Managing delinquent accounts is one of the hardest parts of running a business. When customers delay payments, your cash flow is disrupted. It puts pressure on daily operations and hurts long-standing relationships. Late payments also make the order-to-cash cycle longer, increase bad debt, and add extra work for your team. For finance teams, these are not just numbers—they are risks that could grow into serious financial problems.

In this blog, we will offer practical strategies to manage delinquent accounts and maintain strong customer relationships by setting clear payment terms and automating payment reminders.

But first, let us start with the meaning of delinquent accounts.

What Are Delinquent Accounts?

Delinquent accounts refer to credit accounts where payments are overdue. This could involve credit cards, loans, or any other form of credit where the borrower has missed the payment deadline. An account is considered delinquent when a payment is not made by the due date and is usually at least 30 days late.

Delinquent customers and unpaid debts can create significant cash flow problems and reduce revenue. This, in turn, impacts overall profitability. Delinquent accounts can also harm your credit score and stay on your report for up to seven years.

Poor cash flow can have serious consequences. You might struggle to pay vendors on time, which could strain relationships and lead to penalties or extra interest. In worst-case scenarios, cash flow issues could cause insolvency.

For example, if a business has several customers who delay payments, it may lack the cash to pay its vendors, leading to supply chain disruptions and late fees that worsen its financial health.

What Are the Most Common Causes of a Delinquent Account?

Delinquent accounts happen for many reasons. Knowing these reasons helps prevent overdue payments and manage them better. Let us discuss this in detail.

- Cash Flow Problems

Businesses often encounter cash flow issues. Seasonal dips in revenue, customer late payments, or unexpected expenses can drain funds. This makes it difficult to pay bills on time, leading to overdue accounts.

- Poor Financial Management

Without careful financial planning, businesses can easily miss payments. If they do not closely monitor income and expenses, it becomes tough to pay invoices when due. Poor financial discipline often results in overdue accounts.

- Too Much Credit

Extending too much credit to customers increases the chance of late payments. When businesses are too lenient with credit terms, customers might take on more credit than they can handle, straining cash flow and delaying payments.

- Billing Disputes

Errors in billing or misunderstandings about terms can cause customers to delay payments. Disagreements over invoices or dissatisfaction with services can push accounts into delinquency until issues are resolved.

- Economic Uncertainty

Broader economic issues, like market slumps, can make it hard for businesses to pay their vendors. When revenue falls, companies struggle to keep up with payments, creating overdue accounts.

- Admin Delays

Slow or inefficient billing processes also lead to delinquent accounts. If a business lacks streamlined systems, it may miss payment deadlines or fail to follow up on unpaid invoices, resulting in overdue accounts.

How Overdue Payments Undermine Your Accounts Receivable Efficiency?

Delinquent accounts can harm your business if they start to build up. Knowing how these late payments affect your accounts receivable process is essential to fixing the problems they create.

- Longer Payment Cycles

Late payments mean it takes more time to turn sales into cash. This disrupts your order-to-cash cycle and slows down your cash flow, making it hard to meet your financial deadlines.

- Cash Flow Issues

When customers do not pay on time, cash flow gaps appear. These gaps make it tough to pay vendors and employees and cover daily costs. They can even cause financial strain that may lead to shortfalls.

- Higher Bad Debt

If delinquent accounts remain unpaid for too long, they become bad debt. Writing off these debts reduces profits and raises expenses, damaging your business’s financial health.

- Lost Opportunities

Chasing overdue payments takes time and effort. This means less focus on winning new customers or growing your business. The result? Missed chances for expansion.

- Inaccurate Forecasting

Late payments make it hard to predict your cash flow. You can not plan for the future if you do not know when—or if—you will get paid, making it challenging to make smart business decisions.

- Damaged Vendor Relationships

When you can not pay vendors on time, relationships suffer. This could lead to worse payment terms or even the loss of credit. In the worst cases, you might lose your preferred vendor status entirely.

Practical Strategies to Effectively Manage Delinquent Accounts

Accounts receivable strategies will help you maintain good customer relationships while keeping your business financially healthy. Let’s explore a few strategies on how to handle delinquent accounts efficiently.

1. Group Customers Based on Payment Risk

A smart way to manage accounts is by grouping customers based on payment risks. You can do this by looking at aging reports, payment history, and the amount they owe. This helps you spot high-risk customers who might delay payments. Once you know these customers, you can focus on them first. This approach allows you to address problems before they grow bigger. You can save time and stabilize your cash flow by prioritizing high-risk accounts.

2. Maintain Strong Customer Relationships

Keeping a strong relationship with your customers is important, even when they miss payments. Do not let unpaid bills damage the connection you have built over time. When you contact customers about late payments, keep your tone polite but firm. The goal is to collect the overdue amount without harming the relationship. Sometimes, open communication helps you understand why the payment is late. This allows you to work together and find a solution that benefits both sides.

