You manage an accounts payable (AP) team, and you know how it is—long hours spent sifting through invoices, correcting errors, and trying to stay ahead of payment deadlines.

What if there was a way to make it all easier?

That is where artificial intelligence (AI) steps in. With the power to automate mundane tasks and eliminate errors, AI transforms how your team operates. Instead of reacting to problems, your AP team can be proactive, focusing on tasks that add real value.

In this blog, we will explore how AI in accounts payable is changing the landscape. From improving accuracy to streamlining workflows, AI offers a solution that goes beyond basic automation.

How AI is Inverting the Finance Function Pyramid

AI is changing the traditional finance function pyramid by automating routine tasks and enabling finance teams to focus on strategic activities. In the conventional model, the base of the pyramid consists of transactional tasks like invoice processing and account reconciliation, which dominate finance professionals’ time. This leaves little room for higher-level tasks like budgeting, forecasting, and strategic planning, limiting the organization’s growth potential.

AI changes this dynamic by inverting the pyramid. With AI handling time-consuming, repetitive tasks, finance teams can redirect their focus toward data-driven decision-making and strategic initiatives. AI’s capabilities, such as predictive analytics, risk management, and real-time anomaly detection, empower finance teams to uncover insights that drive the company forward. By shifting the focus from operational to strategic activities, AI transforms the finance function into a key player in organizational growth and innovation.

Let us get a small gist of the effect of AI in accounts payable.

AI in Accounts Payable

35% of businesses already use AI, and 42% are considering using AI. It has become essential for streamlining accounts payable, making processes faster and more accurate by taking over tasks that once required manual effort. It frees up your team’s time, allowing them to focus on higher-value work. Here is how:

- Goodbye, manual data entry: AI can capture invoice details, reducing mistakes and saving hours of work.

- Smart invoice processing: AI learns from past invoices to process new ones quickly and with fewer errors.

- Automatic invoice matching: AI matches invoices with purchase orders and flags any issues, cutting down on delays.

With these improvements, your team can focus on more critical tasks.

7 Ways AI in Accounts Payable is Transforming Finance Function

Now, let’s take a closer look at how AI in accounts payable can transform your day-to-day finance tasks starting with efficiency.

1. Efficiency and Accuracy Enhancements

AI makes your accounts payable process faster and more accurate. Here’s how it works:

- Quick data capture: AI scans invoices in seconds, pulling out important details like amounts, vendor names, and due dates. It’s much faster than manual work and avoids delays.

- Fewer mistakes: When people enter data by hand, mistakes happen. AI removes these errors, leading to accurate payment records and fewer corrections.

- Automated tasks: AI takes care of things like coding, routing, and approving invoices, helping you pay faster without getting stuck in slowdowns.

The result? A smoother process that saves time and reduces costly errors.

Now, let us understand how AI handles invoice processing in detail.

2. AI in Invoice Processing

Invoice processing is often a tedious, error-prone task for accounts payable teams. With AI, this process becomes more competent, faster, and much less burdensome. Here is a closer look at how AI transforms invoice handling:

- Smart invoice coding: AI automatically assigns the right codes to vendor invoices using past data. This keeps your system accurate without needing manual work.

- Quick data capture: AI reads key details from invoices—like vendor names, amounts, and PO numbers—whether they’re PDFs, scanned images, or email attachments. No more manual data entry, which reduces errors.

- Three-way matching: AI checks invoices against purchase orders and goods received notes. It flags any issues, like incorrect amounts or missing items, to avoid overpayments or underpayments.

- Handling exceptions: AI contextually understands discrepancies, like mismatched item names or codes between invoices and purchase orders. It intelligently resolves these issues by comparing unit costs, minimizing manual effort and errors.

- Smooth approval process: AI works with your approval systems to keep invoices moving through the process, preventing delays and helping avoid late fees.

By automating these tasks, AI frees up your AP team to focus on more important, strategic work.

3. Advanced Data Handling and Analytics

AI in accounts payable helps AP teams by providing useful insights from large data sets. By processing data fast and accurately, your team can make better decisions based on real information and improve overall performance.

- Handling different types of data: AI can gather details from PDFs, images, or even handwritten notes. It organizes and processes the data, so you don’t need to enter it manually, which boosts accuracy.

