In economics and businesses, opportunity cost refers to what has to be sacrificed from choosing one option over another. Opportunity cost is usually calculated before taking an action or making a decision. In this article, we will explore what opportunity cost is, how to calculate it, and its importance in gaining business advantages.

What Is Opportunity Cost?

Opportunity cost is a term in economics to describe the values lost from choosing one option over another.

Opportunity cost in microeconomics is a fundamental concept that plays a critical role in decision-making. Understanding how to leverage opportunity costs to your advantage can have significant implications for business finances and operations both.

The Difference Between Opportunity Cost and Sunk Cost

It is essential to distinguish between opportunity cost and sunk cost. Sunk costs are the values that have already been incurred and cannot be recovered. Opportunity costs, on the other hand, refer to the values potentially missed from choosing one option over the other.

Sunk costs are irrelevant to decision-making, while opportunity costs are crucial.

For example, if a business has invested $100,000 in a project that is not generating any profits, the sunk cost is $100,000.

However, if the business has the option to invest $100,000 in a different project that has the potential to generate profits, the opportunity cost of the profits earned from the alternative project.

Opportunity Cost Formula

The opportunity cost formula can be calculated by subtracting the value of the chosen option from the value of the next best alternative. The formula for opportunity cost is:

Opportunity Cost = Value of the Next Best Alternative - Value of the Chosen Option

Opportunity Cost Examples

Let’s consider some examples of opportunity cost.

Example 1

A business has $10,000 to invest in either project A or project B. Project A has an expected return of $12,000, while project B has an expected return of $15,000. The opportunity cost of choosing project A is:

Opportunity Cost = Value of the Next Best Alternative – Value of the Chosen Option Opportunity Cost = $15,000 – $12,000 Opportunity Cost = $3,000

Therefore, the opportunity cost of choosing project A is $3,000, which is the potential return that could have been earned by choosing project B.

Example 2

Let’s say a business is considering opening a new location that will cost $500,000 to set up and is expected to generate $100,000 in monthly revenue. The business estimates that if they don’t open the new location, they could invest the $500,000 in other opportunities that would generate a 10% annual return.

The opportunity cost of opening the new location would be the potential return on investment lost by not investing in the alternative opportunity. The alternative opportunity would generate a return of $50,000 per year (10% of $500,000), or $4,166 per month.

Therefore, the business would need to generate at least $104,166 per month from the new location to make it a better investment option than the alternative opportunity.

What About Marginal Opportunity Cost?

Considering the opportunity costs is important, but what happens when the decision involves incremental changes? This is where the concept of marginal opportunity cost comes in.

Marginal opportunity cost is the additional cost incurred by choosing to produce or consume one more unit of a good or service. It is important because it helps businesses make more informed decisions by taking into account the costs and benefits of the additional units.

Marginal Opportunity Cost Formula

To calculate marginal opportunity cost, you can use the following formula:

Marginal Opportunity Cost = (Change in Cost of Producing or Consuming) / (Change in Quantity Produced or Consumed)

Let’s break down this formula further. The numerator represents the change in cost resulting from producing or consuming one additional unit of the good or service. The denominator represents the change in quantity produced or consumed.

By dividing the change in cost by the change in quantity, you can calculate the marginal opportunity cost.

Marginal Opportunity Cost Formula

For example, a company produces widgets at a total cost of $100 for 10 units. If the business decides to produce one more unit, the total cost increases to $110.

The marginal opportunity cost of producing the 11th unit can be calculated as follows:

Marginal Opportunity Cost = (Change in Cost of Producing) / (Change in Quantity Produced) Marginal Opportunity Cost = ($110 – $100) / (11 – 10) Marginal Opportunity Cost = $10

This means that for the company to produce one more widget, it will incur an additional cost of $10.

The Importance of Opportunity Costs for Businesses

Understanding the opportunity costs of different options can help businesses strategize effective solutions, thus maximizing potential returns and minimizing risks.

Here are some benefits of calculating opportunity costs across various business use cases:

- Determine pricing strategies. Opportunity cost can also be beneficial in accounting to deduct the true cost of production. Businesses can calculate the total cost of a product or service and make informed pricing decisions while reducing expenses.

- Identify comparative advantages. Comparative advantage occurs when a business can produce a good or service at a lower opportunity cost than its competitors. By making use of their comparative advantages, businesses can gain a competitive edge and increase their profits.

- Allocate resources efficiently. If a business has limited resources, using the opportunity cost formula can determine which project or investment will provide the greatest returns and optimize cash flows.

- Improve financial analysis. By comparing the opportunity cost of different investment options, businesses can identify the investments that will provide the greatest returns for a given level of risk.

Seize More Opportunities with Peakflo

Overall, understanding opportunity costs is critical for businesses to make informed decisions that help maximize resources and achieve objectives.

For example, when it comes to finance operations, there are a lot of mundane tasks that should be streamlined.

Lots of companies are stuck in the collection loopholes. Fragmented communications between the finance and commercial departments resulted in piling overdue invoices.

As a result, account managers spend 30% or 40% of their time goes into chasing unpaid invoices, whereas customers are taking longer to pay. This is of course the loss of opportunity costs that businesses can otherwise businesses can use for chasing revenue.

Using Peakflo, you can automate the most time-consuming receivable tasks and get paid faster.

✅ Set up smart workflows with automated reminders based on an escalation matrix.

✅ Detailed reports and predictive cashflow analytics helps you stay ahead.

✅ Stay on top of deliverability on all bounced reminders and track the last opened date.

✅ Self-serve portal for customers to view and clear invoice payments quicker.

✅ 2-way sync with your accounting software to eliminate manual payment reconciliation.

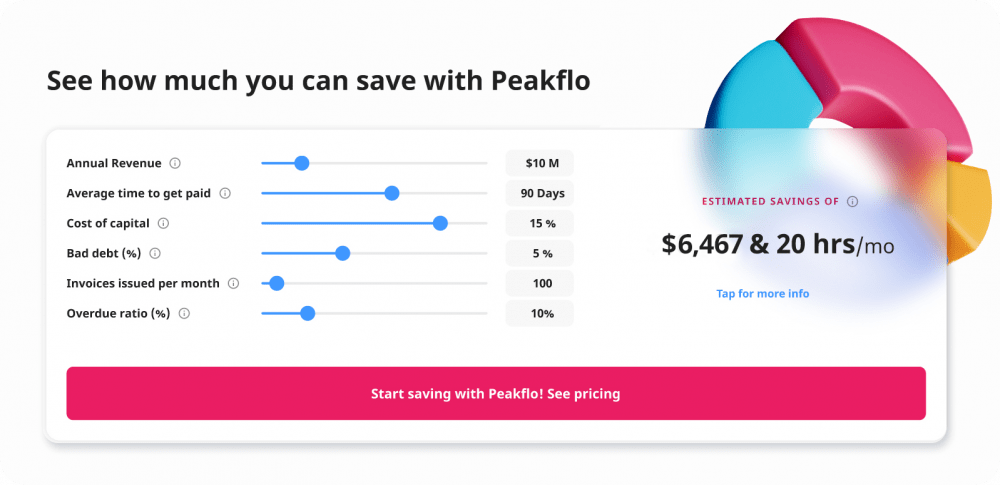

See how much you can save in terms of time and money with our savings calculator once you start automating your tasks.

Try out Peakflo for free today. Save more and go big.