Expense reconciliation is an important part of accounting. It helps track income and spending and keeps financial records organized. However, it can be a difficult and time-consuming task for finance teams. Traditionally, it involved making sure the bank balance matches the income minus the expenses.

Even though it’s crucial, many businesses still use manual methods like spreadsheets and paper for managing expenses, with about 35% of companies relying on these outdated practices. This can lead to errors and make it hard to match financial data with budgets and policies.

To make expense reconciliation easier, automation tools and software have been created to help manage expenses more efficiently. In this article, we’ll discuss why expense reconciliation is important, how it works, common challenges, and the benefits of using automation.

What is Expense Reconciliation?

Expense reconciliation is the process of checking if the expenses a company recorded match what was actually spent. This involves comparing receipts, invoices, and other documents with expense claims and transaction records.

By conducting regular reconciliations, businesses can ensure that their financial records are accurate and up-to-date. Any discrepancies found during reconciliation can be investigated further by comparing transactions with bank statements and other relevant documents. This helps keep the company’s financial data accurate and makes sure any mistakes or issues are quickly found and fixed.

How Do Finance Teams Reconcile Expenses?

Expense reconciliation is the process of comparing and aligning financial records related to expenses within a business. It’s a method used to maintain accurate accounting and monitor employee spending. This process ensures that all expenses incurred during a specific period are in line with the established budget. It’s the final step in the expense management cycle.

During expense reconciliation, finance teams carefully compare actual expenses with the records in the general ledger. This helps find any mistakes, differences, or unauthorized expenses. The process includes these key steps:

- Matching Receipts and Invoices: Verifying that all invoices and receipts are accurately reflected in the financial records.

- Bank Reconciliation: Checking if the transactions in your bank statements match the ones in your accounting system.

- Credit Card Reconciliation: Comparing recorded expenses with credit card statements, especially for companies using corporate cards to manage spending.

- Expense Report Verification: Checking employee expense reports against supporting documents to validate the expenses.

- Budget Compliance: Ensuring that all expenses follow the budget and company rules.

Expense reconciliation helps businesses keep track of expense approvals, confirmations, and receipts for each transaction. This process is important for maintaining accurate finances and making sure expenses are properly managed and recorded.

What are the Ways to Reconcile Expenses?

Employee expense reports can be matched and checked in different ways, depending on how big your business is, how many transactions you have, and the resources available. Here are some of the best methods, from traditional to modern approaches:

1. Paper-based Records

For small businesses or those with mostly paper records, manual reconciliation with paper records is an option. This means keeping a physical ledger of transactions. While it’s an old-fashioned method, it can lead to mistakes, damage, or loss of records, making it harder to use as the business grows.

2. Spreadsheets

Spreadsheets are often used by small companies for expense reconciliation, but they are not very efficient. They can lead to data loss, mistakes, and problems with visibility. Spreadsheets also don’t offer advanced analysis features.

3. Accounting Software

Modern accounting software like Xero and QuickBooks has replaced paper records and spreadsheets. These tools can quickly and easily match expenses. They record and process transactions in real-time, so you no longer have to wait for monthly reconciliation.

4. Outsourced Services

Some companies hire external auditors to regularly review expense reports. This helps maintain a clear and accurate record of expenses, which can be made easier with automated expense management software.

5. Modern Expense Management Solution

Many finance teams use expense management systems to automate the reconciliation process. These tools match receipts with transactions, connect with accounting software, and provide real-time updates. Mobile apps also allow employees to take pictures of receipts and submit them digitally, making the process more accurate and easier.

Many businesses still use manual methods and spreadsheets, but more are switching to modern solutions for expense reconciliation because it’s faster and more accurate.

Why is It Important to Perform Expense Reconciliation?

Performing expense reconciliation is important for several reasons:

- Reconciliation makes sure your financial records match your real expenses, reducing mistakes and inaccuracies.

- It helps you follow company rules, accounting standards, and legal requirements.

- Regularly checking expenses can help spot and prevent fraud, like unauthorized spending or duplicate payments.

- By reconciling expenses, you gain insights into your spending patterns, which can help you make informed decisions regarding budgeting and planning for future expenses.

- Reconciliation provides a clear and detailed view of your financial transactions, allowing you to track expenses and manage cash flow effectively.

- Accurate and current financial information from reconciliation helps you make better business decisions.

- Regularly reconciling expenses keeps your financial records correct and up-to-date, making audits easier and reducing the chance of errors being found.

