Managing finances can be a complex and daunting task, especially when it comes to understanding tax invoices. Finance teams and organizations often struggle with the intricacies of tax compliance, maintaining accurate records, and claiming input tax credits.

Mistakes in these areas can lead to costly penalties and audits, or even damaged reputations.

To help solve these pain points, This guide will delve into the essentials of tax invoices, covering their definition, importance, and appropriate use.

So, let’s dive in and master the art of tax invoicing!

What Is a Tax Invoice?

A tax invoice is a record given by a seller to a buyer that outlines the goods or services provided, their respective prices, and the corresponding taxes. Its purpose is to serve as a proof of the transaction.

Why Do You Need a Tax Invoice?

Tax invoices are critical for several reasons:

- Legal Requirement: Tax authorities require businesses to issue and maintain tax invoices to ensure proper record-keeping and tax compliance. Failure to do so can result in penalties and fines.

- Input Tax Credits: As mentioned earlier, businesses can claim input tax credits by presenting tax invoices. Without them, they may lose out on potential tax savings.

- Customer Information: Tax invoices help customers understand the taxes applied to their purchases and serve as proof of the transaction.

- Accounting Records: Tax invoices form a part of a business’s invoice data entry and financial record-keeping, helping accountants prepare accurate tax filing.

When to Use a Tax Invoice

A tax invoice should be issued under the following circumstances to streamline invoice processing:

- Sale of Goods or Services: When a business sells goods or services to another business or individual, they must issue a tax invoice.

- Taxable Supplies: A tax invoice is necessary when dealing with taxable supplies, such as goods and services that impose sales tax, VAT, or GST.

- Receipt of Advance Payments: When a business receives an advance payment for goods or services, they should issue a tax invoice.

- Reverse Charge Mechanism: In some jurisdictions, the reverse charge mechanism requires the recipient of goods or services to generate a tax invoice instead of the supplier.

- Periodic Billing: For businesses that bill customers periodically, such as utilities or subscription services, tax invoices should be issued at each billing cycle.

Elements of a Tax Invoice

A tax invoice must include the following elements:

- Seller’s Details (name, address, tax registration number)

- Buyer’s Details (name and address)

- Invoice Date

- Invoice Number

- Description of Goods or Services

- Tax Rates and Amounts (sales tax, VAT, GST, etc)

- Subtotal before tax

- Tax amount

- Total amount (including tax)

How to Make a Tax Invoice

There’s a lot of tools to make a tax invoice, such as spreadsheets or Microsoft Word. However, the challenge when using such tools is maintaining uniform formatting throughout all invoices. Additionally, spreadsheets and Word do not offer a user-friendly UI to generate an invoice, as they weren’t built with such a purpose in mind.

That’s why we recommend a digital invoice maker such as Peakflo. Our dashboard is intuitive and has all the necessities you need to make any type of invoice.

Let’s find out how you can create a tax invoice in Peakflo:

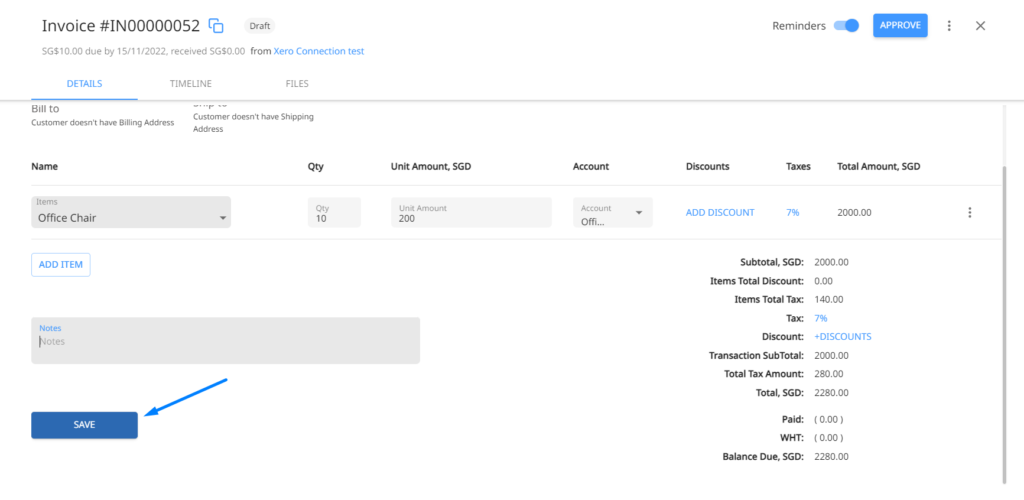

1. Add an Invoice

2. Select the customer you’d like to create an invoice for. Peakflo will automatically generate the rest of the details, such as shipping address and contact information, based on the information you’ve previously input.

3. Add reference number and set the issue date, due date, and promise to pay date if there’s any.

4. Add line items, quantity, unit amount, and select the chart of accounts. As Peakflo automatically syncs data with your accounting software, every item in the transaction will be recorded in the relevant chart of accounts in 2-ways.