3. Automate Your Collection Process

Manually tracking outstanding payments can be time-consuming and exhausting. This is where automation can help. An automated collection system can send reminders and follow-up notices on a set schedule. It does not need constant manual work, saving you time. With automated reminders, you ensure timely and consistent communication with customers. This way, your team can focus on more important tasks. Automation also reduces the chances of errors, like forgetting to follow up on an account.

4. Offer Flexible Payment Options

One of the simplest ways to reduce late payments is to make it easy for customers to pay. Offer various payment methods, like credit cards, online transfers, and electronic payments. Giving customers more ways to pay reduces the chances of them delaying payments. A smooth, simple payment process also improves customer satisfaction. It makes them more likely to pay on time. Flexibility in payment options can go a long way in reducing the risk of delinquent accounts.

5. Establish a Clear Policy for Overdue Accounts

Having a clear and well-structured collection policy is essential. Your policy should explain every step, from when to follow up to how to escalate the situation if payments are not made. This way, your team knows exactly what to do without confusion. The policy should also outline the consequences for continued late payments, such as adding late fees or taking legal action. A formal policy helps ensure that all delinquent accounts are handled fairly and consistently.

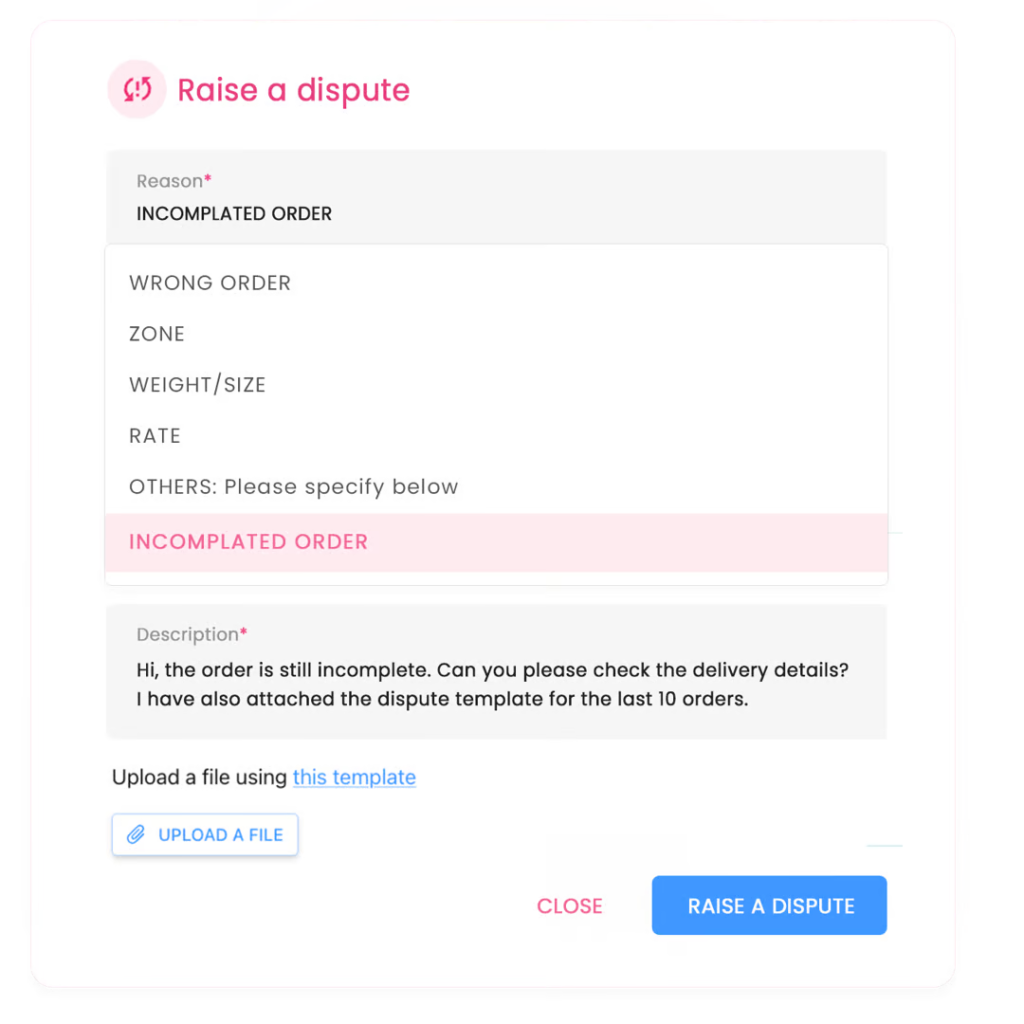

6. Set Up a Dispute Resolution System

Sometimes, payment delays happen because of disputes between the business and the customer. An efficient system for resolving disputes can help prevent this. Your process should include clear communication channels and a team dedicated to handling these issues. Addressing disputes quickly and fairly can speed up the payment process. A good resolution system shows customers you value their business, helping maintain a strong relationship.