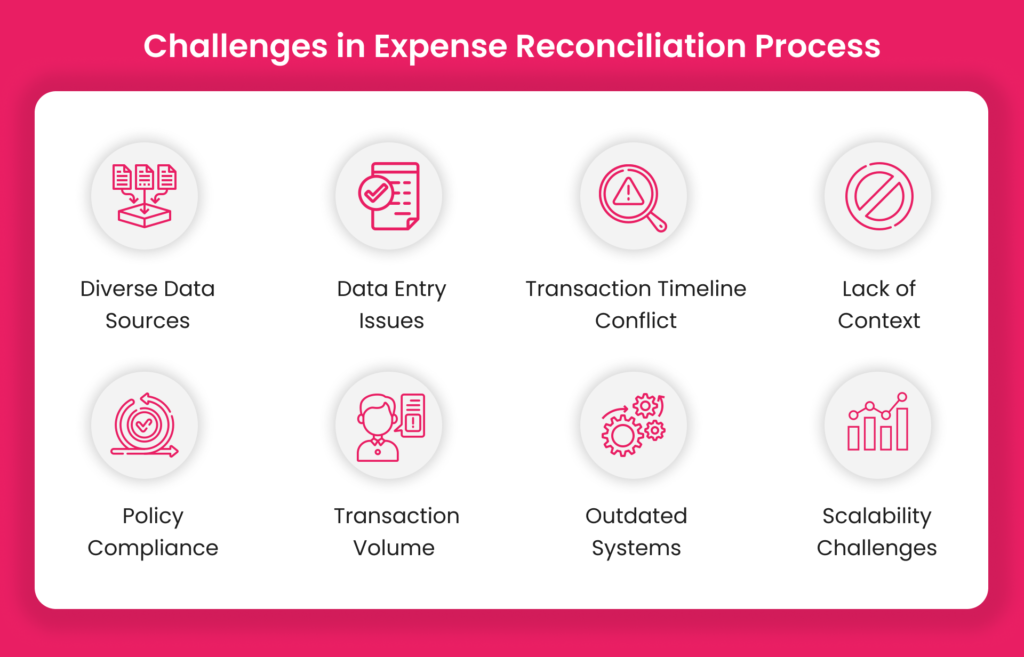

Why Expense Reconciliation is a Challenging Process?

1. Diverse Data Sources

Expense reconciliation means collecting data from different places, like receipts, invoices, and company card statements. Each of these sources looks different, which makes it hard to match and reconcile transactions correctly. This requires careful attention and a good understanding of each source.

2. Data Entry Issues

One of the main challenges of expense reconciliation is handling data in different formats. This means you need to extract the data correctly and enter it into accounting systems with the right general ledger codes and accounts. It’s important to make sure the data is consistent and accurate for the reconciliation to work properly.

3. Transaction Timeline Conflict

Delays in expense reconciliation happen when transactions follow different timelines. For example, company credit card statements might arrive later than employee expense reports. These delays make it harder to close the books on time and gather the necessary documents, slowing down the reconciliation process.

4. Lack of Context

Transactions recorded without clear details or supporting documents can make reconciliation difficult. This is especially true when several people in the company can make transactions. Without enough information, finance teams may find it hard to match expenses correctly.

5. Policy Compliance

Ensuring that expenses comply with company policies is essential but challenging. Employees may unintentionally or intentionally violate policies, leading to non-compliance and discrepancies. Reconciling expenses while enforcing policy compliance requires scrutiny and adherence to company guidelines.

6. Transaction Volume

High transaction volumes can make manual reconciliation inefficient and prone to errors. Managing a large amount of data increases the risk of oversight, highlighting the need for automated reconciliation processes and tools to handle the volume effectively.

7. Outdated Systems

Using old or incompatible financial systems can slow down the expense reconciliation process. It can cause problems like integration issues, double entries, and mistakes when entering business expenses. Upgrading to newer, compatible systems can make the reconciliation process easier and faster.

8. Scalability Challenges

As businesses grow, they may struggle with handling expenses efficiently. Their current processes might not be able to manage a large number of transactions, which can cause mistakes and delays. Using scalable solutions and better processes can help manage the increasing workload more effectively.

How to Fast-Track the Expense Reconciliation Process?

To fast-track the expense reconciliation process, it’s crucial to adopt a comprehensive approach that focuses on automation, digitization, and centralization of your travel and expense management.

Automation with expense management software can save a lot of time by reducing manual work. These tools can automatically match receipts to transactions, connect with accounting systems, and give real-time updates on expenses.

Digitization helps speed things up by getting rid of paper-based processes. Mobile apps can capture receipts digitally, making it easier to track and match expenses.

Centralizing all expense data in one system ensures that every transaction is recorded and matched in one place. This reduces mistakes, removes data silos, improves accuracy, and makes the reconciliation process faster and easier.

Let’s take a look at how Peakflo’s Travel and Expense Management solution helps in speeding up the expense reconciliation process.

- Set expense policies to help your business manage the spending accurately and efficiently.

- Automate expense reports and travel request approval workflow with just a few clicks.

- Allow employees to create expenses and upload receipts to keep a record of all the travel expenses in a single place using mobile or desktop.

- Automatically match the expense report with the receipt and get alerts on any mismatches

- Centralize communications and approvals for a crystal clear audit trail

Choosing the right solution, digitizing receipts, connecting with your current accounting systems, and staying compliant are important steps. As your company grows, it’s important to regularly review and adjust these strategies to keep things running smoothly in the changing world of expense management.

FAQ

How to reconcile expense reports?

To reconcile expense reports, compare the expenses submitted by employees with supporting documents like receipts and credit card statements. Verify amounts, dates, and categories to ensure they match the company policy.

What is the expense reconciliation process?

The process involves collecting expense reports, matching them with receipts and records, verifying policy compliance, and identifying any discrepancies. Once verified, the expenses are approved and recorded in the accounting system.

How do you prepare a reconciliation report?

Start by listing all reported expenses alongside supporting documents. Highlight any mismatches or errors, and provide explanations for discrepancies. Summarize the total reconciled amount and ensure it matches your financial records.