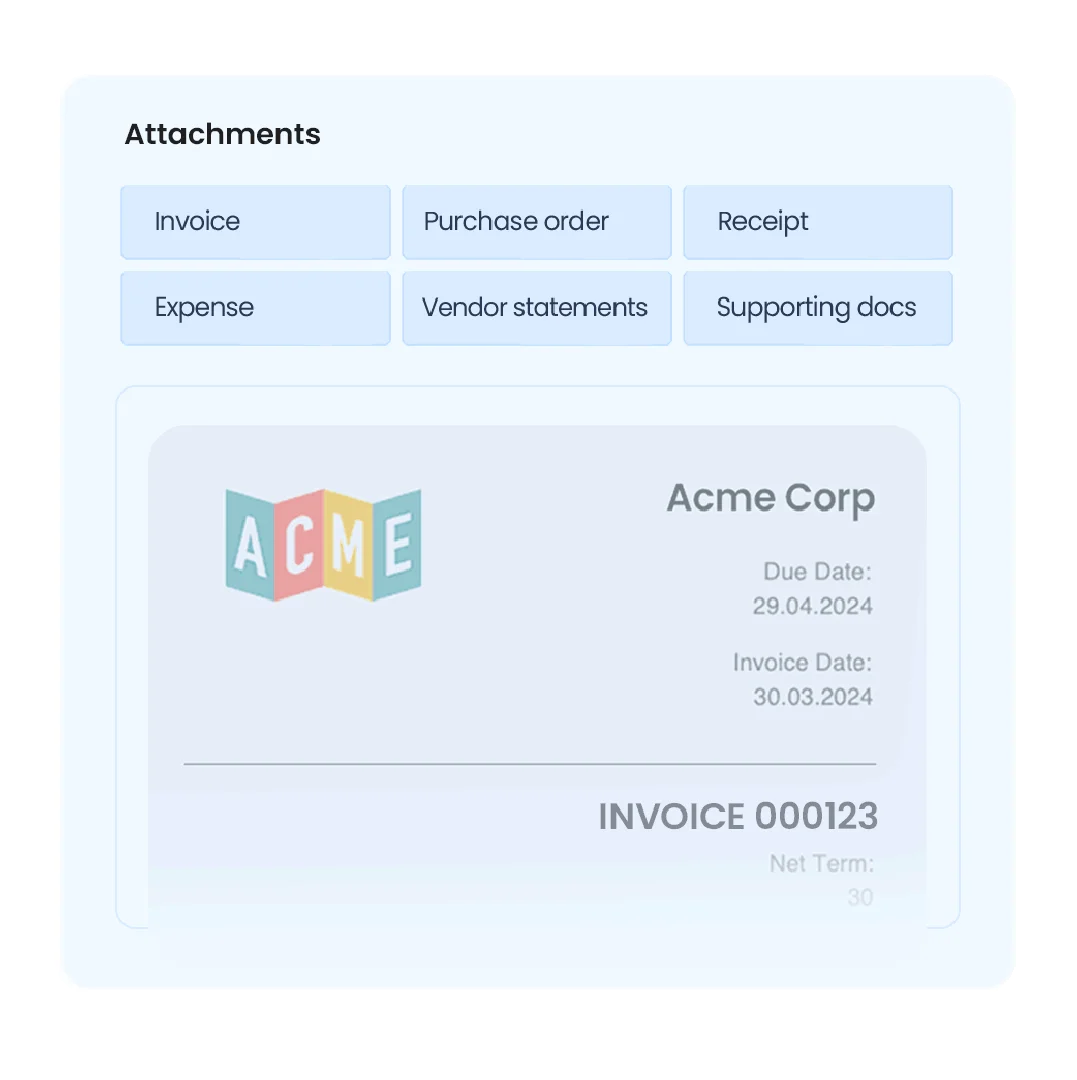

- Document Categorization: With Peakflo AI, you can automate document categorization, saving valuable time. The system classifies hundreds of attachments and documents into predefined or custom categories, such as receipts, invoices, and statements, within seconds. This automation significantly reduces manual effort and improves accuracy.

- Custom field mapping: Extracting specific fields, like subsidiary names or license numbers, from documents can be challenging. Peakflo AI simplifies this process by capturing any custom field required from your documents, making it easier for the finance team to sort and filter data for maximum visibility.

- Multi-language document processing: Peakflo AI is designed to process documents in 41 languages, ensuring global compatibility. Whether it’s invoices, receipts, or contracts in non-English languages, the system accurately maps each letter, word, or character to its respective field, streamlining document processing for international companies.