Proactive Strategies To Avoid Delinquent Accounts

Creating proactive strategies is key to avoiding delinquent accounts. Businesses can keep cash flow steady and reduce financial stress by taking steps before payments become overdue. Here are three strategies that work well:

- Implement Proactive Reminder Systems

One of the easiest ways to prevent late payments is by setting up reminder systems. These reminders can be sent before the payment due date. You can schedule them to go out through email, SMS, or even phone calls. Automated systems can help with this process, ensuring customers are reminded on time without requiring manual effort. This keeps your accounts receivable process running smoothly and helps customers stay on top of their payments.

- Incentivize Early Payments

Another effective strategy is encouraging customers to pay early. You can offer small discounts to those who pay before the due date, motivating customers to settle their invoices sooner. On the other hand, you can also introduce penalties for late payments. Late fees can serve as a deterrent, reminding customers that delays will cost them extra. Both approaches help reduce the likelihood of overdue accounts and ensure timely payments.

- Use Data Analytics for Targeted Collections

Data analytics can be a powerful tool in managing payments. By analyzing customer payment habits, you can identify patterns and risks. Some customers may be more likely to pay late, and you can target these accounts with personalized reminders or incentives. This focused approach helps businesses prioritize their efforts where they matter most. You can avoid potential issues and keep your collection process efficient with data-driven strategies.

Implementing Technology and Automation

Integrating technology and automation into accounts receivable can boost efficiency in a big way. It reduces manual tasks, improves accuracy, and speeds up payments. Here are three ways automation can transform your AR process:

- Use AR Automation Tools

Automation tools handle routine tasks like sending invoices and reminders. These tools work on a schedule, so there is no need for manual follow-ups. Unlike manual systems, automation ensures that invoices are always sent on time. Reminders go out automatically, reducing human error and speeding things up. With AR automation, your team can focus on more complex tasks, making the entire process more productive.

- Track and Prioritize in Real Time

Automation also allows for real-time tracking. Instead of relying on periodic reviews, automated systems monitor accounts continuously. They flag overdue or high-risk accounts as soon as there is an issue. This lets your finance team take action right away. Knowing which accounts need attention, you avoid delays and steady your cash flow.

- Simplify Operations with Automation

Automation streamlines everything—from sending invoices to tracking payments. Choosing the right e-invoicing solution reduces the need for manual checks. They also integrate with other financial tools, creating a unified workflow. This lowers errors, cuts costs, and ensures no account is missed. Your team can manage more accounts efficiently, keeping operations smooth with less effort.

How to Handle Delinquent Accounts with Peakflo?

Peakflo helps manage late payments by automating invoices, reminders, and tracking. It gives real-time reports and matches records to avoid mistakes. This speeds up collections and improves cash flow.

Let us give you a detailed outlook on Peakflo’s solutions for delinquent account management.

1. Proforma Invoice Validation

This feature streamlines client confirmation of your proforma invoices before issuing the invoice to customers. It reduces mistakes that can cause payment delays. Companies can avoid disputes that often lead to late payments by ensuring all invoice details are correct.

2. Invoicing

Peakflo’s e-invoicing solution makes it easy to create and send invoices. These tools automate the process, ensuring that invoices go out on time. This lowers the chances of payments being delayed. Businesses can also track payments in real-time, allowing them to follow up quickly when needed.

3. Finance CRM and Task Management

This tool gives finance teams a central platform to manage all communication about collections. It helps track overdue payments, follow up with customers, and resolve disputes faster. This reduces the effort needed to manage delinquent accounts and ensures no tasks are missed.

4. Payment Reminder Automation

Automated payment reminders help businesses reduce overdue payments. These reminders are scheduled to go out at specific times, ensuring regular follow-ups without needing manual work. This reduces human error and speeds up the payment process.

5. Customer Portal

This self-service portal lets customers view and manage invoices, make payments, or raise disputes. By giving customers access to their payment details, businesses can reduce delays. This transparency improves customer relationships and reduces late payments.

6. Accounts Receivable Reports

Peakflo provides real-time AI-powered reports on accounts receivable, including reports showing overdue accounts. These insights help businesses focus on collections and take action before delinquent accounts become a bigger problem.

7. Automated Reconciliation and Cash Application

This feature makes it easy to match payments with invoices. It helps prevent mistakes that can lead to late payments. If there are any differences, they are flagged right away for a fast fix. Automated reconciliation ensures payments are posted accurately in your accounting system.

Conclusion

Managing delinquent accounts is a major challenge for businesses. Late payments disrupt cash flow and lead to inefficiencies. This forces finance teams to focus on collections instead of growth. The results are clear: longer payment cycles, strained customer relationships, and a higher risk of bad debt.

Businesses need to act early to solve this. Clear payment terms, regular communication, and automated tools can make a big difference. These steps help manage late payments and protect cash flow.

Peakflo offers a solution that simplifies accounts receivable. It tracks invoices in real-time and automates daily tasks. Take a demo tour today and discover how Peakflo can simplify your collections process!

![Why AI Sales Calls Are Making Good Sales Reps Even Better [2025 Guide] ai sales calls](https://blog.peakflo.co/wp-content/uploads/2025/09/65168cf6-3001-4733-8cbc-12d5684cf449-218x150.webp)