- IRAS Guidelines: The IRAS sets specific “acceptable rates” for per diem allowances in different countries. If an employer pays an allowance that exceeds the acceptable rate, the extra amount may be treated as taxable income.

Here is an example to show how IRAS guidelines apply in practice:

- Allowance Below the Acceptable Rate:

The acceptable per diem rate for Germany in 2024 is SGD 125 per day.

Suppose a company called TechSolutions Ltd paid Mr. Lee SGD 100 per day for his business trip to Germany. Since the per diem of SGD 100 is less than the acceptable rate of SGD 125, there is no taxable benefit. Therefore, TechSolutions Ltd does not need to declare this amount in Form IR8A.

- Allowance Above the Acceptable Rate:

The acceptable per diem rate for Germany in 2024 is SGD 125 per day.

Suppose a company called GlobalTech Ltd. paid Ms. Tan a per diem allowance of SGD 150 per day for her business meetings in Germany. For the six days she was there, Ms. Tan received SGD 900.

- Excess Amount per Day = SGD 150 – SGD 125 = SGD 25

- Taxable Amount = SGD 25 x 6 days = SGD 150

Since the excess amount of SGD 25 per day is above the acceptable rate, SGD 150 will be considered taxable income and should be reported in Form IR8A.

List of IRAS Per Diem Rates for 2024

Check out the latest country-specific acceptable per diem allowances for 2024.

