Clear communication with customers is important in collecting payments. It helps businesses get paid on time. Many experts recommend this approach. But it’s also important to check if it works well for different industries and customers.

Even when businesses talk to customers often, late payments are still a big problem. A study by the American Collectors Association found that 30% of small businesses struggle with late payments. This shows that communication alone may not always work. Sometimes, customers just don’t have enough money to pay on time. This proves that outside factors, like financial difficulties, can make communication less effective.

Communication is useful, but it has limits. To improve collections, businesses should use other strategies too. They can offer flexible payment plans or set up automatic payment reminders. These steps can make it easier for customers to pay on time.

Before learning about the best ways to collect payments, it’s important to understand what accounts receivable (AR) collections are and why they matter to a company’s financial health.

What are Accounts Receivable Collections?

Managing and collecting unpaid bills from customers is called accounts receivable collection. This process is important because it helps your company stay financially stable and run smoothly. When customers pay on time, your business can cover its expenses without trouble.

Good AR management helps in many ways. It keeps strong relationships with customers, reduces unpaid debts, and improves your company’s financial health. It also builds a good credit history, which can be useful when applying for loans in the future.

Financial Health and Cash Flow Impact

Your company’s cash flow depends on how quickly and efficiently you collect money from customers. A strong collection process ensures that cash coming in matches or exceeds what you spend on daily operations. If customers take too long to pay, you may not have enough money for regular expenses. This can lead to cash flow problems. You might struggle to pay employees, clear debts, or reinvest in your business.

For example, if your business relies on credit to grow, late payments can make it hard to meet financial commitments. It may also become difficult to qualify for new loans or credit lines.

A well-organized AR collection process is key to keeping your business running smoothly. It helps maintain steady cash flow and supports long-term financial stability.

Good AR management strengthens customer relationships, reduces unpaid debts, and boosts financial health. It also helps build a strong credit history, which is essential for securing future funding.

Now that we’ve covered the basics of AR collections, it’s important to know how to measure success. Let’s explore key metrics that help track and improve collection performance.

Key Metrics for Measuring Performance

You can track performance and improve cash flow by focusing on key numbers in the AR collections process. Two important numbers to watch are Days Sales Outstanding (DSO) and the Accounts Receivable Turnover Ratio. These help you follow best practices for AR collections and measure how well you’re collecting payments.

The Ratio of Accounts Receivable to Transactions

Accounts Receivable Turnover Ratio shows how often you collect payments over a period, usually a year. A higher ratio means you’re collecting money faster, which helps your cash flow.

How to Compute:

The formula for the AR Turnover Ratio is:

AR Turnover Ratio = Net Credit Sales/Average Accounts Receivable

If your average accounts receivable are $100,000 and your yearly net credit sales are $1,000,000, your AR turnover ratio is 10. This means you collect payments about ten times a year.

Top Tips:

- Define Clear Payment Terms: Always explain when and how customers need to pay. Offer discounts for early payments to get your money faster.

- Simplify Invoicing: Send invoices on time and ensure they are correct. Use automation software to track payments, send reminders, and follow up on overdue bills. This reduces delays and errors.

Days Sales Outstanding

DSO tells you how many days it takes to get paid after a sale. A lower DSO means you collect payments faster. A higher DSO could mean payment delays, impacting your cash flow.

How to Compute:

DSO = Accounts Receivable/Total Credit Sales × Number of Days

For example, imagine your total credit sales for the month were $500,000, your AR was $200,000, and if it takes more than 30 days to receive these payments, your Days Sales Outstanding would be:

DSO = 200,000/500,000 × 30 = 12 days

This indicates that it typically takes you 12 days to collect payments.

Top Tips:

- Examine Payment Patterns: Regularly analyze payment patterns from customers. Consumers who are late frequently might require more follow-up or modified credit conditions.

- Provide Payment Plans: Giving customers the option to pay in smaller amounts over time helps them manage their finances. This also lowers the chance of unpaid bills.

- Use AR Management Tools: Track payments in real-time to uncover which customers take longer to pay. This lets you focus on follow-ups and take action quickly.

Keeping an eye on key numbers like AR turnover ratio and DSO helps improve collections. Automating payment reminders and setting clear terms keep cash flow steady and reduce unpaid bills.

The next step is to improve your AR process through proactive communication while keeping these metrics in mind. Prompt follow-ups and reminders can greatly enrich collections.

Proactive Communication and Follow-Up

Getting paid on time is important for your business. To do this, you need to remind customers early, follow up when payments are late, and use tools to make the process easier. Here’s how you can do it.

- Delivering Reminders Before the Deadline

Customers sometimes forget to pay on time. You can help them by sending reminders a few days before the payment is due. This makes it easier for them to plan their payments and avoid late fees.