5. Add the tax rates by selecting from the dropdown. In Peakflo, you can levy any types of tax rates without having to worry about geographical regulations.

6. Click Save.

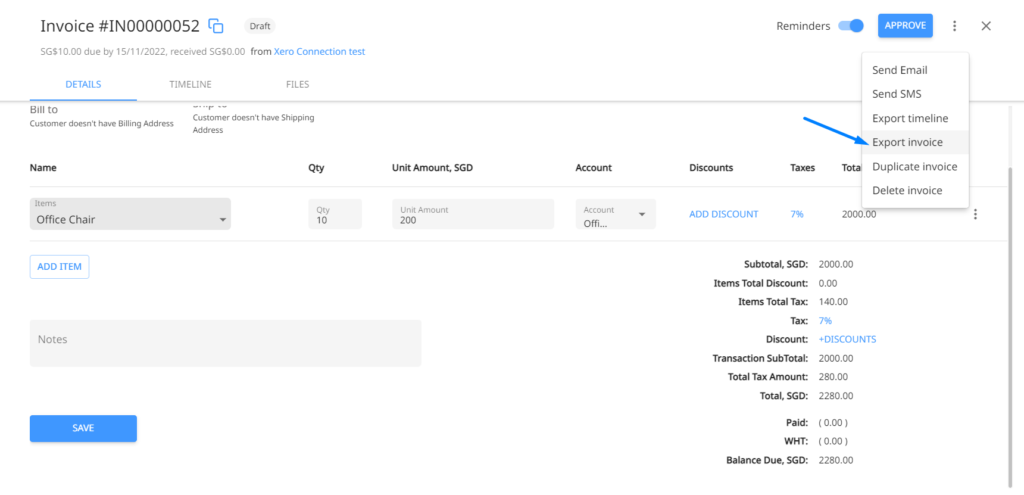

7. Once done, you’ll have the option to either send the invoice to the customers (as an Email or SMS), export the audit trail for easier auditing, export the invoice as a PDF, duplicate the invoice to streamline recurring billing or delete the invoice.

Example of Tax Invoice

Here’s an example of tax invoice:

In the invoice above, you can see there’s a VAT rate of 7%. Therefore, after applying the taxes to the item purchased, the total amount is SGD 353,499.40.

Best Practices for Tax Invoice

-

Standardize invoice formats: Establish a standard tax invoice format for your business to maintain consistency, improve readability, and facilitate easier processing.

-

Implement a numbering system: Assign unique and sequential invoice numbers to each tax invoice for easy tracking and reference.

-

Include all required information: Ensure that all necessary details are included in your tax invoices, such as business name, address, tax identification number, description of goods or services, invoice date, and applicable tax rates.

-

Use electronic invoicing: Implement electronic invoicing (e-invoicing) to save time, reduce paper usage, and improve data accuracy.

-

Keep accurate records: Maintain well-organized and up-to-date records of all tax invoices issued and received. This will help you track expenses, revenue, and tax liabilities more effectively.

-

Set clear payment terms: Clearly state your payment terms, including due dates and penalties for late payments, on your tax invoices to encourage timely payments and minimize disputes.

-

Reconcile regularly: Periodically reconcile your tax invoices with your financial records to ensure accuracy and identify any discrepancies.

-

Stay updated on tax regulations: Regularly review and stay updated on tax regulations in your jurisdiction to ensure your tax invoices meet all legal requirements.

-

Review and audit: Periodically conduct internal audits of your tax invoice management system to identify any areas for improvement or potential issues before they become major problems.

-

Automation: Utilize tax invoicing software or tools to automate the creation, processing, and management of tax invoices. This will reduce manual errors, save time, and ensure better compliance with tax regulations.

Transform your accounts payable and receivable processes with Peakflo, the cutting-edge AP & AR software designed for end-to-end automation. Say goodbye to manual errors and inefficiencies, and streamline your invoice management. Start your free trial now and experience the difference!

FAQ

What is the difference between a tax invoice and an invoice?

An invoice is a general term for a document that details a transaction between a seller and a buyer. A tax invoice is a specific type of invoice that includes additional information related to taxation, such as tax registration numbers and tax amounts. Tax invoices are necessary for claiming input tax credits and ensuring tax compliance.

Is a tax invoice the same as VAT?

A tax invoice is not the same as VAT (Value Added Tax). VAT is a type of tax applied to the sale of goods and services in many countries. A tax invoice is a document that includes information about the transaction, including the VAT amount if applicable. In other words, a tax invoice is a record of a transaction that may involve VAT, while VAT itself is a specific tax charged on goods and services.

Who gets the tax invoice?

The tax invoice is issued by the seller to the buyer. It serves as a record of the transaction and helps both parties maintain accurate financial records. The buyer may use the tax invoice to claim input tax credits (if eligible), while the seller uses it for tax compliance and reporting purposes.

Is a tax invoice a bill or a receipt?

A tax invoice serves as both a bill and a receipt. As a bill, it details the goods or services provided, their prices, and any applicable taxes. Once the buyer has made the payment, the tax invoice also serves as a receipt, confirming that the transaction has been completed and payment has been received.