| Country/ Region | Rate Per Day (S$) | Country/ Region | Rate Per Day (S$) |

| Afghanistan | 101 | Canada | 144 |

| Albania | 87 | Cape Verde | 77 |

| Algeria | 123 | Cayman Islands | 144 |

| Angola | 143 | Central African Rep | 97 |

| Anguilla | 181 | Chad | 87 |

| Antigua | 162 | Chile | 129 |

| Argentina | 98 | China | 90 |

| Armenia | 98 | Colombia | 44 |

| Aruba | 135 | Comoros | 94 |

| Australia | 126 | Congo, Republic | 155 |

| Austria | 116 | Congo, Democratic Rep | 151 |

| Azerbaijan | 85 | Cook Islands | 122 |

| Bahamas | 158 | Costa Rica | 116 |

| Bahrain | 156 | Cote d’Ivoire | 128 |

| Bangladesh | 112 | Croatia | 131 |

| Barbados | 189 | Cuba | 98 |

| Belarus | 95 | Cyprus | 77 |

| Belgium | 137 | Czech Republic | 82 |

| Belize | 90 | Denmark | 134 |

| Benin | 109 | Djibouti | 144 |

| Bermuda | 183 | Dominica | 144 |

| Bhutan | 123 | Dominican Republic | 93 |

| Bolivia | 66 | Ecuador | 90 |

| Bosnia & Herzegovina | 68 | Egypt | 106 |

| Botswana | 72 | El Salvador | 87 |

| Brazil | 40 | Equatorial Guinea | 175 |

| British Virgin Islands | 129 | Eritrea | 60 |

| Brunei | 70 | Estonia | 90 |

| Bulgaria | 93 | Eswatini (Lilangeni) | 61 |

| Burkina Faso | 132 | Ethiopia | 153 |

| Burundi | 93 | Fiji | 132 |

| Cambodia | 136 | Finland | 113 |

| Cameroon | 113 | France | 143 |

| Gabon | 162 | Lesotho | 56 |

| Gambia | 92 | Liberia | 96 |

| Georgia | 100 | Libya | 114 |

| Germany | 118 | Lithuania | 83 |

| Ghana | 157 | Luxembourg | 162 |

| Greece | 103 | Macao | 67 |

| Grenada | 108 | Madagascar | 103 |

| Guam | 101 | Malawi | 76 |

| Guatemala | 98 | Malaysia | 73 |

| Guinea | 112 | Maldives | 155 |

| Guinea-Bissau | 78 | Mali | 112 |

| Guyana | 144 | Malta | 105 |

| Haiti | 120 | Marshall Islands | 84 |

| Honduras | 67 | Mauritania | 71 |

| Hong Kong | 96 | Mauritius | 90 |

| Hungary | 102 | Mexico | 137 |

| Iceland | 112 | Micronesia | 84 |

| India | 100 | Moldova, Rep of | 76 |

| Indonesia | 130 | Monaco | 130 |

| Iran | 39 | Mongolia | 79 |

| Iraq | 119 | Montenegro | 67 |

| Ireland | 119 | Montserrat | 80 |

| Israel | 155 | Morocco | 113 |

| Italy | 111 | Mozambique | 105 |

| Jamaica | 112 | Myanmar | 101 |

| Japan | 162 | Namibia | 70 |

| Jordan | 91 | Nauru | 73 |

| Kazakhstan | 96 | Nepal | 101 |

| Kenya | 128 | Netherlands | 111 |

| Kiribati | 43 | New Zealand | 121 |

| Korea, North | 92 | Nicaragua | 68 |

| Korea, South | 122 | Niger | 93 |

| Kuwait | 198 | Nigeria | 96 |

| Kyrgyzstan | 94 | Niue | 107 |

| Lao People’s Democratic | 80 | Norway | 133 |

| Latvia | 87 | Oman | 105 |

| Lebanon | 141 | ||

| Pakistan | 122 | Sweden | 137 |

| Palau | 112 | Switzerland | 146 |

| Panama | 86 | Syrian Arab Rep | 146 |

| Papua New Guinea | 121 | Taiwan | 64 |

| Paraguay | 75 | Tajikistan | 65 |

| Peru | 108 | Tanzania | 109 |

| Philippines | 96 | Thailand | 87 |

| Poland | 88 | The Republic of North Macedonia | 70 |

| Portugal | 116 | Timor-Leste | 76 |

| Qatar | 128 | Togo | 115 |

| Romania | 92 | Tokelau Islands | 42 |

| Russian Federation | 130 | Tonga | 84 |

| Rwanda | 103 | Trinidad &Tobago | 130 |

| Samoa | 116 | Tunisia | 79 |

| Sao Tome & Principe | 119 | Türkiye | 64 |

| Saudi Arabia | 141 | Turkmenistan | 108 |

| Senegal | 121 | Turks & Caicos Island | 145 |

| Serbia | 76 | Tuvalu | 73 |

| Seychelles | 114 | Uganda | 162 |

| Sierra Leone | 104 | Ukraine | 114 |

| Singapore | 150 | United Arab Emirates | 140 |

| Slovakia | 88 | United Kingdom | 156 |

| Slovenia | 106 | United States | 150 |

| Solomon Islands | 148 | Uruguay | 73 |

| Somalia | 78 | Uzbekistan | 83 |

| South Africa | 56 | Vanuatu | 126 |

| Spain | 116 | Venezuela | 63 |

| Sri Lanka | 80 | Vietnam | 65 |

| St Kitts & Nevis | 152 | Virgin Island (US) | 173 |

| St Lucia | 159 | West Bank & Gaza Strip | 66 |

| St Vincent | 103 | Yemen, Rep of | 103 |

| Sudan | 90 | Zambia | 123 |

| Suriname | 74 | Zimbabwe | 89 |

Common Mistakes to Avoid with Per Diem Allowance

Businesses can make several mistakes when managing per diem allowances. These errors can lead to confusion, extra costs, or even legal problems. By avoiding them, employers can keep things running smoothly for everyone. Here are some common mistakes to avoid:

- Exceeding Allowance Limits

A common mistake is setting per diem rates higher than necessary. This can lead to overspending and, if the amounts exceed what IRAS considers reasonable, cause tax issues. Staying within the guidelines is important to avoid extra costs.

- Not Keeping Good Records

Failing to keep track of who gets the allowance, when they travel, and how much they receive can create problems later. Poor record-keeping makes it hard to verify expenses or comply with audits.

- Not Understanding Tax Rules

Some employers may not know when a per diem allowance becomes taxable. If an employee gets too much money or uses the allowance for personal reasons, it might be taxed. Understanding IRAS rules can help avoid this.

- Not Updating Rates Regularly

Travel costs can change over time. If employers do not update per diem rates based on inflation or rising costs, they might be giving employees too little or too much. It is important to check rates regularly to make sure they match current costs.