For example, businesses using tools like Peakflo can set up automatic reminders. These reminders help customers remember their payments so they don’t miss the due date. You can choose to send reminders by email, text, or any other way that works best.

- Individualized Follow-Ups Regarding Past-Due Payments

If a payment is late, a personal message can help. It shows the customer that you care about their business while reminding them to pay. You can send a message like this:

| “Hi [Customer Name], I hope you’re doing well. We noticed that invoice 12345, due on [due date], hasn’t been paid yet. Can you let us know the status?” |

This keeps the conversation friendly but firm. It also helps solve any issues without creating tension.

- Automating Responses and Reminders

Automation tools can send reminders before and after payments are due. If a payment is overdue for too long, the system can send a stronger message or even schedule a phone call.

This reduces the need for manual work and makes sure no invoice is forgotten. With the right tools, you can improve cash flow, reduce late payments, and keep good relationships with customers.

Following up is important, but so is knowing which customers are more likely to pay late. Next, let’s talk about how to check and reduce the risk of late or unpaid invoices.

Credit Risk Management

Credit risk management is one of the best practices for the accounts receivable collections procedures.

- Credit Risk Assessment and Management

Managing credit risk is important for collecting money owed to your business. First, you need to check if customers can pay on time. This is called assessing credit risk. Start with a clear credit policy. This should include rules about payment schedules, credit limits, and who qualifies for credit. Review this policy often to keep it updated.

Use credit scoring and financial background checks to see if a customer is reliable. These tools help you predict if a customer might not pay.

It’s also helpful to group customers by risk level—high, medium, or low. Set different credit terms for each group. For high-risk customers, lower their credit limit or ask for upfront payments.

- Making Use of Tools to Improve Credit Management

Technology can make credit management easier. Automated tools track payments, send reminders, and flag overdue invoices. A credit risk monitoring system can warn you if a customer’s payment habits change.

If a reliable customer suddenly starts paying late, you can change their credit terms or take action early. This helps prevent unpaid debts. For extra protection, credit insurance can cover losses if a customer fails to pay. Using smart tools and strategies helps maintain a steady cash flow and reduces financial risks.

Using technology to expedite the process comes next after credit risk management. Your collection efforts can be greatly improved with automation and AR management software.

Use of Technology

Technology helps you work faster, make fewer mistakes, and keep things simple when collecting payments. With the right tools, you can follow the best methods to collect money on time and keep your cash flow steady.

- Automate Reminders and Invoices

Automation saves time and makes sure everything is accurate. Instead of sending invoices and reminders manually, software can do it for you. This reduces mistakes and ensures customers get their bills on time.

Automated systems remind customers when a payment is due or overdue. They also track payments and update their status automatically. Since reminders are sent at the right times, you don’t have to follow up manually. This prevents missed deadlines and allows you to focus on more important tasks. Plus, professional and timely invoices improve customer trust.

- Using Software for AR Management

Accounts receivable management software helps track overdue payments and organize collections. These tools allow you to see unpaid invoices, sort accounts easily, and create workflows to manage collections smoothly.

With AR management software, you can prioritize which payments to collect first based on detailed reports. Team members can also coordinate better, making collections more efficient. Since the software provides real-time data, you spend less time searching for payment details and more time making informed decisions.

By using automation and AR software, you can stay ahead in managing receivables. However, technology alone isn’t enough. Strong customer relationships also matter. Next, let’s see how good communication and empathy can improve collections.

Improving Customer Experience

Getting better at collecting AR helps keep your cash flow steady. It also strengthens your bond with customers. When you show understanding in your conversations and keep a friendly tone, customers feel more valued. This improves both their satisfaction and your chances of getting paid on time.

- Show Empathy in Dealings with Customers

Be patient and understanding when interacting with each customer. Acknowledge that their ability to make on-time payments may be affected by financial hardship. By listening and recognizing their situation, you promote open communication and trust. Companies that tailor communications to individual customer profiles report recovery rates that are 27% higher.

- Ensure Positive Communication and Relationships

Communicate with your customers in a courteous, clear, and regular manner. To keep them informed, establish clear terms for payments, and send timely reminders. Reach out by using a variety of channels, including phone calls, emails, and customer portals.

Customized communications improve recovery rates by 27%.

By putting these strategies into practice, you improve customer relations and your collections process, which will increase your financial stability and customer loyalty.

Now, with an emphasis on customer experience, let’s examine some specific best practices that will assist you in streamlining your accounts receivable collections procedures for improved outcomes.