- Live financial insights: AI constantly checks your invoice data, finding patterns like vendor problems or late payments. These insights help you improve financial planning and vendor management.

- Predicting cash flow: AI looks at past data to predict future cash flow trends, allowing you to make better financial decisions and manage your funds more effectively.

With these tools, your AP team gains deeper insights into financial health and can make faster, smarter decisions.

While AI is crucial for driving qualitative improvements, its impact on security is equally impressive. So let us now explore how AI enhances security measures.

4. Fraud Detection and Compliance

AI in accounts payable is changing how teams handle fraud detection and compliance, making these tasks faster, more accurate, and more dependable. AI also ensures that everything follows company policies, keeping clear records for transparency. Here’s how:

- Spotting fake invoices: AI scans for unusual patterns, such as duplicate payments or invoices with inflated amounts. It flags suspicious activity early, reducing the chance of costly mistakes.

- Keeping compliance: AI uses built-in rules to ensure every invoice meets your company’s policies and legal regulations. It highlights any issues and keeps audit trails accurate and easy to access.

- Check contract details against invoices: AI eliminates the manual task of cross-referencing contract and invoice details, such as payment terms. It automatically checks and flags any discrepancies, ensuring accuracy in your financial processes and saving valuable time for your team.

- Boosting fraud prevention: AI detects fraud attempts that might slip past human review. Whether it’s odd vendor behavior or inconsistent invoice data, AI’s algorithms can catch these problems.

These fraud prevention tools save money and help protect your business’s reputation.

5. Improving Supplier Relationships and Spend Management

AI plays a big role in improving how you work with vendors and manage spending. It also cuts costs tied to manual invoice processing. Here’s how:

- Vendor evaluation and onboarding: AI analyzes vendor performance data, helping you choose the best vendors while making the onboarding process faster.

- Managing vendor performance: AI tracks vendor interactions continuously, allowing you to spot trends and address issues early. This helps you negotiate better contracts and maintain strong partnerships.

- Cutting invoice processing costs: By automating tasks like invoice matching and payment approvals, AI reduces the cost of handling vendor transactions. It also improves cash flow by ensuring payments are made on time.

- Vendor Statement Reconciliation: AI-powered reconciliation tools, like those offered by Peakflo, allow finance teams to quickly match vendor statements against invoices and payments. This eliminates manual errors and ensures that discrepancies, such as duplicate payments or missed invoices, are identified and resolved promptly. By accelerating reconciliation processes by up to 20x, AI ensures smoother vendor relationships and helps you maintain accurate financial records.

AI is undeniably transforming supplier relationships and spend management, helping businesses streamline processes, cut costs, and foster stronger vendor partnerships. By integrating AI into AP workflows, companies can optimize vendor management and enhance internal operations, such as coding invoices and GL mapping. Next, we will see how.

6. Coding Invoices and GL Mapping

One of the trickiest parts of automating accounts payable is handling coding and GL mapping. The challenge comes from the fact that multiple General Ledger (GL) codes can apply to the same expense, often split across line items or product codes. This makes it a manual process that usually requires input from business teams or the CFO.

On top of that, coding can be subjective. Expenses can get tagged incorrectly, especially when the categories aren’t obvious. But AI and machine learning are changing the game when it comes to invoice processing. These tools are particularly good at helping assign the right category and GL code to each invoice.

Once a user selects a code, the AI remembers it for future invoices from the same vendor, automating the process over time. Essentially, the system “learns” your AP team’s preferences as it processes more invoices.

With AI-based large language models (LLMs), you can automate invoice coding by letting the AI suggest the right GL category. You can even customize it to provide multiple suggestions, giving your team more flexibility.

But how does all of it impact the role of your employees? Let us take a look below.

7. Impact on Human Roles and Expertise

AI is here to empower your team. As it takes over repetitive tasks, your accounts payable team’s roles evolve. Instead of spending hours on manual processes, your team can focus on tasks that drive value for your business, like analyzing vendor performance or optimizing cash flow. Here is how:

- Shift in responsibilities: With AI handling data entry and invoice matching, your team can focus on decision-making and strategic tasks that require human insight.

- Enhanced decision-making: AI provides real-time data and predictive insights, helping your team make informed financial decisions without drowning in paperwork.

- Document analysis: Peakflo AI simplifies document analysis by summarizing lengthy documents and extracting key insights. Your team can easily ask questions and get instant answers, allowing them to understand complex documents faster and make more informed decisions.