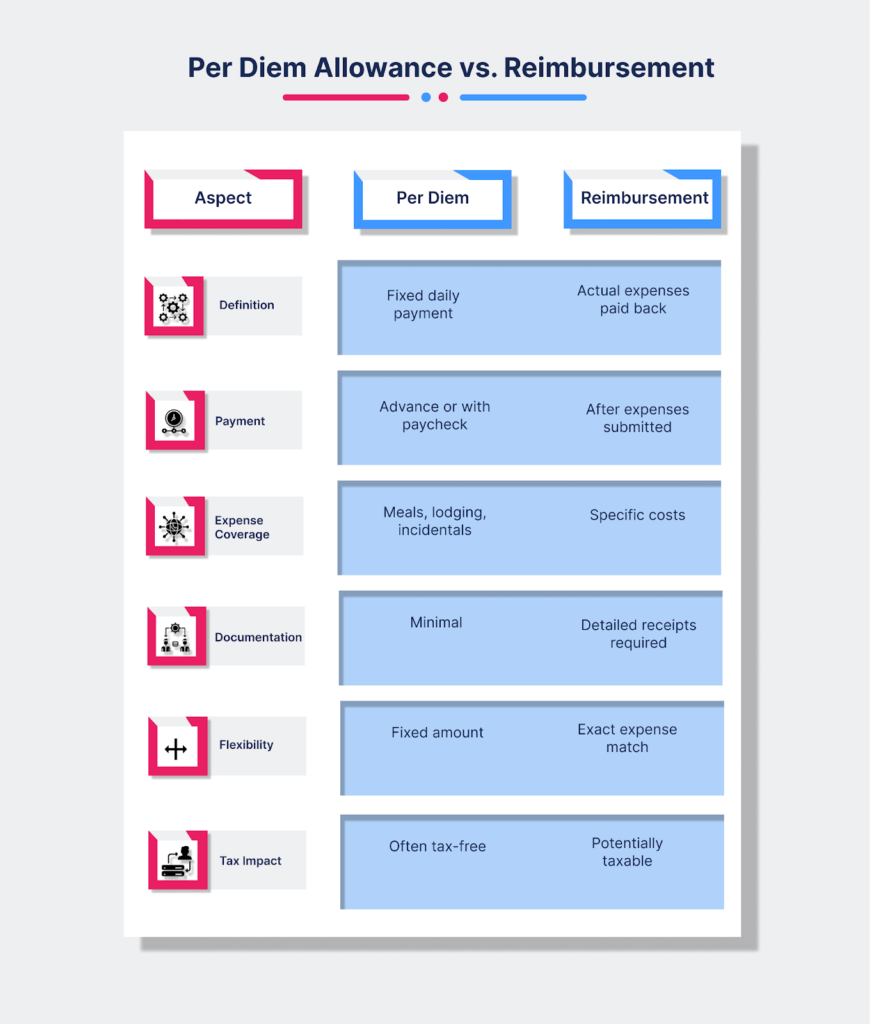

Per Diem Allowance vs. Reimbursement: What is the Difference?

It is important to know the difference between a per diem allowance and a reimbursement. Both help cover travel expenses, but they work in different ways.

- A per diem allowance is a fixed daily amount given to employees for travel expenses. It is fixed so employees know exactly how much they can spend each day.

- A reimbursement happens when an employee spends money out of their pocket and asks the company to pay it back. Employees must provide receipts and details for every purchase.

Understanding when to use each one can help businesses and employees manage costs better.

Each method has its place. Per diem allowances are simpler, while reimbursement offers more flexibility for unique expenses.

Automating Travel and Expense Management with Peakflo

Managing per diem allowances and travel expenses can be challenging for businesses. However, automating the process with Peakflo makes everything simpler. By streamlining tasks such as travel requests, expense reports, and reimbursements, businesses can save time, reduce errors, and stay within budget.

- Simple Employee Setup

Peakflo makes it easy to add employees and manage their travel expenses. You can quickly upload employee information in bulk using a CSV or integrate with existing ERP. Such expense report automation features help businesses save time and ensure that everyone is set up properly. Once employees are added, you can assign them the right permissions so they only have access to what they need.

- Clear Permissions and Access

With Peakflo’s automated travel expense management, you can control who can submit expenses, approve requests, and view reports. It’s easy to assign the correct permissions to each employee or manager. This ensures that only authorized people are handling or approving per diem expenses. The platform lets you check all permissions in one glance, so you always know who is in charge of what.

- Customize Expense Policies

Every business has different rules for what employees can spend on travel. With Peakflo, you can set up custom policies to match your company’s needs. You can define limits for meals, accommodation, and incidentals, ensuring that employees follow the rules for per diem expenses. This helps businesses avoid overspending and ensures that per diem allowances are managed correctly.

- Control Currency Conversion Fees

When employees travel internationally, currency exchange fees can add up quickly. With Peakflo, you can set limits on these fees to make sure they do not exceed your company’s policy. If the exchange rate surcharge goes over the limit, the traveler is immediately notified, ensuring full transparency.

- Boost Efficiency with Automated Approvals

One of the best features of Peakflo is the ability to automate approvals. Managers can quickly review and approve per diem allowances and travel expenses with just a few clicks. This speeds up the process and makes things easier for everyone.

- Set Per Diem Rates

Peakflo makes managing per diem expenses easier by giving you flexibility. Depending on your employees ‘ needs, you can set different rates for full or half-day travel expenses. It also lets you adjust per diem limits based on the city or country. Plus, you can assign limits to specific expenses, giving you better control and clear visibility over your travel expense reporting and budget management.

Conclusion

Managing per diem allowance is an important part of business. It helps ensure employees have enough money to cover their travel costs while also keeping company expenses under control. When businesses understand how per diem rates work in Singapore, they can set fair and clear allowances that support employees on their work trips.

Using tools such as Peakflo can make managing these expenses much easier. By automating tasks such as travel requests, expense reports, and reimbursements, companies can save time, reduce mistakes, and better control their finances.

Ready to ditch the spreadsheets? Book a demo tour and discover how automation can make per diem allowances and reimbursements effortless and error-free.

![Why AI Sales Calls Are Making Good Sales Reps Even Better [2025 Guide] ai sales calls](https://blog.peakflo.co/wp-content/uploads/2025/09/65168cf6-3001-4733-8cbc-12d5684cf449-218x150.webp)