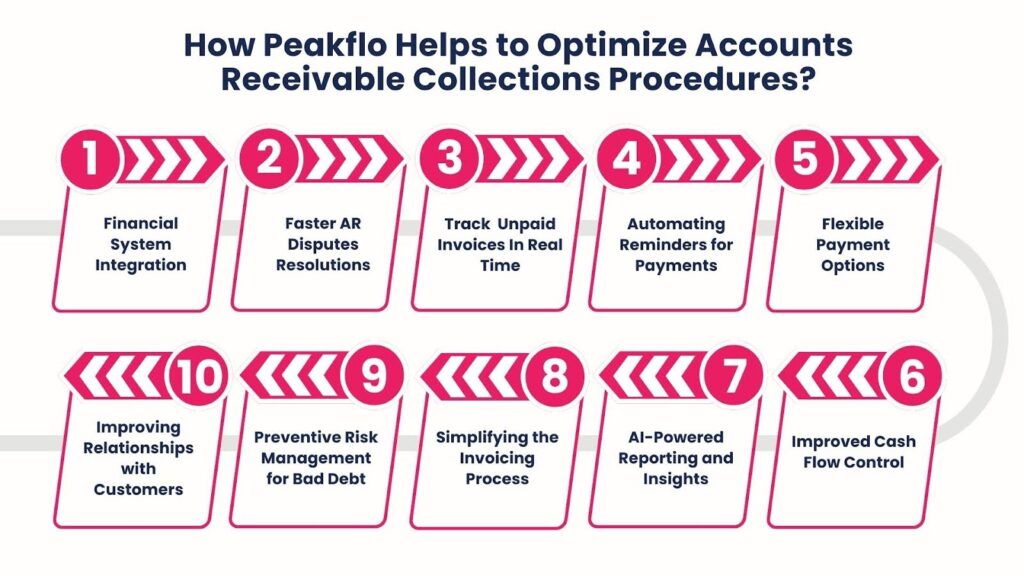

How Peakflo Helps to Optimize Accounts Receivable Collections Procedures?

Accuracy, effectiveness, and a positive customer experience are necessary for optimizing accounts receivable collections. With key features that improve cash flow management and collections, Peakflo simplifies the process.

- Financial System Integration: Peakflo ensures real-time synchronization by smoothly integrating with ERPs and accounting software. This minimizes the need for reconciliation by eliminating human data entry errors and ensuring that each payment is accurately recorded.

- Faster AR Dispute Resolution: Peakflo streamlines and expedites dispute resolution by centralizing records of invoices, payments, and customer interactions. With instant access to historical data, AR teams experience fewer delays and escalations.

- Track Unpaid Invoices in Real-Time: Peakflo provides a comprehensive overview of past-due invoices, outstanding amounts, and payment schedules. This helps AR teams minimize revenue leakage, prioritize collections, and follow up on critical accounts.

- Automating Reminders for Payments: Peakflo ensures timely customer follow-ups by automating dunning. As a result, manual outreach is reduced, cash flow is accelerated, and payment delays decrease.

- Flexible Payment Options: Peakflo simplifies transactions by offering multiple payment options, including digital payments, bank transfers, and credit cards. By allowing customers to choose the most convenient option, on-time payments are more likely.

- Improved Cash Flow Control: Peakflo helps businesses automate follow-ups, create structured payment terms, and monitor past-due payments. This reduces collection bottlenecks and ensures a steady cash flow.

- AI-Powered Reporting and Insights: Through real-time AR analytics, Peakflo provides insights into cash flow performance, past-due invoices, and payment trends. These data-driven reports empower businesses to make informed financial decisions.

- Simplifying the Invoicing Process: Businesses can use Peakflo’s platform to create, modify, and send invoices. This guarantees clarity, accuracy, and consistency, reducing invoice disputes and processing delays.

- Preventive Risk Management for Bad Debt: Peakflo helps businesses take proactive measures by identifying early warning signs of payment issues. By adjusting credit terms, offering payment plans, or restricting additional credit, businesses can lower the risk of bad debt losses.

- Improving Relationships with Customers: Peakflo fosters clear communication and sends professional, non-intrusive reminders to maintain positive customer relationships. This approach builds trust and long-term loyalty while ensuring timely payments.

Conclusion

Continuously evaluate and improve your tactics to keep your accounts receivable collections procedures efficient. As customer expectations and payment patterns evolve with the business environment, adopting new technologies, staying up-to-date on best practices, and adjusting policies as needed can help increase cash flow and reduce bad debts.

Regular performance reviews of your AR team and automation tools like Peakflo can help identify inefficiencies and allow you to modify your strategy. A commitment to ongoing development ensures that your AR collections process will remain competitive and responsive to current needs in your industry.

Peakflo makes collecting payments easier with automatic reminders on email and WhatsApp. This can help you get paid up to 20 days sooner. Request a demo to see how Peakflo can handle invoices, payment reminders, and cash tracking. It helps businesses control cash flow better and reduce unpaid bills.