- Document search: With Peakflo AI, finding crucial financial documents is effortless. Simple queries like “Show me invoices from last quarter” or “Find the latest payment terms of Company X” instantly locate relevant documents. This cuts down time spent searching and allows your team to focus on higher-value tasks.

As AI transforms AP workflows, your team’s expertise becomes even more critical, focused on strategy rather than repetitive tasks. Now, let us look at how Peakflo’s AI capabilities are leading this transformation in accounts payable.

Steps to Embrace AI in Accounts Payable

- Assess Current Processes

Start by taking a close look at your existing AP workflows. Identify the areas where manual intervention is slowing things down or causing errors. Pinpointing these bottlenecks will highlight the processes that are prime for automation. - Choose the Right AI Solutions

Find AI tools that match your specific needs. Look for key features such as:- Automated Invoice Data Capture: Use AI-powered OCR to extract data from invoices, reducing manual entry errors and speeding up processing.

- Invoice Matching and Validation: Implement AI to automatically match invoices with purchase orders and flag discrepancies for review.

- Automate Approval Workflows

Use AI-driven systems to automate invoice approval workflows. These tools can learn from historical data, streamlining approval processes and reducing delays.

- Integrate with Existing Systems

Ensure the AI tools you choose can integrate smoothly with your current accounting software and ERP systems. Seamless integration is key for keeping your data consistent and workflows efficient. - Training and Change Management

The final step is training the finance team on using the AI tools effectively and addressing any concerns. Make it clear that AI enhances operations, not replaces jobs. After implementation, track success with KPIs like processing time, cost savings, and accuracy, and stay open to improving processes as technology evolves.

Peakflo’s AI Capabilities in Accounts Payable

Peakflo uses AI to automate key tasks in accounts payable, speeding up your workflow and making it more accurate. By taking care of tedious jobs like data entry and fraud detection, Peakflo lets your team focus on bigger tasks. Here’s how it works:

- Automatic data capture: Peakflo’s AI pulls invoice details from various formats and languages, eliminating the need for manual data entry. It handles data smoothly, processing files like PDFs in 41 languages, even with custom fields.

- Three-way matching: Peakflo matches invoices, purchase orders, and goods received notes (GRNs). This reduces the risk of mistakes like overpayments or underpayments.

- Vendor statement reconciliation: Peakflo automatically reconciles vendor statements from emails, highlighting any issues. This removes the need for your team to do it manually.

Peakflo makes your team more accurate, helps prevent fraud, and enables smarter decisions, giving you better control over your AP processes.

Future Trends of AI in Accounts Payable Processes

The rise of AI in accounts payable is reshaping how businesses handle financial operations. With its potential to enhance efficiency, cut costs, and improve accuracy, AI is setting the stage for a smarter, faster future. Here are the key trends leading this transformation:

- Enhanced Automation and Efficiency

AI streamlines invoice processing by automating data extraction and validation. OCR technology captures data, matches it with purchase orders, and validates receipts, reducing manual work and errors while speeding up processes. - Advanced Fraud Detection

AI enhances fraud prevention by analyzing transaction patterns to detect anomalies, such as duplicate invoices or unauthorized payments, minimizing the risk of financial losses. - Predictive Analytics

AI-powered predictive analytics help forecast cash flow and anticipate vendor issues. By analyzing trends, AI optimizes payment schedules and mitigates potential delays. - Integration with Blockchain Technology

AI and blockchain together offer secure, transparent transactions. Smart contracts automate payments based on predefined terms, reducing manual intervention and fostering trust. - Mobile Accessibility and Remote Management

AI-driven platforms enable teams to manage AP tasks remotely, offering flexibility and agility in financial operations. - AI for Communication Overhaul

AI acts as a real-time account manager, automating tasks such as sending reminders, generating follow-up emails, and analyzing customer responses, allowing finance teams to focus on more strategic work. - AI Assistance for Writing and Summarizing

AI tools like Peakflo streamline communication by helping craft emails, translate messages, and summarize customer insights. This improves clarity and decision-making while saving time.

Conclusion

AI today is a crucial part of staying competitive. By automating tasks, reducing errors, and offering real-time insights, AI lets your team focus on more strategic activities. It boosts efficiency, cuts down on fraud, and helps you manage vendor relationships more effectively. If you are ready to see how Peakflo can transform your AP processes with AI, book a demo and explore how its powerful features can streamline your workflow and improve accuracy.